Cryptoneyx 2025 Review: Everything You Need to Know

Summary

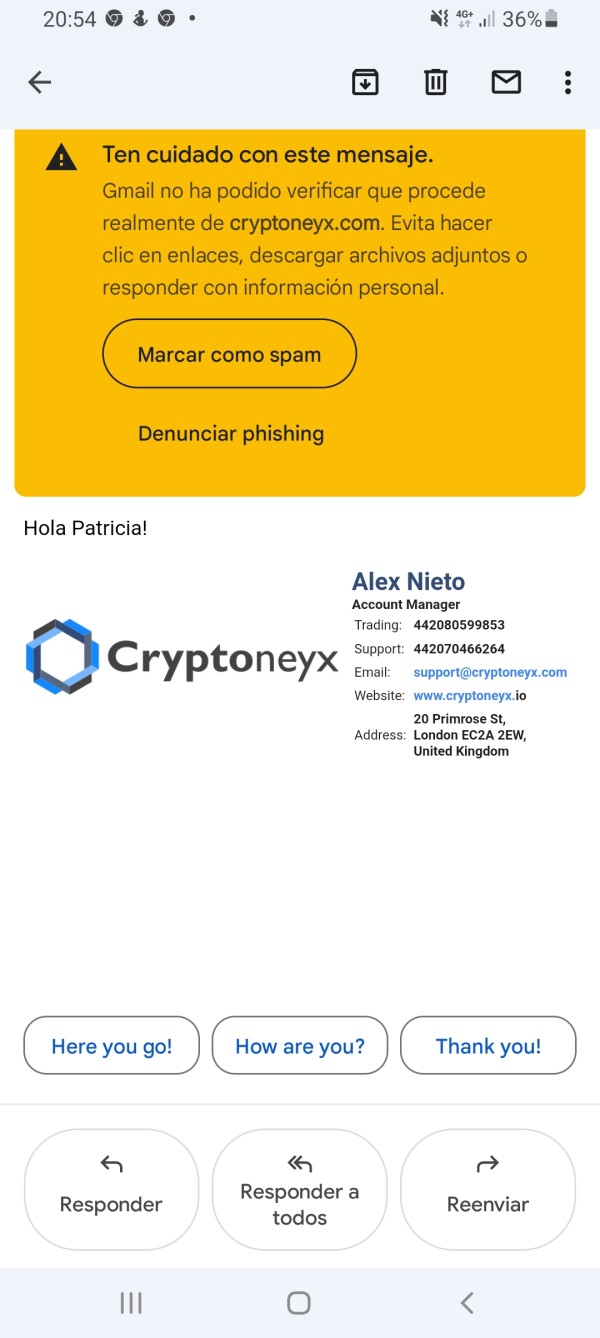

This comprehensive cryptoneyx review reveals significant concerns about the broker's regulatory standing and operational legitimacy. Cryptoneyx has been flagged by Italy's CONSOB as a warning-listed entity. The platform has also been identified by Belgium's FSMA as a fraudulent online trading platform. Despite operating from Saint Vincent and the Grenadines, the broker lacks proper regulatory oversight in major financial jurisdictions, which creates serious risks for traders. The platform requires an exceptionally high minimum deposit of $10,000. It also offers maximum leverage of 1:400, positioning itself toward high-risk tolerance traders who have substantial capital available. With a TrustScore of 4.36 and multiple regulatory warnings, potential clients must exercise extreme caution when considering this broker. The platform operates through proprietary trading software with 24/5 customer support, but the regulatory red flags overshadow any potential operational benefits that might exist.

Important Notice

This cryptoneyx review analysis is based on publicly available information and regulatory warnings from multiple financial authorities across different jurisdictions. Cryptoneyx's regulatory status varies significantly by region, with the broker being unregulated in most major financial centers and actively warned against by European authorities who monitor trading platforms. Users should be aware that regulatory differences exist between countries, and what may be permissible in Saint Vincent and the Grenadines may not meet the standards required by European or other major regulatory bodies. This review methodology incorporates official regulatory statements, available company information, and accessible user feedback to provide a comprehensive assessment of the broker's offerings and risks that traders should consider.

Rating Framework

Broker Overview

Cryptoneyx operates as an online trading platform headquartered in Saint Vincent and the Grenadines. This jurisdiction is known for lighter regulatory oversight compared to major financial centers like the United States or United Kingdom. The company's establishment date remains unclear from available public information, but the broker has gained attention primarily due to regulatory warnings rather than positive market recognition that would normally attract traders. According to regulatory alerts, Cryptoneyx positions itself as a comprehensive trading platform offering various financial instruments, though specific details about their business model and operational structure are limited in publicly available documentation.

The broker utilizes a proprietary trading platform rather than established industry standards like MetaTrader 4 or 5. This approach may present both opportunities and challenges for traders familiar with conventional trading environments that most brokers use. This cryptoneyx review finds that the company's regulatory foundation raises significant concerns, particularly given the warnings issued by European financial authorities who actively monitor trading platforms. The platform's focus on high-minimum deposit requirements suggests targeting of affluent traders, though the regulatory warnings may deter institutional and sophisticated retail participants who prioritize compliance and oversight.

