CFD Global 2025 Review: Everything You Need to Know

Executive Summary

CFD Global is a regulated forex and CFD trading platform. It has gained moderate market recognition since it started. The platform operates under the Cyprus Securities and Exchange Commission oversight. This broker positions itself as a good option for retail investors who want exposure to foreign exchange and contracts for difference trading. The platform's main strength is its use of the MetaTrader 4 trading platform. This gives traders familiar tools and functionality.

The broker serves retail investors who want diverse trading opportunities across multiple asset classes. These include forex pairs, precious metals, stocks, commodities, bonds, and indices. User feedback about CFD Global stays relatively neutral. This suggests a balanced trading experience without major standout features or big concerns. This cfd global review aims to provide complete insights into the broker's offerings. It helps potential clients make informed decisions about their trading platform selection.

CFD Global maintains regulatory compliance and offers a stable trading environment. However, some aspects of transparency need improvement to enhance overall client confidence and satisfaction.

Important Notice

CFD Global operates mainly under Cyprus jurisdiction through its CySEC regulation. Investors should understand the legal framework differences compared to other regional regulatory environments. The regulatory protections and investor compensation schemes available may vary significantly from those offered by brokers regulated in other jurisdictions such as the FCA, ASIC, or SEC.

This evaluation is based on comprehensive analysis of user feedback, company background information, and available trading conditions. The assessment aims to provide objective insights while acknowledging that individual trading experiences may vary based on specific requirements and market conditions.

Rating Framework

Broker Overview

CFD Global entered the financial services market in 2016. The company established itself as a Cyprus-based trading platform operated by Key Way Investments Ltd. The company has built its foundation on providing online forex and CFD trading services to retail investors seeking access to global financial markets. The broker's business model centers on offering direct market access through sophisticated trading technology while maintaining regulatory compliance within the European Union framework.

The platform distinguishes itself through its adoption of MetaTrader 4. This is one of the most widely recognized and trusted trading platforms in the industry. This choice reflects the company's commitment to providing traders with proven, reliable technology that supports both manual and automated trading strategies. CFD Global's asset coverage spans multiple categories, including 45 currency pairs, precious metals, individual stocks, various commodities, government bonds, and major market indices. The broker operates under the supervision of the Cyprus Securities and Exchange Commission. This provides a regulatory framework designed to protect investor interests and ensure fair trading practices. This cfd global review will examine how these foundational elements translate into practical trading advantages for end users.

Regulatory Environment: CFD Global operates under CySEC regulation. This provides European Union-standard investor protections. This regulatory framework includes segregated client funds, compensation scheme participation, and adherence to MiFID II requirements. It offers traders a degree of security and recourse.

Deposit and Withdrawal Methods: Specific information about available deposit and withdrawal options is not detailed in available documentation. This represents an area where greater transparency would benefit potential clients.

Minimum Deposit Requirements: The broker has not clearly disclosed minimum deposit thresholds in readily accessible materials. This may create uncertainty for prospective traders planning their initial investment.

Promotional Offerings: Current bonus and promotional programs are not specifically outlined in available resources. This suggests either limited promotional activity or insufficient marketing transparency.

Trading Assets: The platform provides access to 45 forex currency pairs alongside CFD trading opportunities in precious metals, individual stocks, commodities, bonds, and major indices. This offers reasonable diversification for retail traders.

Cost Structure: Detailed information about spreads, commissions, and other trading costs is not comprehensively available. This potentially indicates transparency issues that could affect trader decision-making processes.

Leverage Options: Specific leverage ratios and their application across different asset classes are not clearly documented in accessible materials.

Platform Technology: CFD Global utilizes MetaTrader 4. This provides traders with industry-standard charting tools, technical indicators, and automated trading capabilities through Expert Advisors.

Geographic Restrictions: Information about regional trading restrictions or prohibited jurisdictions is not clearly specified in available documentation.

Customer Support Languages: The range of languages supported by customer service teams is not detailed in accessible materials. This cfd global review notes this as an area requiring clarification for international clients.

Detailed Rating Analysis

Account Conditions Analysis

The evaluation of CFD Global's account conditions faces significant limitations due to insufficient publicly available information about account types, structures, and specific requirements. This lack of transparency represents a considerable concern for potential clients who require clear understanding of trading conditions before committing funds.

Without detailed information about different account tiers, minimum deposit requirements, or special account features such as Islamic accounts for Shariah-compliant trading, prospective clients cannot adequately assess whether the broker's offerings align with their specific needs. The absence of clearly documented account opening procedures also creates uncertainty about the onboarding process and required documentation.

Professional traders and institutional clients particularly require comprehensive information about account conditions to evaluate whether the broker can accommodate larger trading volumes, provide appropriate leverage, and offer suitable account management services. The current information gap in this area suggests that CFD Global may need to improve its transparency and client communication regarding account structures.

