Connexar Capital 2025 Review: Everything You Need to Know

Executive Summary

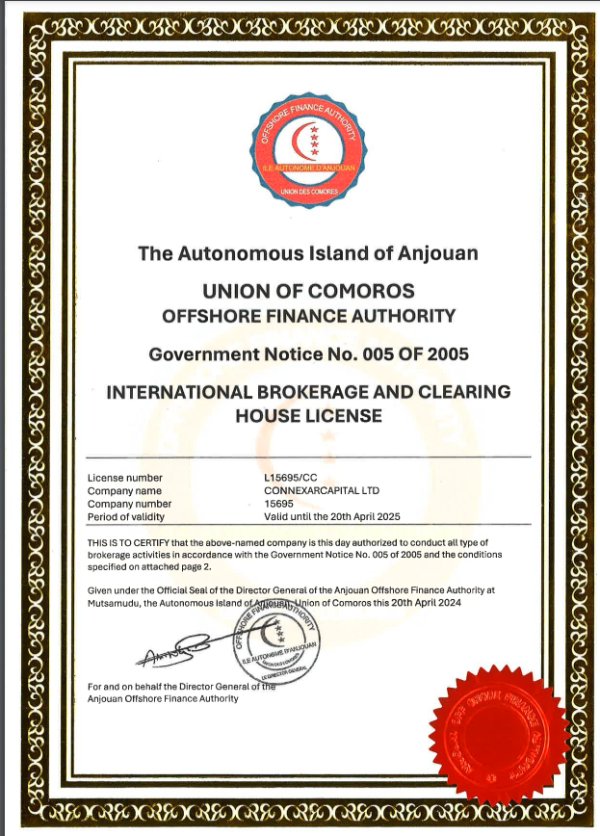

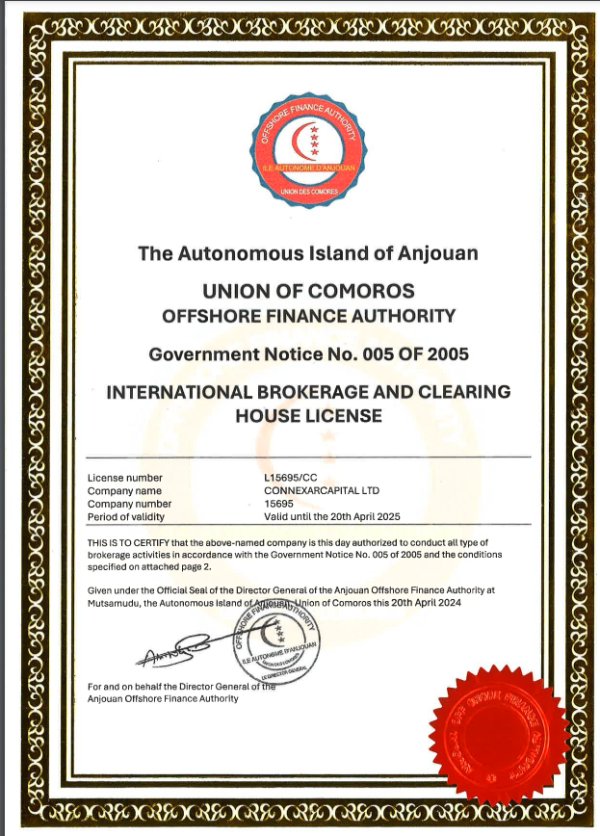

Connexar Capital works as a forex broker registered under the Anjouan Offshore Finance Authority. This connexar capital review shows that the broker has a mixed profile in the competitive forex trading world, with both strengths and concerns that traders should consider. The broker got international brokerage and clearing licenses as of April 20, 2024, but people still debate whether it's legitimate and properly regulated.

The broker's main strength is its support for the MetaTrader 5 platform. This platform gives traders advanced trading tools and features on both desktop and mobile devices, making it easier to trade from anywhere. User feedback on Trustpilot shows that clients have had positive trading experiences with Connexar Capital. They especially like the deposit and withdrawal processes and the customer support services.

