DA 2025 Review: Everything You Need to Know

Executive Summary

DA presents a unique approach to brokerage services. The platform positions itself as a place where brokers can operate with significant freedom and control. This da review reveals a mixed picture of opportunities and limitations that potential users should carefully consider. The platform's primary appeal lies in its emphasis on broker independence, allowing professionals to function as their own bosses while maintaining access to essential trading infrastructure and support systems. According to available information, DA has integrated automated trading systems into its framework. This represents a notable technological advancement for traders seeking algorithmic solutions and automated strategies.

The platform appears to target a specific demographic: independent-minded traders and brokers who value operational freedom over traditional structured environments. However, our analysis reveals significant gaps in transparency regarding regulatory oversight, trading conditions, and comprehensive service offerings that users should be aware of. The lack of detailed information about licensing, compliance measures, and specific trading parameters raises questions about the platform's suitability for risk-conscious traders. While the automated trading integration suggests technological sophistication, the absence of comprehensive user feedback and detailed operational data makes it challenging to provide a definitive assessment of DA's overall value proposition.

Important Disclaimers

Potential users should be aware that this evaluation is based on limited publicly available information. Specific regulatory details and comprehensive trading conditions were not clearly disclosed in available sources, which limits our ability to provide complete assessments. Different regions may experience varying service levels and regulatory protections when using DA's services. This review methodology relies on accessible documentation and available user reports, though comprehensive real-world testing and extensive user feedback verification were not conducted for this analysis. Traders should independently verify all regulatory compliance and trading conditions relevant to their jurisdiction before engaging with any brokerage platform.

Rating Framework

Broker Overview

DA operates under a distinctive business model that emphasizes broker autonomy and independence. According to available information, the platform's core philosophy centers on enabling brokers to function as independent operators while providing necessary technological infrastructure and support systems. This approach appeals to experienced professionals who prefer managing their own client relationships and trading strategies without extensive corporate oversight or micromanagement. The platform's structure suggests it caters to brokers seeking entrepreneurial freedom within the financial services sector.

The technological foundation of DA includes integrated automated trading capabilities. This indicates the platform's commitment to modern trading solutions and advanced technological infrastructure. However, specific details regarding the establishment date, corporate background, and comprehensive service offerings remain unclear from available sources and documentation. The platform appears to position itself as a facilitator rather than a traditional full-service brokerage, focusing on providing tools and infrastructure while allowing brokers significant operational latitude and decision-making freedom. This da review finds that while the independence-focused model may attract certain professionals, the lack of detailed operational information presents challenges for thorough evaluation.

Regulatory Status: Available documentation does not provide clear information about specific regulatory authorities overseeing DA's operations. This represents a significant transparency concern for potential users who prioritize regulatory oversight and protection.

