cyber capital 2025 Review: Everything You Need to Know

Abstract

This cyber capital review looks at the controversial broker Cyber Capital from a critical angle. Our analysis uses extensive market research and user feedback to form conclusions. Overall, our evaluation shows a negative outlook for this platform. The broker offers a relatively low minimum deposit of $250 and high leverage up to 1:200, which may seem attractive for investors interested in cryptocurrencies and forex trading. However, serious concerns remain about its reliability and transparency that cannot be ignored.

Multiple users have raised doubts about the broker's credentials. They have also made fraud allegations that point to significant risks. These risks may outweigh any potential benefits the platform claims to offer. The negative feedback suggests that this broker may not suit investors who prioritize safety and strong regulatory oversight. While Cyber Capital tries to serve traders interested in both digital and traditional assets, the trust and service quality issues hurt its value proposition badly.

This cyber capital review aims to give a complete analysis of these factors. The goal is to help potential clients make informed decisions about their investments.

Notice

Cyber Capital may face varying legal risks across different regions due to missing regulatory information. Potential investors should note this important concern. It is crucial to understand that this review relies on user feedback and market analysis rather than direct trading experience or first-hand platform usage. The lack of disclosed regulatory credentials means that legal protections could differ internationally. This situation may affect fund security and overall trading transparency in significant ways.

Readers should conduct additional research and remain cautious when considering this platform. The absence of clear regulatory backing creates uncertainty about investor protections.

Scoring Framework

Below is the rating for Cyber Capital across six dimensions based on detailed analysis:

Broker Overview

Cyber Capital is a broker with headquarters located in Europe. The firm focuses primarily on managing cryptocurrency assets alongside forex markets. It positions itself as a specialist in long-term portfolio management for investors interested in diversified investment strategies that include digital and traditional asset markets. The exact year of establishment is not disclosed, which raises questions about the company's history.

Cyber Capital has tried to create a niche by promoting accessible deposit thresholds and attractive leverage offerings. However, this lack of historical information creates uncertainty about the firm's endurance and growth in a highly competitive sector. This cyber capital review considers multiple aspects of the firm's background to provide a clear picture of its operations and potential risks that investors should understand.

In addition to its European base, Cyber Capital offers trading in both cryptocurrencies and forex. The broker aims to serve investors with varied asset interests through this dual approach. Its business model centers on long-term investment strategies with a focus on portfolio management rather than day-to-day trading, which positions it in a niche market segment. However, significant details remain undisclosed, including specifics on the trading platform type and regulatory oversight.

This information gap leaves potential investors with unanswered questions about the broker's legitimacy. The limited transparency persists even as the broker promotes high leverage ratios and low deposit requirements. This combination further fuels skepticism among users who expect clear information about their investment platforms. As highlighted in this cyber capital review, the lack of transparency about its operational framework, combined with user concerns, requires a cautious approach for those considering investing with Cyber Capital.

-

Regulatory Regions :

Specific regulatory information for Cyber Capital is not disclosed and remains unclear. Different sources suggest that the broker might operate under varying legal jurisdictions without clear oversight details provided to investors. This lack of detailed regulatory backing leaves open the possibility of differing legal protections based on the investor's region. The absence of clear regulatory information creates uncertainty about investor safeguards and legal recourse options.