Connexar Capital mainly targets investors who want to trade forex and CFDs. The broker offers access to major currency pairs and various other trading instruments that can help diversify portfolios. However, potential clients should know that the broker's registration under an offshore jurisdiction may raise questions about regulatory oversight and investor protection standards.

The overall assessment of Connexar Capital stays neutral. This reflects both positive user experiences and legitimate concerns about regulatory transparency, creating a balanced but cautious outlook. While the broker appears to deliver working trading services, prospective traders should carefully consider the regulatory implications before putting their money at risk.

Important Notice

This review uses publicly available information and user feedback from various sources. Connexar Capital's registration under the Anjouan Offshore Finance Authority may have different regulatory compliance standards compared to brokers licensed by major financial authorities such as the FCA, ASIC, or CySEC, which could affect trader protection. Traders should know that offshore regulatory jurisdictions may offer different levels of investor protection and dispute resolution mechanisms.

The evaluation in this review has not been independently verified through direct testing of the broker's services. All assessments come from available documentation, user testimonials, and publicly accessible information, which means some details might be incomplete or outdated. Potential clients should do their own research and consider their risk tolerance before engaging with any forex broker operating under offshore regulatory frameworks.

Rating Framework

Broker Overview

Connexar Capital works as a forex brokerage firm registered in the United Kingdom. However, its primary regulatory authorization comes from the Anjouan Offshore Finance Authority, which operates under different standards than major regulators. The broker focuses on providing foreign exchange and CFD trading services to both retail and institutional clients.

While specific founding details are not well documented in available sources, the company has established itself as a service provider in the competitive forex market. The broker's business model centers on facilitating access to global currency markets through electronic trading platforms, which is standard for modern forex brokers. Connexar Capital makes money through spreads and potentially commissions, though specific fee structures have not been detailed in available documentation.

The company positions itself as a technology-driven broker. It emphasizes platform reliability and user experience as key selling points for potential clients. This connexar capital review shows that the broker uses the MetaTrader 5 platform as its primary trading interface, supporting both PC and mobile device access for maximum flexibility.

The platform choice suggests a focus on providing professional-grade trading tools. These include advanced charting capabilities, technical indicators, and automated trading support that experienced traders often require. The broker's asset offering includes foreign exchange pairs and contracts for difference, allowing traders to access various global markets through a single platform interface.

Regulatory Status: Connexar Capital holds registration with the Anjouan Offshore Finance Authority. This authority issued the broker an international brokerage and clearing license on April 20, 2024, providing some regulatory foundation. However, this offshore regulatory framework may offer different oversight standards compared to major financial authorities.

Trading Assets: The broker provides access to forex currency pairs and CFD instruments. Specific asset counts and exotic pair availability have not been detailed in available sources, which could be important for traders seeking diverse trading opportunities.

Platform Technology: Connexar Capital supports the MetaTrader 5 trading platform. This platform is available for both desktop and mobile devices, providing advanced trading functionality and analytical tools that most traders expect.

Account Structure: Specific information about account types, minimum deposit requirements, and tiered service levels has not been disclosed in available documentation. This represents a significant information gap for potential clients who need to understand their options.

Cost Framework: Details about spreads, commissions, overnight financing charges, and other trading costs have not been specified in accessible sources. This makes cost comparison challenging for traders evaluating different brokers.

Leverage Options: Leverage ratios and margin requirements have not been detailed in available information. This is crucial data for risk assessment that traders need before opening accounts.

Payment Methods: Deposit and withdrawal options, processing times, and associated fees have not been comprehensively documented. However, user feedback suggests functional payment processing that works reasonably well.

Geographic Restrictions: Specific jurisdictional limitations and restricted territories have not been clearly outlined in available sources. This could affect whether certain traders can legally use the broker's services.

