Is Cryptoneyx safe?

Business

License

Is Cryptoneyx A Scam?

Introduction

Cryptoneyx is an online trading platform that has gained attention in the forex market, particularly among those interested in cryptocurrency trading. As the trading landscape becomes increasingly crowded, it's imperative for traders to exercise caution and thoroughly evaluate the brokers they choose to engage with. The potential for scams and fraudulent activities is ever-present, making it crucial to verify the legitimacy and reliability of any trading platform. This article aims to provide a comprehensive analysis of Cryptoneyx, exploring its regulatory status, company background, trading conditions, customer experiences, and overall safety. Our investigation is based on a thorough review of available information, including regulatory filings, customer feedback, and expert analyses.

Regulation and Legitimacy

The regulatory status of a broker is a significant factor in determining its legitimacy and safety. Unfortunately, Cryptoneyx is not regulated by any major financial authority, which raises red flags for potential investors. The lack of regulation means there is no oversight to ensure that the broker adheres to industry standards, which can lead to potential risks for traders.

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| N/A | N/A | N/A | Not Verified |

The absence of a valid license from reputable regulatory bodies such as the Financial Conduct Authority (FCA) in the UK or the Commodity Futures Trading Commission (CFTC) in the USA means that traders have little recourse in the event of disputes or issues with fund withdrawals. This lack of oversight is a critical concern, as it implies that the broker operates without the necessary checks and balances that protect investors. Historical compliance issues have also been noted, with several countries' regulatory bodies, including Belgium's FSMA and Italy's CONSOB, issuing warnings against Cryptoneyx for operating without authorization.

Company Background Investigation

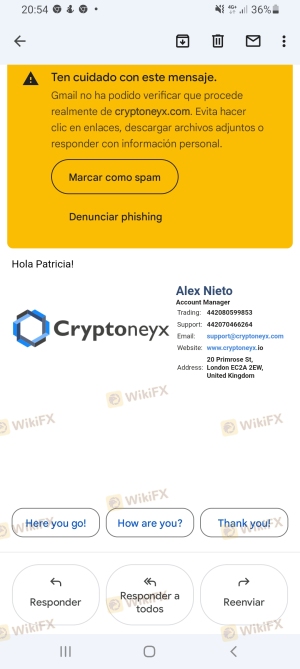

Cryptoneyx appears to have a relatively short history in the trading industry. The company claims to have been established in 2022, which raises concerns about its longevity and experience in the market. Additionally, the ownership structure of Cryptoneyx is unclear, as there is no publicly available information about its founders or management team. This lack of transparency is troubling, as a reputable broker should provide details about its leadership and operational history.

The management teams background is essential in assessing the broker's reliability. However, due to the absence of information regarding the team's qualifications and experience, potential clients may find it challenging to trust the platform. Furthermore, the company's transparency regarding its operations and financial practices is inadequate. The failure to disclose critical information such as the company's physical address and registration details further exacerbates concerns about its legitimacy.

Trading Conditions Analysis

When evaluating a broker, understanding the trading conditions they offer is vital. Cryptoneyx imposes a high minimum deposit requirement of $10,000 for its basic account, which is significantly higher than the industry average. This high barrier to entry can deter many potential traders and raises questions about the broker's accessibility.

| Fee Type | Cryptoneyx | Industry Average |

|---|---|---|

| Spread for Major Currency Pairs | High | Low |

| Commission Structure | N/A | Varies |

| Overnight Interest Range | N/A | Varies |

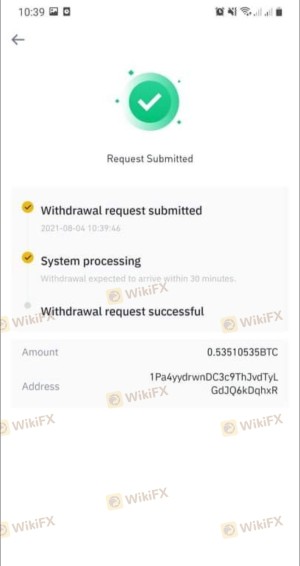

The overall fee structure of Cryptoneyx appears to be non-competitive, especially when considering the high spreads and lack of clarity regarding commissions. Additionally, there are reports of unusual fees associated with withdrawals, which can be a tactic used by unregulated brokers to retain client funds. The lack of transparency around these fees is concerning and suggests that traders may encounter unexpected costs when attempting to access their funds.

Customer Funds Security

Fund security is a paramount concern for any trader. Cryptoneyx does not provide adequate information regarding its fund security measures. The absence of segregated accounts, which protect clients' funds in the event of a broker's insolvency, is alarming. Furthermore, there is no mention of investor protection schemes that would typically safeguard client deposits.

Historically, there have been issues related to fund security with unregulated brokers, and Cryptoneyx does not seem to be an exception. Without proper regulatory oversight, the risk of fund misappropriation is significantly heightened, making it essential for potential clients to be cautious.

Customer Experience and Complaints

Customer feedback is a crucial indicator of a broker's reliability. Many users have reported negative experiences with Cryptoneyx, highlighting difficulties in withdrawing funds and poor customer service. Common complaints include:

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Issues | High | Poor |

| Customer Support Quality | High | Poor |

Typical cases involve clients who have deposited significant amounts only to find themselves unable to withdraw their funds after repeated attempts. This pattern of complaints is indicative of potential fraudulent practices, which further supports the notion that Cryptoneyx may not be safe for traders.

Platform and Execution

The trading platform offered by Cryptoneyx is said to include popular options like MetaTrader 4 and 5. However, many users have reported issues with platform stability and execution quality. There have been claims of slippage and rejected orders, which can significantly impact trading performance.

Risk Assessment

Using Cryptoneyx carries several risks, primarily due to its unregulated status and poor customer feedback.

| Risk Category | Risk Level | Brief Description |

|---|---|---|

| Regulatory Risk | High | No regulatory oversight |

| Fund Security Risk | High | Lack of fund protection measures |

| Customer Service Risk | High | Poor response to client complaints |

To mitigate these risks, it is advisable for traders to conduct thorough research and consider using only regulated brokers with a proven track record.

Conclusion and Recommendations

In conclusion, the evidence strongly suggests that Cryptoneyx is not a safe trading platform. The lack of regulation, poor customer feedback, and high minimum deposit requirements are significant red flags. Traders should be cautious and consider alternative, more reputable brokerage options that offer regulatory protection and better customer service.

For those seeking reliable trading platforms, consider brokers like Forex.com, IG, or OANDA, which are well-regulated and have positive reputations in the trading community. Always prioritize your safety and conduct thorough due diligence before investing your hard-earned money.

Is Cryptoneyx a scam, or is it legit?

The latest exposure and evaluation content of Cryptoneyx brokers.

Cryptoneyx Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

Cryptoneyx latest industry rating score is 1.46, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.46 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.