CRYPTO FX 2025 Review: Everything You Need to Know

Summary

This CRYPTO FX review shows major concerns about this trading platform. Potential investors should think carefully before using it. Based on market research and user feedback, CRYPTO FX works without proper regulatory oversight, which creates serious red flags for trader safety and fund security.

The broker has mainly attracted high-risk seeking traders. However, many user complaints point to poor customer service and operational difficulties. The platform lacks clear information about its business model, regulatory status, and trading conditions, making it especially bad for new traders or those wanting reliable trading environments.

User feedback consistently shows problems with customer support and various operational issues that can hurt trading experiences. Some traders might like potentially higher-risk, higher-reward scenarios, but the lack of proper regulatory protection means users have limited options if disputes or withdrawal problems happen. Given that regulated brokers now offer complete protection and transparent operations, CRYPTO FX's approach seems outdated and risky for most retail traders.

Important Notice

Regional Entity Differences: CRYPTO FX has not clearly stated its operational regions or legal frameworks. This makes it hard for traders to understand which legal protections might apply to their accounts. This lack of clarity about operational territories adds another layer of uncertainty for potential users.

Review Methodology: This evaluation uses comprehensive user feedback analysis, available market research, and publicly accessible official information. Due to limited transparency from CRYPTO FX about its operations, some assessments rely heavily on user experiences and third-party observations rather than verified company data.

Rating Framework

Broker Overview

CRYPTO FX operates in a challenging position within the competitive forex and CFD trading landscape. The broker's establishment date and company background information remain unclear based on available sources. This immediately raises transparency concerns for potential traders.

Without clear information about the company's founding, ownership structure, or operational history, traders lack essential background context needed to make informed decisions about trusting their funds to this platform. The business model used by CRYPTO FX is not clearly detailed in available materials. This leaves questions about whether they operate as a market maker, ECN broker, or through other execution models.

This lack of clarity extends to their revenue structure, trading conditions, and operational procedures that directly impact trader experiences. Regarding trading platforms and asset offerings, specific information about CRYPTO FX's technological infrastructure remains limited. The broker appears to focus on forex and CFD trading, but detailed asset lists, platform specifications, and trading tools are not well documented.

This CRYPTO FX review highlights the concerning pattern of limited transparency that extends across multiple operational aspects. Most importantly, available research shows an absence of effective regulatory oversight. This represents a fundamental concern for trader protection and fund security in today's regulated trading environment.

Regulatory Framework: Available information does not identify specific regulatory authorities overseeing CRYPTO FX operations. This represents a significant concern for trader protection and fund security.

