AceFxPro 2025 Review: Everything You Need to Know

Summary: AceFxPro, established in 2015, has garnered mixed reviews from users and experts alike. While it offers a wide range of trading instruments and a user-friendly platform, concerns regarding its unregulated status and withdrawal issues have raised red flags among potential investors.

Note: It is important to recognize that AceFxPro operates under various regional entities, which may affect its credibility and regulatory oversight. This review aims to provide a fair and accurate assessment based on multiple sources.

Ratings Overview

We evaluate brokers based on extensive research and user feedback to ensure a comprehensive understanding of their services.

Broker Overview

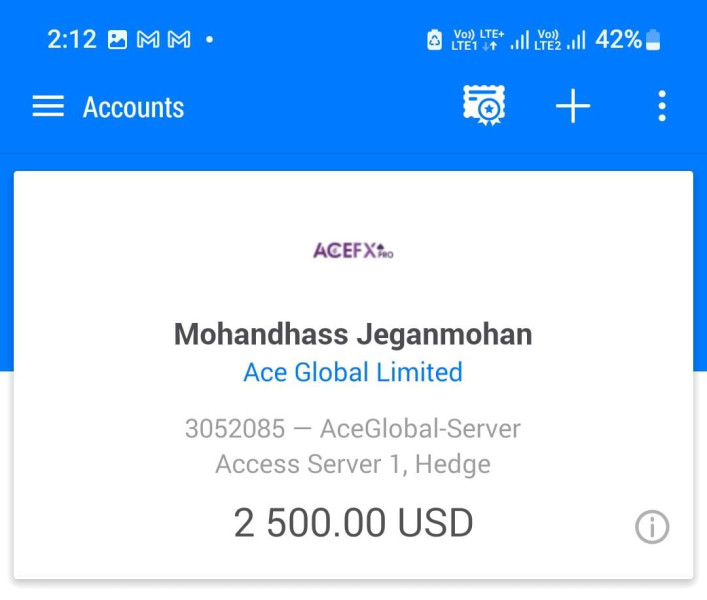

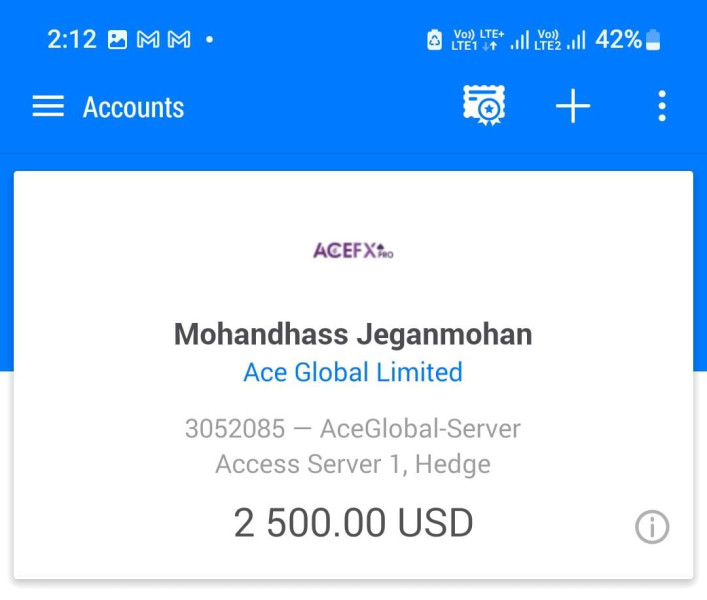

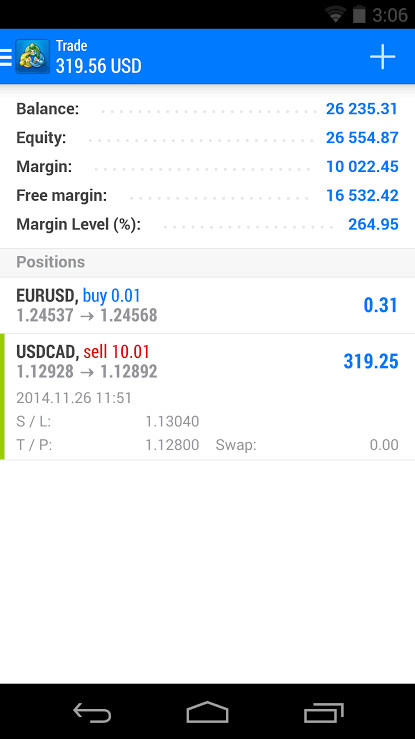

AceFxPro, operated by Ace Global Limited, is a forex and CFD broker established in 2015. The broker primarily utilizes the MetaTrader 5 (MT5) platform, which supports a range of trading strategies and offers advanced analytical tools. AceFxPro provides access to various asset classes, including forex pairs, cryptocurrencies, commodities, and indices. However, it is important to note that the broker is registered in Saint Vincent and the Grenadines and lacks regulation from recognized authorities, which poses significant risks for traders.