Customer Support Languages: The range of supported languages for customer service has not been specified. This connexar capital review notes generally positive support feedback, but language options remain unclear.

Detailed Rating Analysis

Account Conditions Analysis

The evaluation of Connexar Capital's account conditions faces significant limitations due to insufficient publicly available information. Standard industry offerings typically include multiple account tiers with varying minimum deposits, spreads, and service levels, but Connexar Capital keeps these details private. This lack of transparency represents a notable concern for potential clients seeking to understand their trading conditions before account opening.

Without access to detailed account specifications, it becomes challenging to assess how competitive the broker's offerings are compared to industry standards. Most reputable brokers provide clear information about account types, ranging from basic retail accounts to premium institutional services that cater to different trader needs. The absence of such details may indicate either limited account variety or insufficient marketing transparency.

The account opening process, verification requirements, and ongoing account maintenance conditions have not been documented in available sources. This information gap extends to special account features such as Islamic accounts for Sharia-compliant trading, which many modern brokers offer to accommodate diverse client needs and religious requirements.

This connexar capital review cannot provide a definitive rating for account conditions due to insufficient data. This highlights the importance of direct broker contact for prospective clients seeking specific account information and demonstrates potential transparency issues.

Connexar Capital demonstrates strength in its platform offering through MetaTrader 5 support. This provides traders with access to advanced technical analysis tools, multiple timeframes, and comprehensive charting capabilities that professional traders often require. The MT5 platform represents industry-standard technology, offering features such as depth of market display, economic calendar integration, and support for algorithmic trading strategies through Expert Advisors.

The platform's mobile accessibility ensures that traders can monitor positions and execute trades across various devices. This maintains connectivity to global markets regardless of location, which is essential for active traders. MT5's built-in technical indicators and drawing tools provide sufficient analytical resources for both novice and experienced traders to conduct market analysis and develop trading strategies.

However, beyond the core platform offering, additional educational resources, market research, and analytical tools have not been detailed in available documentation. Many competitive brokers supplement their platform offerings with daily market analysis, educational webinars, and trading guides to support client development and market understanding, creating more value for traders.

The absence of information regarding proprietary research tools, economic calendars, or educational content represents a potential limitation. This is especially true compared to full-service brokers who provide comprehensive trading ecosystems with extensive support materials.

Customer Service and Support Analysis

User feedback from Trustpilot indicates generally positive experiences with Connexar Capital's customer support services. Clients report decent support quality and responsiveness, which suggests the broker maintains functional communication channels. The testimonial highlighting "decent customer support" suggests that the broker addresses client inquiries adequately, though specific response times and service quality metrics have not been quantified.

The availability of multiple communication channels, support hours, and multilingual capabilities remains unclear from available documentation. Modern forex brokers typically offer 24/5 support during market hours through live chat, email, and telephone channels, but Connexar Capital's specific support infrastructure has not been detailed in public information.

Problem resolution capabilities and escalation procedures represent important service quality indicators that have not been documented in available sources. The ability to efficiently resolve technical issues, account problems, and trading disputes significantly impacts overall client satisfaction and broker reliability, making this information gap concerning.

While initial user feedback appears positive, the limited sample size and lack of comprehensive service documentation prevent a thorough assessment of support quality consistency. The absence of detailed service level agreements or published support standards may indicate areas where the broker could improve transparency and client communication.

Trading Experience Analysis

User testimonials suggest that Connexar Capital provides a satisfactory trading experience. Clients report positive interactions and functional platform performance, which indicates basic competency in service delivery. The MetaTrader 5 platform foundation typically ensures reliable order execution and stable connectivity to global markets, though specific performance metrics such as execution speeds and slippage rates have not been documented.

Platform stability during high-volatility periods represents a crucial factor for trading experience quality. However, stress-test data and system reliability statistics remain unavailable, making it difficult to assess performance under challenging market conditions. The broker's infrastructure capacity and server locations, which directly impact execution quality and latency, have not been disclosed in accessible documentation.