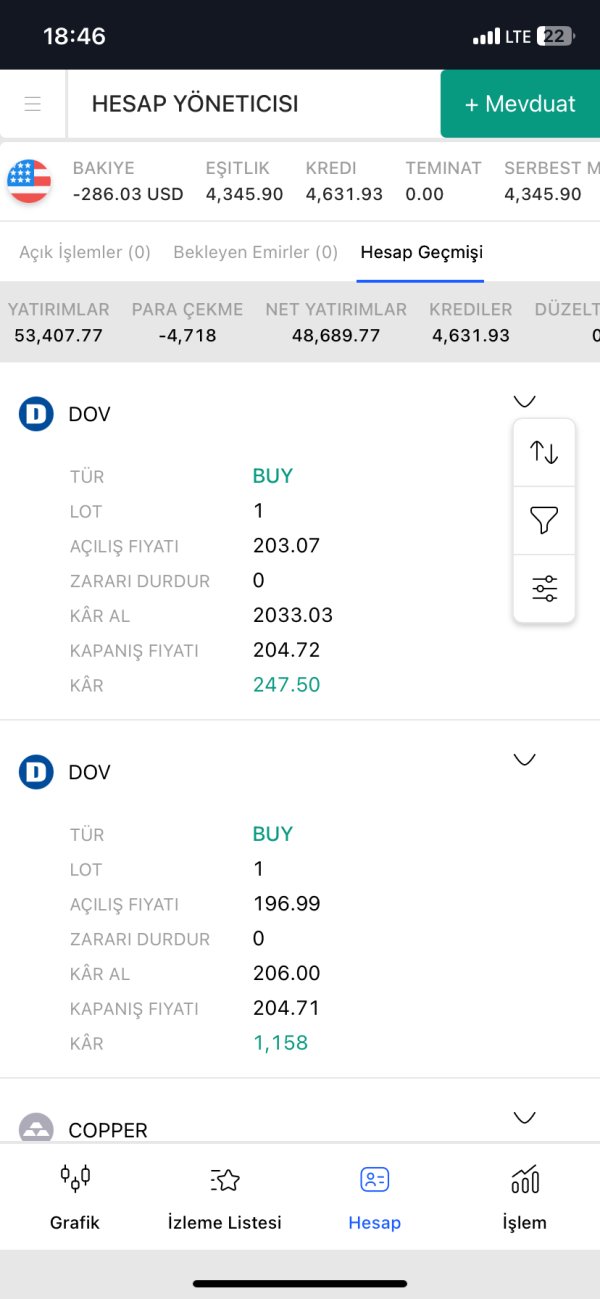

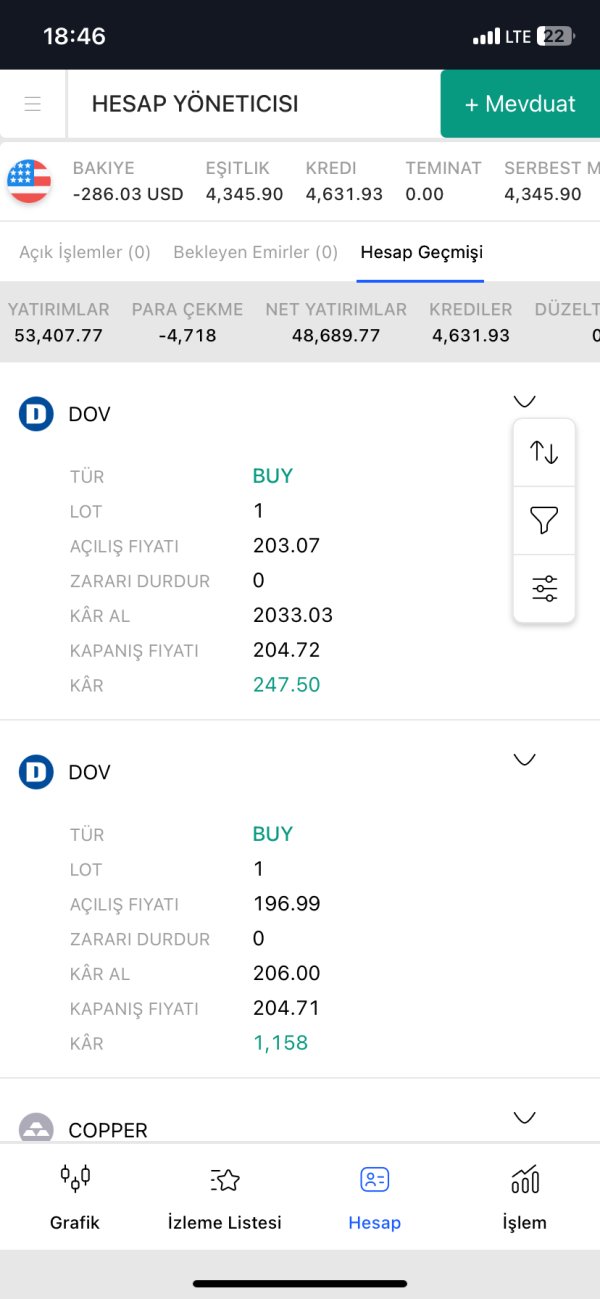

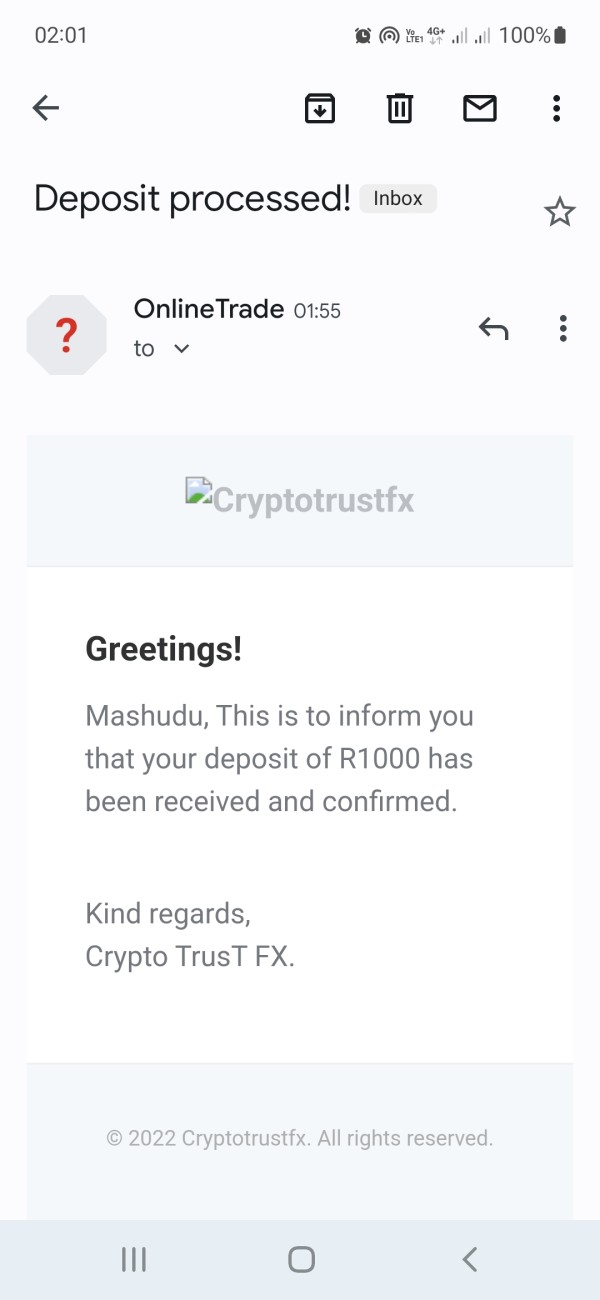

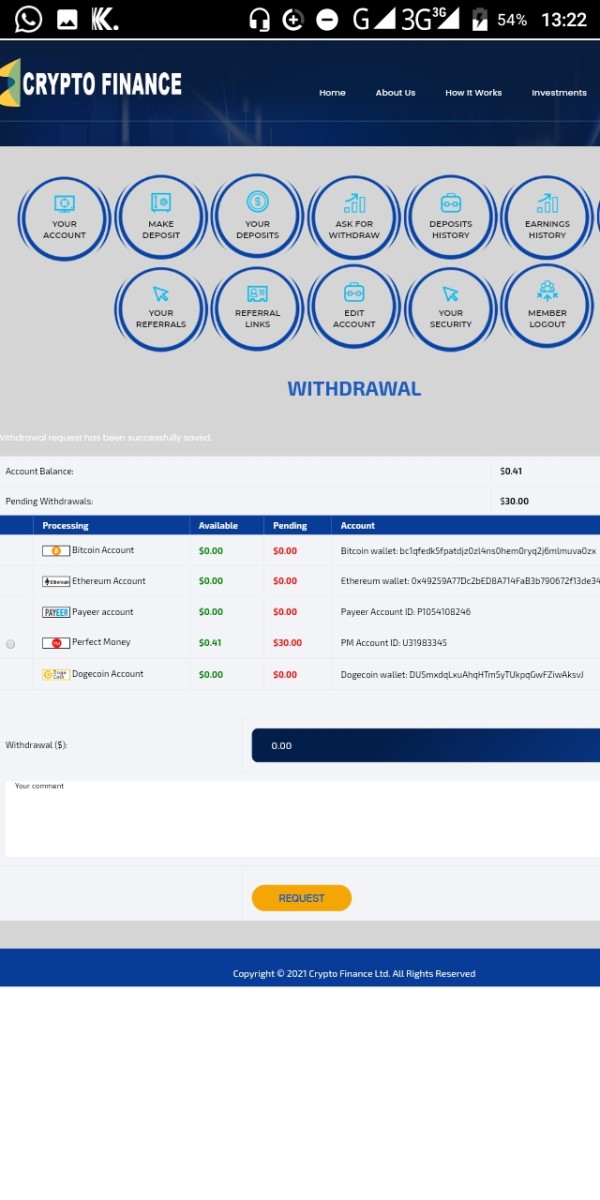

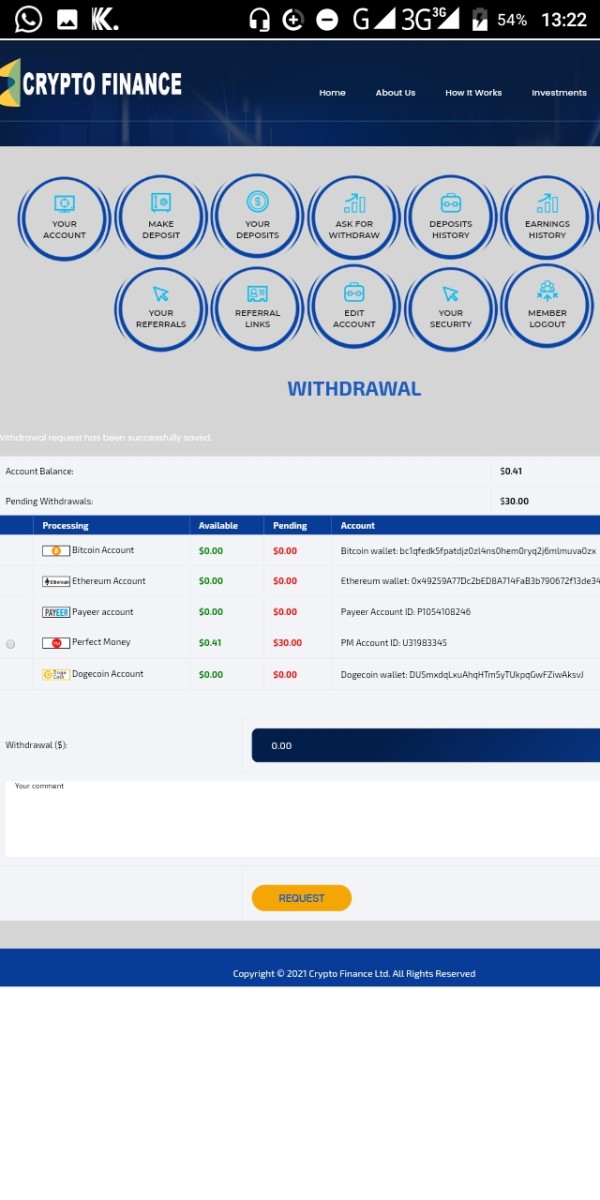

Deposit and Withdrawal Methods: The platform reportedly supports basic payment methods including bank transfers and credit card payments. However, specific processing times and fees are not detailed in available sources.