Regulatory Status: Cryptoneyx faces significant regulatory challenges that impact its credibility. The platform has been placed on Italy's CONSOB warning list and identified by Belgium's FSMA as a fraudulent online trading platform, which represents serious concerns about legitimacy. These regulatory actions raise serious questions about the broker's legitimacy and operational compliance with international standards.

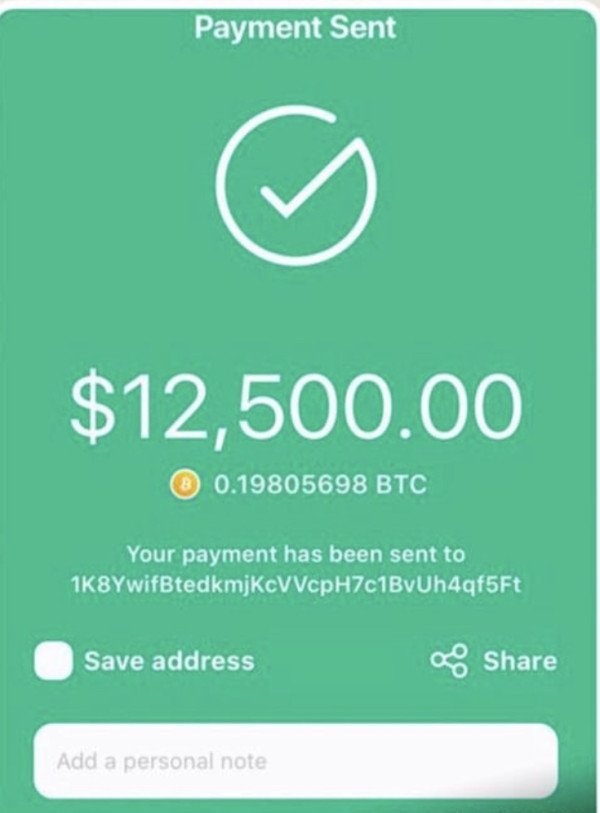

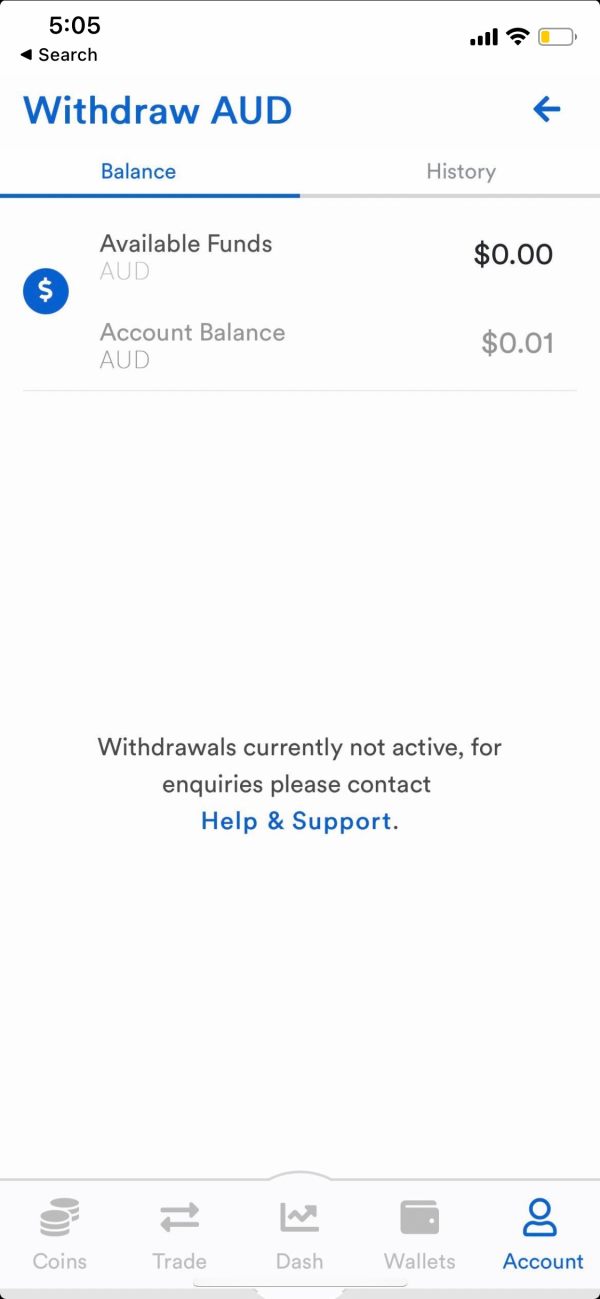

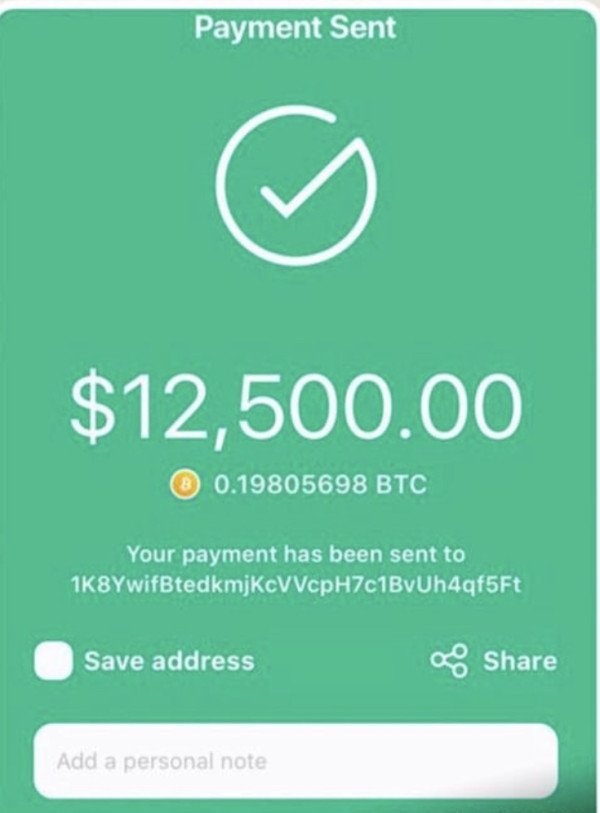

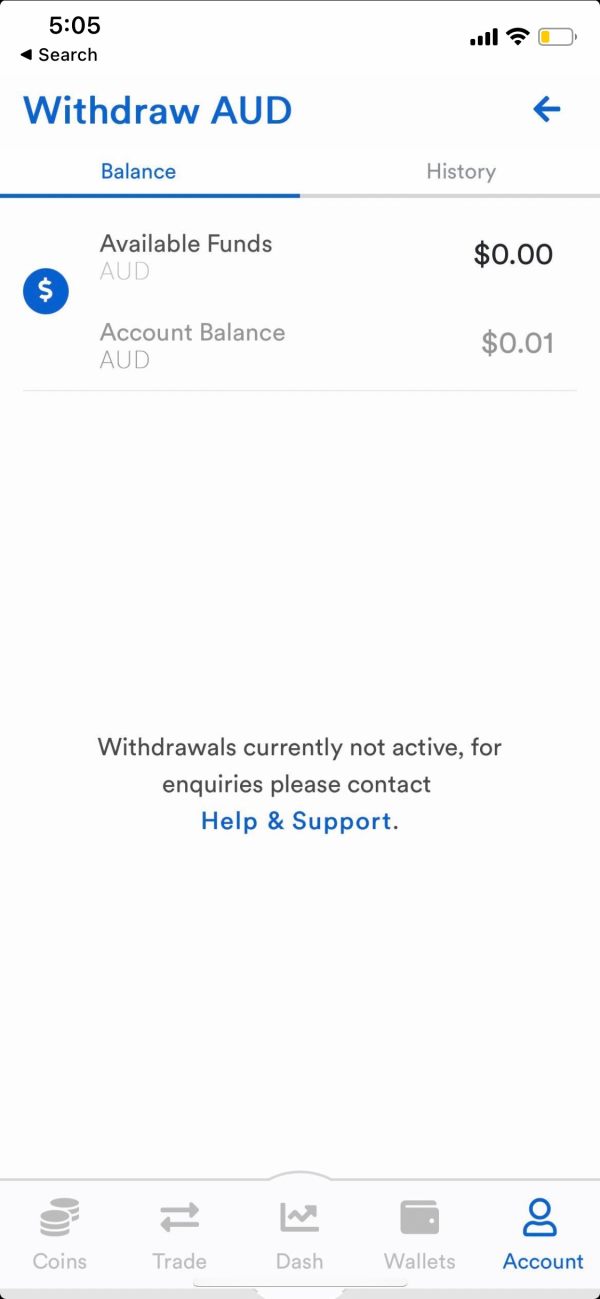

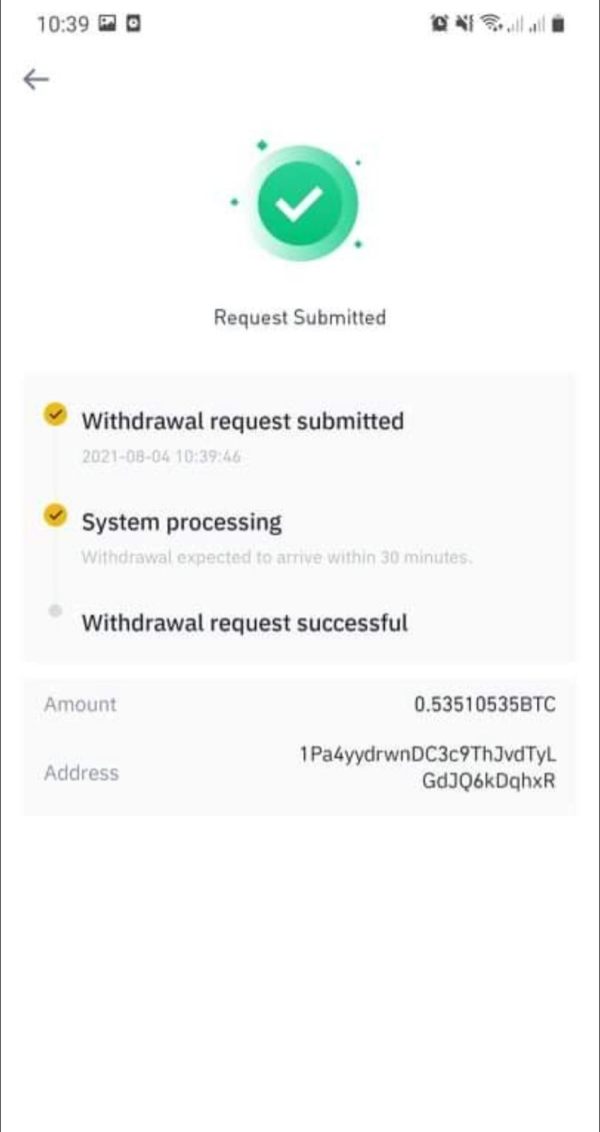

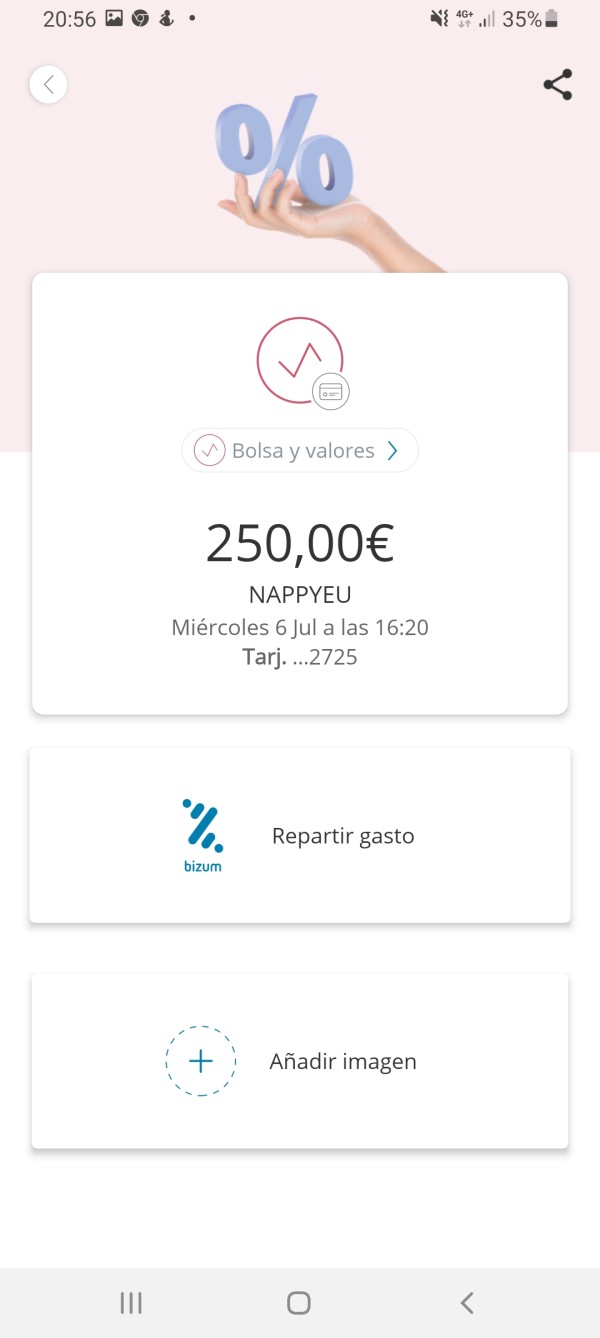

