Senta 2025 Review: Everything You Need to Know

Summary

Senta presents itself as an emerging forex broker in the competitive foreign exchange market. Our comprehensive senta review reveals significant gaps in available information about this trading platform that offers forex trading and CFD services. Senta operates without clearly disclosed regulatory oversight, which raises important considerations for potential traders who want to protect their investments.

The broker has not received notable complaints according to available records. However, the absence of detailed regulatory information requires careful evaluation by prospective clients who value transparency and security. The platform appears to target traders seeking entry into forex markets, particularly those who may prioritize accessibility over stringent regulatory credentials that most established brokers provide.

Senta's service portfolio includes foreign exchange trading, contracts for difference, and commodity trading options. The limited transparency regarding operational details, regulatory compliance, and specific trading conditions suggests that this broker may be more suitable for traders with higher risk tolerance and lower regulatory requirements. For investors considering Senta as their trading partner, thorough due diligence becomes essential given the information gaps identified in this senta review that highlight potential concerns.

The broker's neutral standing in the market, combined with the absence of significant negative feedback, positions it as a middle-ground option. This status requires careful consideration of individual trading needs and risk management preferences before making any financial commitments.

Important Notice

This senta review is based on publicly available information and should be considered within the context of regional regulatory differences. These differences may affect trading conditions and legal protections that vary significantly across different jurisdictions. Senta's regulatory status remains unclear across different jurisdictions, and traders should independently verify compliance requirements in their specific regions before engaging with the platform to avoid potential legal issues.

Our evaluation methodology relies on available data sources, user feedback where accessible, and industry standard assessment criteria. However, the limited availability of detailed user reviews and comprehensive complaint records means that some aspects of this analysis are based on incomplete information that may not reflect the full picture. Prospective traders are strongly advised to conduct their own research and consider consulting with financial advisors familiar with their local regulatory environment before making trading decisions that could impact their financial future.

Rating Framework

Broker Overview

Senta operates as a forex brokerage firm offering trading services in foreign exchange markets, contracts for difference, and commodity trading. The broker's establishment date and detailed company background remain undisclosed in available documentation, which represents a significant information gap for potential clients seeking comprehensive broker evaluation that most serious traders require. The platform appears to focus on providing access to major financial markets through online trading services, though specific details about the company's operational history, founding principles, and business development trajectory are not readily available to the public.

The broker's business model centers on facilitating retail forex trading and CFD transactions for individual traders and potentially institutional clients. Senta's service portfolio encompasses foreign exchange pairs, contracts for difference across various asset classes, and commodity trading opportunities that appeal to diverse trading strategies. However, the absence of detailed information regarding the company's operational scale, client base size, and market positioning makes it challenging to assess the broker's competitive standing within the broader forex industry landscape.

This senta review identifies that while Senta offers core trading services expected from forex brokers, the limited transparency regarding company specifics creates uncertainty. The platform's trading infrastructure, technology partnerships, and execution models are not clearly documented, which may influence trader confidence and decision-making processes when selecting a brokerage partner for their investment activities.

Regulatory Status: Available information does not specify particular regulatory authorities overseeing Senta's operations. This represents a significant consideration for traders prioritizing regulatory protection and compliance standards that provide legal recourse in case of disputes.

Deposit and Withdrawal Methods: Specific payment processing options, supported currencies, and transaction procedures are not detailed in current documentation. This lack of information requires direct inquiry with the broker for clarification about how clients can fund their accounts and withdraw profits.

Minimum Deposit Requirements: Exact minimum deposit amounts and account funding thresholds are not specified in available sources. This suggests potential variation based on account types or regional differences that may affect accessibility for new traders.

Promotional Offers: Bonus structures, incentive programs, and promotional campaigns are not documented in accessible information. This indicates either absence of such programs or limited marketing disclosure that could benefit potential clients.

Tradable Assets: Based on available information, Senta provides access to forex currency pairs, contracts for difference across multiple asset classes, and commodity trading instruments. However, specific asset counts and market coverage details remain unspecified, making it difficult to assess trading opportunities.

Cost Structure: Detailed information regarding spreads, commission rates, overnight financing charges, and additional fees is not available in current documentation. This requires direct consultation with the broker for accurate pricing information that affects trading profitability.

Leverage Ratios: Maximum leverage offerings and risk management parameters are not specified in available sources. These typically vary based on regulatory jurisdiction and account classification, which affects potential returns and risks.

Platform Options: Specific trading platform software, mobile applications, and technology infrastructure details are not documented in accessible information. This makes it challenging to evaluate the quality of trading tools and user interface design.

