CTX Prime 2025 Review: Everything You Need to Know

Executive Summary

This ctx prime review shows major problems with CTX Prime as an online forex broker. CTX Prime works as an unregistered broker that lacks real forex licenses, which creates big risks for traders who might want to use it. The platform belongs to RMD Developments LTD and offers a web-based trading system that targets new cryptocurrency investors.

Many sources and user reviews warn people not to open accounts or send money to CTX Prime because it has no regulation and uses questionable business methods. Financial watchdogs have blacklisted the broker, and it lacks the basic regulatory oversight that safe forex trading requires. CTX Prime claims to help new traders with simple trading tools, but its lack of proper licensing and regulatory compliance makes it wrong for any trader.

The missing transparent fee structures, proper customer support, and legitimate regulatory backing put CTX Prime in the high-risk group of forex brokers that experienced traders and industry experts tell people to avoid.

Important Disclaimers

Regional Entity Differences: CTX Prime claims to work from Dominica, which is a place that does not regulate forex and CFD brokers. This regulatory gap makes investment risks much higher because no local financial authorities watch over the broker's operations or protect trader funds.

The lack of regulatory oversight in Dominica means traders have limited options if disputes or fraudulent activities happen.

Review Methodology: This evaluation uses available user feedback, market research, and public information about CTX Prime's operations. Our assessment tries to give an objective analysis while showing the major risks that come with this unregulated broker.

Overall Rating Framework

Broker Overview

CTX Prime operates under the ownership of RMD Developments LTD, with registration claims in Dominica. The broker's establishment date stays unclear from available information.

The company positions itself as a provider of CFD and forex trading services, specifically targeting newcomers to the cryptocurrency and forex markets. CTX Prime lacks the essential regulatory licenses that legitimate forex brokerage operations require, despite these claims.

The broker's business model seems to focus on attracting inexperienced traders through simplified web-based platforms and marketing materials that emphasize ease of use for beginners. This approach becomes problematic when combined with the complete absence of regulatory oversight and the numerous warnings issued by financial authorities and experienced traders.

CTX Prime uses a web-based trading platform developed by PandaTS, offering access to forex and CFD trading instruments. The platform's primary asset classes include foreign exchange pairs and contracts for difference, though specific details about available instruments remain limited.

Available information does not identify any legitimate regulatory authorities overseeing CTX Prime's operations, which represents a critical red flag for potential traders considering this broker.

Regulatory Status: CTX Prime claims operation from Dominica, but this jurisdiction does not provide regulatory oversight for forex and CFD brokers, leaving traders without protection.

Deposit and Withdrawal Methods: Specific information about deposit and withdrawal methods is not detailed in available materials, raising concerns about transparency.

Minimum Deposit Requirements: The broker has not disclosed minimum deposit requirements, which is unusual for legitimate forex brokers who typically provide clear account opening information.

Bonuses and Promotions: No specific bonus or promotional information is mentioned in available sources, suggesting limited marketing incentives.

Tradable Assets: The platform supports forex and CFD trading, though the complete range of available instruments remains unclear.

Cost Structure: Specific spread and commission information is not provided, with user feedback suggesting higher-than-average trading costs and poor transparency.

Leverage Ratios: Available information does not specify leverage ratios offered by CTX Prime, another transparency concern.

Platform Options: The broker offers a web-based trading platform created by PandaTS, but lacks support for industry-standard platforms like MT4 or MT5.

Geographic Restrictions: Specific regional restrictions are not detailed in available information.

Customer Service Languages: Available sources do not specify which languages are supported for customer service.

This ctx prime review highlights significant information gaps that legitimate brokers typically address transparently.

Detailed Rating Analysis

Account Conditions Analysis (Score: 1/10)

CTX Prime's account conditions receive the lowest possible rating due to fundamental transparency issues and lack of regulatory protection. Available information does not specify different account types, their features, or associated benefits, which represents a significant departure from industry standards where brokers typically offer detailed account comparisons.

The absence of clearly stated minimum deposit requirements creates uncertainty for potential traders who need this basic information to make informed decisions. Legitimate forex brokers universally provide transparent account opening requirements, fee structures, and account features.

CTX Prime's failure to disclose these essential details raises immediate red flags about the broker's legitimacy and commitment to transparency. User feedback consistently warns against account opening with CTX Prime, with multiple sources specifically advising potential traders to avoid transferring any funds to the platform.

The lack of special account features, such as Islamic accounts for Muslim traders or professional accounts for experienced traders, further demonstrates the broker's limited service offerings. When compared to regulated brokers that provide comprehensive account information, clear fee structures, and regulatory protection, CTX Prime falls significantly short of industry standards.

This ctx prime review emphasizes that the broker's account conditions lack the basic transparency and protection that traders should expect from legitimate forex brokers.