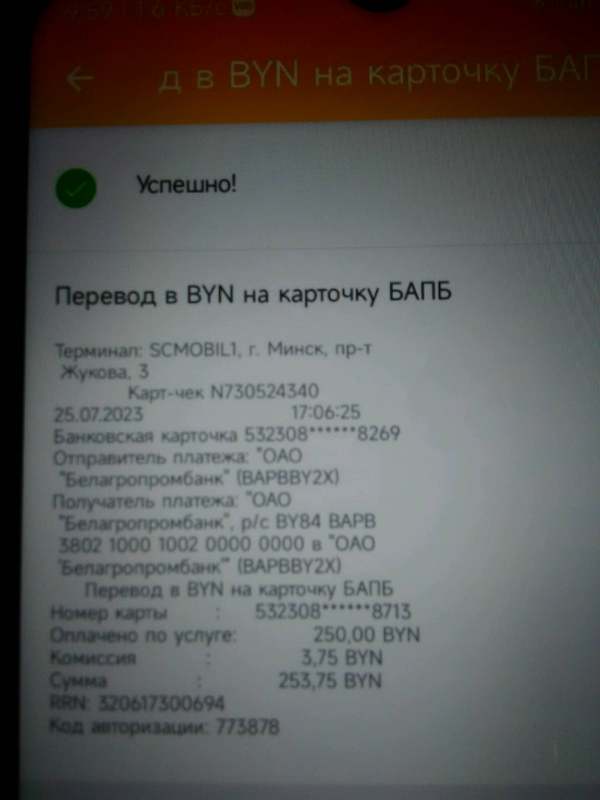

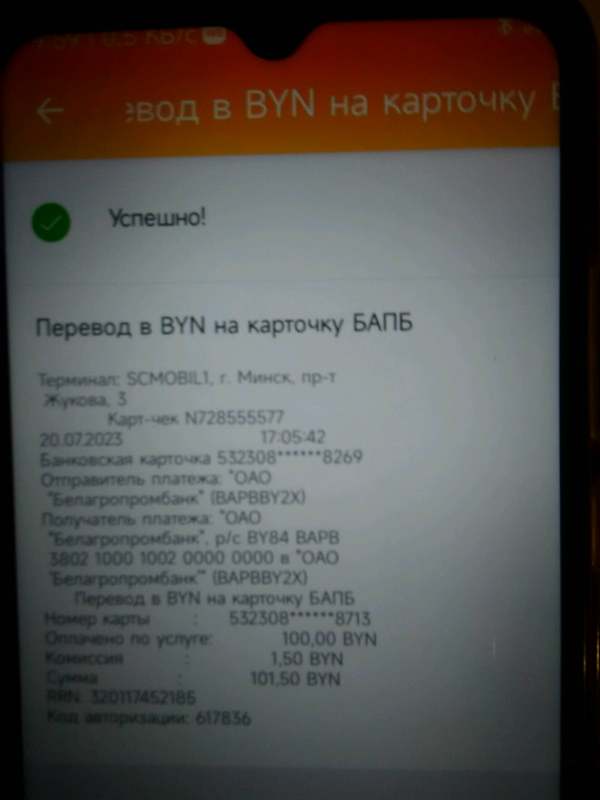

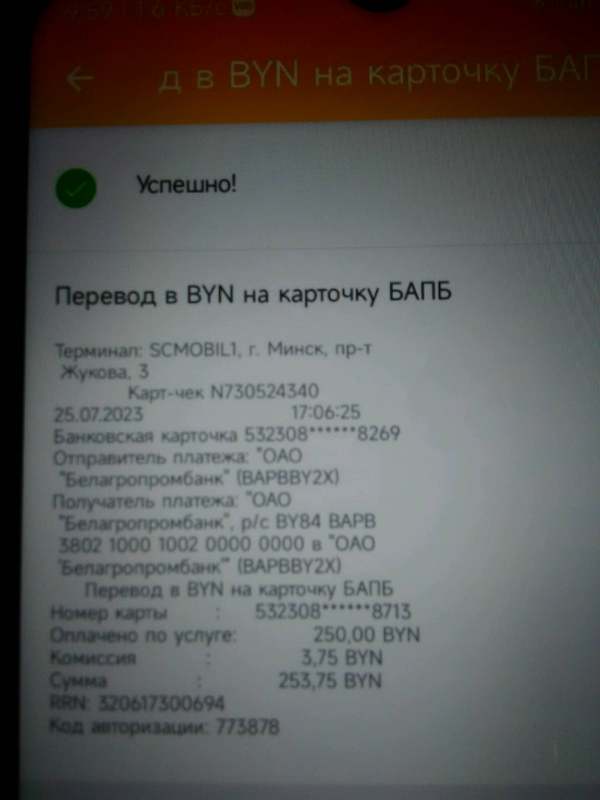

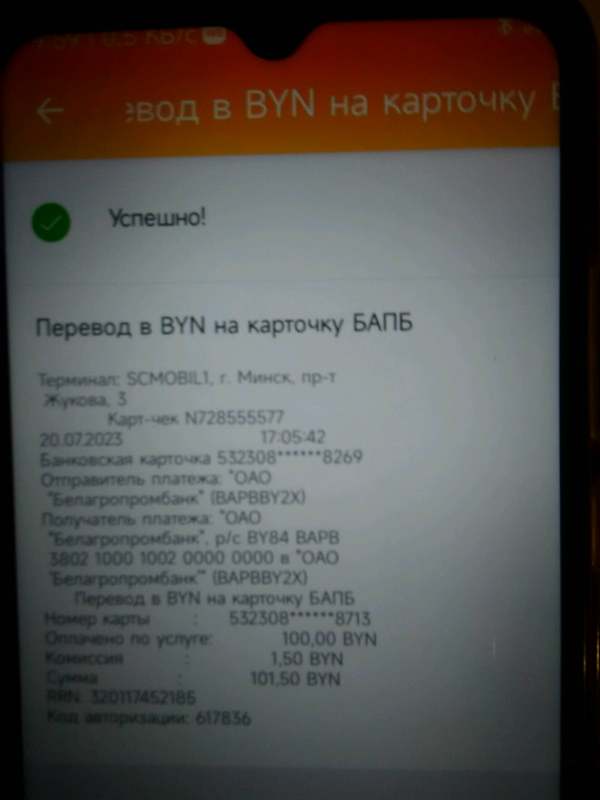

Deposit and Withdrawal Methods :

The available information does not detail the deposit and withdrawal methods supported by Cyber Capital. There is no comprehensive breakdown of payment options or processing times provided to potential investors. This makes it difficult for people to evaluate the convenience and security of fund movements. The lack of transparency about payment methods raises additional concerns about the platform's operational clarity.

Minimum Deposit Requirement :

Cyber Capital requires a minimum deposit of $250, which is one of its advertised features. While this low entry barrier may seem appealing to new investors, user feedback questions whether such a deposit threshold is reasonable given the overall service quality concerns.

BONUS and Promotions :

There is no clear information about bonus or promotional offers available to new or existing clients at Cyber Capital. The absence of promotional details adds to concerns over the overall transparency of the broker's offerings to potential investors. This lack of information makes it difficult to compare the platform's value proposition against competitors in the market.

Tradable Assets :