Minimum Deposit Requirements: Specific minimum deposit amounts are not clearly specified in available documentation. This makes it difficult for potential traders to plan their initial investment.

Promotional Offerings: Information about bonuses, promotions, or special trading incentives is not readily available in current sources.

Available Trading Assets: While the platform appears to focus on forex and CFD trading, comprehensive asset lists including specific currency pairs, indices, commodities, or other instruments are not detailed in available materials.

Cost Structure: Critical information about spreads, commissions, overnight fees, and other trading costs remains unclear based on current documentation. This lack of transparency makes it impossible for traders to accurately calculate their potential trading expenses.

Leverage Options: Specific leverage ratios offered to different account types or regions are not mentioned in available sources.

Platform Technology: Details about specific trading platforms, whether proprietary or third-party solutions like MetaTrader, are not clearly documented.

Geographic Restrictions: Information about countries or regions where CRYPTO FX services are restricted or unavailable is not specified.

Customer Support Languages: Available customer service languages and communication options are not detailed in current sources.

This CRYPTO FX review emphasizes how the lack of detailed operational information creates significant uncertainty for potential users.

Detailed Rating Analysis

Account Conditions Analysis

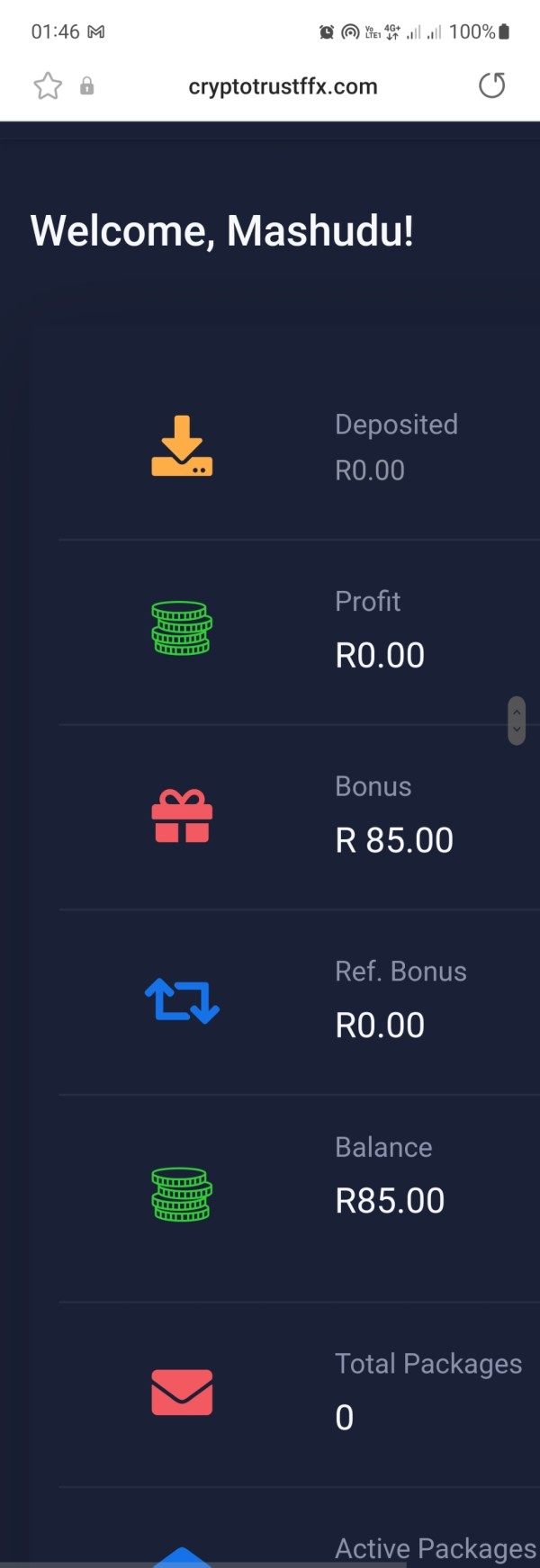

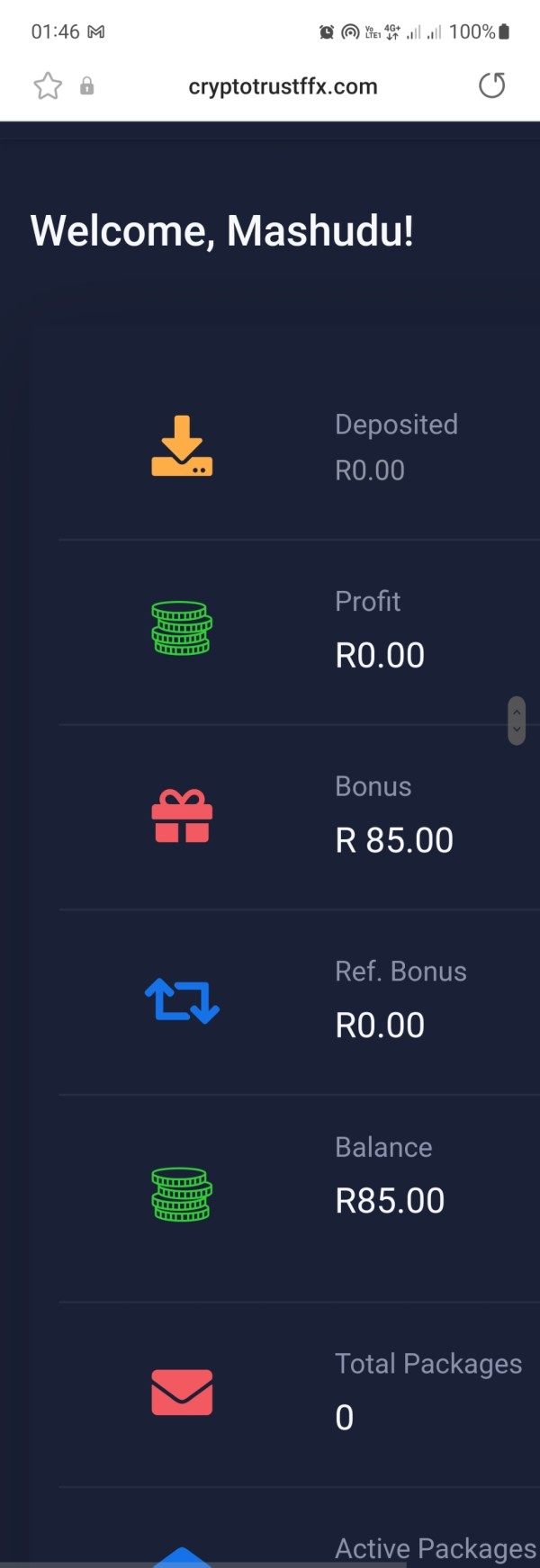

The account conditions offered by CRYPTO FX present several concerns for potential traders. Available information does not clearly outline different account types, their respective features, or the specific benefits associated with each tier. This lack of transparency makes it extremely difficult for traders to understand what they can expect from their trading relationship with the broker.

