Is CRYPTO FX safe?

Business

License

Is CRYPTO FX Safe or a Scam?

Introduction

CRYPTO FX is a forex broker that positions itself within the increasingly competitive landscape of online trading, particularly focusing on cryptocurrency and forex trading. As with any financial service, it is crucial for traders to thoroughly evaluate the credibility and reliability of brokers before committing their funds. The potential for financial loss is significant, especially in an industry where scams and unregulated entities are prevalent. In this article, we will investigate whether CRYPTO FX is a safe trading platform or a potential scam. Our investigative approach combines qualitative analysis of customer feedback with quantitative data regarding regulatory compliance and operational practices.

Regulation and Legality

A broker's regulatory status is a pivotal factor in determining its legitimacy and safety. Unfortunately, CRYPTO FX lacks regulation from any recognized financial authority, which raises significant red flags for potential investors. Regulation serves as a protective measure, ensuring that brokers adhere to strict operational standards and safeguarding client funds. The following table summarizes the regulatory status of CRYPTO FX:

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| None | N/A | N/A | Not Verified |

The absence of any regulatory oversight means that CRYPTO FX operates without the accountability that comes with being regulated. This lack of oversight can lead to unscrupulous practices, such as misappropriation of funds or failure to execute trades as promised. Additionally, the brokers historical compliance record is non-existent, further complicating any assessment of its reliability. Without a regulatory body to oversee its operations, traders are left vulnerable to potential fraud or malpractice.

Company Background Investigation

CRYPTO FX is operated by a company that provides limited information regarding its history and ownership structure. This lack of transparency is concerning and often indicative of a less trustworthy entity. The management team behind CRYPTO FX has not been publicly disclosed, which makes it difficult to assess their qualifications or experience in the financial services sector. A robust management team with a proven track record is essential for building trust with clients, and the absence of such information raises questions about the broker's credibility.

Furthermore, the company's operational transparency is notably lacking. Investors should expect brokers to provide clear information about their ownership, operational history, and the individuals responsible for managing their funds. The failure to disclose this information can be a significant warning sign, leading to increased skepticism about the broker's intentions and operational integrity.

Trading Conditions Analysis

The trading conditions offered by CRYPTO FX, including fees and spreads, are critical for traders to consider. A broker's fee structure can significantly affect profitability, and any unusual fees can indicate potential issues. CRYPTO FX claims to offer competitive trading conditions, but the lack of transparency regarding its fee structure is concerning. Below is a comparison of the core trading costs associated with CRYPTO FX:

| Fee Type | CRYPTO FX | Industry Average |

|---|---|---|

| Major Currency Pair Spread | TBD | 1.0 pips |

| Commission Structure | TBD | Varies |

| Overnight Interest Range | TBD | Varies |

While the specifics of CRYPTO FX's fees are not readily available, the general lack of information often suggests that traders may face hidden fees or charges. Unusual fees can erode trading profits and lead to dissatisfaction among clients. Therefore, it is essential for prospective traders to approach CRYPTO FX with caution until more transparent information regarding its fee structure is provided.

Client Fund Safety

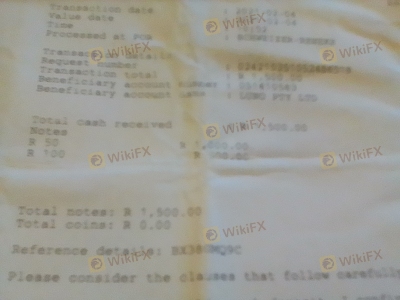

The security of client funds is paramount when selecting a broker. CRYPTO FX has not provided adequate information regarding its safety measures for client funds. Effective measures typically include segregated accounts, investor protection schemes, and negative balance protection policies. The absence of these safety protocols increases the risk of loss for traders.

Without clear information on how client funds are managed and protected, traders should be wary of depositing significant amounts with CRYPTO FX. Historical complaints and issues regarding fund security can provide insight into a broker's reliability. Unfortunately, any previous incidents involving CRYPTO FX regarding fund security have not been disclosed, leaving potential clients in the dark about the risks they may face.

Customer Experience and Complaints

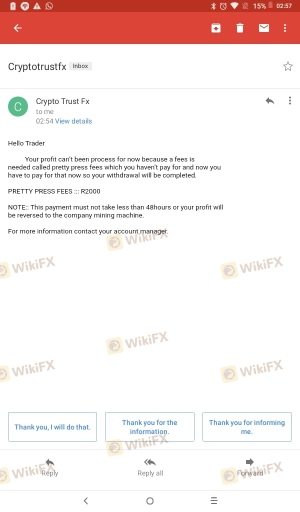

Customer feedback is an invaluable resource when assessing a broker's reliability. Reviews of CRYPTO FX reveal a pattern of dissatisfaction among users, with numerous complaints regarding withdrawal difficulties and unresponsive customer support. Below is a summary of the major complaint types and their severity:

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Issues | High | Poor |

| Unresponsive Support | Medium | Poor |

| Misleading Information | High | Poor |

These complaints highlight significant concerns about CRYPTO FX's operational practices. Users have reported being unable to withdraw their funds, which is a serious issue that can indicate potential fraud. Additionally, the lack of responsive customer support exacerbates these issues, leaving clients feeling abandoned and frustrated. The combination of these factors suggests a troubling pattern that potential investors should consider seriously.

Platform and Execution

The performance and reliability of a trading platform are crucial for a positive trading experience. Users have reported mixed experiences with CRYPTO FX's platform, with some highlighting issues related to stability and execution quality. Delays in order execution and instances of slippage can significantly affect trading outcomes, particularly in volatile markets.

Furthermore, any signs of platform manipulation or unfulfilled orders can lead to distrust among traders. A broker's ability to provide a seamless trading experience is essential for maintaining client trust, and any recurring issues in this area can be detrimental to its reputation.

Risk Assessment

Engaging with CRYPTO FX presents several risks that potential traders should be aware of. Below is a concise risk scorecard summarizing the key risk areas associated with this broker:

| Risk Category | Risk Level (Low/Medium/High) | Brief Description |

|---|---|---|

| Regulatory Compliance | High | No regulatory oversight |

| Fund Security | High | Lack of transparency in fund management |

| Customer Support | Medium | Poor responsiveness to client inquiries |

| Trading Conditions | Medium | Unclear fee structure and potential hidden costs |

Given these risks, it is advisable for traders to exercise caution when considering CRYPTO FX for their trading needs. Engaging with unregulated brokers can lead to significant financial loss, and potential traders should weigh the risks against their investment goals.

Conclusion and Recommendations

In conclusion, our investigation suggests that CRYPTO FX raises several red flags that warrant serious consideration. The lack of regulation, transparency, and poor customer feedback points to a potential scam. While some traders may be tempted by the prospect of high leverage and trading opportunities, the risks associated with this broker are substantial.

For those seeking a reliable trading experience, we recommend considering alternative brokers that are well-regulated and have a proven track record of client satisfaction. Brokers such as eToro, Interactive Brokers, and Swissquote offer robust regulatory frameworks and transparent trading conditions, making them safer choices for traders looking to navigate the forex and cryptocurrency markets. Always prioritize safety and due diligence when selecting a broker, as the right choice can mean the difference between a successful trading experience and significant financial loss.

Is CRYPTO FX a scam, or is it legit?

The latest exposure and evaluation content of CRYPTO FX brokers.

CRYPTO FX Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

CRYPTO FX latest industry rating score is 1.57, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.57 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.