Is DGCTC safe?

Business

License

Is DGCTC Safe or a Scam?

Introduction

DGCTC is a relatively new player in the foreign exchange market, having been established in 2023. It positions itself as a broker offering various trading instruments, including commodities and CFDs. As the forex market continues to grow, traders must be cautious in evaluating brokers to ensure their safety and legitimacy. With numerous reports of scams and fraudulent practices in the industry, it is crucial for traders to conduct thorough due diligence before engaging with any broker. This article aims to investigate the safety of DGCTC by examining its regulatory status, company background, trading conditions, customer experiences, and overall risk profile. We utilized a comprehensive research methodology, including analysis of online reviews, regulatory databases, and user feedback, to provide a balanced assessment of whether DGCTC is a safe option for traders.

Regulation and Legitimacy

The regulatory environment is a critical factor in assessing the safety of any forex broker. Regulation serves as a safeguard for traders, ensuring that brokers adhere to strict financial standards and practices. Unfortunately, DGCTC is currently unregulated, which raises significant concerns regarding its legitimacy and trustworthiness. The absence of a regulatory framework means that traders have limited recourse in case of disputes or issues with fund management.

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| N/A | N/A | N/A | Not Verified |

The lack of regulatory oversight is a red flag, as it indicates that DGCTC does not have to comply with the stringent requirements imposed by recognized financial authorities. This includes the absence of client fund protection measures and transparency in operations. Traders should be particularly wary of brokers without credible regulatory backing, as they may be more prone to engage in fraudulent activities. Historical compliance records of regulated brokers show a commitment to maintaining industry standards, which is absent in the case of DGCTC. Therefore, it is essential to consider these factors when asking, "Is DGCTC safe?"

Company Background Investigation

DGCTC, registered in Australia, is a relatively new entity with a short operational history. The company claims to offer a broad range of trading instruments, but its limited track record raises questions about its reliability. The ownership structure of DGCTC is unclear, as there is scant information available regarding its management team and their professional backgrounds. A transparent company is typically characterized by clear disclosures about its founders and management, including their qualifications and experience in the trading industry.

In terms of transparency, DGCTC's website lacks detailed information about its operations, which is concerning for potential investors. A reputable broker usually provides comprehensive information about its services, fees, and trading conditions. The absence of such disclosures may lead traders to question the company's motives and integrity. In light of these factors, it is prudent to approach DGCTC with caution and skepticism, particularly when evaluating the question, "Is DGCTC safe?"

Trading Conditions Analysis

When assessing the trading conditions offered by DGCTC, it is crucial to analyze its fee structure, spreads, and overall trading environment. DGCTC advertises competitive spreads, but the lack of transparency regarding commissions and other fees raises concerns. Traders should be aware of any hidden fees that may impact their profitability.

| Fee Type | DGCTC | Industry Average |

|---|---|---|

| Major Currency Pair Spread | 30 pips | 1-2 pips |

| Commission Structure | Not disclosed | Varies widely |

| Overnight Interest Range | Not disclosed | Typically 1-3% |

The significant spread of 30 pips on major currency pairs is notably higher than the industry average, which could substantially erode trading profits. Furthermore, the lack of information on commissions and overnight interest rates suggests that traders may encounter unexpected costs. This lack of clarity raises questions about the broker's commitment to fair trading practices and transparency. Therefore, traders must carefully consider these factors when pondering, "Is DGCTC safe?"

Client Fund Security

The safety of client funds is paramount when evaluating a forex broker. DGCTC's lack of regulation raises serious concerns about its fund security measures. Regulated brokers are typically required to maintain client funds in segregated accounts, ensuring that traders' money is protected in the event of bankruptcy or financial difficulties. Additionally, reputable brokers often provide investor protection schemes to safeguard client deposits.

Unfortunately, DGCTC does not provide any information regarding its fund security protocols, which is alarming. Without clear policies on fund segregation and investor protection, traders are left vulnerable to potential losses. Furthermore, any historical issues related to fund safety or disputes could significantly impact a trader's decision to engage with DGCTC. In summary, the absence of robust fund security measures makes it challenging to affirmatively answer the question, "Is DGCTC safe?"

