Capital Futures 2025 Review: Everything You Need to Know

In this comprehensive review of Capital Futures, we explore the strengths and weaknesses of this brokerage, highlighting user experiences and expert opinions. Overall, Capital Futures has garnered a mixed reputation, with some users praising its trading platforms and asset offerings, while others have raised concerns about withdrawal issues and customer service.

Note: It is important to consider that Capital Futures operates through different entities in various regions, which may affect user experiences and regulatory oversight. Therefore, conducting thorough research is essential for potential users.

Ratings Overview

We score brokers based on user feedback, regulatory compliance, and overall market reputation.

Broker Overview

Founded in 1996, Capital Futures is a trading platform based in China, primarily focused on futures and commodities trading. The brokerage is regulated by the China Financial Futures Exchange (CFFEX), which adds a layer of legitimacy to its operations. However, it lacks coverage from major international regulators, which may raise concerns for some traders.

Capital Futures does not support popular trading platforms like MetaTrader 4 or 5, opting instead for its proprietary systems. The brokerage offers access to a range of financial instruments, including forex, commodities, and contracts for difference (CFDs).

Detailed Analysis

Regulated Geographical Areas

Capital Futures is primarily regulated in China under the CFFEX. This regional focus may limit its appeal to international traders who prefer brokers with broader regulatory coverage. The absence of licenses from top-tier regulators like the FCA or ASIC raises questions about the broker's reliability in the global market.