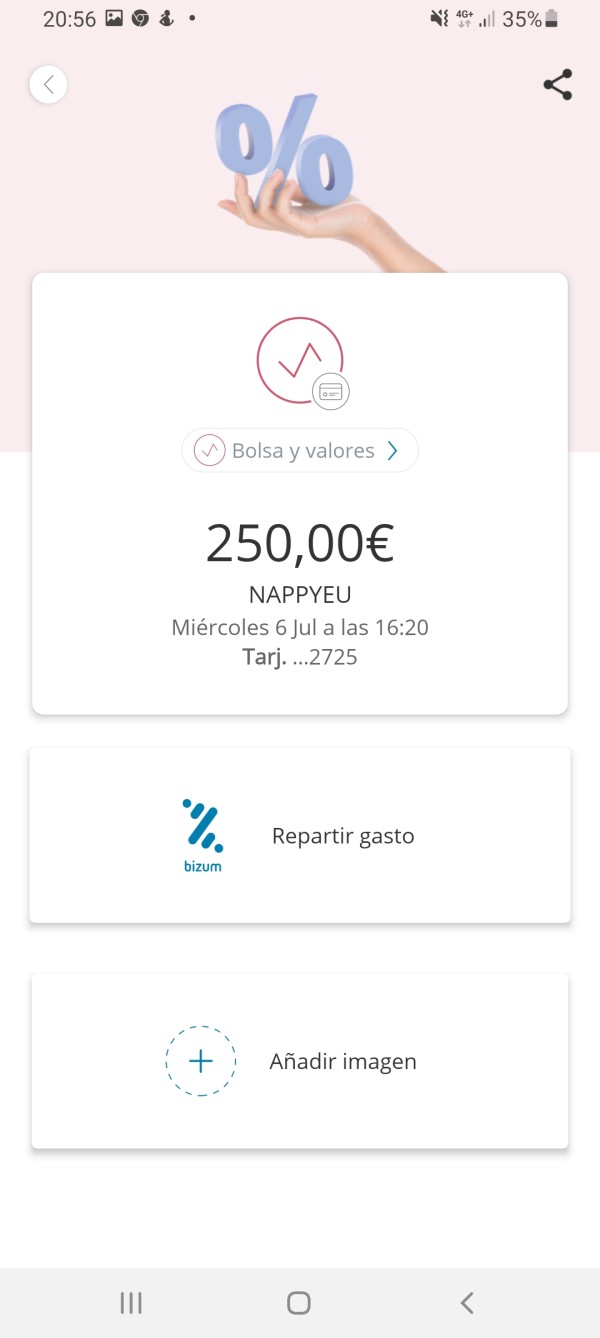

Deposit and Withdrawal Methods: Specific information about deposit and withdrawal methods is not detailed in available public documentation. The broker accepts a minimum deposit of $10,000, which is substantially higher than industry standards for retail trading platforms.