Minimum deposit requirements, which are crucial for trader planning and accessibility, are not clearly specified in available documentation. This absence of clear financial requirements creates uncertainty for potential users who need to budget for their trading activities. User feedback suggests that the account opening experience has been problematic for some traders.

Reports include unclear procedures and inadequate guidance during the setup process. The absence of information about special account features, such as Islamic accounts for traders requiring swap-free trading, professional accounts for experienced traders, or managed account options, suggests limited accommodation for diverse trader needs. Most regulated brokers provide comprehensive account information upfront, making CRYPTO FX's lack of transparency particularly concerning.

User experiences shared in various forums indicate frustration with the account management process. This includes difficulties in understanding account terms, unclear fee structures, and problems with account verification procedures. This CRYPTO FX review reveals that the broker's approach to account management appears to prioritize opacity over client transparency.

This approach is inconsistent with modern broker standards.

The trading tools and educational resources available through CRYPTO FX remain largely undocumented in available sources. This represents a significant disadvantage for traders seeking comprehensive market analysis capabilities. Modern forex trading requires access to advanced charting tools, technical indicators, economic calendars, and market research to make informed trading decisions.

Available information does not detail specific analytical tools, research resources, or educational materials that might be available to CRYPTO FX users. This absence of information is particularly concerning given that most reputable brokers emphasize their educational offerings and analytical capabilities as key differentiators in the competitive trading market. The lack of documented educational resources suggests that new traders may not receive adequate support in developing their trading skills and market understanding.

Educational materials, webinars, trading guides, and market analysis are standard offerings from established brokers, and their absence indicates a limited commitment to trader development. Automated trading support, including expert advisor compatibility, API access, or copy trading features, is not mentioned in available documentation. These tools are increasingly important for modern traders who rely on algorithmic strategies or social trading approaches.

User feedback does not provide substantial insight into the quality or availability of trading tools. This may indicate either limited tool offerings or poor user engagement with available resources. The absence of positive feedback about analytical capabilities or educational value suggests these areas may be underdeveloped.

