BESSEME Review 6

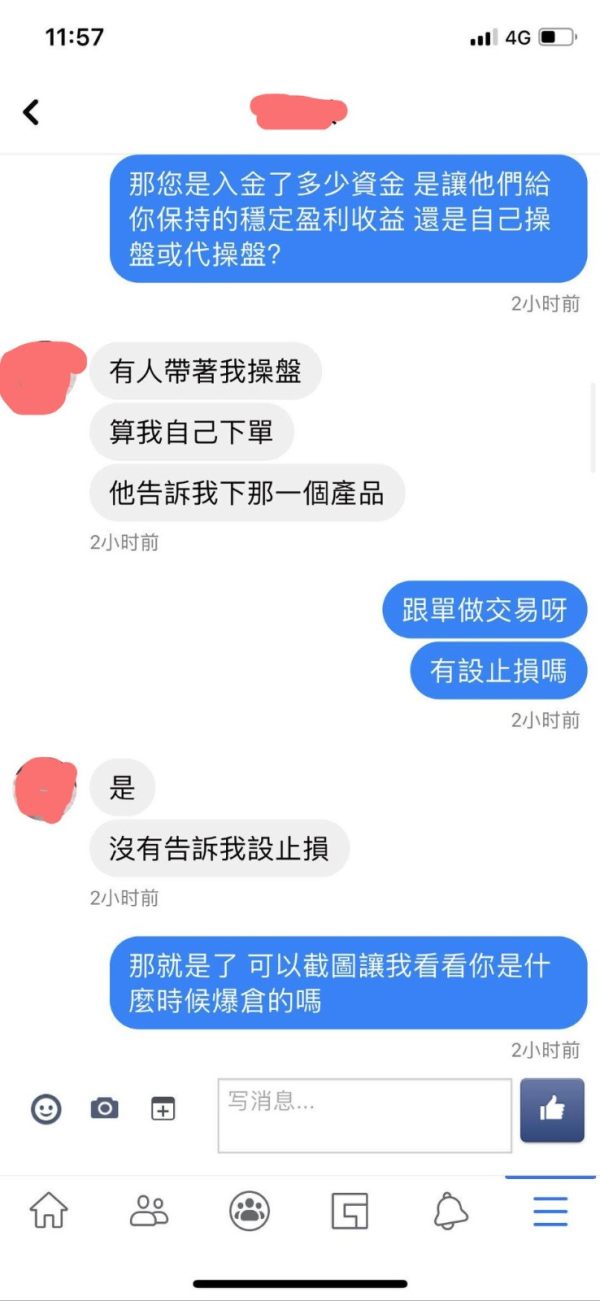

A friend on the Internet invited me to deposited. At first, it was normal but when I withdrew, the customer service said my account was liquidated. I had to pay $3037, which was not mentioned before. He disappeared although he said he took the responsibility at first.