Minimum Deposit Requirements: The platform requires a substantial $10,000 minimum deposit. This amount is significantly higher than industry standards and limits access for most retail traders who typically start with smaller amounts.

Bonus and Promotional Offers: Available information indicates the broker does not currently offer bonus promotions or incentive programs to new or existing clients.

Available Trading Assets: Detailed information about specific tradeable assets and instrument categories is not comprehensively available in public documentation.

Cost Structure and Fees: The platform operates with floating spreads that can change based on market conditions. Specific commission structures and additional fees are not clearly detailed in available information, which creates transparency concerns for potential clients.

Leverage Ratios: Cryptoneyx offers maximum leverage of 1:400. This represents high-risk trading conditions that may not be suitable for inexperienced traders who lack proper risk management skills.

Platform Options: The broker provides web-based trading, downloadable terminals, and mobile applications. All of these platforms are built on their proprietary technology platform rather than industry-standard solutions.

Geographic Restrictions: Specific regional limitations and restricted territories are not clearly outlined in available public information.

Customer Service Languages: The primary customer service language appears to be English. Additional language support details are not specified in publicly available documentation.

This cryptoneyx review emphasizes the importance of understanding these operational parameters within the context of the regulatory warnings that have been issued.

Detailed Rating Analysis

Account Conditions Analysis

The account structure at Cryptoneyx presents significant barriers to entry for most retail traders. This is primarily due to the exceptionally high $10,000 minimum deposit requirement that exceeds normal industry standards. This threshold is substantially above industry norms, where many reputable brokers offer account opening with deposits as low as $100-$500 for new traders. The high minimum suggests the platform targets affluent traders or those with substantial trading capital, but this positioning becomes problematic when considered alongside the regulatory warnings from European authorities.

Available information does not provide comprehensive details about different account types, tier structures, or special account features. These features might justify such high entry requirements, but their absence raises transparency concerns. The absence of detailed account specifications raises questions about transparency and client service differentiation that most reputable brokers provide. Traditional account features such as Islamic accounts, managed accounts, or educational account options are not clearly documented in available materials.

The account opening process details are not extensively available in public documentation. This makes it difficult for potential clients to understand verification requirements, documentation needs, or approval timelines that would normally be transparent. This lack of transparency, combined with regulatory warnings, creates additional concerns for prospective clients considering the platform for their trading activities.

When compared to regulated brokers in major jurisdictions, the combination of high minimum deposits and regulatory uncertainty makes Cryptoneyx's account conditions particularly unattractive for most traders. This cryptoneyx review suggests that the account structure may be designed to attract specific client types, but the regulatory issues overshadow any potential benefits that might exist.

The trading tools and resources offered by Cryptoneyx remain largely undocumented in available public information. This presents a significant transparency concern for potential clients who need to evaluate platform capabilities. Most reputable brokers provide detailed information about their analytical tools, charting capabilities, technical indicators, and research resources as key differentiators in the competitive trading environment where platforms compete for trader attention.

Educational resources are crucial for trader development and platform adoption. However, these resources are not clearly outlined in accessible documentation from Cryptoneyx. The absence of information about webinars, tutorials, market analysis, or educational content suggests either limited educational support or poor communication of available resources that traders typically expect.

Research and analysis capabilities are not detailed in public materials. These typically include economic calendars, market news, expert analysis, and fundamental research tools that traders rely on for decision-making. These resources are typically essential for informed trading decisions and are standard offerings among established brokers who prioritize client success.

Automated trading support is not clearly documented by Cryptoneyx. This includes expert advisors, copy trading, or algorithmic trading capabilities that many modern traders expect from their platforms. Given the proprietary nature of their platform, integration with third-party tools and automated trading systems may be limited compared to standard platforms like MetaTrader that offer extensive automation options.

The lack of detailed information about tools and resources, combined with the regulatory concerns, suggests that Cryptoneyx may not prioritize transparency in communicating their service offerings. This is concerning for potential clients seeking comprehensive trading support and educational resources.