Customer Service and Support Analysis

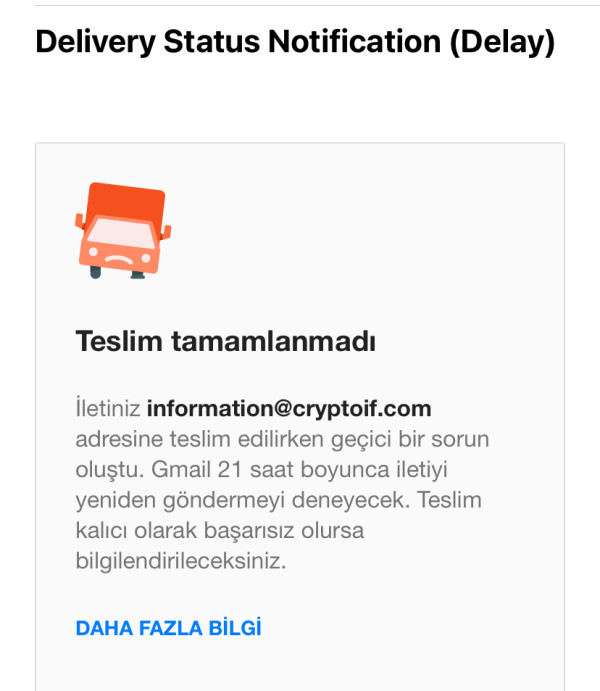

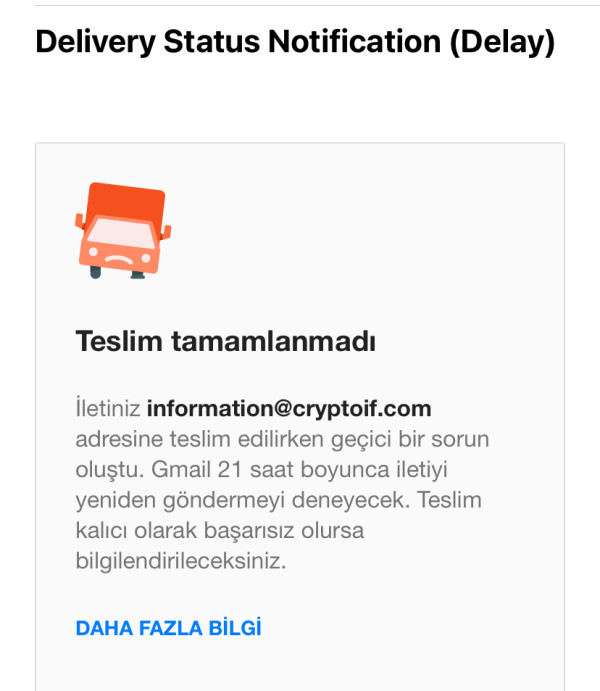

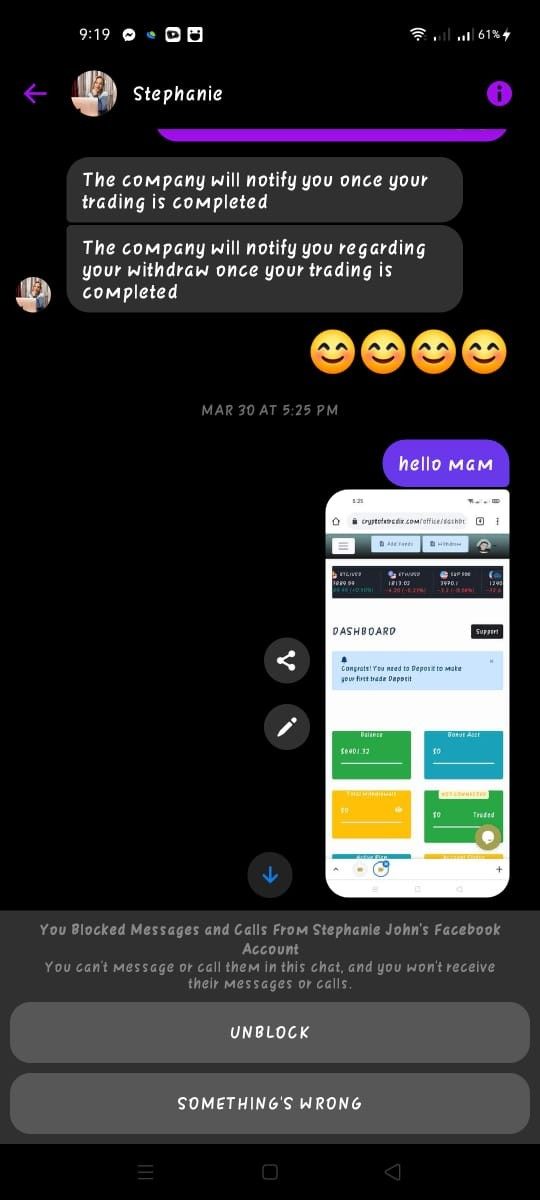

Customer service quality emerges as one of the most significant concerns in user feedback about CRYPTO FX. Multiple reports indicate that customer support responsiveness is inadequate. Users experience extended wait times for responses to their inquiries and support requests.

This pattern of poor communication creates substantial frustration for traders who require timely assistance with their accounts or trading activities. The available contact methods and customer service channels are not clearly documented. This leaves potential users uncertain about how to reach support when needed.

Professional brokers typically provide multiple communication channels including live chat, email, phone support, and comprehensive FAQ sections. The lack of clear customer service information suggests limited support infrastructure. User feedback consistently highlights issues with support quality, including reports of unprofessional responses, inadequate problem resolution, and lack of follow-up on customer concerns.

These service quality issues can significantly impact trader confidence and satisfaction, particularly when dealing with account or trading-related problems that require prompt resolution. Multilingual support availability is not documented, which may create additional barriers for international traders who require assistance in their native languages. The absence of 24/7 support or clearly defined service hours adds uncertainty for traders operating in different time zones.

The pattern of customer service complaints suggests systemic issues rather than isolated incidents. This indicates fundamental problems with CRYPTO FX's approach to client support and relationship management.

Trading Experience Analysis

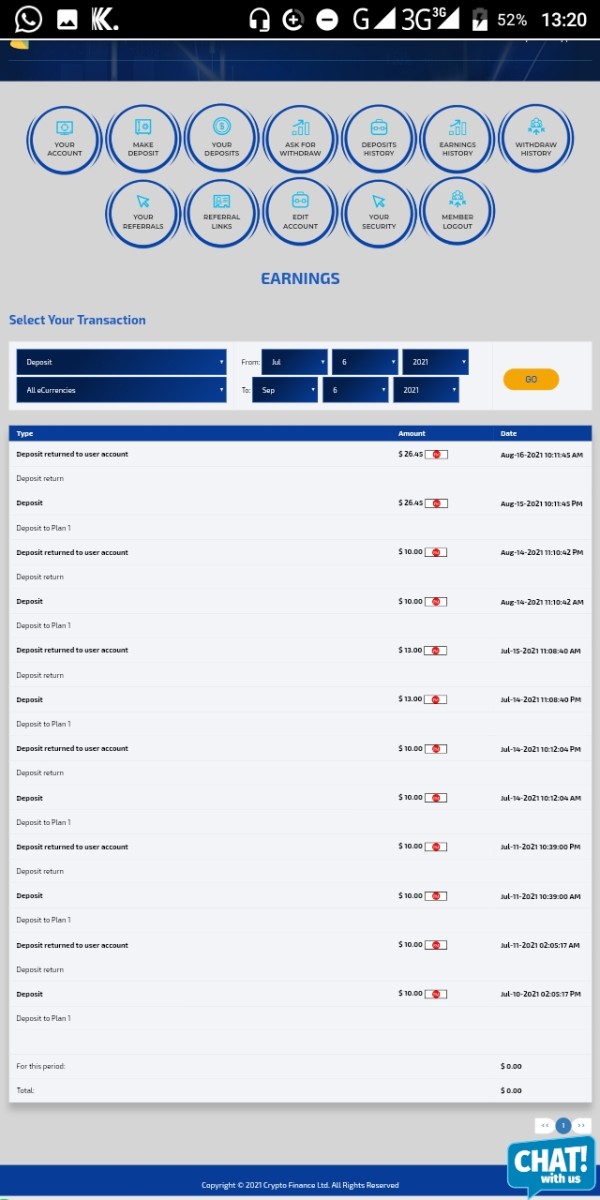

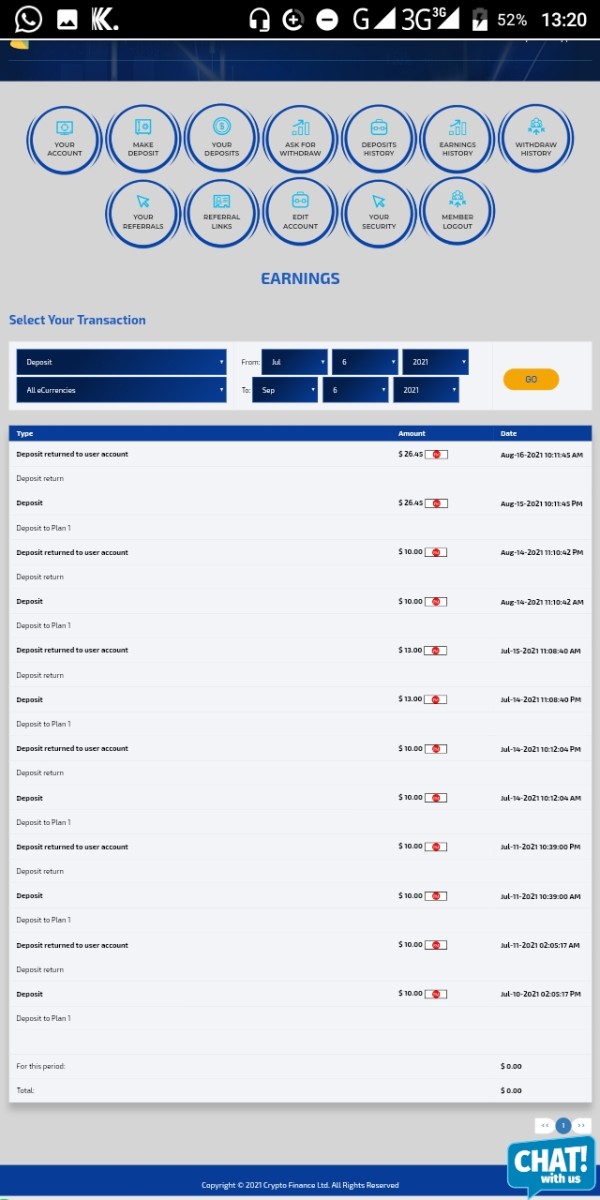

The trading experience offered by CRYPTO FX appears problematic based on available user feedback and limited operational transparency. Users have reported various operational issues that directly impact their ability to execute trades effectively and manage their trading activities successfully. Platform stability concerns emerge from user reports, with mentions of technical problems that can interfere with trade execution and account management.

