CNCBI Review 1

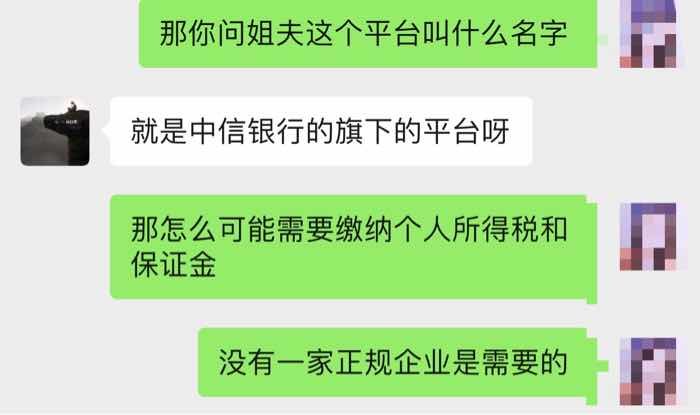

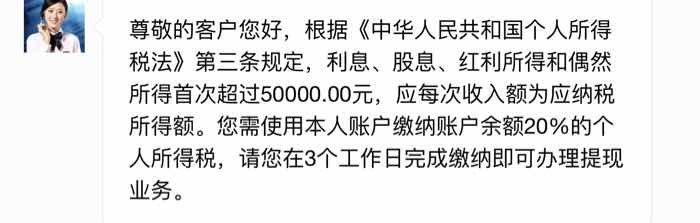

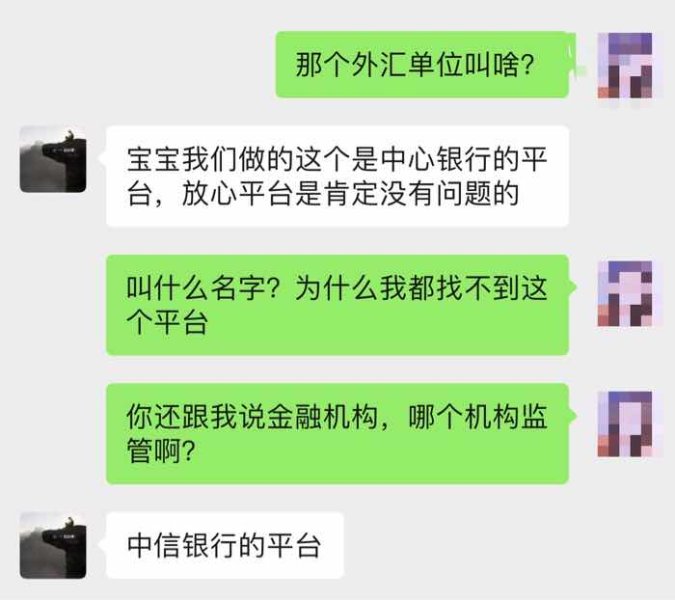

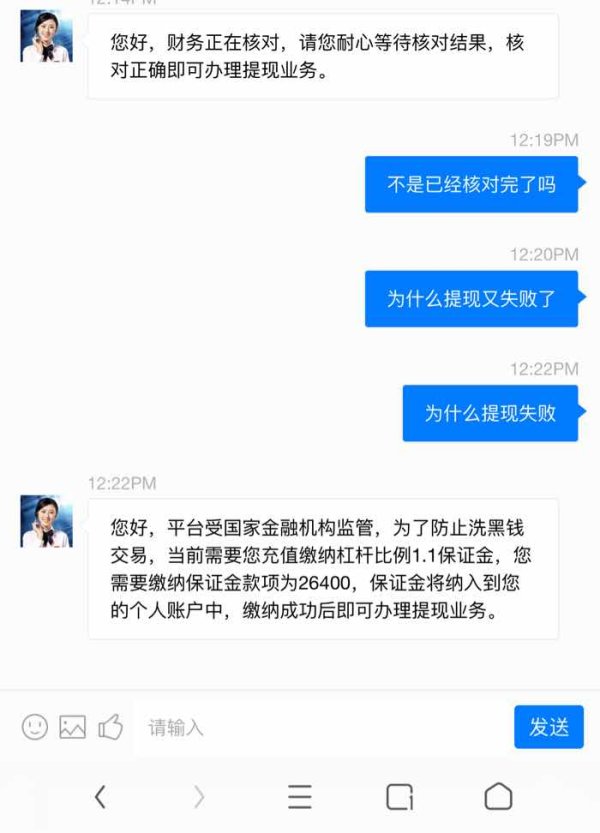

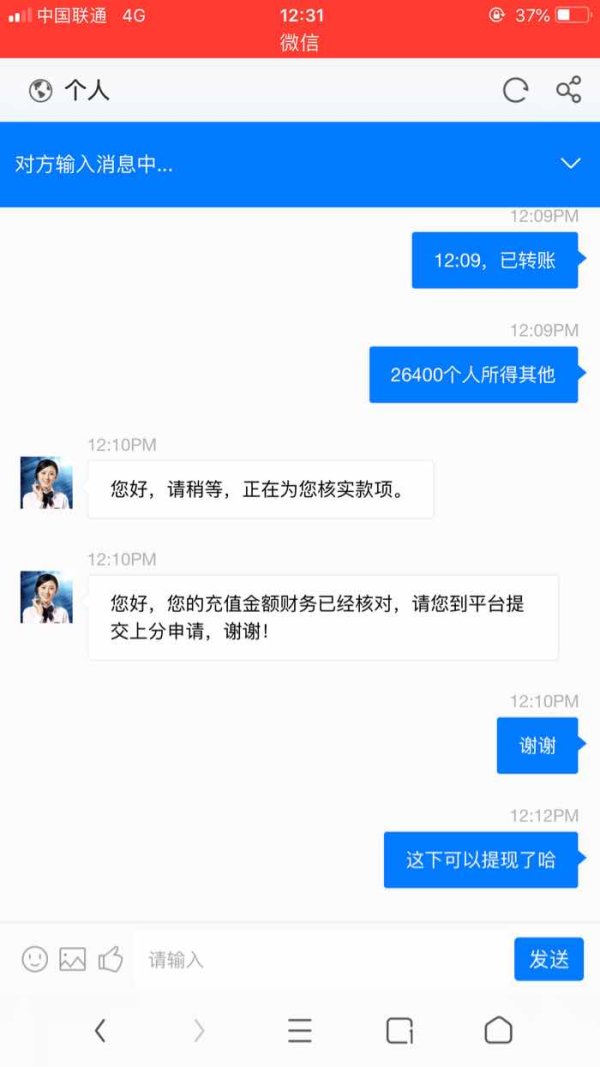

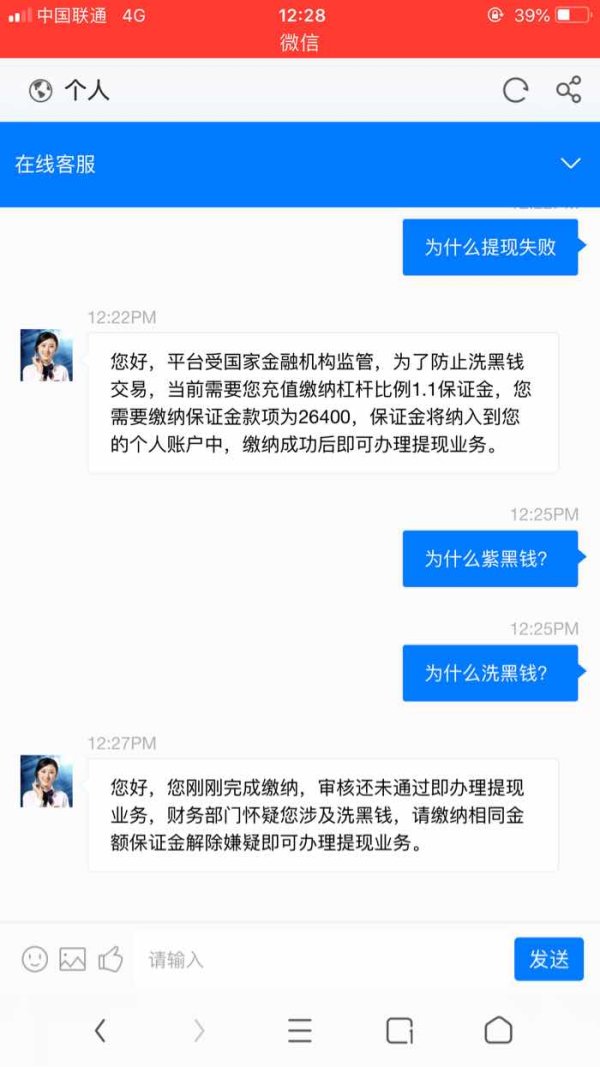

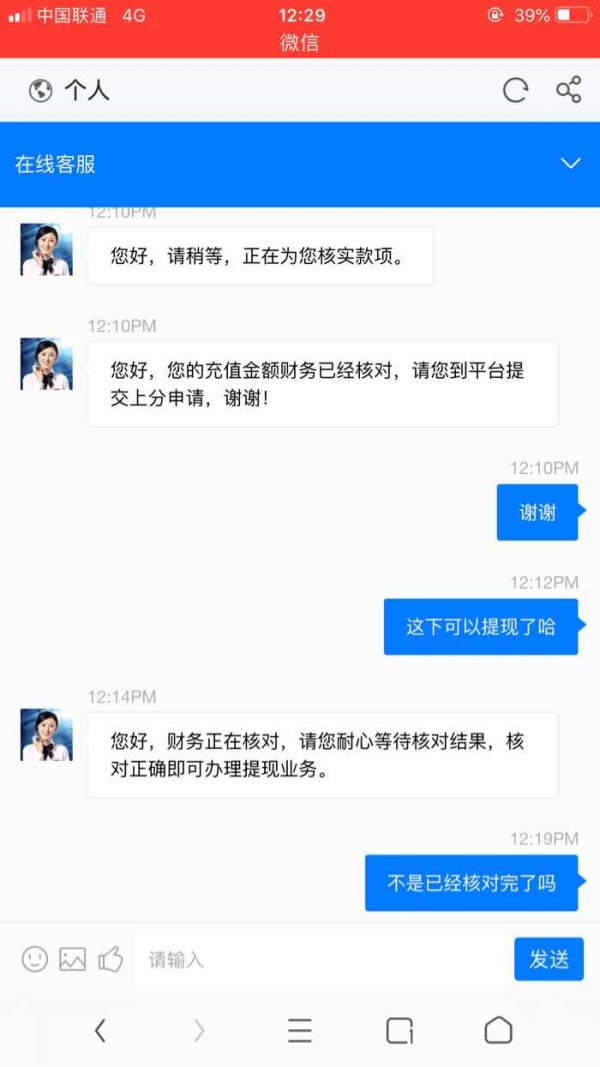

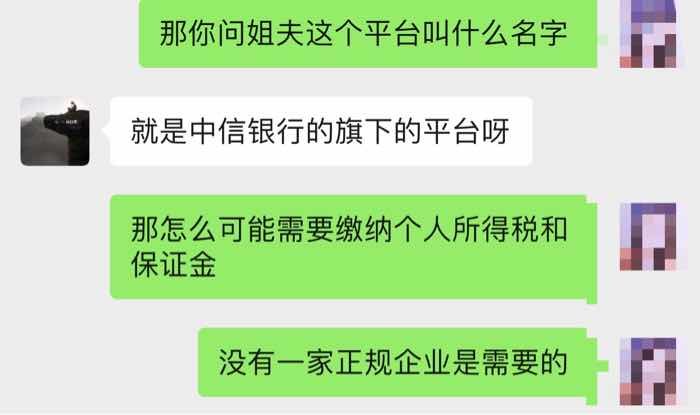