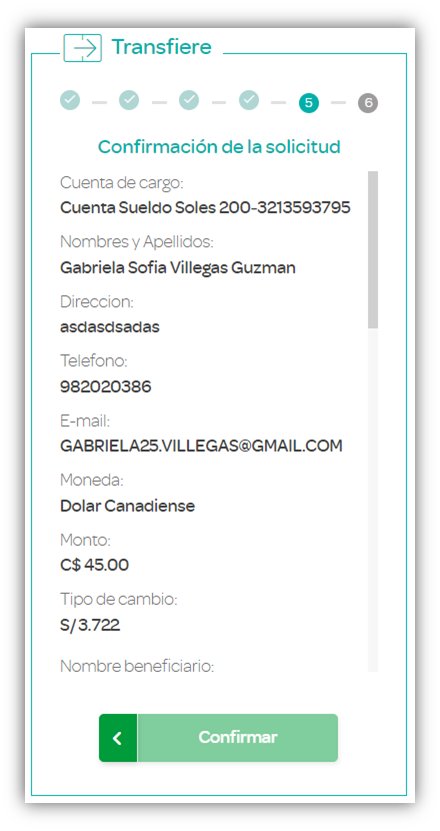

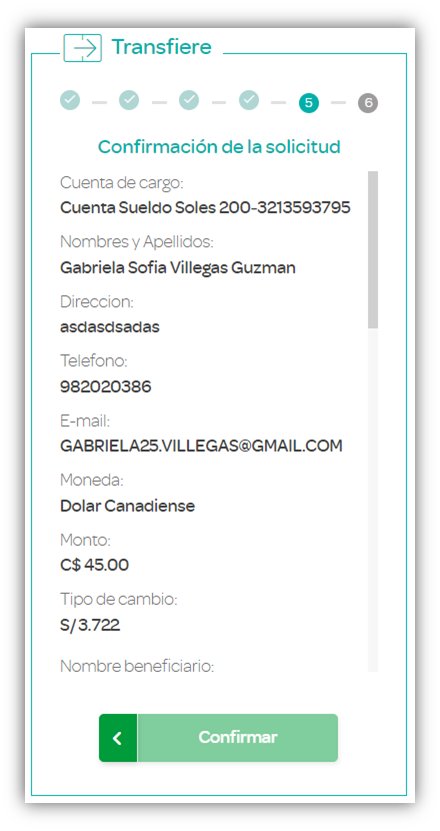

Deposit and Withdrawal Methods: Specific information regarding available payment methods, processing times, and associated fees was not detailed in accessible sources.

Minimum Deposit Requirements: Exact minimum deposit amounts and account funding requirements were not specified in available materials.

Promotional Offers: Details about welcome bonuses, trading incentives, or promotional programs were not clearly outlined in reviewed sources.