In the fast-paced forex market, platform reliability is crucial for maintaining trading opportunities and avoiding unwanted losses due to technical failures. Order execution quality issues have been reported by users, including problems with slippage and requotes that can significantly impact trading profitability. These execution problems suggest potential issues with the broker's liquidity arrangements or order processing systems that directly affect trader outcomes.

The lack of detailed information about platform functionality makes it difficult to assess the completeness of trading features available to users. Modern traders expect comprehensive charting capabilities, advanced order types, risk management tools, and mobile trading options that may not be adequately provided. User feedback indicates concerns about spread stability and trading conditions, suggesting that the trading environment may not meet the standards expected by experienced traders.

The absence of transparent information about typical spreads, execution speeds, and trading conditions makes it impossible for traders to properly evaluate the platform's competitiveness. This CRYPTO FX review emphasizes that trading experience issues can significantly impact trader success and satisfaction. Platform reliability is a critical consideration.

Trust and Safety Analysis

Trust and safety represent the most critical concerns regarding CRYPTO FX. Available information indicates significant regulatory and security issues. The absence of effective regulatory oversight means that traders lack the fundamental protections typically associated with licensed and regulated forex brokers.

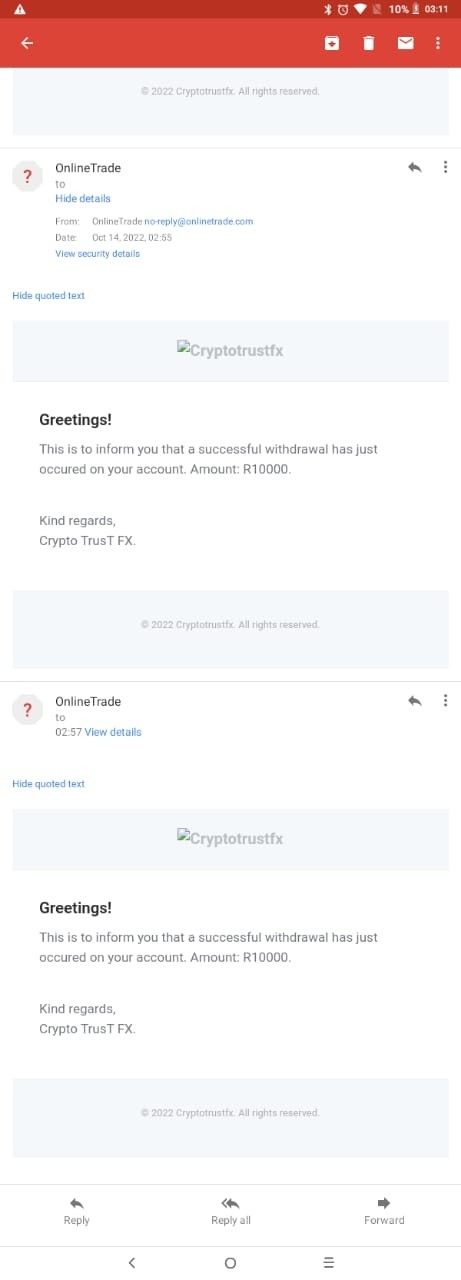

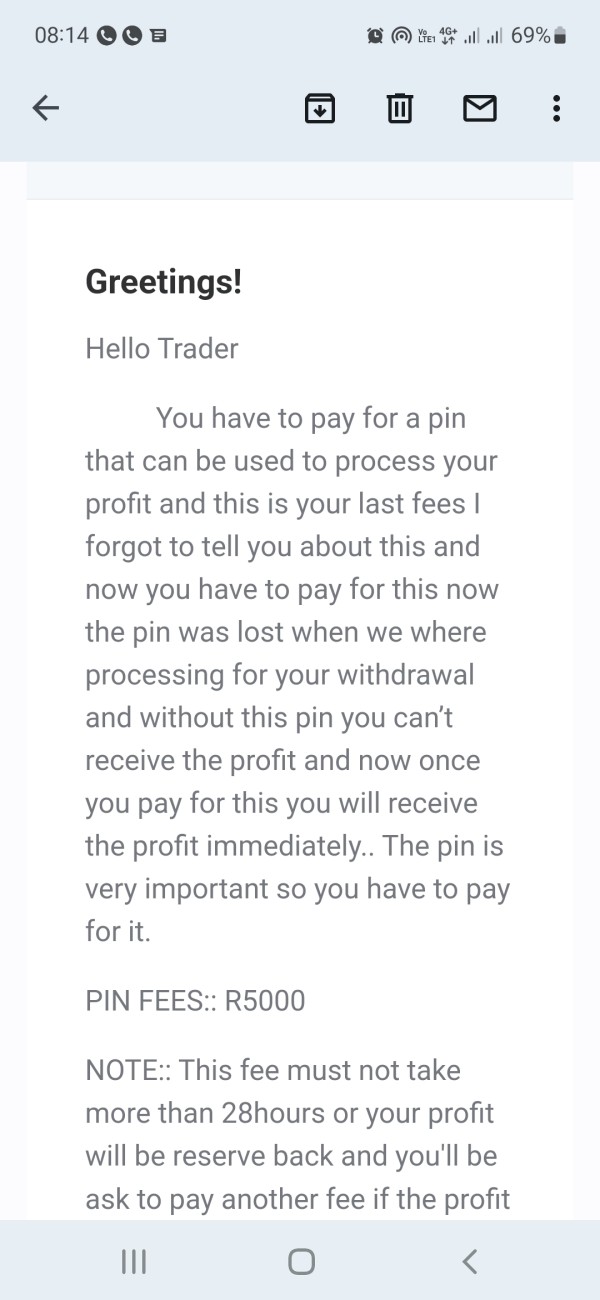

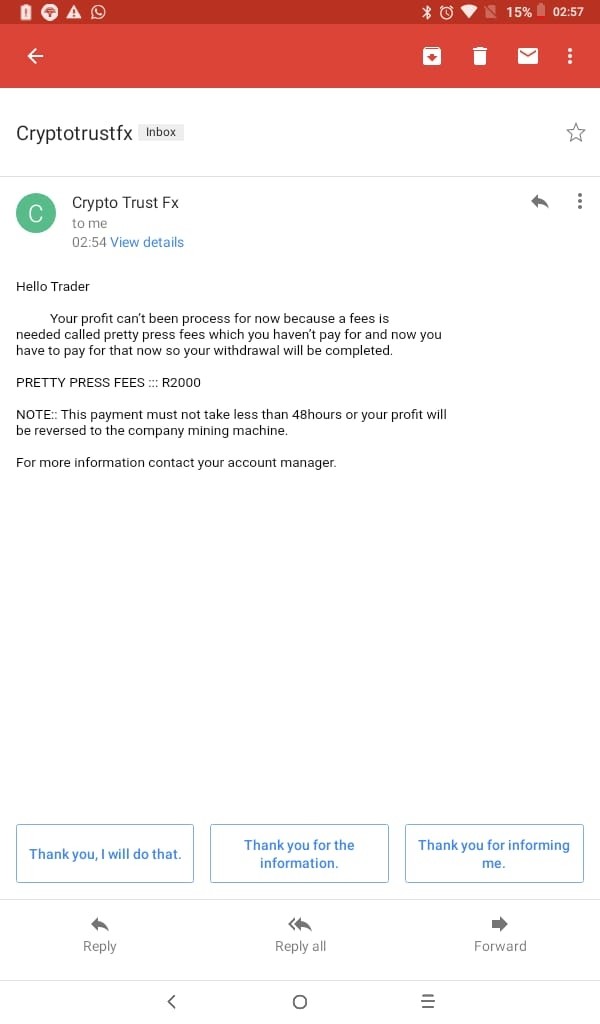

Regulatory licensing is essential for trader protection, fund segregation, and dispute resolution mechanisms. Without proper regulatory oversight, traders have limited recourse in case of problems with fund withdrawals, account disputes, or operational issues. The lack of identified regulatory authorities overseeing CRYPTO FX operations represents a fundamental risk for potential users.

