Is Yunikon FX safe?

Business

License

Is Yunikon FX A Scam?

Introduction

Yunikon FX is a forex broker that has emerged in the competitive landscape of online trading, claiming to offer a user-friendly platform for trading various financial instruments, including forex, commodities, and cryptocurrencies. As with any broker, it is crucial for traders to conduct thorough due diligence before committing their funds. The forex market is rife with both legitimate opportunities and potential scams, making it imperative for traders to carefully evaluate brokers like Yunikon FX. This article seeks to provide an objective analysis of Yunikon FX, examining its regulatory status, company background, trading conditions, and customer experiences to answer the pressing question: Is Yunikon FX safe?

To conduct this investigation, we have utilized multiple sources, including broker reviews, regulatory databases, and customer feedback, to build a comprehensive picture of Yunikon FX's operations and reputation.

Regulation and Legitimacy

The regulatory environment in which a broker operates is one of the most critical factors in assessing its legitimacy and safety. Yunikon FX is registered in Saint Vincent and the Grenadines, a jurisdiction often criticized for its lax regulatory framework. While the broker claims to be licensed by the Financial Services Authority (FSA) of this region, this regulatory body is not considered stringent compared to major international regulators.

| Regulatory Body | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| FSA | Not specified | Saint Vincent and the Grenadines | Unverified |

The lack of robust regulatory oversight raises significant concerns regarding investor protection. Many reviews indicate that Yunikon FX does not adhere to the same compliance standards as brokers regulated by more reputable authorities such as the U.S. Commodity Futures Trading Commission (CFTC) or the UK's Financial Conduct Authority (FCA). Without stringent regulations, traders may find themselves exposed to higher risks, including potential fraud or mismanagement of funds.

Company Background Investigation

Yunikon FX, officially known as Yuni Kon Financial Limited, has been in operation for approximately two to five years. The company is headquartered at Beachmont Business Centre, 348, Kingstown, Saint Vincent and the Grenadines. However, the lack of detailed information about its ownership structure and management team raises concerns about transparency.

The management team behind Yunikon FX has not been widely publicized, and there is limited information regarding their qualifications and experience in the financial industry. This lack of transparency can be a red flag for potential investors, as a well-established broker typically provides clear information about its leadership and operational history.

Moreover, the absence of comprehensive disclosures about the company's financial health and operational practices further complicates the assessment of its legitimacy. In today's trading environment, transparency is a cornerstone of trust, and Yunikon FX appears to fall short in this regard.

Trading Conditions Analysis

Understanding the trading conditions offered by Yunikon FX is essential for evaluating its overall value to traders. The broker claims to provide competitive spreads and leverage options, but the details can vary significantly across different account types.

| Fee Type | Yunikon FX | Industry Average |

|---|---|---|

| Major Currency Pair Spread | From 0.8 pips | 1.0 - 2.0 pips |

| Commission Model | Variable | Fixed/Variable |

| Overnight Interest Range | Not disclosed | 0.5% - 2% |

While Yunikon FX advertises spreads starting from 0.8 pips, it is crucial to note that such low spreads may not be consistently available and could widen during volatile market conditions. Additionally, the broker's commission structure is not clearly defined, leading to potential hidden costs that could impact overall profitability.

Another area of concern is the broker's policies on overnight interest, which are not transparently disclosed. Traders should be cautious of any unexpected fees that may arise, as these can significantly affect trading outcomes.

Client Funds Security

The safety of client funds is a paramount concern when choosing a forex broker. Yunikon FX claims to implement measures to secure client funds, but the effectiveness of these measures is questionable given the regulatory environment in which it operates.

One of the critical aspects of fund security is the segregation of client accounts. Yunikon FX states that it keeps client funds in separate accounts; however, the lack of independent verification raises doubts about the reliability of this claim. Furthermore, the absence of negative balance protection means that traders could potentially lose more than their initial investment, a risk that is not acceptable for many traders.