This cfd global review emphasizes that potential clients should directly contact the broker to obtain specific account condition details before making trading decisions. Publicly available information proves insufficient for thorough evaluation.

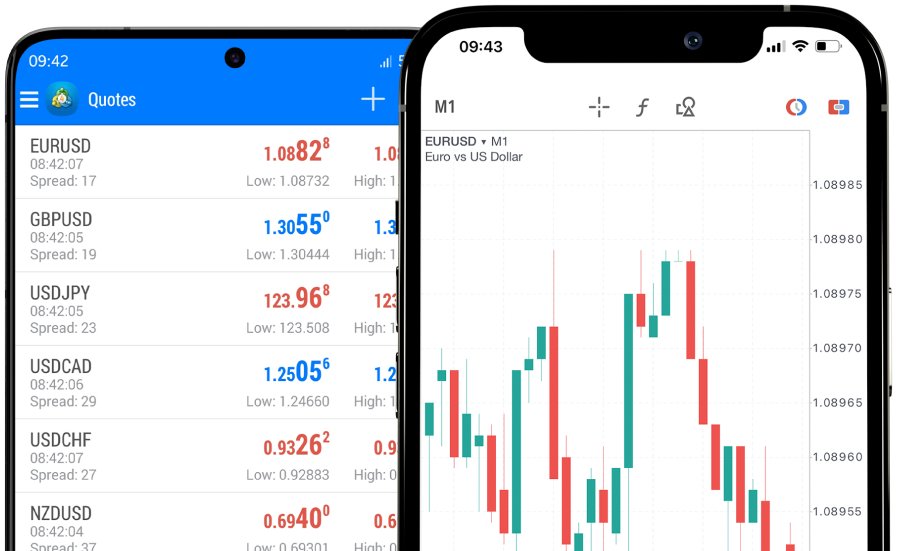

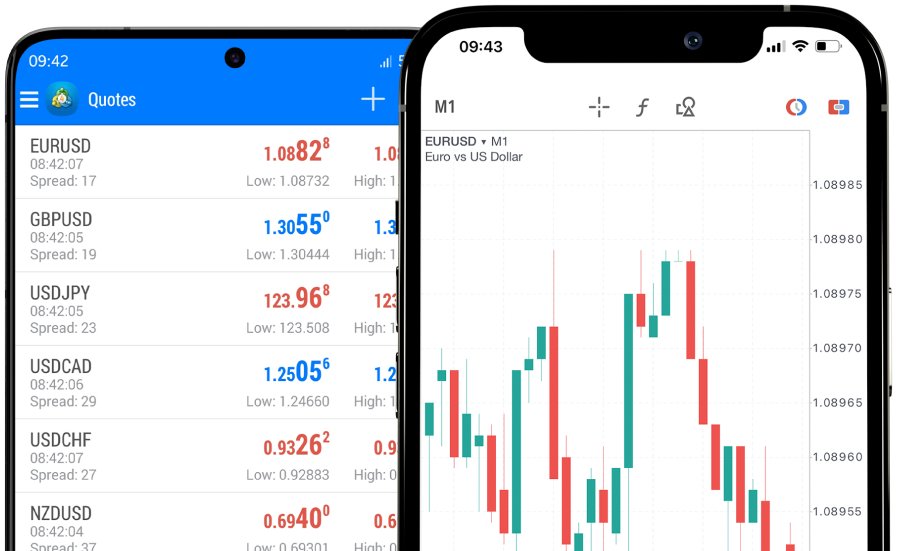

CFD Global's tool and resource offering centers on the MetaTrader 4 platform. This provides a solid foundation for technical analysis and trade execution. MT4's comprehensive charting capabilities, extensive technical indicator library, and support for automated trading through Expert Advisors represent significant advantages for traders seeking sophisticated analysis tools.

The platform's multi-asset support allows traders to diversify their portfolios across forex, metals, stocks, and other CFD instruments through a single interface. This integration streamlines portfolio management and provides opportunities for cross-market analysis and trading strategies.

However, the evaluation reveals gaps in available information about additional research resources, market analysis tools, and educational materials that could enhance the trading experience. Many competitive brokers provide proprietary research, daily market commentary, economic calendars, and educational webinars that support trader development and decision-making.

The absence of detailed information about mobile trading capabilities, web-based platform options, or additional analytical tools suggests either limited offerings in these areas or insufficient marketing of available resources. Advanced traders may find the tool set adequate for basic needs but potentially lacking in specialized research and analysis capabilities compared to more comprehensive broker offerings.

Customer Service and Support Analysis

The assessment of CFD Global's customer service capabilities is significantly hampered by limited available information about support channels, response times, and service quality metrics. This information gap represents a critical concern, as reliable customer support is essential for addressing trading issues, technical problems, and account-related inquiries.