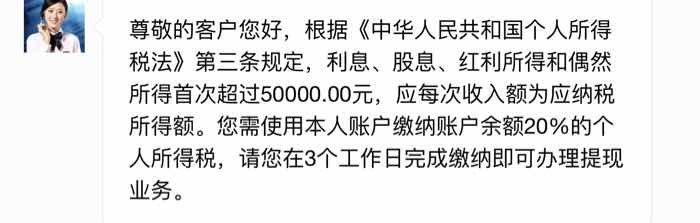

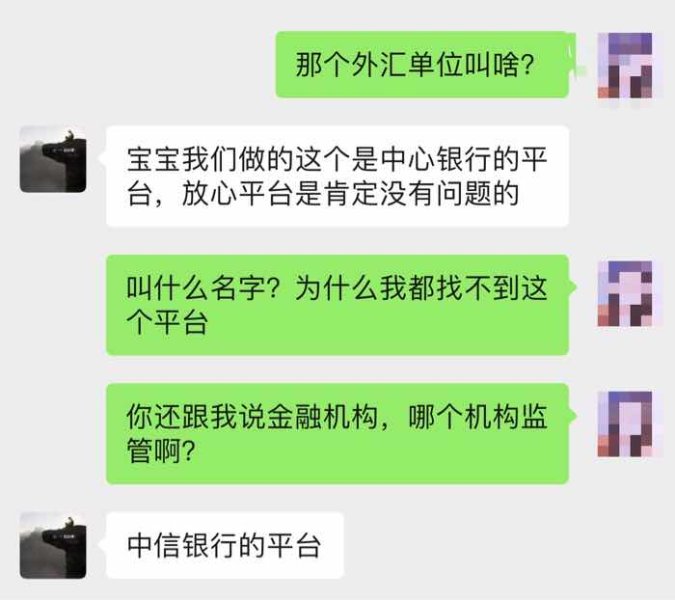

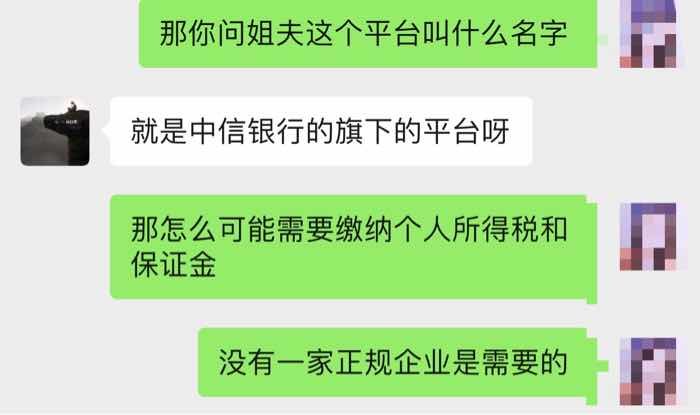

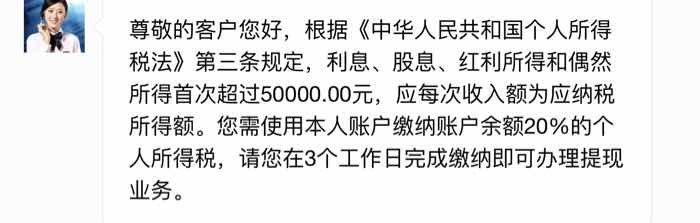

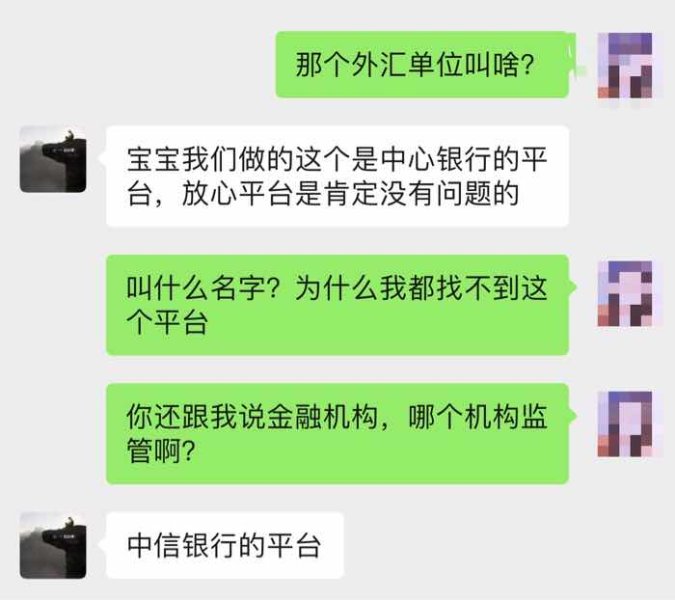

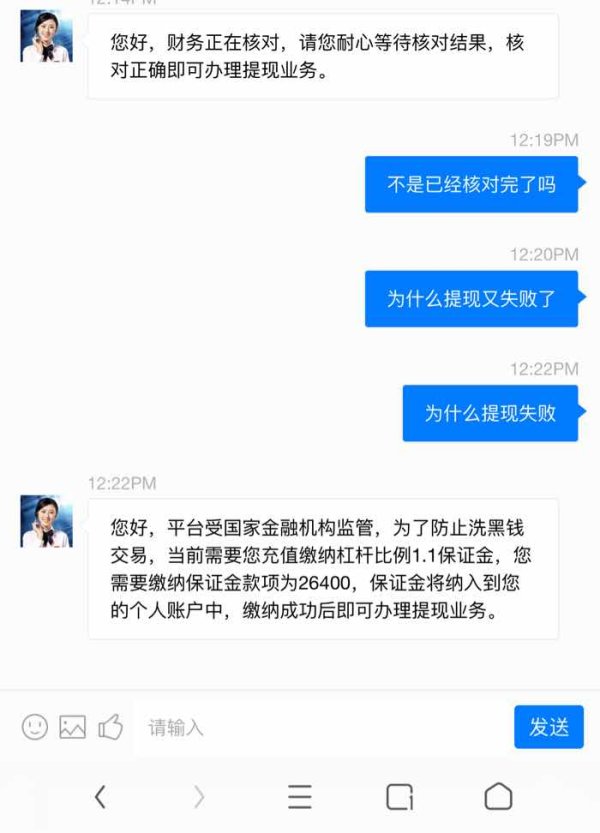

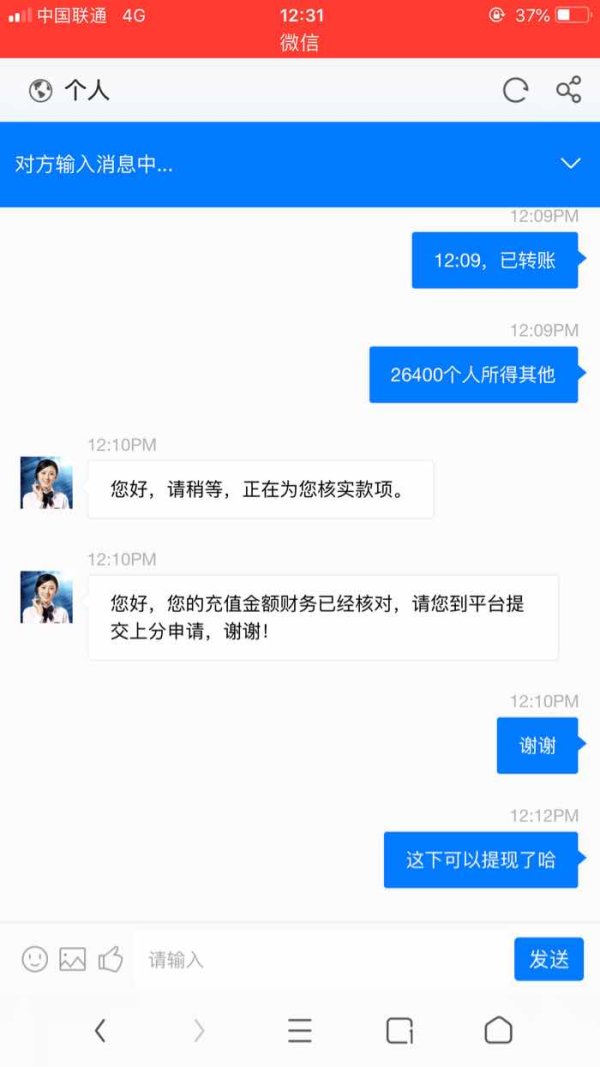

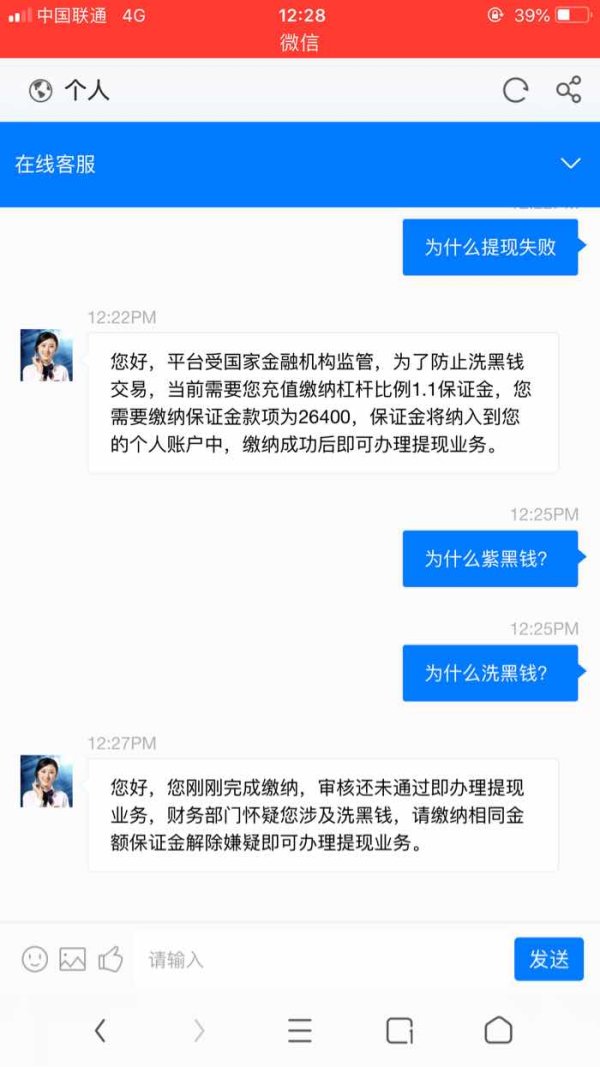