CTX Prime receives a below-average rating for tools and resources, primarily due to its limited platform offerings and lack of comprehensive trading tools. The broker provides a web-based trading platform developed by PandaTS, which may offer basic functionality suitable for complete beginners but lacks the sophisticated features that serious traders require.

The platform's web-based nature means traders can access their accounts without downloading specialized software, which could appeal to newcomers who prefer browser-based trading. However, the absence of industry-standard platforms like MetaTrader 4 or MetaTrader 5 significantly limits the broker's appeal to experienced traders who rely on these platforms' advanced charting tools, expert advisors, and extensive indicator libraries.

Available information does not mention specific research and analysis resources, educational materials, or market commentary that legitimate brokers typically provide to support their clients' trading decisions. The lack of educational resources is particularly concerning given CTX Prime's stated focus on novice traders who would benefit most from comprehensive learning materials.

User feedback suggests dissatisfaction with the limited professional tools available on the platform. Industry experts consistently warn about the platform's risks, which overshadow any potential benefits of its simplified interface.

The absence of automated trading support, advanced charting capabilities, and comprehensive market analysis tools places CTX Prime at a significant disadvantage compared to regulated competitors.

Customer Service Analysis (Score: 2/10)

CTX Prime's customer service receives a poor rating based on consistent user feedback highlighting inadequate support quality and responsiveness. Available information does not specify the customer service channels available to traders, such as live chat, email support, or telephone assistance, which represents another transparency gap that legitimate brokers typically address clearly.

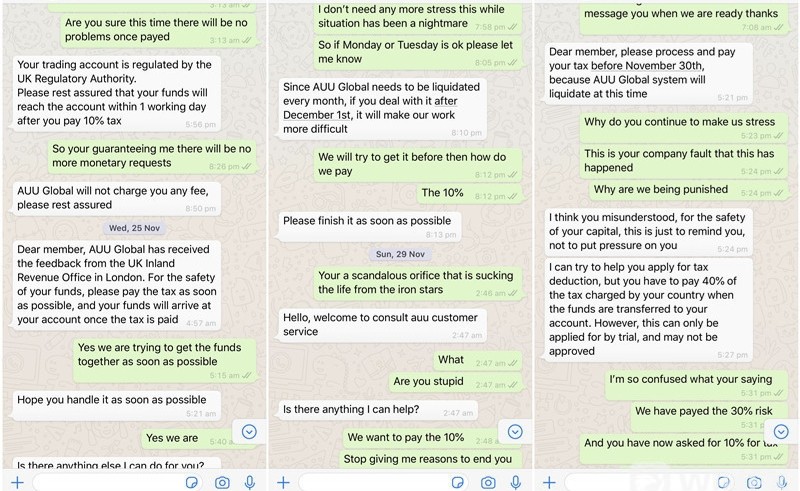

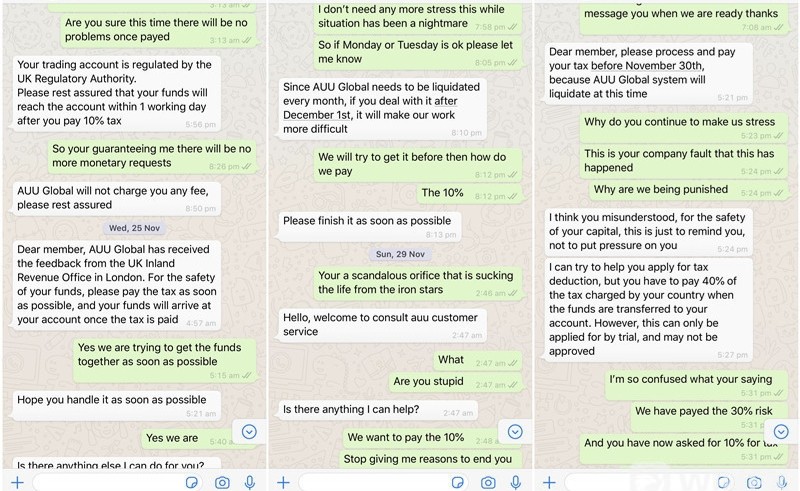

User reports consistently indicate slow response times when attempting to contact customer support, with many traders expressing frustration about delayed or inadequate responses to their inquiries. The quality of service appears to be significantly below industry standards, with users reporting unhelpful responses and difficulty resolving account-related issues.

The absence of detailed information about multilingual support capabilities raises concerns for international traders who may require assistance in their native languages. Professional forex brokers typically provide comprehensive language support and clearly communicate their customer service hours and availability.

User feedback regarding CTX Prime's customer support is predominantly negative, with traders reporting poor experiences when seeking assistance with account issues, trading problems, or withdrawal requests. The lack of documented problem resolution cases or positive customer service experiences further reinforces concerns about the broker's commitment to client support.

Given the broker's unregulated status and the numerous warnings from users and industry experts, the poor customer service quality compounds the overall risks associated with choosing CTX Prime as a trading partner.