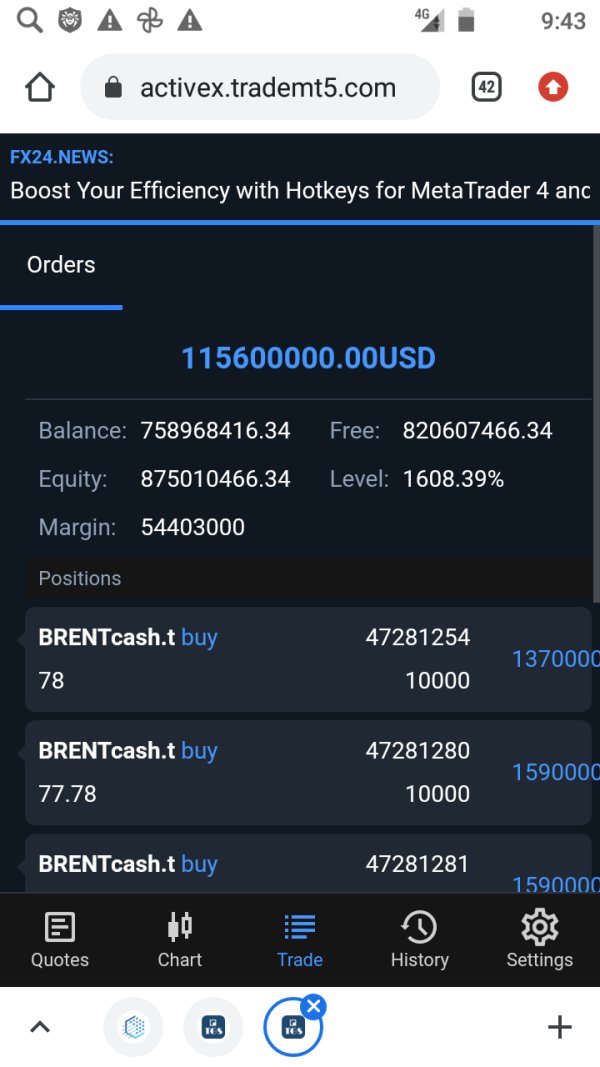

Investors can trade in both cryptocurrencies and forex markets with Cyber Capital. The inclusion of digital assets alongside traditional foreign exchange trading shows an attempt to diversify offerings for different investor preferences. However, the specifics related to asset pairs or trading conditions remain unclear to potential users. This dual focus may attract investors looking to leverage different market trends, yet the lack of detailed asset information leaves critical questions unanswered about what is actually available.

Cost Structure :

The detailed cost structure, including spreads, commissions, and other fees, is not provided by Cyber Capital in any reviewed materials. This significant omission makes it challenging to assess whether the pricing is competitive or if hidden charges might apply to trades. Investors must consider that a transparent cost framework is crucial for evaluating overall value and risk exposure before committing funds. The absence of this information in available resources further adds to concerns around the broker's reliability and transparency. Without clear pricing information, investors cannot make informed decisions about the true cost of trading with this platform.

Leverage Ratio :

Cyber Capital offers a maximum leverage ratio of up to 1:200 for its trading accounts. While high leverage can dramatically increase potential returns for successful trades, it also significantly amplifies the risk of losses, particularly given existing concerns regarding the broker's trustworthiness.

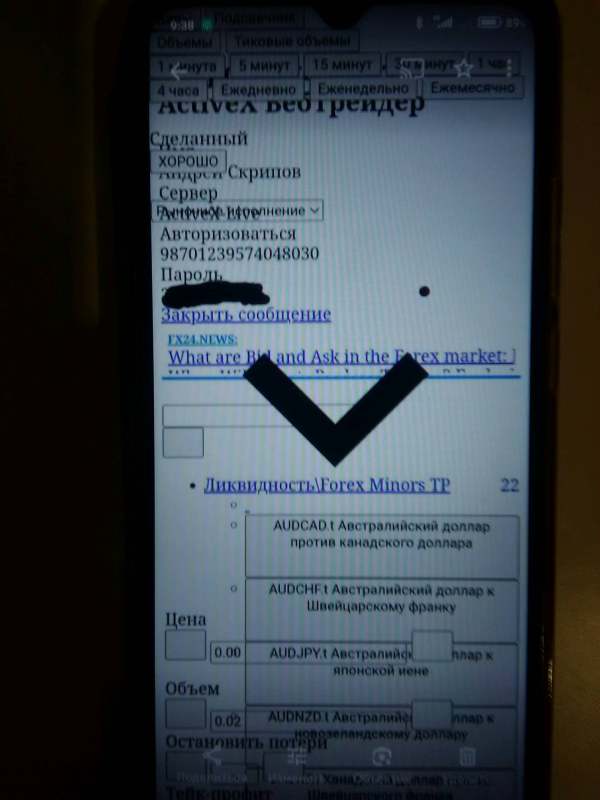

Platform Options :

Information about the specific trading platforms or software used by Cyber Capital has not been detailed in available disclosures. This lack of information may limit the investor's ability to evaluate the technological strength and user-friendliness of the platform. Without platform details, potential users cannot assess whether the trading environment meets their technical needs and preferences.