Fund safety measures, including client money segregation, deposit insurance, and independent auditing, are not documented in available sources. These protections are standard requirements for regulated brokers and their absence creates significant risk for trader funds and account security. Company transparency issues extend beyond regulatory concerns to include limited information about ownership, operational procedures, and business practices.

Reputable brokers typically provide comprehensive information about their corporate structure, regulatory compliance, and operational standards. The user community has identified CRYPTO FX as a high-risk broker, which reflects collective concerns about safety and reliability. This community assessment, combined with regulatory concerns, suggests that traders should exercise extreme caution when considering this broker.

Industry reputation and third-party evaluations consistently point to trust issues. This makes CRYPTO FX unsuitable for traders who prioritize fund security and regulatory protection.

User Experience Analysis

Overall user satisfaction with CRYPTO FX appears significantly below industry standards based on available feedback and reported experiences. The pattern of negative reviews and user complaints suggests systematic issues that impact the entire user journey from account opening through ongoing trading activities. Interface design and platform usability information is limited in available sources, but user feedback does not highlight positive experiences with platform navigation or functionality.

Modern traders expect intuitive, responsive platforms that facilitate efficient trading and account management. The registration and verification process has reportedly created difficulties for some users, with unclear procedures and inadequate guidance during account setup. Streamlined onboarding processes are standard in the industry, and problems in this area create immediate negative impressions for new users.