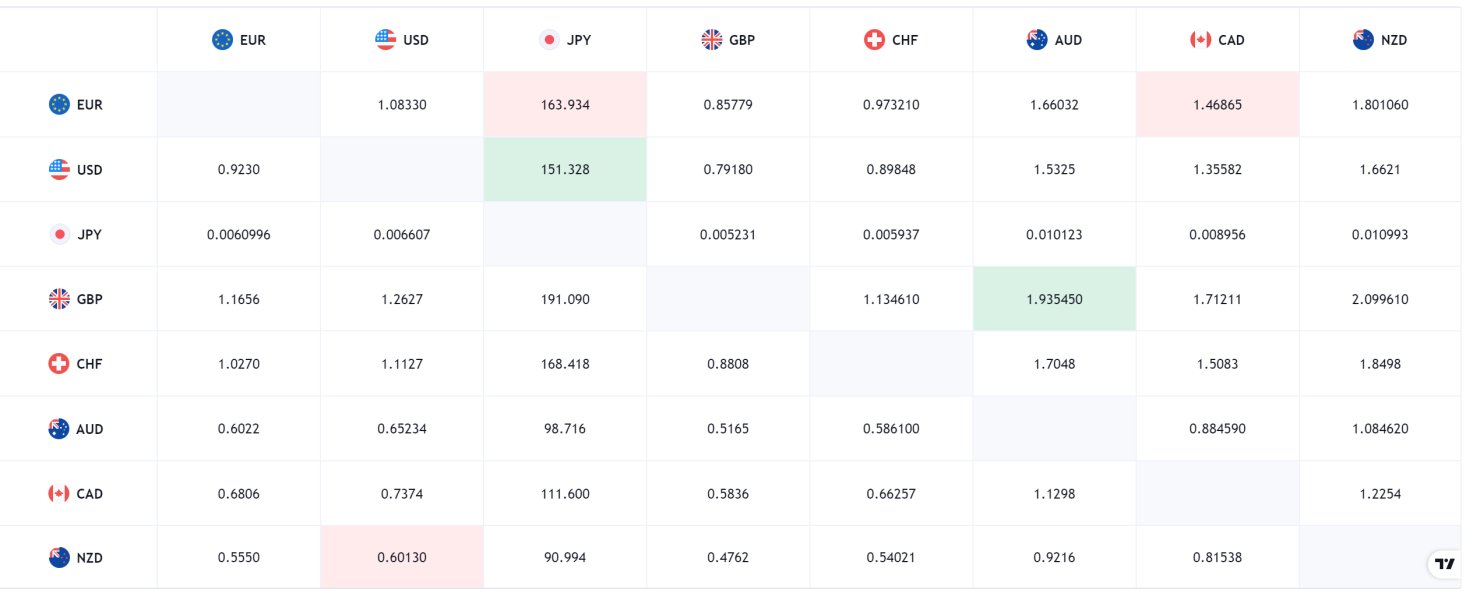

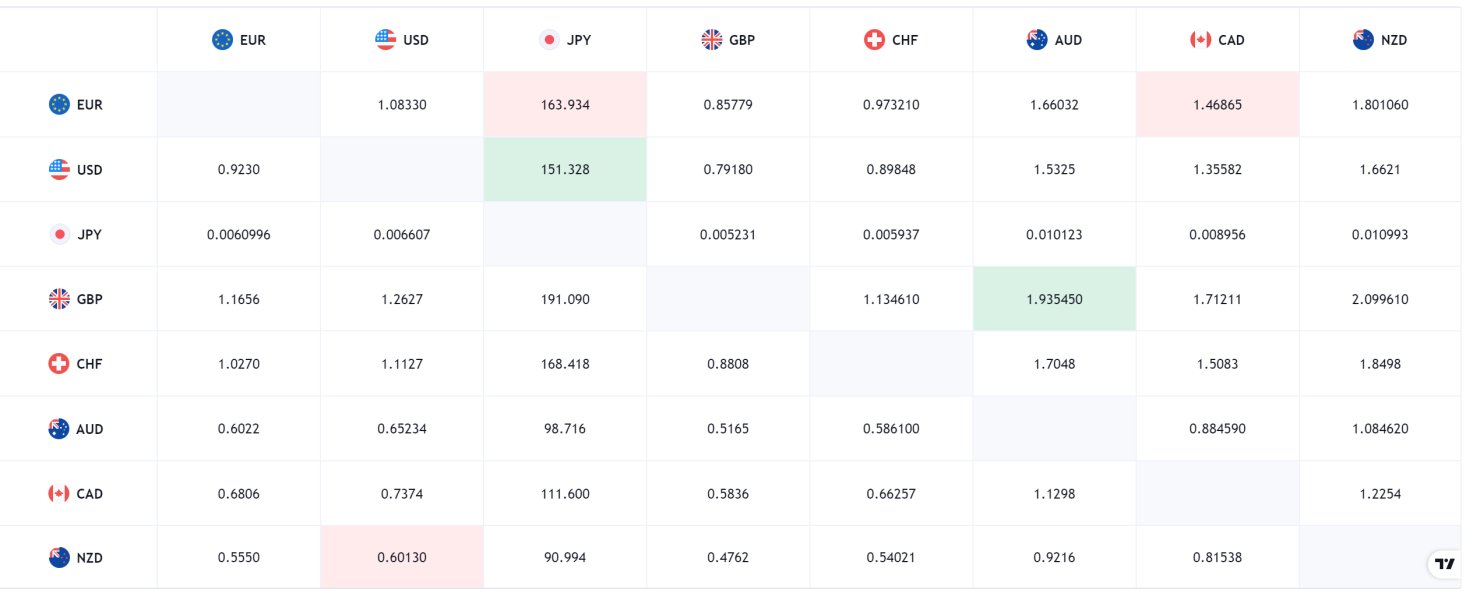

Available Assets: The range of tradeable instruments, including forex pairs, commodities, indices, and other financial products, was not comprehensively detailed.

Cost Structure: Specific information regarding spreads, commissions, overnight fees, and other trading costs was not provided in available documentation. This makes cost comparison difficult for potential users evaluating different brokerage options.

Leverage Options: Maximum leverage ratios and margin requirements for different account types and instruments were not specified.

Platform Selection: While automated trading integration is mentioned, details about platform options, including mobile applications and web-based interfaces, remain unclear.

Geographic Restrictions: Information about service availability in different countries and regional limitations was not provided.

Customer Support Languages: Available languages for customer service communication were not specified in reviewed materials.

This da review highlights significant information gaps that potential users should address through direct inquiry with the platform.