Customer Service and Support Analysis

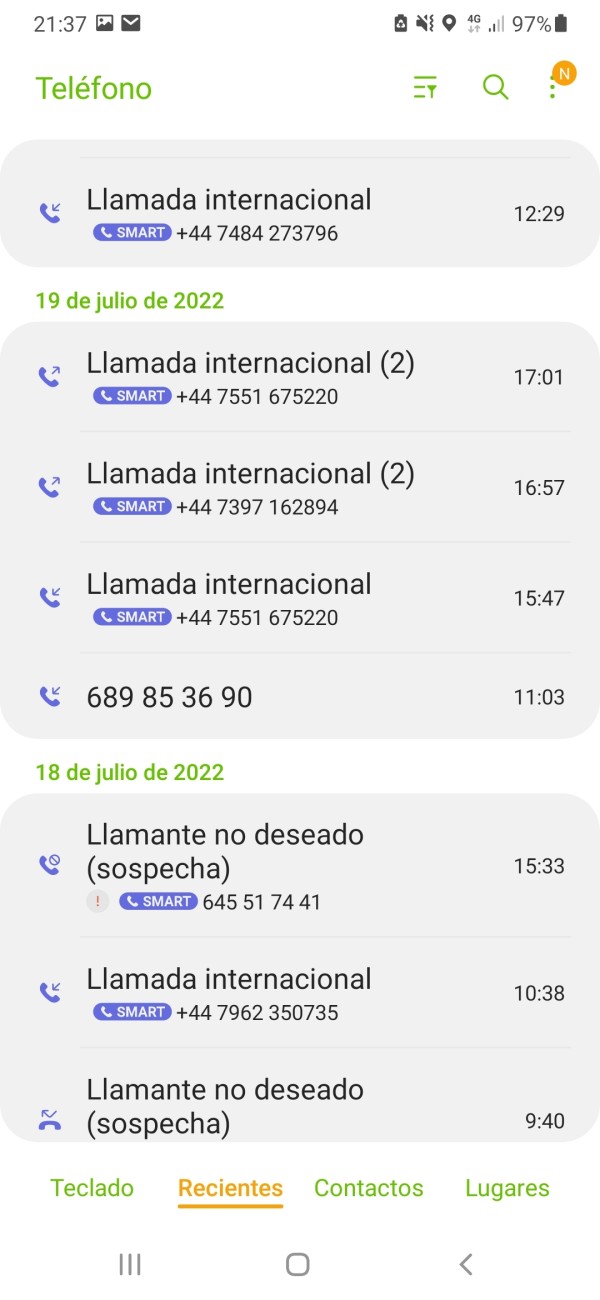

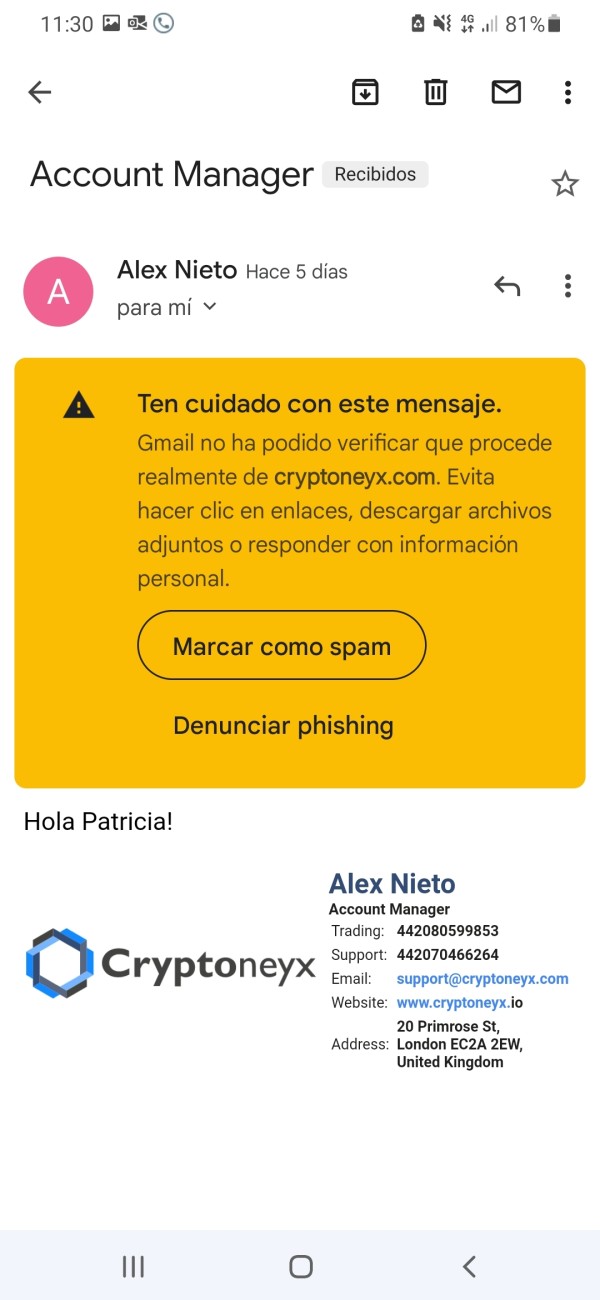

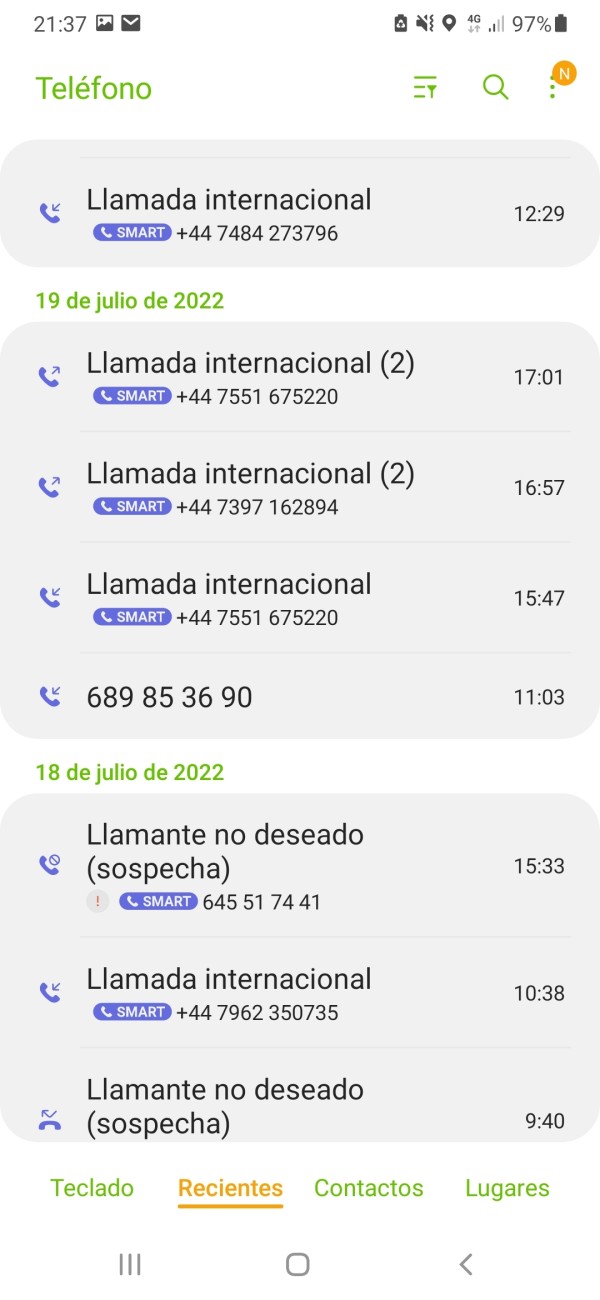

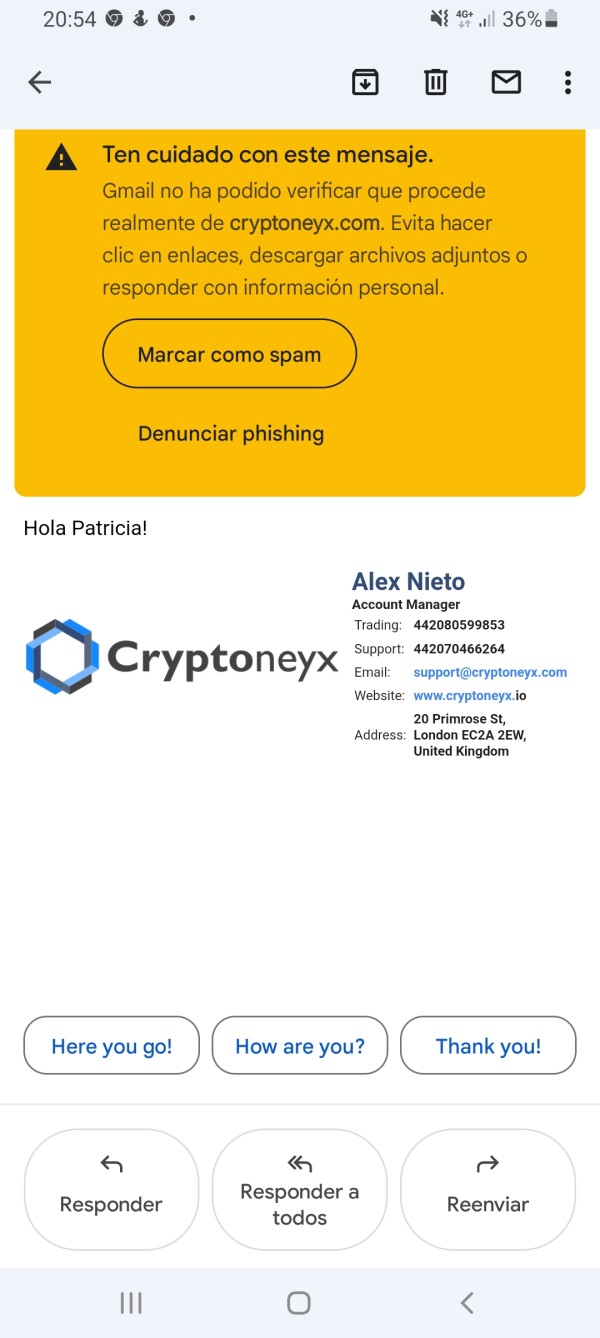

Cryptoneyx provides customer support through multiple channels that include basic communication methods. The platform offers telephone support at +442070466264 and email communication at INFORMATION@CRYPTOIFX.COM for client inquiries. The platform operates with 24/5 availability, which covers standard trading week requirements but excludes weekend support that some traders might require for position management or urgent inquiries that arise outside normal business hours.

The customer service structure appears to be primarily English-based. However, comprehensive language support details are not clearly specified in available documentation from the company. For international brokers, multi-language support is typically crucial for serving diverse client bases, and the limited language information may indicate restricted geographic focus or service limitations that could affect international traders.

Response time metrics and service quality indicators are not available in public documentation. This makes it difficult to assess the effectiveness of their customer support operations and whether they meet industry standards. User feedback specifically regarding customer service experiences is not extensively documented in accessible sources, which limits the ability to evaluate actual service quality.

The customer support infrastructure provides basic contact methods and reasonable availability hours. However, it lacks the comprehensive support features often found with regulated brokers, such as live chat, dedicated account managers, or specialized technical support teams that traders often need. The combination of limited support information and regulatory warnings may indicate that customer service quality could be compromised compared to established platforms.