Deposit/Withdrawal Currencies/Cryptocurrencies

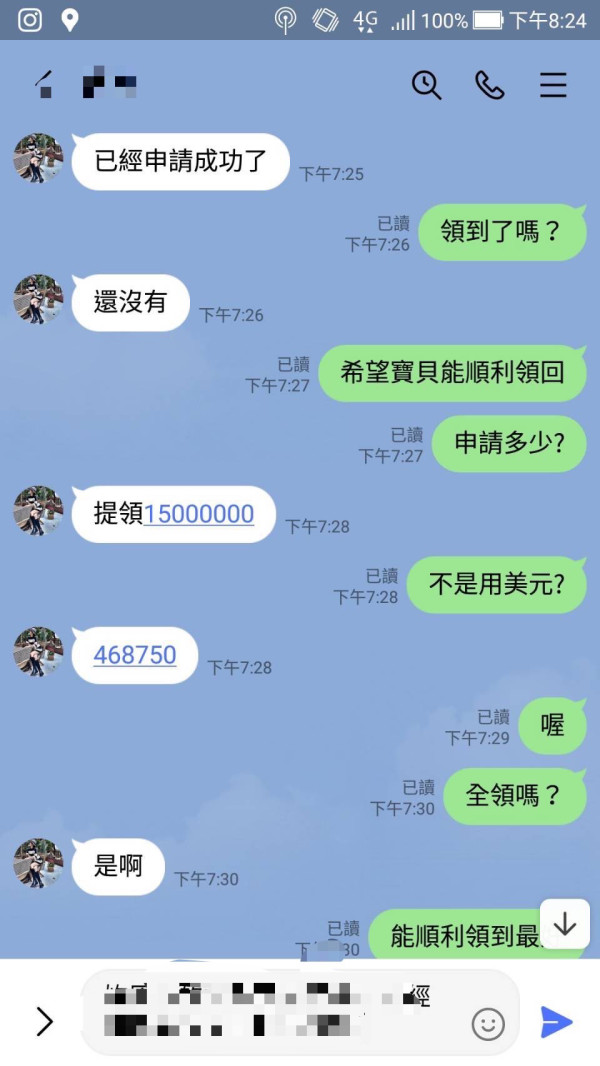

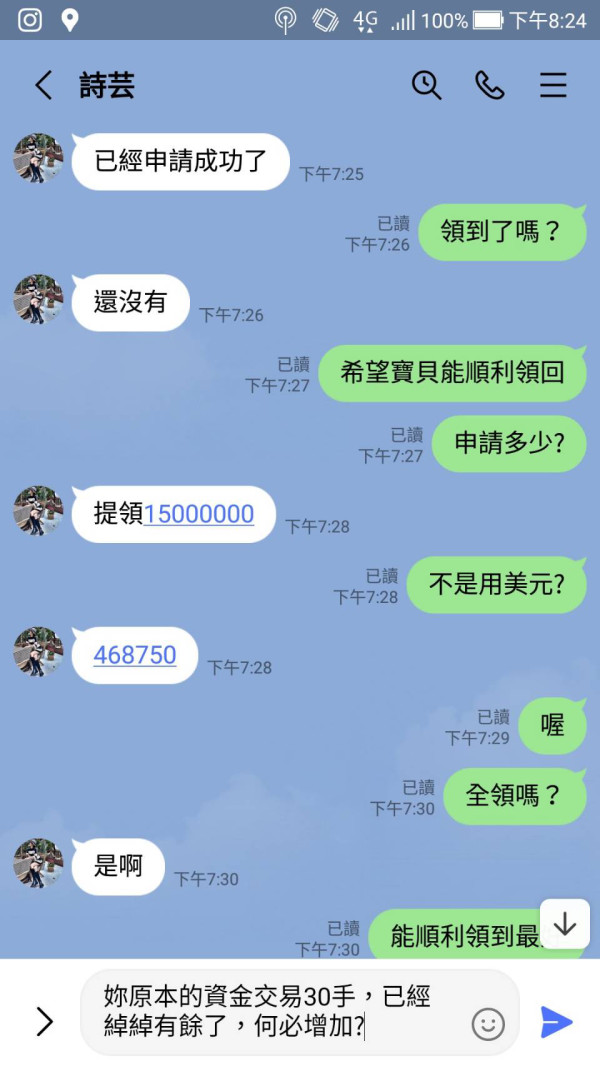

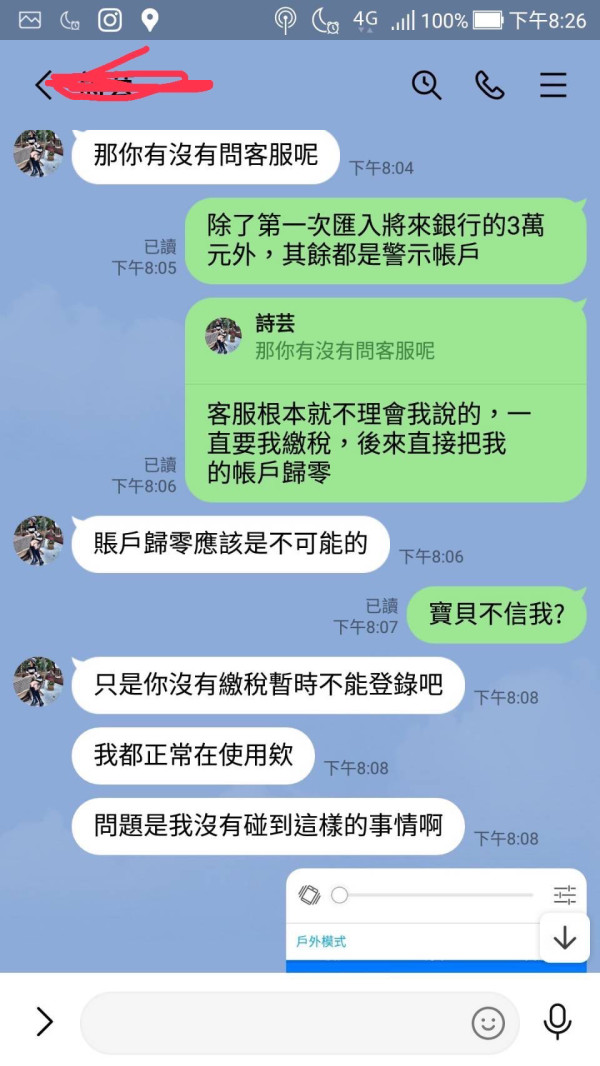

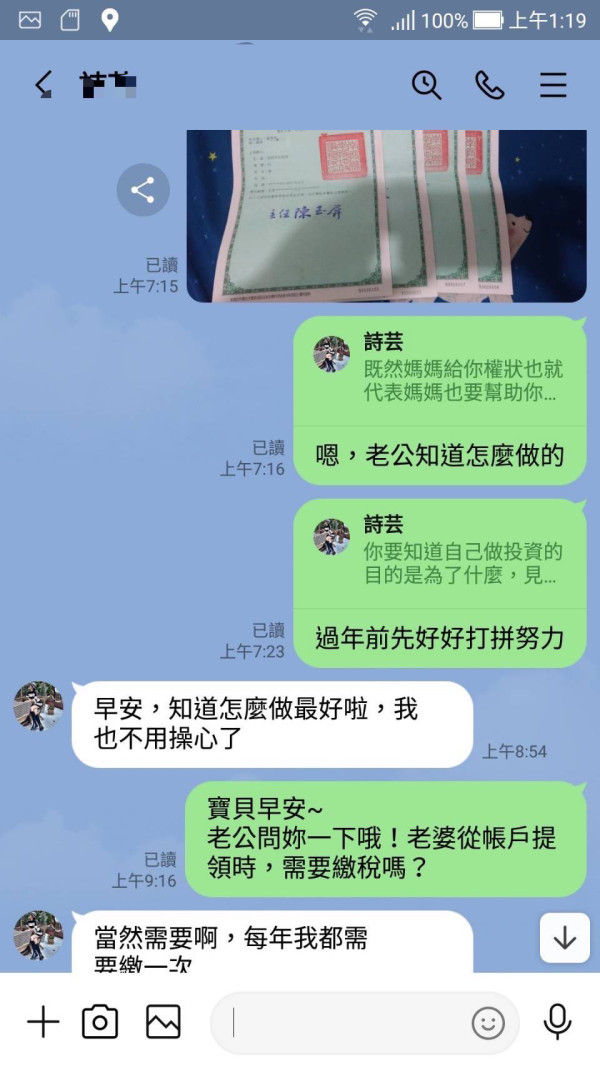

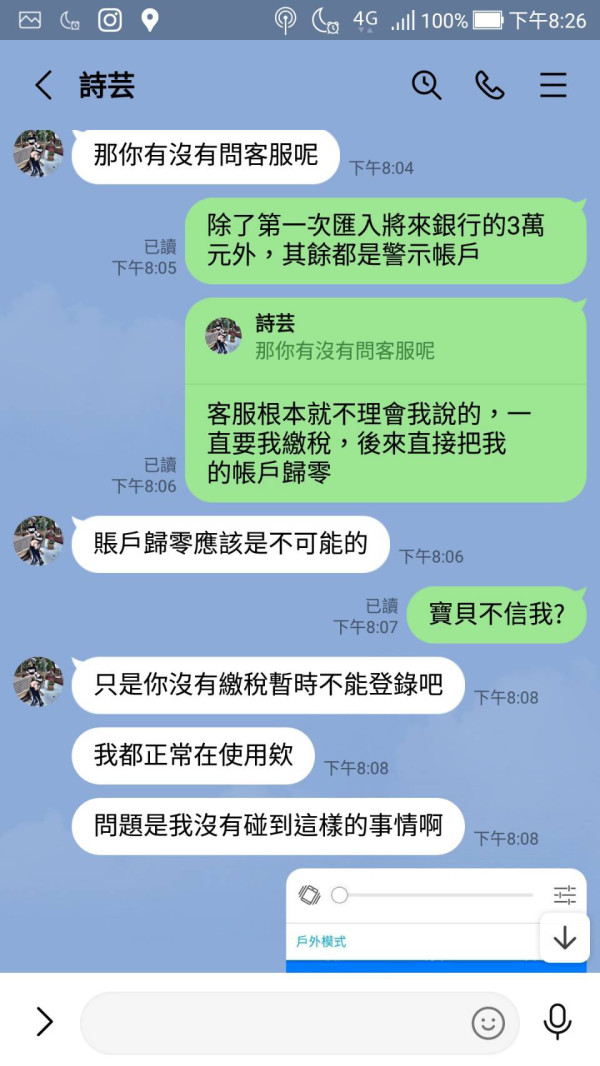

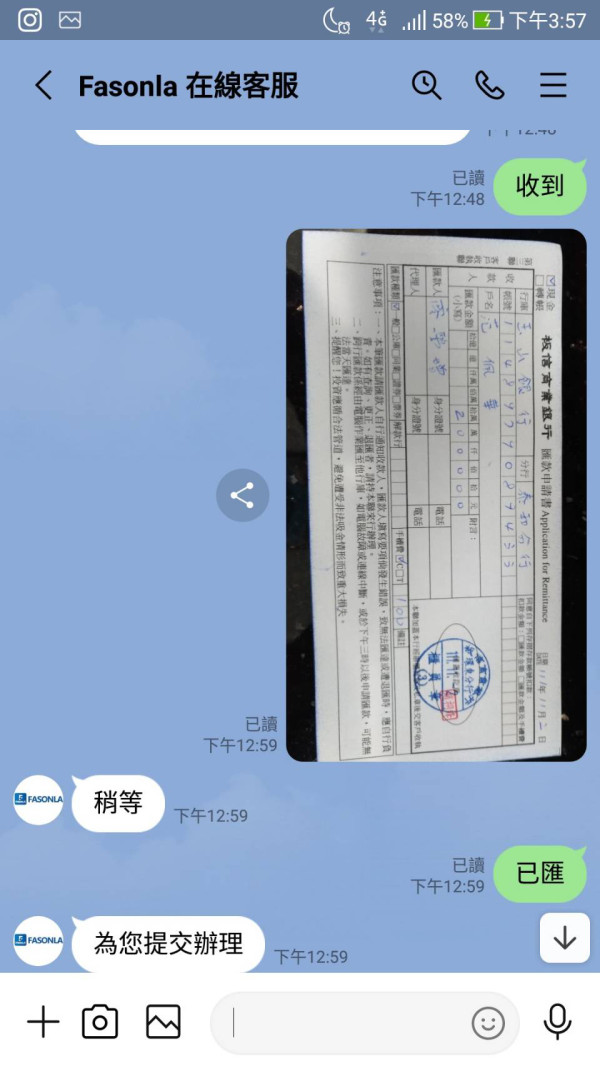

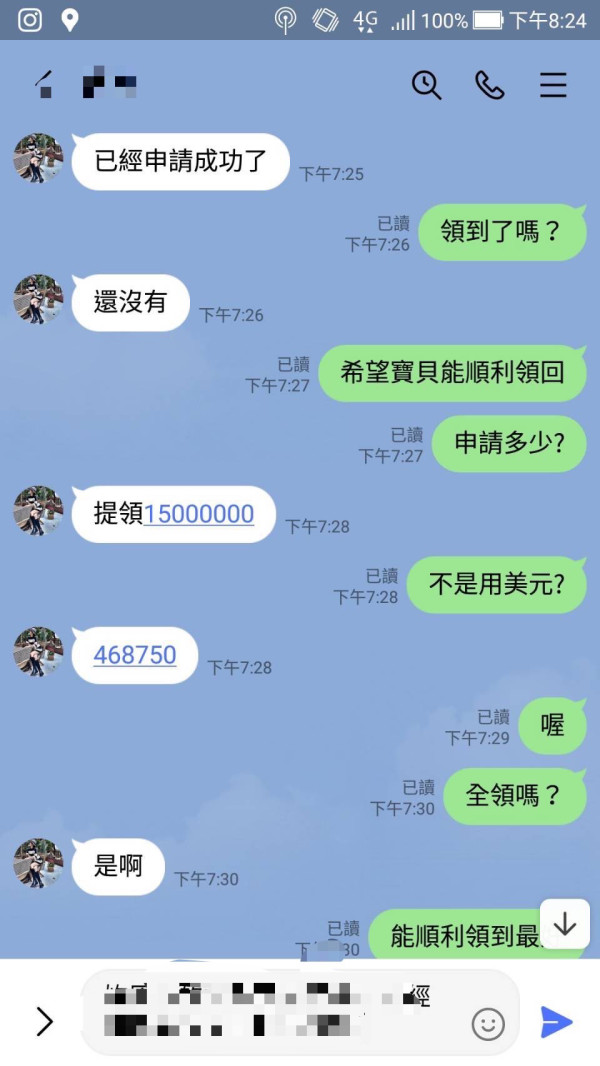

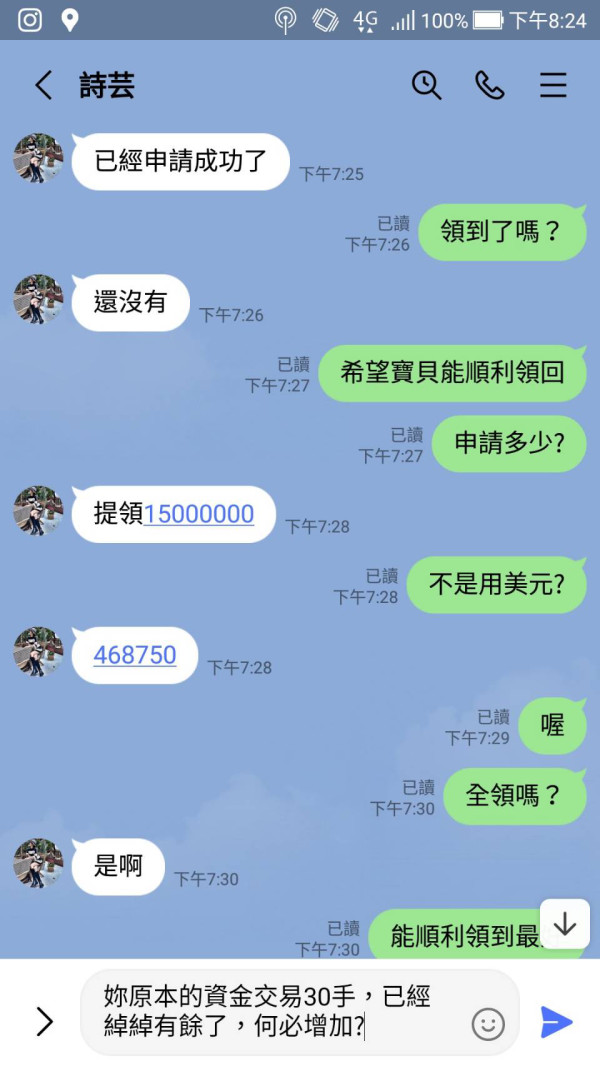

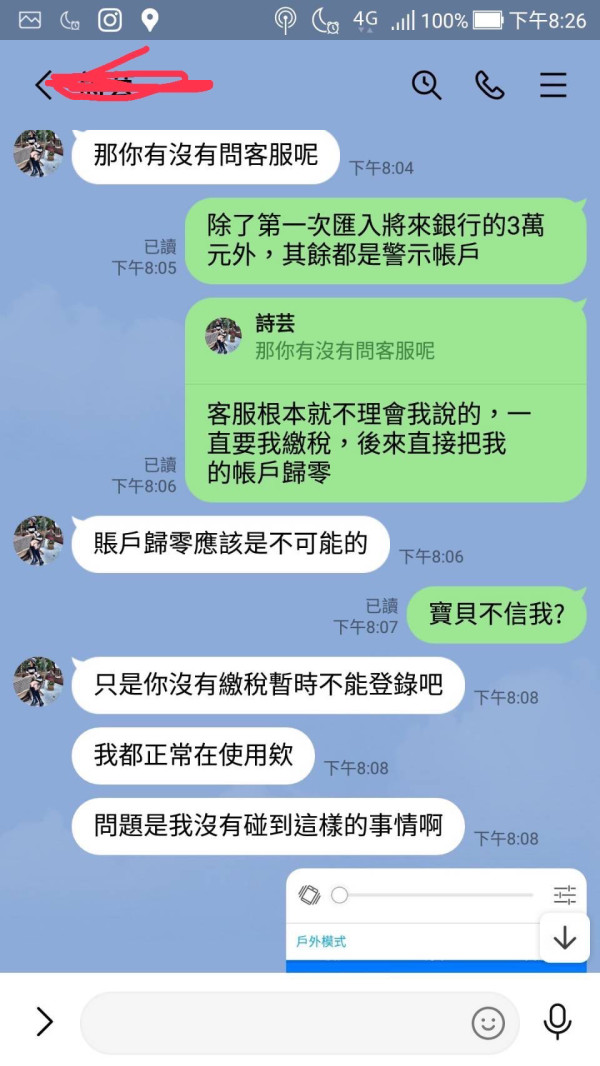

The platform supports deposits and withdrawals in major currencies; however, it does not explicitly mention any support for cryptocurrencies. Users have reported issues with fund withdrawals, which is a significant concern highlighted in several reviews. According to a report from WikiBit, some users have faced difficulties in accessing their funds, leading to claims of fraudulent practices.

Minimum Deposit