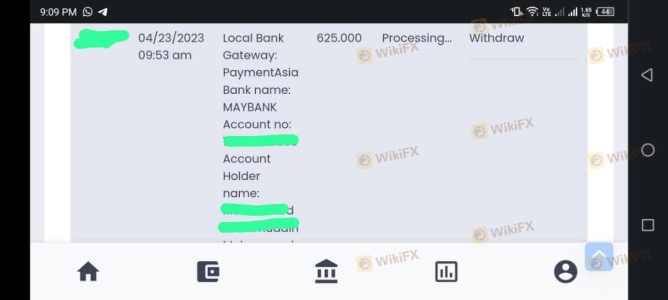

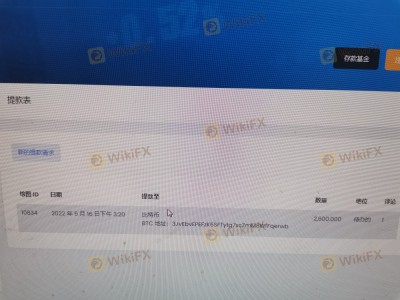

Historically, there have been reports of issues related to fund withdrawals, with clients expressing frustration over delays and lack of communication. Such incidents can severely undermine trust and indicate deeper problems within the broker's operational framework.

Customer Experience and Complaints

Analyzing customer feedback is essential for understanding the real-world implications of trading with Yunikon FX. Numerous reviews highlight a pattern of dissatisfaction among clients, particularly concerning the withdrawal process and customer support.

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Delays | High | Poor |

| Lack of Customer Support | Medium | Poor |

| Misleading Information | High | Poor |

Many users have reported prolonged delays in processing withdrawal requests, with some waiting months without resolution. Additionally, the quality of customer support has been criticized, with users often receiving inadequate responses to their inquiries. This lack of effective communication can exacerbate frustrations and lead to further distrust.

For instance, one user reported that after several months of trading, their withdrawal request remained pending, and attempts to contact support yielded no results. Such experiences contribute to the growing sentiment that Yunikon FX may not be a safe broker to engage with.

Platform and Trade Execution

The trading platform offered by Yunikon FX is a proprietary version of MetaTrader 4, a well-known platform in the industry. While MT4 is generally regarded as reliable, the performance of Yunikon FX's version has come under scrutiny.

Users have reported issues with order execution, including slippage and rejections, which can significantly impact trading results. A high rejection rate can be particularly concerning, as it may suggest potential manipulative practices by the broker.

Moreover, the overall user experience on the platform has been described as subpar, with some users noting that the interface is not as intuitive as other leading platforms. This can hinder traders, especially those who are new to the market, from effectively managing their trades.

Risk Assessment

Using Yunikon FX poses several risks that potential traders should carefully consider. The following table summarizes the key risk areas associated with this broker:

| Risk Category | Risk Level (Low/Medium/High) | Brief Description |

|---|---|---|

| Regulatory Risk | High | No robust regulatory oversight |

| Fund Security Risk | High | Potential for fund mismanagement |

| Withdrawal Risk | High | Significant delays reported |

| Customer Support Risk | Medium | Poor response times |

Given these risks, it is advisable for traders to approach Yunikon FX with caution. Engaging with an unregulated broker can lead to significant financial loss, and it is essential to prioritize safety and security when choosing a trading partner.

Conclusion and Recommendations

In conclusion, the evidence gathered suggests that Yunikon FX may not be a safe broker for trading. The lack of robust regulatory oversight, combined with numerous customer complaints regarding fund security and withdrawal issues, raises serious concerns about the broker's legitimacy.

For traders seeking a reliable forex trading experience, it is recommended to consider alternatives that are well-regulated and have a proven track record of customer satisfaction. Brokers regulated by reputable authorities, such as the FCA or ASIC, typically offer greater security and transparency, making them safer options for traders.

Ultimately, the decision to engage with Yunikon FX should be made with careful consideration of the associated risks, and potential clients are encouraged to seek out brokers that prioritize regulatory compliance and customer support.

Is Yunikon FX a scam, or is it legit?

The latest exposure and evaluation content of Yunikon FX brokers.

Yunikon FX Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

Yunikon FX latest industry rating score is 1.51, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.51 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.