Regional Restrictions :

There is no clear information about regional restrictions or limitations imposed by Cyber Capital on potential investors. Investors should assume that regional legal variations might apply due to the lack of detailed regulatory disclosures from the company.

Customer Service Language :

Specific details about the languages in which customer support is offered are not provided by the company. This leaves important questions about accessibility for non-English speaking investors unanswered.

This cyber capital review section aims to outline all available specifics while highlighting significant information gaps. These gaps warrant further inquiry by prospective users before making investment decisions.

Detailed Scoring Analysis

2.6.1 Account Conditions Analysis

Cyber Capital's account conditions center on a minimum deposit requirement of $250. This entry-level threshold appears accessible compared to other industry standards in the brokerage world. However, multiple user reports raise concerns about whether this minimum deposit adequately reflects the overall quality and service stability of the broker's offerings. The lack of detailed information about account types, the opening process, and specialized account features like Islamic options makes the situation worse.

Users have frequently questioned the fairness and clarity of the account terms offered by the platform. They cite that the low deposit might be a strategy to mask deeper operational problems within the company. When compared to industry benchmarks, the offered account conditions seem to fall short of expectations in multiple areas. This contributes to an overall rating of 4/10 for this category. There is strong consensus among users that the account conditions may not provide sufficient reliability and transparency for safe investing. This necessitates heightened caution from potential investors considering this platform.

The available information about Cyber Capital's tools and resources is noticeably limited. The broker does not provide clear details about the range or quality of trading tools, charting software, or analytical resources that are essential for making informed trading decisions. While many brokers today invest heavily in high-quality trading platforms, research materials, and educational content, Cyber Capital appears to have significant gaps in this crucial area.

There is a clear absence of data on whether the broker supports automated trading or offers advanced research tools. This is concerning for investors who rely heavily on such resources for their trading strategies and decision-making processes. The general sentiment among users reflects disappointment and frustration due to the lack of technical tools and informational content available on the platform. Compared to industry standards, the deficiency in robust trading aids directly influences the low score of 3/10 for this category. This underscores the need for major improvements in this domain before the platform can compete effectively.