The minimum deposit requirement for opening an account with Capital Futures is reportedly competitive, although specific figures were not consistently mentioned across sources. This makes it accessible for new traders looking to enter the market without a substantial initial investment.

Capital Futures does not appear to offer any bonuses or promotions, a standard practice among many regulated brokers aiming to comply with regulatory guidelines that discourage such incentives.

Tradable Asset Classes

Capital Futures provides a diverse range of trading options, including forex, commodities, and CFDs. However, the absence of widely used trading platforms like MT4 or MT5 may limit the trading experience for many users who prefer these tools for their advanced features.

Costs (Spreads, Fees, Commissions)

The cost structure at Capital Futures includes spreads that are described as average compared to industry standards. However, specific figures regarding spreads were not consistently available. Users should be aware of potential hidden fees, particularly concerning withdrawal processes, as highlighted by various user reviews.

Leverage

The leverage offered by Capital Futures is unspecified in the reviewed sources, which may be a point of concern for traders looking for high-leverage options. The lack of clarity around this aspect could deter potential clients who prioritize leverage in their trading strategies.

Capital Futures does not support MetaTrader 4 or 5, which are popular among traders for their advanced analytical tools and automated trading capabilities. Instead, it offers its proprietary trading platform, which may not meet the expectations of all users.

Restricted Regions

Capital Futures primarily operates within the Chinese market. As a result, traders from other regions may face restrictions, limiting the broker's international appeal.

Available Customer Service Languages

The primary language of customer support appears to be Chinese, which may pose challenges for non-Chinese speaking users. The overall quality of customer service has been criticized, with reports of slow response times and unhelpful support, as noted in various reviews.

Final Ratings Overview

Detailed Breakdown

- Account Conditions: The minimum deposit is competitive, but the lack of clear leverage options may deter some traders.

- Tools and Resources: The absence of MT4/MT5 limits access to advanced tools, which may affect trading strategies.

- Customer Service & Support: Users report slow response times and issues with fund withdrawals, raising concerns about reliability.

- Trading Experience: While the platform offers a variety of instruments, the trading experience may be hindered by the proprietary platform's limitations.

- Trustworthiness: Regulated by CFFEX, but lacking broader international oversight raises questions about its reliability.

- User Experience: Mixed reviews regarding user experience, with some praising the platform while others highlight withdrawal issues.

In conclusion, while Capital Futures offers a range of trading options and is regulated by a local authority, potential users should exercise caution due to reported withdrawal issues and the lack of support for popular trading platforms. Comprehensive research and due diligence are essential before engaging with this brokerage.