Geographic Restrictions: Regional availability and jurisdictional limitations are not clearly outlined in current sources. This information is crucial for international traders seeking to understand access requirements.

Customer Support Languages: Multilingual support options and communication channels are not specified in available documentation. This senta review highlights the need for prospective traders to directly contact the broker for comprehensive details regarding these essential trading parameters.

Account Conditions Analysis

The evaluation of Senta's account conditions faces significant limitations due to insufficient information disclosure in available sources. Traditional account assessment criteria including account type varieties, minimum deposit requirements, and special account features cannot be thoroughly analyzed based on current documentation that lacks essential details. This information gap represents a considerable challenge for traders seeking to understand the broker's account structure and associated terms that directly impact their trading experience.

Without detailed account specifications, potential clients cannot adequately assess whether Senta's offerings align with their trading capital, experience level, and strategic requirements. The absence of clear information regarding account opening procedures, verification processes, and ongoing account maintenance requirements further complicates the evaluation process for prospective traders who need this information to make informed decisions.

Industry standard practice typically involves multiple account tiers designed to accommodate different trader profiles. These range from beginner-friendly accounts with lower minimum deposits to advanced accounts offering enhanced features and preferential trading conditions that experienced traders prefer. However, Senta's specific approach to account segmentation and tier differentiation cannot be determined from available sources, which limits the ability to match trader needs with appropriate account types.

The lack of transparent account condition information in this senta review suggests that interested traders must engage directly with the broker. This requirement helps obtain essential details regarding deposit requirements, account features, and associated terms that affect trading costs and capabilities.

Assessment of Senta's trading tools and educational resources proves challenging due to limited information availability in accessible documentation. Standard forex broker offerings typically include comprehensive charting packages, technical analysis tools, market research, and educational materials designed to support trader development and decision-making processes that are essential for successful trading. However, specific details regarding Senta's tool portfolio and resource library are not documented in current sources, making it impossible to evaluate their quality and comprehensiveness.

Professional trading platforms generally provide advanced charting capabilities, multiple timeframe analysis, technical indicators, and automated trading support through expert advisors or signal services. The absence of detailed information about Senta's technological infrastructure and tool offerings prevents thorough evaluation of the platform's analytical capabilities and trading enhancement features that serious traders require for market analysis.

Educational resources represent a crucial component of broker services, particularly for developing traders seeking to improve their market knowledge and trading skills. Typical offerings include webinars, tutorials, market analysis, economic calendars, and educational articles covering fundamental and technical analysis concepts that help traders make better decisions. However, Senta's specific commitment to trader education and resource provision cannot be assessed based on available information, which may indicate limited educational support.

The lack of detailed tool and resource information in this senta review indicates that prospective traders must directly inquire about available features. This includes educational support and analytical capabilities before making platform selection decisions that will affect their trading success.

Customer Service and Support Analysis

Evaluation of Senta's customer service infrastructure encounters significant limitations due to insufficient information disclosure regarding support channels, response times, and service quality metrics. Professional forex brokers typically maintain multiple communication channels including live chat, email support, telephone assistance, and comprehensive FAQ sections to address trader inquiries and technical issues effectively when problems arise during trading activities.

Standard customer service assessment criteria include availability hours, multilingual support options, response time benchmarks, and problem resolution effectiveness. However, specific details regarding Senta's customer support structure, staffing levels, and service quality standards are not documented in available sources, preventing comprehensive evaluation of support capabilities that traders rely on during critical trading situations.

Quality customer service represents a critical factor in forex broker selection, particularly during market volatility periods when traders require immediate assistance. This includes help with technical issues, account problems, or trading-related inquiries that can affect trading performance and account security. The absence of clear information regarding Senta's support infrastructure creates uncertainty about the broker's commitment to client assistance and problem resolution when traders need help most.

Professional support teams typically offer specialized assistance for different client needs, including technical support for platform issues, account management for administrative matters, and trading support for market-related inquiries. However, Senta's specific approach to customer service organization and specialist support availability cannot be determined from current documentation. This requires direct inquiry for clarification about support quality and availability.

Trading Experience Analysis

Assessment of Senta's trading experience quality faces substantial limitations due to insufficient information regarding platform performance, execution standards, and user interface design. Critical trading experience factors include platform stability, order execution speed, slippage rates, and overall system reliability during various market conditions that can significantly impact trading results and profitability.

However, specific performance metrics and user experience data are not available in current documentation. Professional trading platforms typically provide seamless order execution, minimal latency, and robust infrastructure capable of handling high-volume trading periods without significant performance degradation that could cost traders money during important market movements.