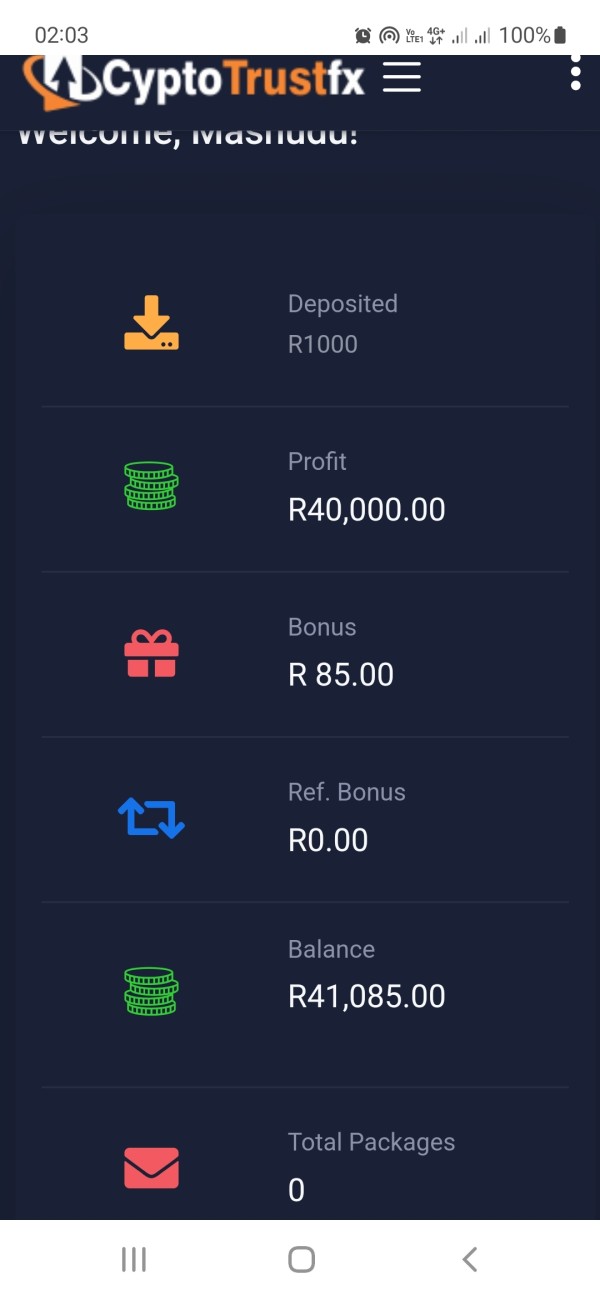

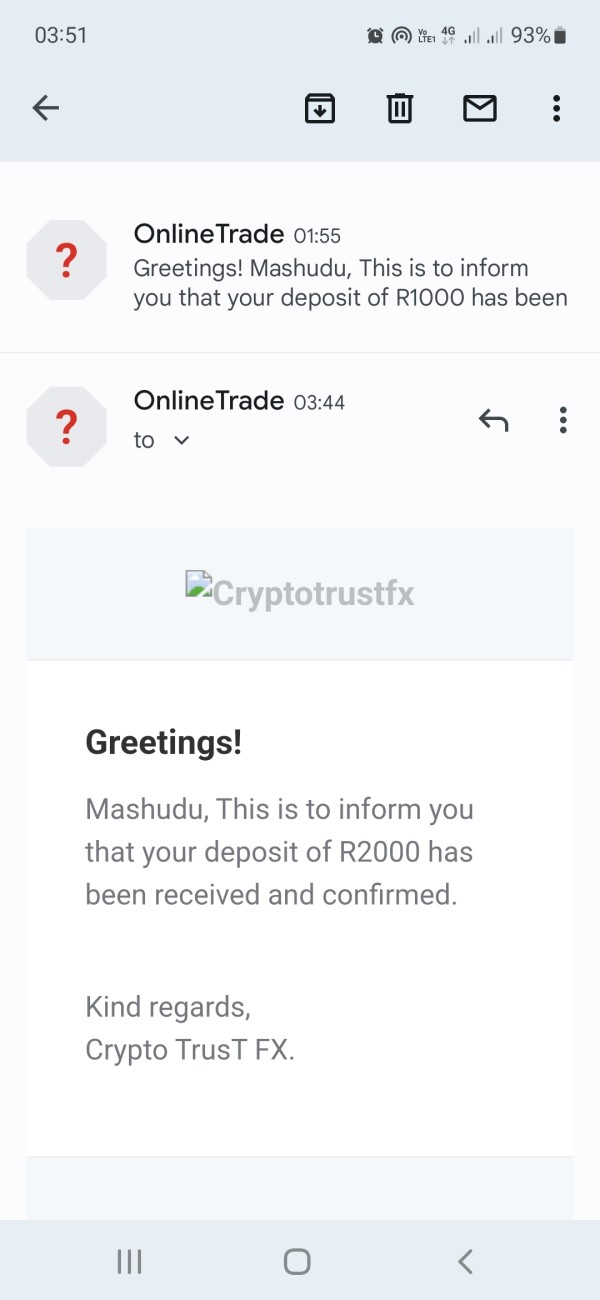

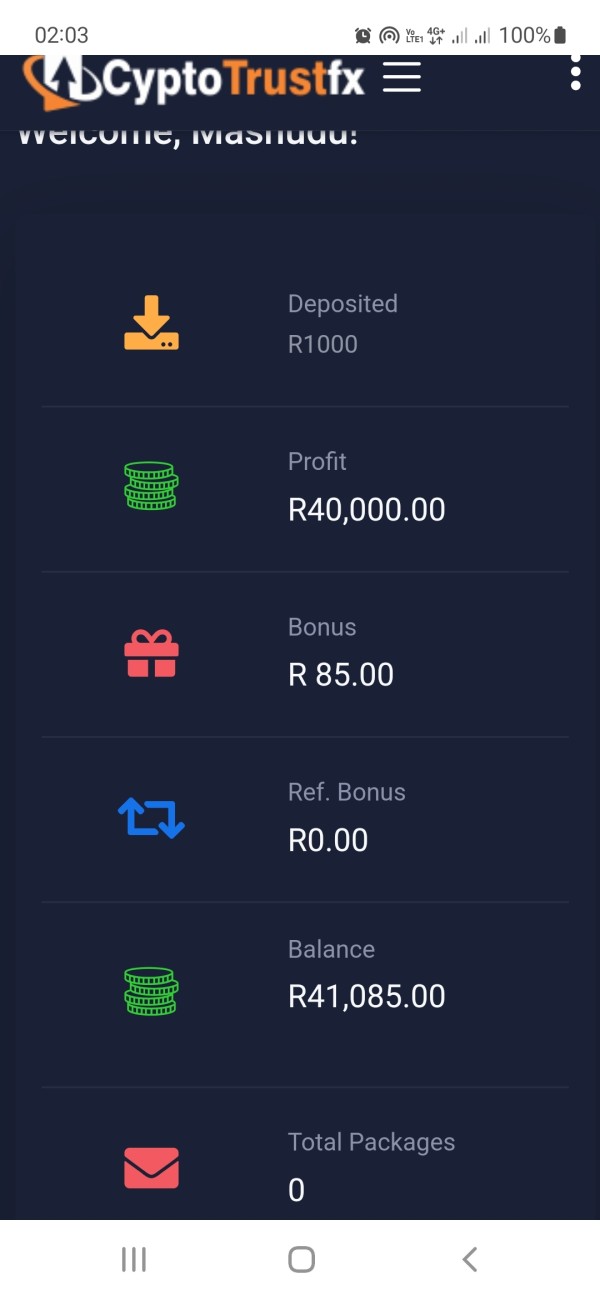

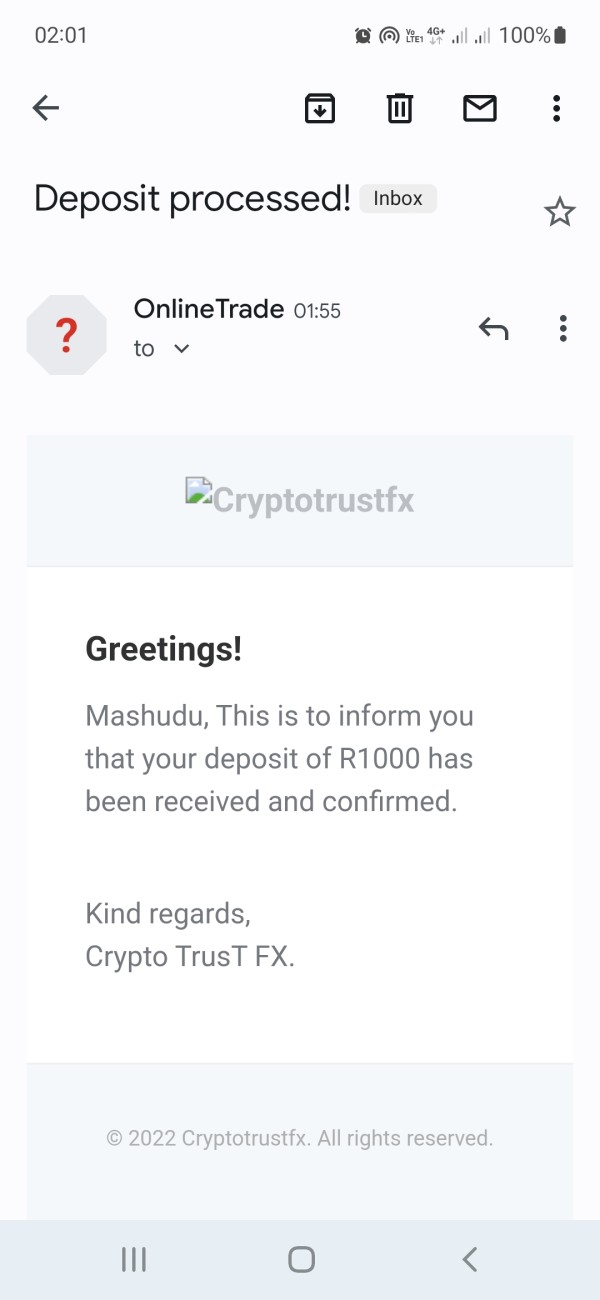

Fund operation experiences, including deposits and withdrawals, lack comprehensive documentation and positive user testimonials. Given the critical importance of reliable fund access, the absence of positive feedback about financial transactions represents a significant concern. Common user complaints center around customer service issues, operational problems, and lack of transparency about trading conditions and fees.

The volume and consistency of negative feedback suggests that these issues represent ongoing operational problems rather than isolated incidents. The user profile that might find CRYPTO FX suitable appears limited to very high-risk tolerance traders who prioritize potential opportunities over regulatory protection and operational reliability. For most retail traders, the combination of regulatory concerns and operational issues makes this broker unsuitable for their trading needs.

Conclusion

This comprehensive CRYPTO FX review reveals significant concerns across multiple operational areas that make this broker unsuitable for most retail traders. The absence of effective regulatory oversight, combined with poor user feedback and limited operational transparency, creates an environment of substantial risk for potential users. The broker appears to attract primarily high-risk seeking traders, but even this user segment should carefully consider the implications of trading with an unregulated entity.

The lack of fundamental protections, unclear trading conditions, and reported operational problems suggest that traders would be better served by choosing regulated alternatives that offer comprehensive client protection and transparent operations. While some traders may be attracted to potentially different trading conditions, the combination of regulatory concerns, customer service issues, and operational problems significantly outweighs any potential advantages. Most traders should prioritize regulated brokers that offer clear terms, reliable customer support, and established track records of client protection.