Problem resolution processes and escalation procedures are not clearly documented. This could present challenges for clients experiencing issues with their accounts or trading activities that require prompt resolution.

Trading Experience Analysis

The trading experience at Cryptoneyx centers around their proprietary trading platform. This platform differs from industry-standard platforms like MetaTrader 4 or 5 that most traders are familiar with and have experience using. This proprietary approach may offer unique features but could also present learning curves for traders accustomed to conventional trading environments that provide familiar interfaces and functionality.

Platform stability and execution speed metrics are not available in public documentation. This makes it difficult to assess the technical performance that traders can expect from the system. Reliable execution and platform uptime are critical factors for trading success, and the absence of performance data raises questions about operational transparency that traders typically require when evaluating platforms.

The platform supports scalping trading strategies according to available information. This indicates fast execution capabilities and potentially competitive spread structures for short-term trading approaches that scalpers require. However, without detailed execution statistics or user performance feedback, the actual effectiveness of scalping support remains unclear and unverified by independent sources.

Order execution quality is not documented in available information. This includes slippage rates, requote frequency, and fill rates that are crucial metrics for trader success. These metrics are crucial for traders to understand the true cost and reliability of trading through the platform, especially for strategies that depend on precise execution timing.

Mobile trading capabilities are available through their proprietary application. However, user reviews and functionality comparisons with established mobile trading platforms are not extensively available in public sources. The trading experience assessment is significantly impacted by the regulatory warnings, as traders must weigh potential platform benefits against substantial compliance and safety concerns highlighted in this cryptoneyx review.

Trust and Reliability Analysis

The trust and reliability assessment for Cryptoneyx reveals severe concerns that significantly impact the broker's credibility in the financial services sector. Italy's CONSOB has placed the broker on their warning list, which represents a serious regulatory red flag for potential clients. Belgium's FSMA has explicitly identified Cryptoneyx as a fraudulent online trading platform, which is one of the most serious designations that regulatory authorities can assign. These regulatory actions represent some of the most serious warnings that financial authorities can issue against trading platforms.

The broker's operational base in Saint Vincent and the Grenadines is legally permissible for business operations. However, this jurisdiction provides limited regulatory protection compared to major financial centers with robust oversight frameworks that protect traders. This jurisdiction choice, combined with the European regulatory warnings, creates a concerning pattern regarding compliance and operational legitimacy that raises questions about the platform's commitment to regulatory standards.

Fund safety measures, segregation of client funds, and investor protection protocols are not clearly documented in available public information. These are critical safety features that traders need to evaluate platform security. Reputable brokers typically provide detailed information about client fund protection, insurance coverage, and segregation practices as key trust-building measures that demonstrate their commitment to client safety.

Company transparency regarding ownership, management, financial statements, and operational procedures appears limited based on publicly available information. This information is typically available from reputable brokers who prioritize transparency with their clients. This lack of transparency, combined with regulatory warnings, significantly undermines confidence in the platform's reliability and operational integrity.

The broker's industry reputation has been severely damaged by the regulatory warnings and fraud allegations. This damage makes it difficult for potential clients to justify the risks associated with the platform regardless of any potential trading benefits offered by their services.

User Experience Analysis

User experience assessment for Cryptoneyx is significantly influenced by the platform's TrustScore of 4.36. This score indicates moderate user concerns about the platform's reliability and service quality based on actual user feedback. This score suggests that users who have interacted with the platform have experienced issues that impact their overall satisfaction and confidence in the service.

Interface design and usability details are not extensively documented in available public information. This makes it difficult to assess how user-friendly the proprietary platform actually is for daily trading activities. Most successful trading platforms prioritize intuitive design and efficient navigation, but without detailed user feedback, these aspects remain unclear and unverified by independent sources.

The registration and verification process specifics are not clearly outlined in public documentation. The high minimum deposit requirement suggests that the onboarding process may be designed for high-value clients rather than typical retail traders. However, the combination of regulatory warnings and limited process transparency may create additional friction for potential users who are concerned about platform legitimacy.

Fund management operations are not comprehensively detailed in available information. This includes deposit and withdrawal experiences, processing times, and fee structures that are crucial for user satisfaction. These operational aspects are crucial for user satisfaction and platform usability, as traders need reliable access to their funds.

The user profile appears to target high-risk tolerance traders with substantial capital. This is evident from the $10,000 minimum deposit and 1:400 leverage offerings that appeal to experienced traders. However, the regulatory warnings significantly complicate the user experience by introducing substantial compliance and safety concerns that override potential platform benefits for most traders.

Conclusion

This comprehensive cryptoneyx review reveals a trading platform facing significant regulatory challenges that overshadow any potential operational benefits it might offer. While the broker offers high leverage ratios and supports scalping strategies for active traders, the warnings from Italy's CONSOB and Belgium's FSMA regarding fraudulent operations create substantial risks for potential clients who prioritize safety and regulatory compliance. The exceptionally high $10,000 minimum deposit requirement, combined with limited transparency about platform features and regulatory compliance, makes Cryptoneyx unsuitable for most retail traders who seek accessible and regulated trading environments. Even traders with high risk tolerance should exercise extreme caution and consider regulated alternatives that provide better investor protection and regulatory oversight from established financial authorities.