The absence of detailed information about Senta's trading technology, execution models, and platform performance prevents thorough evaluation of the trading environment quality. Mobile trading capabilities represent increasingly important aspects of modern forex trading, enabling traders to monitor markets and execute transactions from various locations throughout the day. Standard mobile applications offer comprehensive trading functionality, real-time market data, and account management features that modern traders expect from professional platforms.

However, Senta's mobile trading solutions and application capabilities are not documented in available sources. Trading environment stability, including consistent spread offerings, reliable market data feeds, and transparent execution policies, significantly influences trader satisfaction and performance outcomes that determine long-term trading success.

The lack of specific information regarding these critical aspects in this senta review indicates that prospective traders must directly evaluate platform performance. This evaluation should include demo accounts or direct broker consultation before committing to live trading activities.

Trust and Reliability Analysis

Trust assessment for Senta encounters significant challenges due to limited information regarding regulatory compliance, fund security measures, and operational transparency. Regulatory oversight represents a fundamental trust indicator for forex brokers, providing legal frameworks for client protection, dispute resolution, and operational standards that protect trader investments and ensure fair treatment.

However, specific regulatory credentials and compliance certifications are not clearly documented for Senta. Fund security measures, including segregated client accounts, deposit insurance, and financial reporting transparency, constitute essential trust factors for broker evaluation that serious traders consider before depositing funds. Professional brokers typically maintain client funds in segregated accounts separate from operational capital, providing additional protection against potential financial difficulties that could threaten client deposits.

However, Senta's specific fund protection measures and security protocols are not detailed in available sources. Company transparency indicators include regular financial reporting, management team disclosure, and operational history documentation that help traders assess broker credibility and long-term viability. Established brokers often provide comprehensive company information, including founding details, management backgrounds, and business development milestones that demonstrate their commitment to transparency and professional operations.

The absence of such transparency elements for Senta creates uncertainty regarding the broker's operational credibility and long-term stability. Industry recognition through awards, certifications, or professional associations often indicates broker credibility and market standing within the competitive forex industry.

However, available information does not document specific industry acknowledgments or professional affiliations for Senta. This limits assessment of the broker's reputation within the forex industry community.

User Experience Analysis

User experience evaluation for Senta proves challenging due to limited availability of client feedback, satisfaction surveys, and comprehensive user reviews. Typical user experience assessment encompasses platform usability, account management efficiency, transaction processing effectiveness, and overall client satisfaction levels that indicate how well the broker serves its clients in real-world trading situations.

However, specific user experience data and client testimonials are not documented in accessible sources. Interface design and platform usability significantly influence trader productivity and satisfaction levels during daily trading activities. Modern trading platforms typically feature intuitive navigation, customizable layouts, and efficient order management systems designed to enhance trading workflow and reduce operational friction that can interfere with trading performance.

However, specific details regarding Senta's platform design and usability features cannot be assessed based on available information. Registration and account verification processes impact initial user experience and platform accessibility for new traders seeking to start their trading journey. Streamlined onboarding procedures, clear documentation requirements, and efficient verification systems contribute to positive first impressions and reduced barriers to trading commencement that encourage new traders to begin trading quickly.