Comprehensive Rating Analysis

Account Conditions Analysis

The evaluation of DA's account conditions presents challenges due to limited available information. Traditional brokerage reviews typically examine multiple account tiers, minimum deposit requirements, and specific features tailored to different trader profiles and experience levels. However, DA's documentation does not provide clear details about account types or their respective characteristics and benefits. This lack of transparency makes it difficult for potential clients to understand what options are available and how they might align with individual trading needs.

The absence of specific minimum deposit information is particularly concerning for new traders who need to budget appropriately for their trading activities. Most reputable brokers clearly outline their account requirements, including initial funding amounts, maintenance fees, and upgrade criteria for different account levels. Without this fundamental information, traders cannot make informed decisions about whether DA's offerings match their financial capabilities and trading objectives.

The account opening process and required documentation also remain unclear from available sources. Modern traders expect streamlined verification procedures while maintaining compliance with international financial regulations and anti-money laundering requirements. The lack of detailed information about DA's onboarding process raises questions about operational efficiency and regulatory compliance standards. This da review emphasizes the need for greater transparency in account-related policies and procedures.

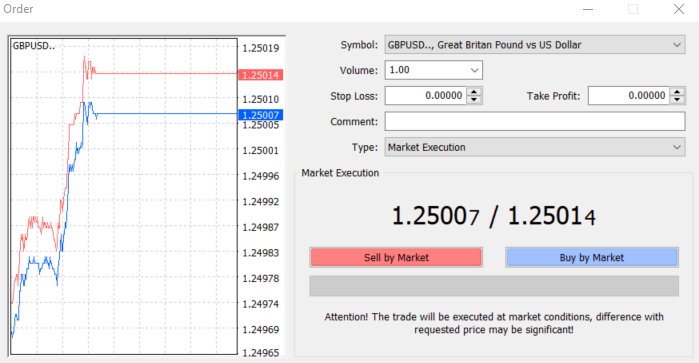

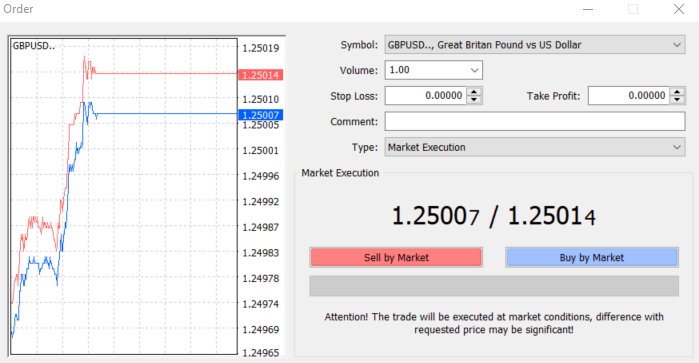

DA's integration of automated trading systems represents a potentially valuable feature for traders interested in algorithmic strategies. Automated trading capabilities can provide significant advantages, including emotion-free execution, 24-hour market monitoring, and the ability to implement complex strategies consistently across different market conditions. However, the specific functionality, customization options, and performance metrics of DA's automated systems are not detailed in available information.

The absence of information about additional trading tools raises concerns about the platform's comprehensiveness. Professional traders typically require access to advanced charting software, technical analysis indicators, economic calendars, and market research resources to make informed trading decisions. Without clear documentation of these essential tools, it becomes difficult to assess whether DA provides a complete trading environment or merely basic functionality.

Educational resources and market analysis are crucial components of a comprehensive brokerage offering. New traders particularly benefit from tutorials, webinars, and market commentary that help develop their skills and understanding of financial markets. The lack of information about DA's educational initiatives suggests either limited offerings in this area or insufficient communication about available resources. This gap may particularly impact novice traders who require guidance and support as they develop their trading expertise.

Customer Service and Support Analysis

Customer service quality often distinguishes exceptional brokers from mediocre ones, yet DA's support infrastructure remains largely undocumented in available sources. Essential service elements such as available contact methods, response times, and support hours are not clearly specified in the platform's documentation. This information gap is particularly problematic given the fast-paced nature of financial markets, where timely support can be crucial for resolving urgent issues.