Mobile trading functionality through MT5 mobile applications should provide consistent user experience across devices. The integration between desktop and mobile platforms typically allows for seamless position management and market monitoring, though specific mobile feature availability and performance optimization details have not been verified.

This connexar capital review notes that while user feedback indicates general satisfaction, the absence of detailed performance data and technical specifications limits comprehensive trading experience assessment. Factors such as order execution speed, platform uptime, and system reliability during market stress periods remain undocumented, representing important considerations for serious traders who need reliable performance.

Trust and Reliability Analysis

Connexar Capital's regulatory status under the Anjouan Offshore Finance Authority raises legitimate questions about oversight standards and investor protection mechanisms. Offshore regulatory frameworks typically offer different levels of financial supervision compared to established authorities such as the Financial Conduct Authority or Australian Securities and Investments Commission, which may concern some traders. The international brokerage and clearing license obtained on April 20, 2024, provides some regulatory foundation, though the specific requirements and ongoing compliance obligations under Anjouan jurisdiction have not been detailed.

Client fund segregation practices, deposit insurance coverage, and dispute resolution mechanisms remain unclear from available documentation. These are critical factors for trader protection that established brokers typically highlight prominently in their marketing materials. Corporate transparency regarding company ownership, financial statements, and operational history appears limited, which may concern traders seeking comprehensive due diligence information.

Established brokers typically provide detailed company information, regulatory compliance reports, and financial stability indicators to build client confidence. The existence of legitimacy debates surrounding the broker, as noted in available sources, suggests that market participants have raised concerns about regulatory standing or operational transparency, creating additional uncertainty.

These discussions highlight the importance of thorough research and risk assessment before engaging with any broker operating under offshore regulatory frameworks. Traders should carefully consider their comfort level with such regulatory arrangements before committing funds.

User Experience Analysis

Overall user satisfaction appears positive based on available feedback. Clients report successful deposit and withdrawal processes alongside functional trading operations, which indicates basic operational competency. The testimonial indicating "2 years with Connexar Capital" and describing a "great experience" suggests some level of client retention and service consistency over extended periods.

The deposit and withdrawal experience represents a critical component of user satisfaction. Positive feedback in this area indicates functional payment processing systems that work reliably for basic transactions. However, specific processing times, supported payment methods, and associated fees have not been detailed, limiting comprehensive user experience assessment.

Platform usability and interface design, while supported by MT5's established framework, may vary based on broker customization and additional features. The absence of detailed user interface reviews or platform customization information prevents thorough evaluation of the complete user experience ecosystem, making it difficult to assess how well the broker has implemented the platform.

Registration and account verification processes, ongoing account management, and client communication systems have not been extensively documented. These operational elements significantly impact overall user satisfaction and broker relationship quality, representing areas where additional transparency would benefit potential clients seeking comprehensive service evaluation.

Conclusion

Connexar Capital presents a mixed profile in the forex brokerage landscape. The broker demonstrates functional trading services while raising questions about regulatory transparency and comprehensive service documentation, creating a complex evaluation picture. The broker's strength lies in its MetaTrader 5 platform support and generally positive user feedback regarding trading experience and customer support quality.

However, significant information gaps regarding account conditions, fee structures, and detailed service specifications limit comprehensive evaluation capabilities. The offshore regulatory framework under the Anjouan Offshore Finance Authority may suit traders comfortable with such jurisdictions but could concern those preferring established regulatory oversight and stronger investor protections.

This connexar capital review suggests that the broker may be suitable for traders seeking basic forex and CFD trading functionality who are comfortable with offshore regulatory frameworks. However, the lack of detailed transparency and ongoing legitimacy discussions recommend careful consideration and thorough due diligence before account opening, especially for traders with significant capital at risk. Potential clients should directly contact the broker for specific service details and consider their risk tolerance regarding offshore regulatory jurisdictions before making any commitments.