Detailed Section

Regulatory Region

AceFxPro is registered with the Financial Services Authority (FSA) of Saint Vincent and the Grenadines. However, this jurisdiction is known for its lack of stringent regulatory oversight, raising concerns about the safety of client funds and the broker's operational integrity.

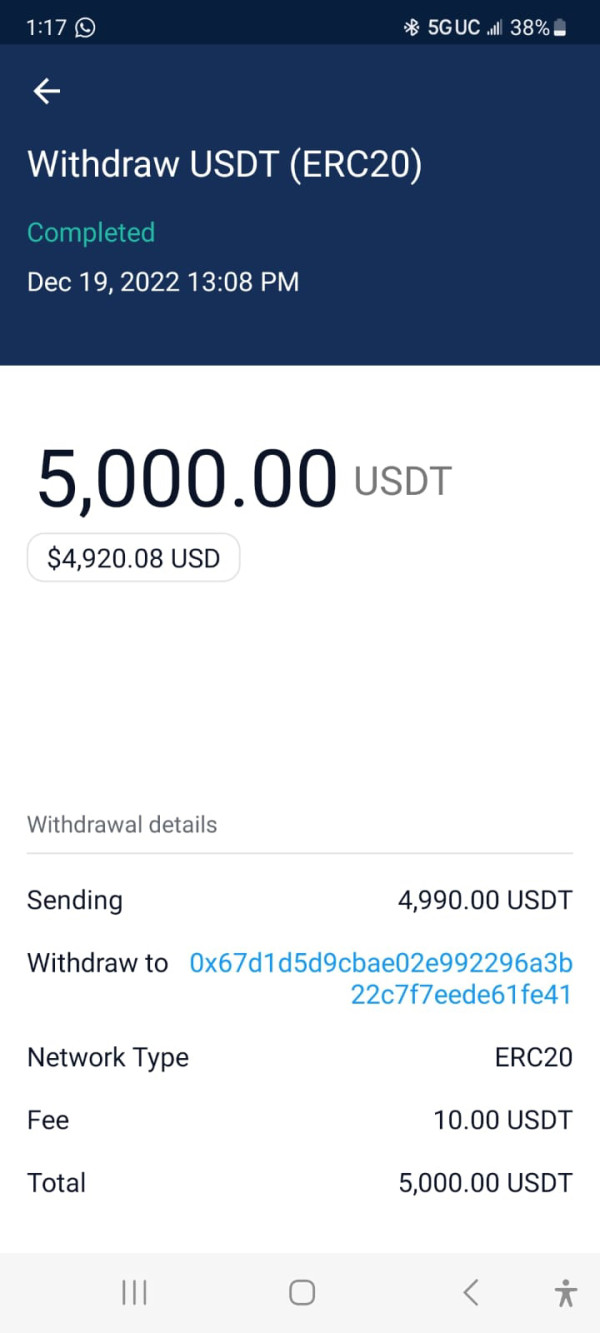

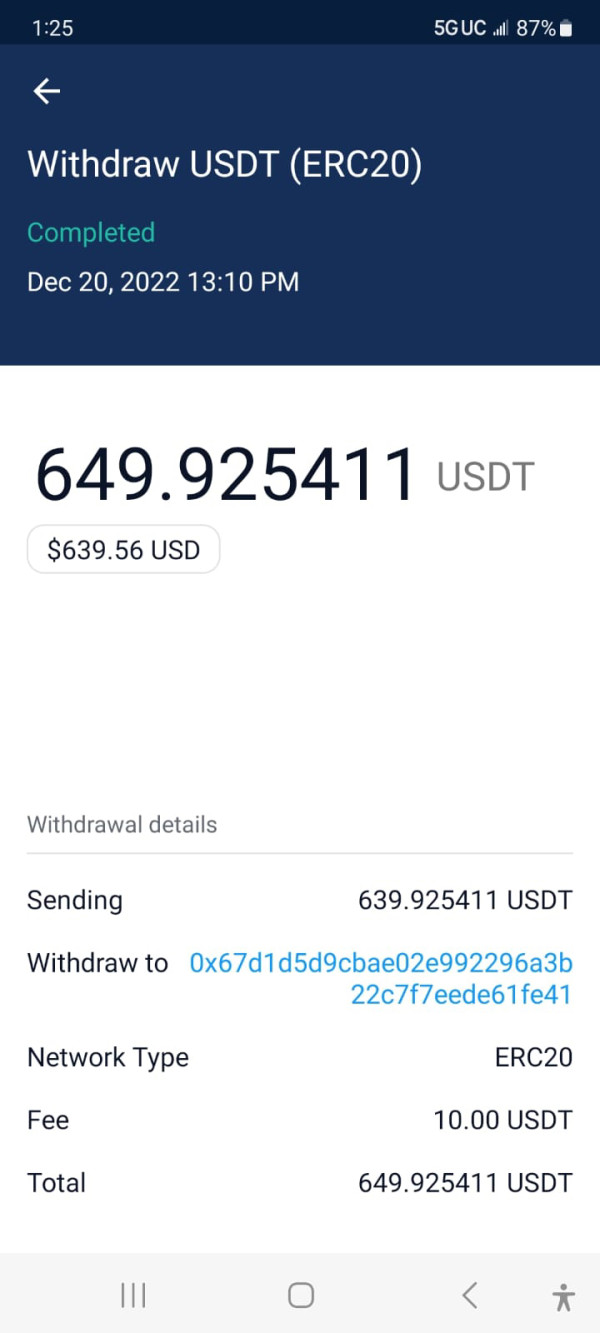

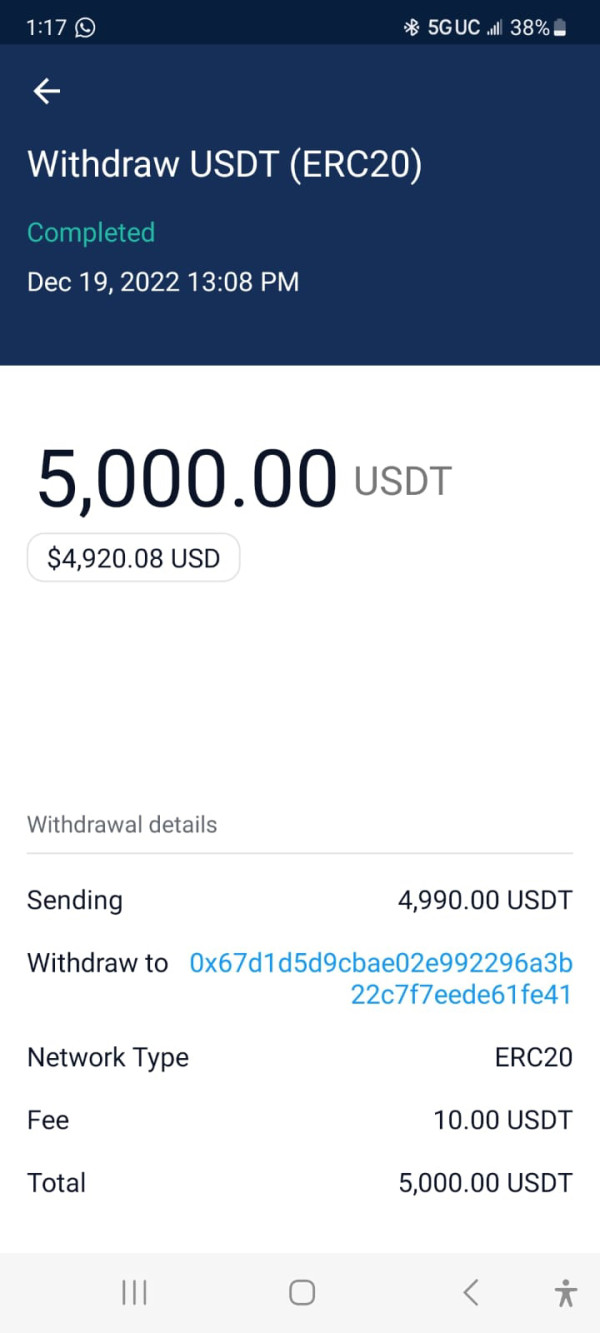

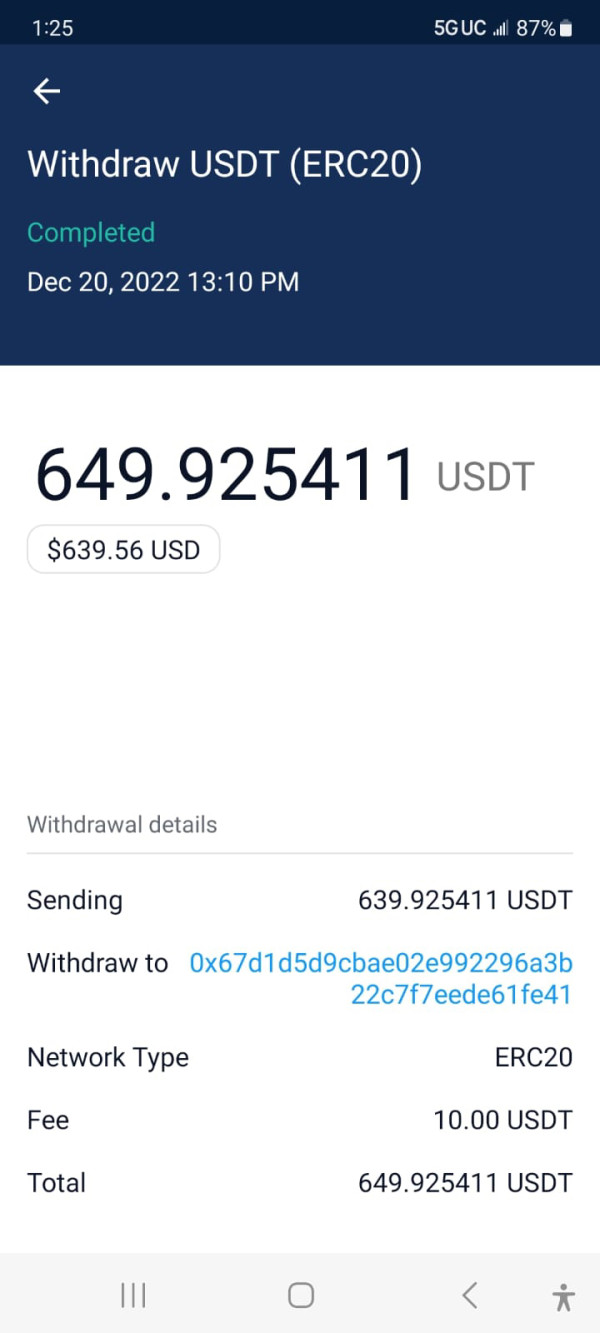

Deposit/Withdrawal Currencies and Cryptocurrencies

Deposits and withdrawals can be made using bank transfers, credit/debit cards, and cryptocurrencies. However, many users have reported issues with withdrawals, claiming delays and rejections without clear explanations.

Minimum Deposit

The minimum deposit required to open an account with AceFxPro is $200, which is relatively standard compared to other brokers. However, the absence of cent accounts may deter novice traders who prefer to start with smaller investments.

AceFxPro occasionally offers bonuses and promotional incentives, but the specifics of these promotions are often unclear and may come with hidden conditions that could complicate withdrawals.

Tradable Asset Classes