2.6.3 Customer Service and Support Analysis

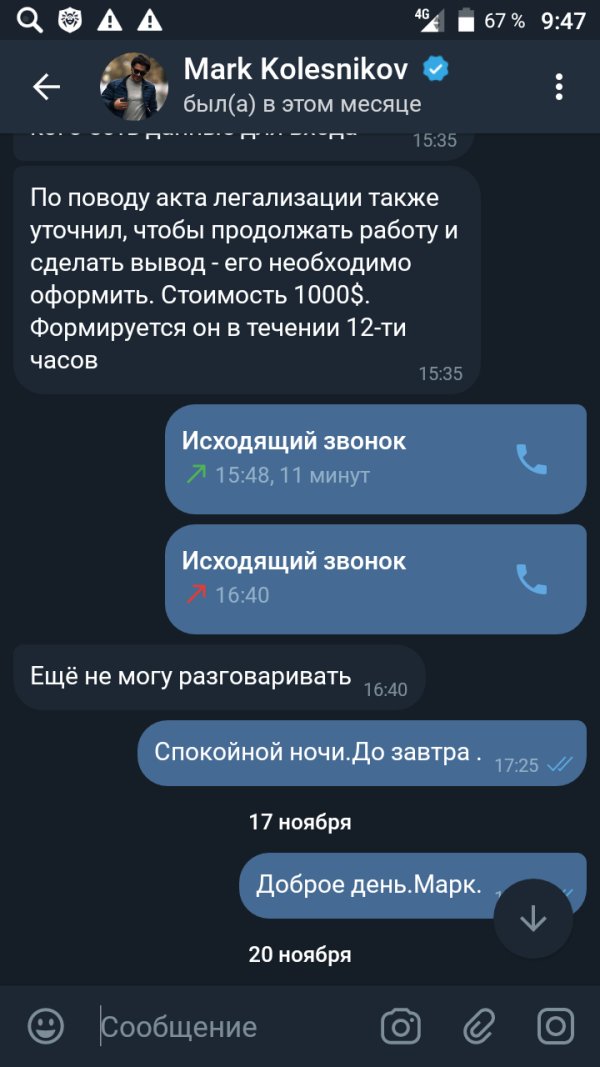

Customer service and support are critical factors in the online brokerage space. Cyber Capital has been rated poorly in this important regard based on available evidence. The analysis reveals significant concerns around the responsiveness, accessibility, and overall quality of customer support provided to users. Numerous users have voiced complaints about the lack of transparency and difficulty in obtaining timely resolutions to their issues and concerns.

The limited available data provides no clear insight into the various support channels available to customers. There is also no information about whether multi-language assistance is offered to international users. Additionally, there is little evidence to suggest an efficient or robust customer service infrastructure capable of addressing client concerns effectively and promptly. These unresolved concerns, combined with reports of delayed or inadequate responses, justify a low score of 2/10 in this category. The overall sentiment suggests that investors may face persistent challenges when attempting to receive clear and consistent support from the platform. This further undermines confidence in Cyber Capital's operational integrity and customer care standards.