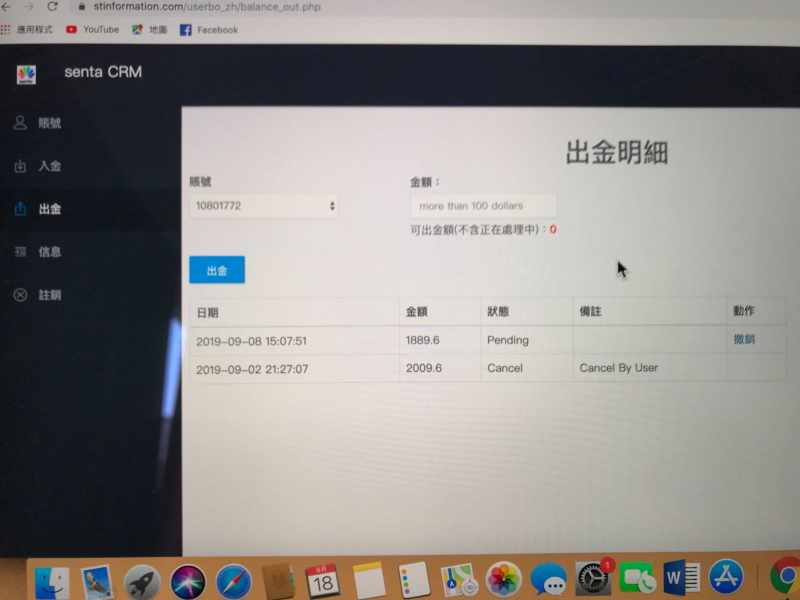

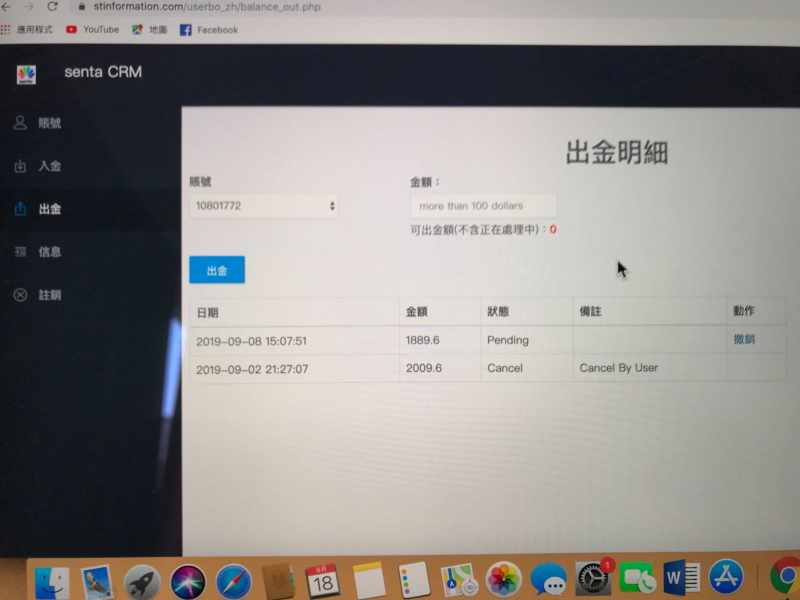

However, Senta's specific onboarding experience and process efficiency are not documented in current sources. Fund management experience, including deposit processing speed, withdrawal efficiency, and transaction transparency, represents crucial user experience components that affect trader satisfaction and confidence in the broker's services.

Professional brokers typically maintain efficient payment processing systems with clear fee structures and reasonable processing timeframes. The absence of specific information regarding Senta's payment processing experience prevents comprehensive user experience evaluation in this senta review.

Conclusion

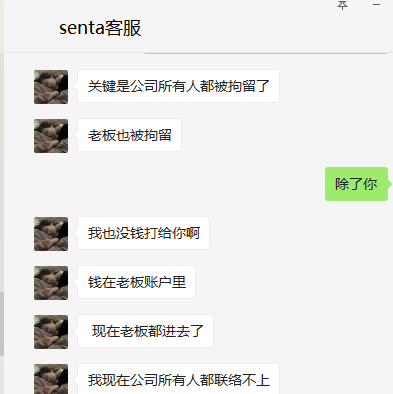

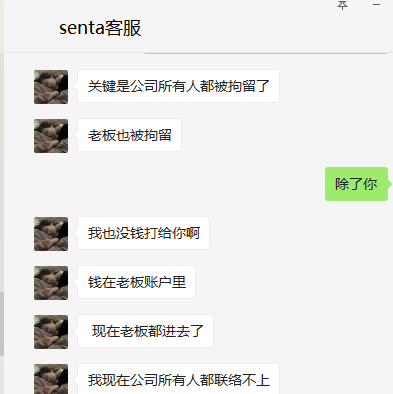

This comprehensive senta review reveals a forex broker operating with limited transparency and insufficient information disclosure across multiple critical evaluation areas. While Senta offers core trading services including forex, CFD, and commodity trading, the absence of detailed regulatory information, account specifications, and operational transparency creates significant uncertainty for potential clients who need this information to make informed trading decisions.

The broker's neutral market standing, characterized by the absence of notable complaints, suggests adequate basic service delivery. However, comprehensive quality assessment remains challenging due to information limitations that prevent thorough evaluation of essential broker characteristics and service quality.

Senta may be suitable for traders with higher risk tolerance and lower regulatory protection requirements, particularly those seeking basic market access without extensive broker verification needs. However, the significant information gaps identified throughout this evaluation suggest that most traders would benefit from considering more transparent alternatives with clearer regulatory credentials and comprehensive service documentation that provides greater confidence and security.

The primary disadvantages include insufficient regulatory disclosure, limited operational transparency, and inadequate information availability for informed decision-making. Conversely, the absence of significant negative feedback and complaint records suggests that existing clients may experience satisfactory basic service levels, though comprehensive satisfaction assessment cannot be completed based on available data that limits our ability to fully evaluate this broker's performance and reliability.