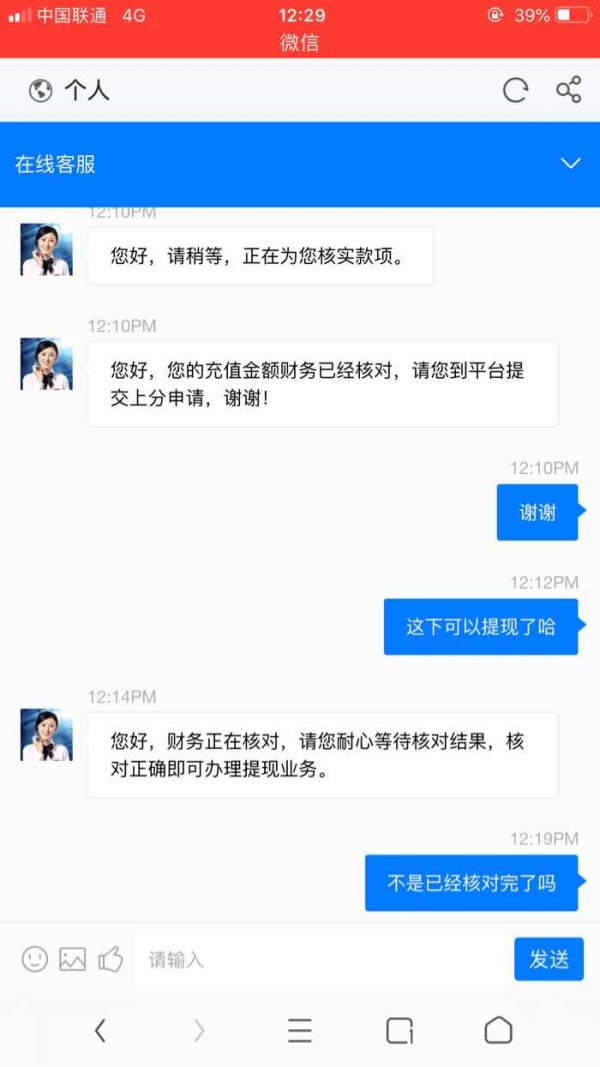

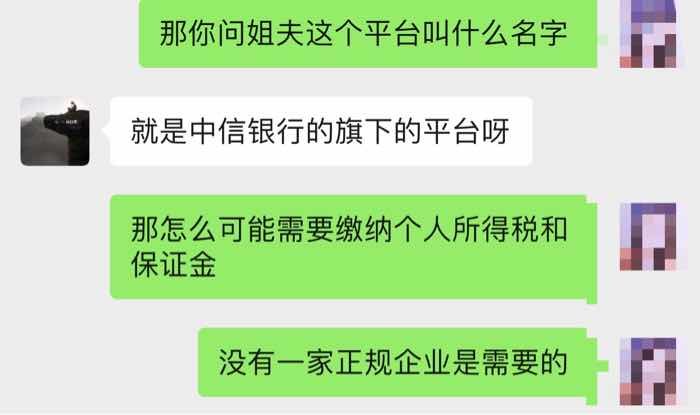

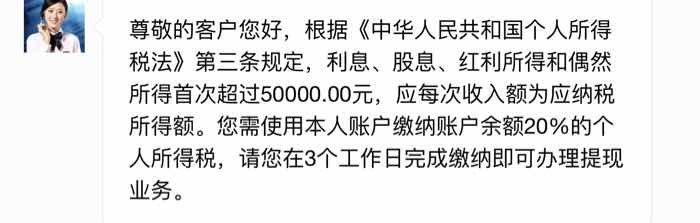

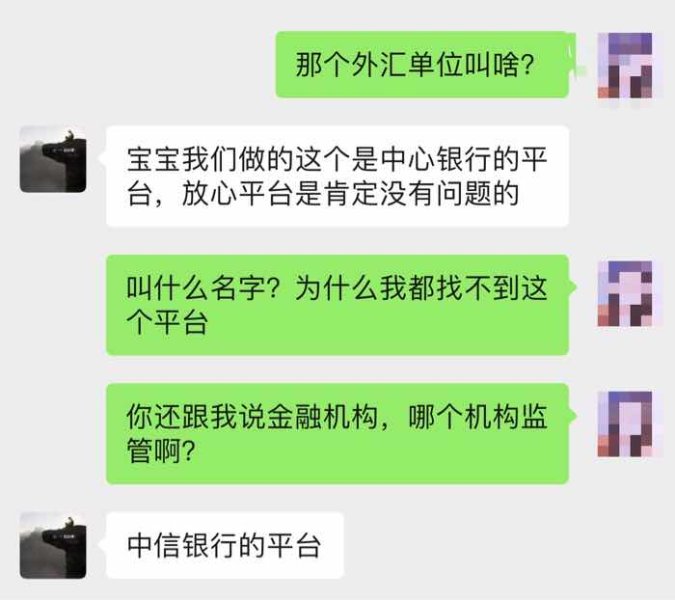

The customer service said that I should pay personal income tax to get my withdrawal. They said I should pay margin because I may launder money after I paid the tax. CNCBI, the fraud platform.

CNCBI Forex Broker provides real users with * positive reviews, * neutral reviews and 1 exposure review!

The customer service said that I should pay personal income tax to get my withdrawal. They said I should pay margin because I may launder money after I paid the tax. CNCBI, the fraud platform.

In the ever-evolving landscape of forex trading, Cncbi has emerged as a notable player, but opinions about its services are mixed. While some users appreciate its competitive trading conditions and range of assets, others express concerns regarding customer service and withdrawal processes. This review delves into user experiences, expert opinions, and crucial features of Cncbi to provide a comprehensive understanding of this broker.

Note: It's important to recognize that Cncbi operates across various jurisdictions, which may affect the services and regulatory compliance in different regions. Therefore, users are advised to conduct thorough research based on their location.

| Category | Rating (out of 10) |

|---|---|

| Account Conditions | 7 |

| Tools and Resources | 6 |

| Customer Service and Support | 5 |

| Trading Experience | 6 |

| Trustworthiness | 7 |

| User Experience | 6 |

How We Rate Brokers: Our ratings are based on user feedback, expert analysis, and key performance indicators relevant to forex trading.