Trading Experience Analysis (Score: 2/10)

The trading experience with CTX Prime receives a poor rating due to significant platform stability issues and execution problems reported by users. Trader feedback indicates frequent delays and instability during trading sessions, which can result in missed opportunities and increased trading costs for users attempting to execute time-sensitive trades.

Order execution quality appears to be problematic, with users reporting frequent slippage and requoting issues that can significantly impact trading profitability. These execution problems are particularly concerning in volatile market conditions where precise order execution becomes crucial for successful trading outcomes.

The platform lacks essential charting tools and technical indicators that traders rely on for market analysis and decision-making. This limitation forces traders to seek external analysis tools, creating inefficiencies and potential synchronization issues between analysis and execution platforms.

Available information does not provide details about mobile trading experiences, which is increasingly important as traders expect seamless access across multiple devices. The absence of mobile platform information suggests limited development investment in user experience optimization.

User feedback indicates poor liquidity and higher-than-average trading costs, which directly impact profitability. The combination of execution problems, limited analytical tools, and cost concerns creates an overall trading environment that falls well below industry standards.

This ctx prime review emphasizes that the trading experience issues, combined with regulatory concerns, make CTX Prime unsuitable for serious forex trading.

Trustworthiness Analysis (Score: 1/10)

CTX Prime receives the lowest possible trustworthiness rating due to its unregulated status and inclusion on financial watchdog blacklists. The broker operates without legitimate regulatory licenses, which means traders have no regulatory protection for their funds or recourse in case of disputes or fraudulent activities.

The company's registration in Dominica provides no meaningful regulatory oversight, as this jurisdiction does not regulate forex and CFD brokers. This regulatory gap means there are no financial authorities monitoring CTX Prime's business practices, capital adequacy, or client fund segregation procedures that are standard requirements for legitimate forex brokers.

Multiple sources have documented the broker's inclusion on blacklists maintained by financial regulatory authorities and industry watchdogs. These blacklist inclusions often result from investigations into questionable business practices, lack of proper licensing, or failure to meet regulatory standards required for forex brokerage operations.

The company demonstrates poor transparency regarding its ownership structure, financial reporting, and business operations. Legitimate forex brokers typically provide detailed company information, regulatory compliance reports, and clear contact details, none of which are adequately provided by CTX Prime.

Industry reports and user feedback consistently express negative assessments of the broker's trustworthiness, with multiple sources specifically warning traders to avoid the platform. The absence of positive third-party endorsements from reputable financial publications or regulatory acknowledgments further reinforces concerns about the broker's legitimacy and reliability.

User Experience Analysis (Score: 2/10)

CTX Prime's user experience receives a poor rating based on consistently low user satisfaction scores and fundamental platform limitations. Overall user satisfaction appears to be significantly below industry averages, with traders expressing dissatisfaction across multiple aspects of their interaction with the platform.

The platform's interface design reportedly lacks user-friendliness, with complex navigation that makes it difficult for both novice and experienced traders to efficiently access essential features. This design flaw is particularly problematic given the broker's stated focus on attracting new traders who would benefit from intuitive, well-designed interfaces.

Available information does not provide specific details about the registration and verification processes, which are crucial touchpoints that significantly impact initial user experience. Legitimate brokers typically streamline these processes while maintaining necessary compliance procedures, but CTX Prime's approach to user onboarding remains unclear.

User feedback regarding deposit and withdrawal experiences is not specifically detailed in available sources, though the overall negative sentiment suggests potential issues with fund management processes. The absence of clear information about payment processing times and methods contributes to user uncertainty and dissatisfaction.

Common user complaints center around the platform's lack of trustworthiness and poor service quality, with many users specifically recommending that others avoid the broker entirely. The predominance of negative feedback and warnings from the user community creates a clear picture of inadequate user experience across all platform interactions.

The broker would need to significantly enhance transparency, improve platform design, and address fundamental trust issues to provide an acceptable user experience that meets modern forex trading standards.

Conclusion

This comprehensive ctx prime review reveals that CTX Prime operates as a high-risk, unregulated forex broker that poses significant dangers to potential traders. The broker's lack of legitimate regulatory oversight, combined with its inclusion on financial watchdog blacklists, makes it unsuitable for any trader regardless of experience level.

We strongly advise against using CTX Prime for forex or CFD trading, particularly warning novice investors who may be attracted by the broker's simplified marketing approach. The risks associated with unregulated brokers far outweigh any perceived benefits, especially when numerous legitimate, regulated alternatives are available in the forex market.

While the platform may offer basic web-based trading functionality, the fundamental lack of regulatory protection, poor customer service, execution problems, and overwhelming negative user feedback create an unacceptable risk profile. Traders seeking reliable forex brokerage services should focus on properly regulated brokers that offer comprehensive protection and transparent business practices.