The availability of multilingual support is increasingly important as brokers serve global clientele. However, information about language options and regional support capabilities is not provided in reviewed materials and documentation. This lack of clarity may concern international traders who prefer communicating in their native languages, especially when dealing with complex technical or financial issues.

Professional traders also value access to dedicated account managers and specialized technical support. The absence of information about personalized service options suggests either limited availability of such services or insufficient communication about their existence and benefits. Without clear documentation of support tiers and specialized assistance options, traders cannot evaluate whether DA's service model aligns with their support expectations and requirements.

Trading Experience Analysis

The trading experience encompasses platform stability, execution speed, and overall user interface quality. Unfortunately, specific information about DA's trading platform performance is not available in reviewed sources and documentation. Traders typically prioritize platforms that offer reliable connectivity, fast order execution, and intuitive interfaces that facilitate efficient trading activities.

Mobile trading capabilities have become essential for modern traders who need market access regardless of location. The absence of detailed information about DA's mobile applications or responsive web interfaces represents a significant information gap that affects user evaluation. Today's traders expect seamless functionality across devices, including smartphones and tablets, with full access to trading tools and account management features.

Order execution quality directly impacts trading profitability, making it a critical evaluation factor. Elements such as slippage rates, requote frequency, and execution speeds during volatile market conditions are essential considerations for serious traders. However, this da review cannot provide specific assessments of these performance metrics due to limited available data about DA's execution capabilities and infrastructure quality.

Trust and Reliability Analysis

Regulatory oversight forms the foundation of broker trustworthiness, yet DA's regulatory status remains unclear from available documentation. Reputable brokers typically hold licenses from recognized financial authorities and clearly display their regulatory credentials on their websites and marketing materials. The absence of specific regulatory information raises significant concerns about oversight, compliance standards, and client protection measures.

Client fund protection mechanisms are crucial for trader security, including segregated account policies and compensation schemes. However, available information does not detail DA's fund protection measures or insurance coverage for client deposits and investments. This transparency gap is particularly concerning given the importance of capital security in financial trading environments.

Corporate transparency, including company ownership, operational history, and financial stability, contributes to overall trustworthiness. The limited availability of comprehensive corporate information makes it difficult to assess DA's long-term viability and commitment to client service excellence. Traders typically prefer brokers with established track records and clear corporate governance structures.

User Experience Analysis

User experience encompasses the entire client journey, from initial registration through ongoing trading activities. However, specific information about DA's user interface design, navigation structure, and overall usability is not available in reviewed sources and documentation. Modern traders expect intuitive platforms that minimize complexity while providing access to sophisticated trading tools and features.

The registration and account verification process significantly impacts initial user experience. Streamlined onboarding procedures that maintain regulatory compliance while minimizing delays are highly valued by traders eager to begin trading activities and access market opportunities. Without specific information about DA's verification requirements and processing times, potential users cannot anticipate the account setup experience.

Ongoing user satisfaction depends on factors such as platform reliability, feature accessibility, and overall service quality. The absence of comprehensive user feedback and satisfaction metrics makes it challenging to assess how well DA meets client expectations and requirements. This information gap limits the ability to provide definitive recommendations about the platform's suitability for different trader profiles and preferences.

Conclusion

This comprehensive da review reveals a platform with both interesting concepts and significant transparency challenges. DA's emphasis on broker independence and automated trading integration suggests innovative approaches to brokerage services that may appeal to certain trader segments. However, the substantial gaps in available information regarding regulatory oversight, trading conditions, and comprehensive service offerings create considerable uncertainty for potential users.

The platform appears most suitable for experienced brokers and traders who value operational autonomy and are interested in automated trading capabilities. However, the lack of detailed regulatory information and comprehensive user feedback makes it difficult to recommend DA for risk-averse traders or those requiring extensive support services and guidance. Potential users should conduct thorough due diligence and direct inquiry with DA to obtain the detailed information necessary for informed decision-making.