Without clear documentation of available support channels such as live chat, telephone support, email assistance, or help desk systems, potential clients cannot evaluate the accessibility and convenience of customer service options. The absence of information about support availability hours, multilingual capabilities, and response time commitments creates uncertainty about service reliability.

Effective customer support becomes particularly crucial during market volatility when traders may need immediate assistance with platform issues or urgent account matters. The lack of transparent information about support quality and availability may indicate either underdeveloped customer service infrastructure or insufficient communication about existing capabilities.

Professional traders and active clients typically require prompt, knowledgeable support to address technical issues and account management needs. The current information limitations suggest that prospective clients should specifically inquire about customer service capabilities and test response times before committing to the platform for their trading activities.

Trading Experience Analysis

User feedback indicates that CFD Global provides a relatively stable trading environment with consistent platform performance. The MetaTrader 4 implementation appears to function reliably, offering traders access to standard charting tools, technical indicators, and order management capabilities without significant technical disruptions.

The platform's execution quality appears satisfactory based on available user reports, though specific data about slippage rates, requote frequency, and order rejection statistics are not comprehensively documented. The stability of spreads has received positive mentions in user feedback, suggesting reasonable pricing consistency during normal market conditions.

Mobile trading capabilities and overall platform responsiveness contribute to a functional trading experience, though detailed performance metrics and comparative analysis against industry benchmarks are not readily available. The absence of advanced features such as one-click trading, advanced order types, or sophisticated risk management tools may limit appeal for more demanding traders.

The trading environment appears suitable for standard retail trading activities, though institutional clients or high-frequency traders may find the offering less comprehensive compared to specialized platforms. This cfd global review notes that while the basic trading experience meets standard expectations, advanced traders may require additional platform features for optimal performance.

Trustworthiness Analysis

CFD Global's regulatory status under CySEC provides a foundation of trustworthiness through European Union regulatory standards and investor protection mechanisms. CySEC regulation includes requirements for segregated client funds, participation in investor compensation schemes, and adherence to strict operational standards designed to protect client interests.

However, the evaluation reveals concerning transparency gaps that may affect overall trustworthiness perception. The limited availability of detailed information about company operations, trading conditions, and fee structures suggests insufficient disclosure practices that could undermine client confidence.

The absence of readily available information about fund security measures, beyond basic regulatory requirements, represents an area where enhanced transparency would strengthen trustworthiness. Many competitive brokers provide detailed explanations of client fund protection, insurance coverage, and operational security measures that reassure clients about asset safety.

The company's relatively recent establishment in 2016 means it lacks the long-term track record that builds confidence through demonstrated stability and crisis management. While regulatory compliance provides important protections, the overall trustworthiness assessment is limited by transparency concerns and insufficient detailed disclosure about operational practices and risk management procedures.

User Experience Analysis

Available user feedback suggests that CFD Global provides a neutral to moderately positive user experience. Most clients report functional platform performance without exceptional standout features. The overall user satisfaction appears centered on basic platform reliability rather than innovative features or superior service quality.

The user onboarding experience, including registration and account verification processes, lacks detailed documentation that would allow comprehensive evaluation. This information gap may indicate either streamlined processes that require minimal explanation or insufficient communication about account setup procedures.

Trading interface design and usability appear adequate based on the MetaTrader 4 standard, though customization options and platform enhancements specific to CFD Global are not clearly documented. The absence of detailed information about deposit and withdrawal experiences, including processing times and fee structures, limits the ability to assess overall transaction convenience.

User demographic analysis suggests the platform primarily serves retail investors seeking basic forex and CFD trading capabilities rather than sophisticated traders requiring advanced features. The neutral feedback pattern indicates that while the platform meets basic functional requirements, it may lack distinctive features that create exceptional user satisfaction or strong client loyalty compared to more innovative competitors.

Conclusion

CFD Global presents itself as a regulated forex and CFD trading platform that meets basic industry standards while maintaining CySEC compliance. The broker's strength lies in its regulatory foundation and the reliability of the MetaTrader 4 platform, which provides traders with proven technology and multi-asset trading capabilities.

However, significant transparency concerns limit the platform's appeal, particularly regarding account conditions, fee structures, and detailed service offerings. The lack of comprehensive information about customer support, educational resources, and additional trading tools suggests either limited capabilities in these areas or insufficient marketing communication.

The platform appears most suitable for retail investors seeking straightforward forex and CFD trading with basic regulatory protections, rather than sophisticated traders requiring advanced features or institutional-grade services. Potential clients should conduct direct inquiries to obtain specific information about trading conditions and services before making platform commitments. Publicly available information proves insufficient for thorough evaluation.