Cncbi, established in the early 2000s, has positioned itself as a versatile broker catering to a diverse audience. It offers a range of trading platforms, including popular options like MT4 and MT5, which are favored for their user-friendly interfaces and robust analytical tools. Cncbi provides access to various asset classes, including forex, commodities, and cryptocurrencies, appealing to a wide range of traders.

The broker is regulated by multiple authorities, ensuring a level of trust and security for its users. However, the specific regulatory bodies may vary depending on the region, which is a critical factor for potential clients.

Regulated Geographies/Regions: Cncbi operates under several regulatory frameworks, including those from the UK‘s FCA and Australia’s ASIC. This multi-jurisdictional approach adds a layer of credibility but may also lead to inconsistencies in service quality across regions.

Deposit/Withdrawal Currencies/Cryptocurrencies: Users can typically deposit and withdraw in major currencies such as USD, EUR, and GBP. Additionally, Cncbi has begun to support certain cryptocurrencies, making it appealing for crypto traders.

Minimum Deposit: The minimum deposit requirement is generally competitive, starting around $100, which is accessible for most retail traders. However, this can vary based on the account type selected.

Bonuses/Promotions: Cncbi occasionally offers promotional bonuses to attract new clients. However, users should read the terms carefully, as these bonuses often come with specific trading volume requirements.

Tradable Asset Classes: Cncbi provides a diverse range of assets, including over 50 currency pairs, various commodities, and a selection of cryptocurrencies. This diversity allows traders to build a well-rounded portfolio.

Costs (Spreads, Fees, Commissions): The cost structure is competitive, with spreads starting as low as 1 pip on major pairs. However, some users have reported hidden fees, particularly regarding withdrawals, which could affect overall trading costs.

Leverage: Cncbi offers leverage up to 1:500, which can significantly amplify potential returns but also increases risk. Traders are advised to use leverage cautiously and be aware of the associated risks.

Allowed Trading Platforms: In addition to MT4 and MT5, Cncbi offers a proprietary trading platform, providing flexibility for users who prefer different trading environments.

Restricted Regions: While Cncbi operates globally, some regions may face restrictions due to regulatory compliance. Users should verify their eligibility before opening an account.

Customer Service Languages Available: Cncbi provides customer support in multiple languages, catering to its international clientele. However, user reviews suggest that response times can be slow, which is a common area of concern.

| Category | Rating (out of 10) |

|---|---|

| Account Conditions | 7 |

| Tools and Resources | 6 |

| Customer Service and Support | 5 |

| Trading Experience | 6 |

| Trustworthiness | 7 |

| User Experience | 6 |

Account Conditions: Users have noted that Cncbi provides a reasonable account setup process with various account types tailored to different trading styles. However, there have been complaints regarding the clarity of terms associated with bonuses and promotions.

Tools and Resources: The broker offers a decent array of trading tools, including market analysis, economic calendars, and educational resources. However, some users feel that these tools could be more extensive and user-friendly.

Customer Service and Support: Customer service is a critical area where Cncbi has received mixed reviews. While some users report satisfactory experiences, others have highlighted delays in response times and difficulties in resolving issues, which can be frustrating for traders needing immediate assistance.

Trading Experience: The trading experience on Cncbis platforms has been generally positive, with users appreciating the intuitive design and functionality. However, there are reports of occasional technical glitches that can disrupt trading.

Trustworthiness: Cncbi's regulatory status contributes positively to its trustworthiness. Nonetheless, potential clients should be aware of varying experiences based on their geographical location, which could affect their overall perception of the broker.

User Experience: Overall, user experiences with Cncbi vary widely. While many traders appreciate the competitive spreads and diverse asset offerings, concerns about customer service and withdrawal processes are recurring themes in user feedback.

In conclusion, while Cncbi presents a compelling option for forex traders, potential clients should weigh the pros and cons carefully. The Cncbi review indicates that while the broker has strengths in trading conditions and asset variety, areas such as customer service and withdrawal processes require improvement. As always, thorough research and consideration of personal trading needs are essential before making a decision.

FX Broker Capital Trading Markets Review