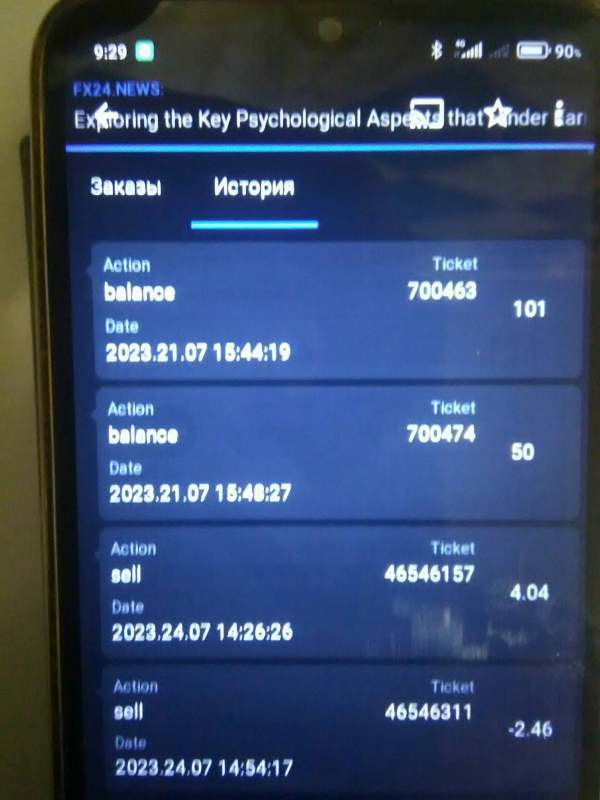

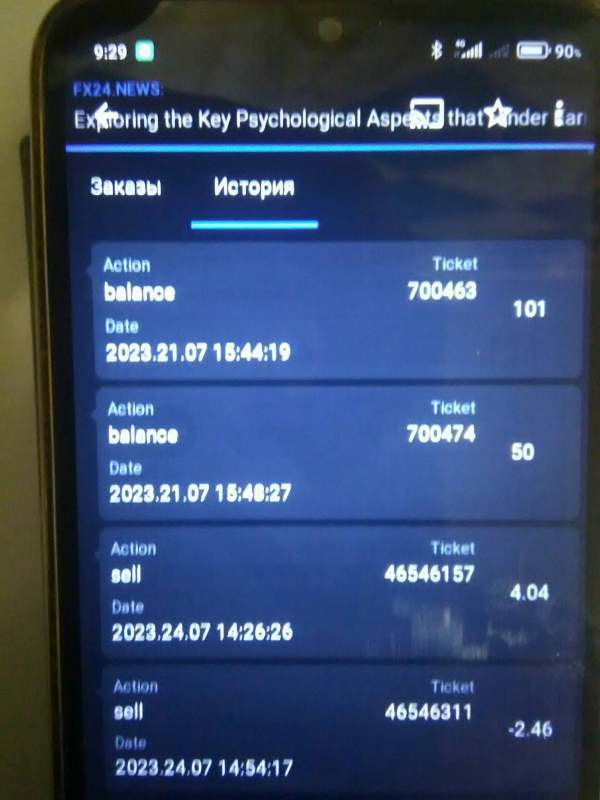

2.6.4 Trading Experience Analysis

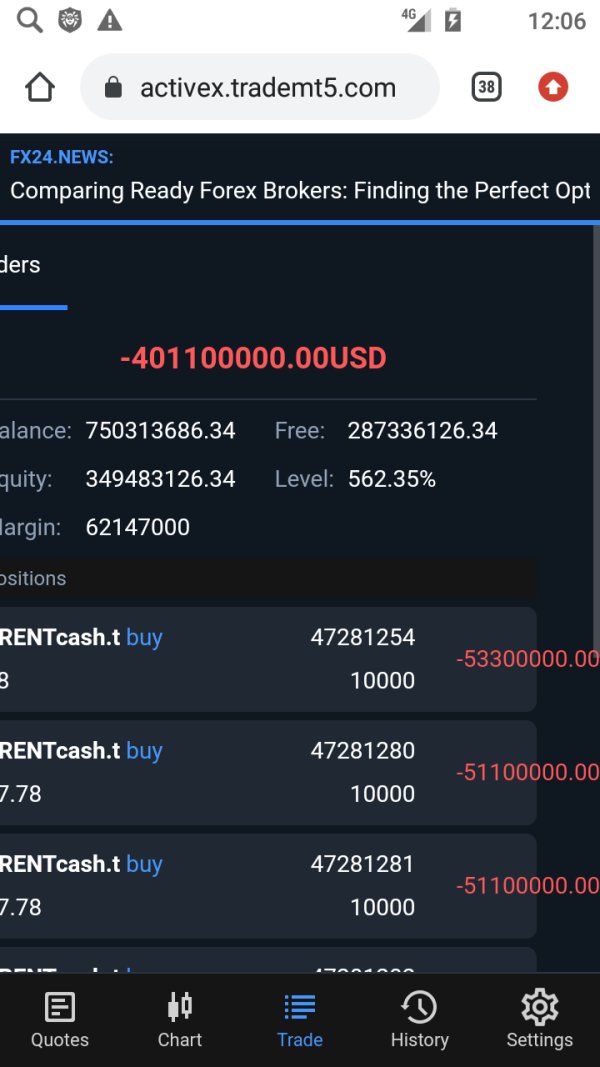

The trading experience offered by Cyber Capital suffers from a lack of detailed disclosure about platform performance, order execution efficiency, and overall system stability. Users have not reported extensive positive feedback about their interactions with the trading interface and system functionality. Many highlight the absence of crucial details such as mobile trading features or speed of execution that modern traders expect.

The omission of specific information about the trading platform leads to an uncertain environment. Order execution quality and system reliability remain questionable without proper documentation or user testimonials. With limited evidence to support the broker's claims of a seamless trading experience, investors are left with numerous unanswered questions about platform performance. Such deficiencies and the ambiguity surrounding performance metrics have resulted in an overall rating of 3/10 for trading experience. This creates a scenario where potential traders might experience suboptimal conditions compared to industry standards and competitor offerings.

This is another instance where the term "cyber capital review" must remind stakeholders to consider all uncovered vulnerabilities.