Traders can access a diverse range of instruments, including over 100 currency pairs, various cryptocurrencies (like Bitcoin and Ethereum), indices, precious metals, and commodities. This variety allows for portfolio diversification but may not be sufficient for traders seeking niche markets.

Costs (Spreads, Fees, Commissions)

Spreads at AceFxPro vary by account type, starting from 1.6 pips on standard accounts and going as low as 0.2 pips on ultimate accounts. There are no deposit or withdrawal fees, but trading fees of $7 per lot apply for pro and ultimate accounts. The overall cost structure is considered higher than average, particularly for standard accounts.

Leverage

AceFxPro offers leverage up to 1:500, which can be attractive for experienced traders looking to maximize their positions. However, such high leverage also increases the risk of significant losses, particularly for inexperienced traders.

The broker primarily supports the MetaTrader 5 platform, which is known for its advanced trading capabilities. There is no support for the older MetaTrader 4 platform, which may disappoint some users who prefer its features.

Restricted Regions

AceFxPro is not available in certain jurisdictions, including the EU, EEA, and the UK. This lack of availability is mainly due to its unregulated status, which makes it unsuitable for traders in those regions.

Available Customer Support Languages

Customer support is available in multiple languages, but users have reported inconsistent experiences with response times and the quality of support provided.

Ratings Recap

Detailed Breakdown

- Account Conditions (5.5/10): The minimum deposit is standard, but the lack of cent accounts limits accessibility for new traders.

- Tools and Resources (4.0/10): While the MT5 platform is robust, additional educational resources are lacking, particularly for beginners.

- Customer Service & Support (4.3/10): Mixed reviews highlight issues with response times and effectiveness of support, particularly during withdrawal requests.

- Trading Experience (5.0/10): Users report a generally satisfactory trading experience, though withdrawal issues can mar the overall satisfaction.

- Trustworthiness (3.0/10): The unregulated status of AceFxPro raises significant concerns about the safety of funds and overall reliability.

- User Experience (4.5/10): The platform is user-friendly, but negative experiences related to withdrawals can overshadow the positive aspects.

In conclusion, while AceFxPro presents a range of trading options and a modern platform, potential traders should exercise caution due to its unregulated status and concerning user feedback regarding withdrawals. It is advisable to consider alternative brokers with stronger regulatory oversight to ensure the safety of investments.