Customer Experience and Complaints

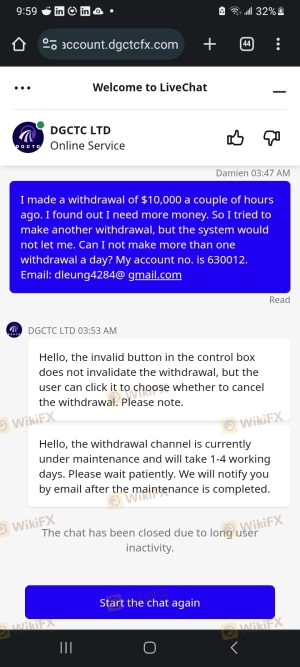

Customer feedback is an essential aspect of evaluating a broker's credibility. Analyzing user experiences can reveal patterns of complaints and the broker's responsiveness to issues. DGCTC has received mixed reviews, with some users praising its customer service while others report difficulties in withdrawing funds.

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Issues | High | Slow response |

| High Spreads | Medium | Acknowledged |

| Customer Service Wait Times | Low | Acceptable |

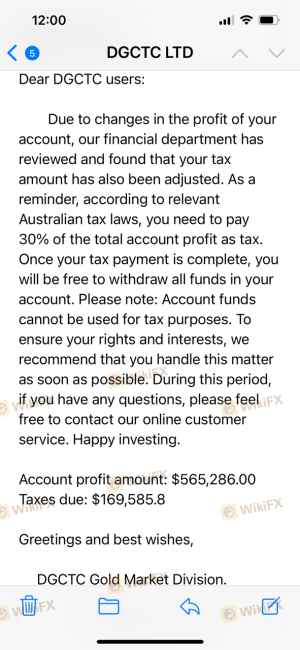

One notable case involved a trader who reported a significant delay in withdrawing funds after experiencing substantial profits. The broker's insistence on additional deposits before processing the withdrawal raised alarm bells and highlighted potential red flags. Additionally, while some users reported positive experiences with customer support, the overall sentiment indicates a lack of reliability in resolving critical issues. This inconsistency in customer experiences further complicates the inquiry into whether "Is DGCTC safe?"

Platform and Trade Execution

The performance and reliability of a trading platform are crucial for traders. DGCTC offers a proprietary trading platform, but user reviews suggest that it may suffer from performance issues, including slow execution times and occasional glitches. These factors can significantly impact a trader's ability to execute trades effectively.

Moreover, the absence of industry-standard platforms like MetaTrader 4 or 5 raises concerns about the platform's capabilities and features. Traders often prefer established platforms due to their proven performance and extensive functionalities. The potential for slippage and order rejections can also affect trading outcomes, leading to frustrations among users. Given these considerations, it is essential to evaluate the platform's reliability when questioning, "Is DGCTC safe?"

Risk Assessment

Overall, the risks associated with trading through DGCTC are considerable. The lack of regulation, transparency issues, and mixed customer experiences contribute to a high-risk profile for potential traders.

| Risk Category | Risk Level (Low/Medium/High) | Brief Description |

|---|---|---|

| Regulatory Risk | High | No regulatory oversight or protection. |

| Financial Risk | High | High spreads and unclear fees. |

| Operational Risk | Medium | Platform performance issues. |

To mitigate these risks, traders should consider opening a small account to test the platform and its features before committing larger sums. Additionally, conducting further research into alternative brokers with established reputations and regulatory backing is advisable.

Conclusion and Recommendations

In conclusion, the evidence suggests that DGCTC presents several red flags that warrant caution. The lack of regulation, transparency issues, and mixed customer feedback raise significant concerns about its safety and legitimacy. Traders must be particularly vigilant when considering whether "Is DGCTC safe?"

For those seeking to engage in forex trading, it is advisable to explore established brokers with solid regulatory frameworks and positive user experiences. Reputable alternatives may include brokers regulated by recognized authorities, which offer better protection for client funds and transparent trading conditions. Ultimately, thorough research and careful consideration are essential for making informed trading decisions.

Is DGCTC a scam, or is it legit?

The latest exposure and evaluation content of DGCTC brokers.

DGCTC Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

DGCTC latest industry rating score is 1.39, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.39 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.