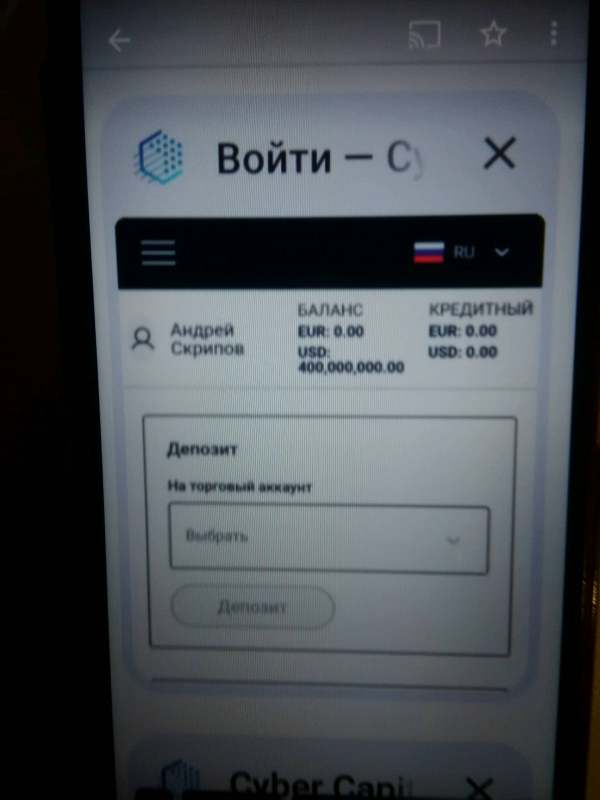

2.6.5 Trust Analysis

Trust remains a major concern for Cyber Capital largely due to unresolved fraud allegations and persistent negative feedback about the firm's transparency. Regulatory credentials and safeguards are either not disclosed or are presented in an ambiguous manner to potential investors. This leaves investors without crucial assurance regarding the safety of their funds and investments. Reports from multiple users indicate that the broker's handling of client issues and overall communication about its operational policies contribute to deep-rooted distrust among the user base.

The absence of a clear regulatory framework and circulation of dubious claims about potential fraudulent practices have severely damaged its reputation. Disparities in reported information and inconsistent compliance further reduce the prospects of establishing trust with potential investors. In view of these significant issues, Cyber Capital receives a rating of just 1/10 in trustworthiness. This compels investors to exercise extreme caution before engaging with the platform or committing any funds. The trust issues represent perhaps the most serious concern highlighted in this analysis.

2.6.6 User Experience Analysis

The overall user experience with Cyber Capital is marked by reports of dissatisfaction and ongoing concerns about transparency. Many users emphasize that despite a seemingly accessible deposit requirement and promises of trading in both cryptocurrencies and forex, the actual experience falls short of expectations. This disappointment stems from ambiguous interface details and complex registration procedures that create barriers for users.

The lack of clear documentation and a poorly designed user journey have led to frequent complaints about difficulties in fund management and obtaining necessary support. Feedback suggests that the integration of user-friendly design and efficient navigation features is noticeably absent from the platform. This significantly lowers the overall satisfaction rate among users who have tried the service. Consequently, the broker receives a user experience score of 3/10 in this important category. In this cyber capital review, investors are advised to consider these shortcomings carefully before proceeding. The potential for operational delays and unresolved issues can further impede a smooth trading experience that investors expect from modern platforms.

Conclusion

Cyber Capital presents significant risks and operational problems that warrant a cautious approach for potential investors. While the low minimum deposit of $250 and high leverage of up to 1:200 may initially attract those interested in the crypto and forex markets, these benefits are overshadowed by serious concerns. The overwhelming issues related to transparency, customer support, and trust seriously undermine the platform's credibility and safety for investors.

This cyber capital review clearly shows that the broker is not well-suited for those seeking a secure and reliable trading environment. Investors interested in these asset classes should be mindful of the inherent risks and consider seeking alternative platforms instead. Better options would offer greater regulatory assurance and proven operational stability that this platform currently lacks.