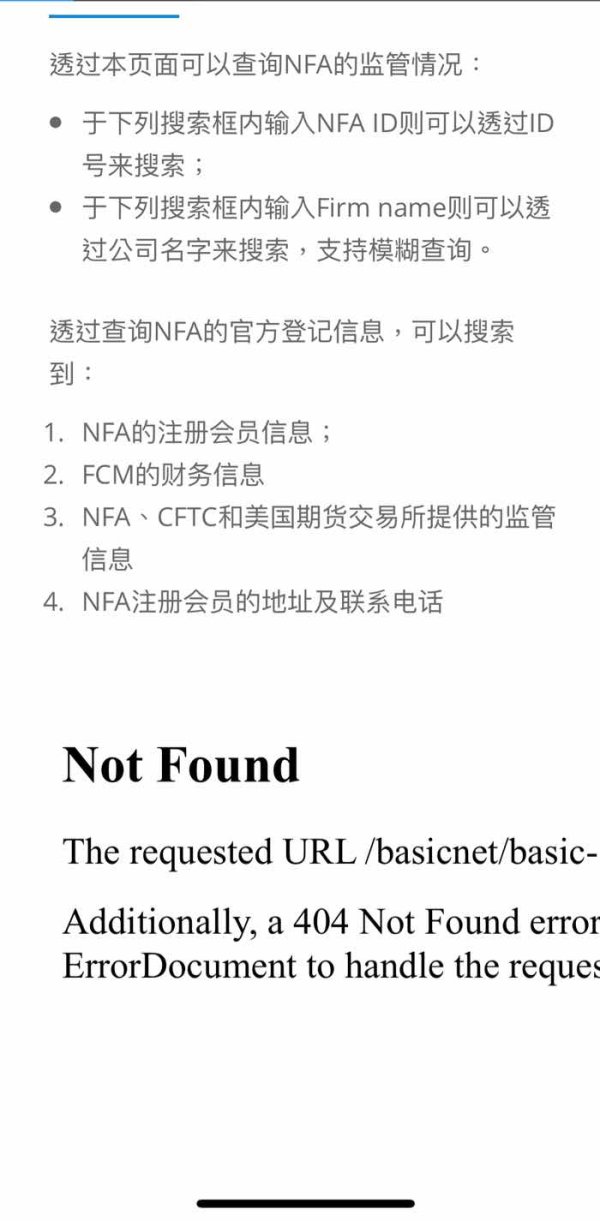

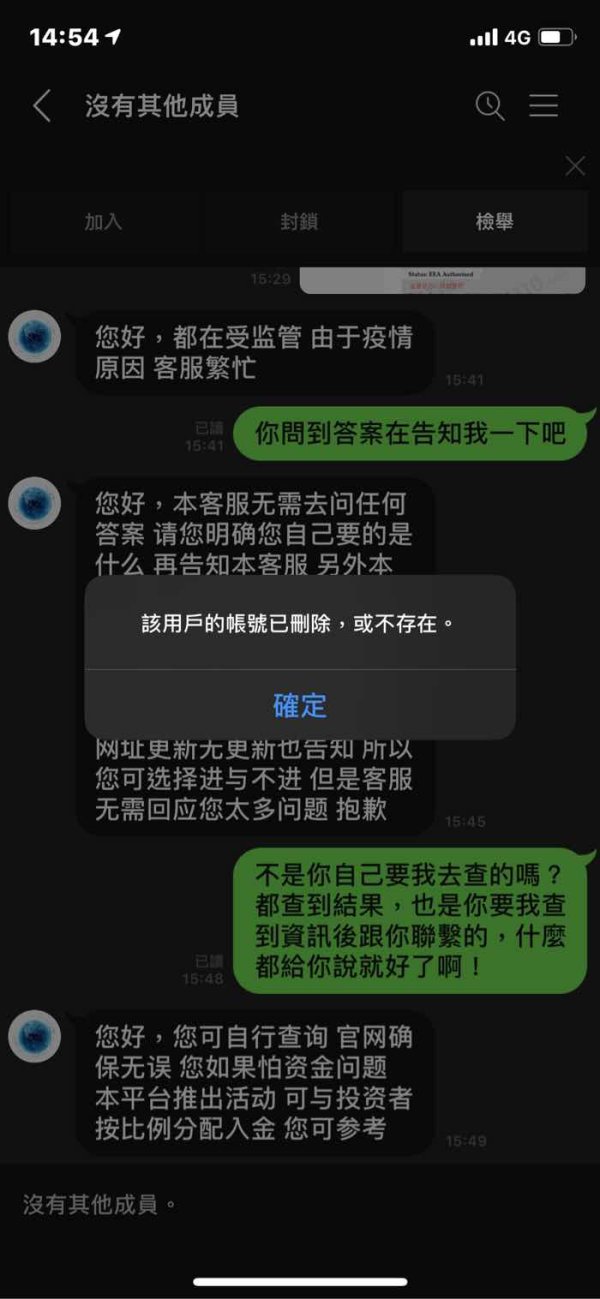

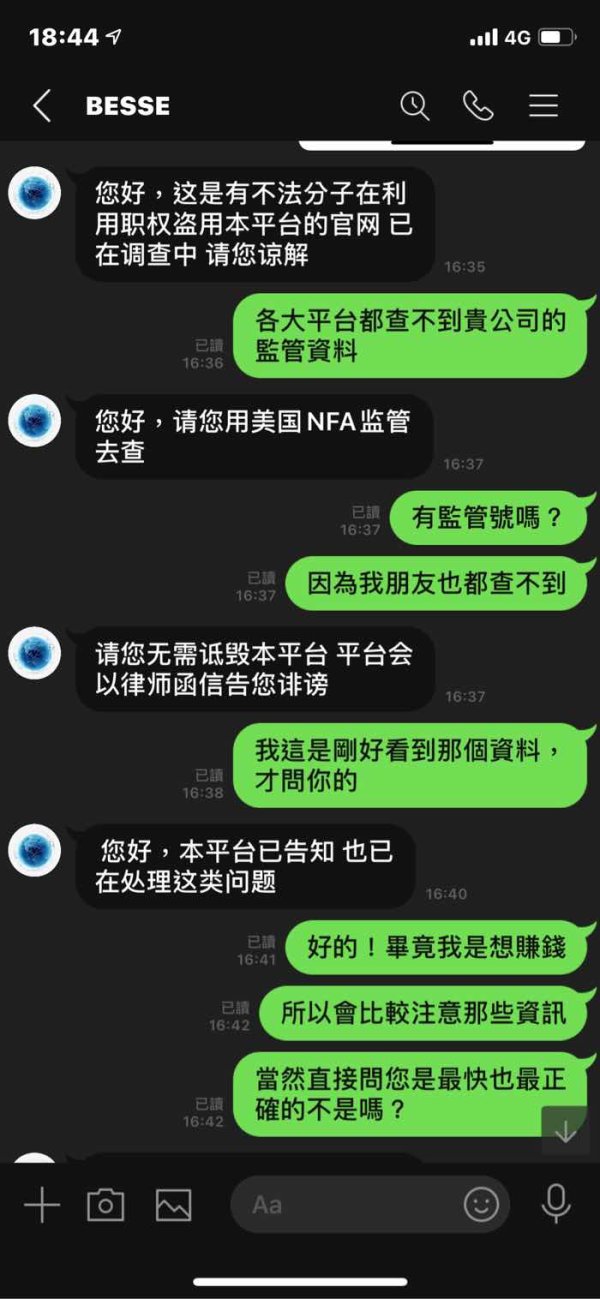

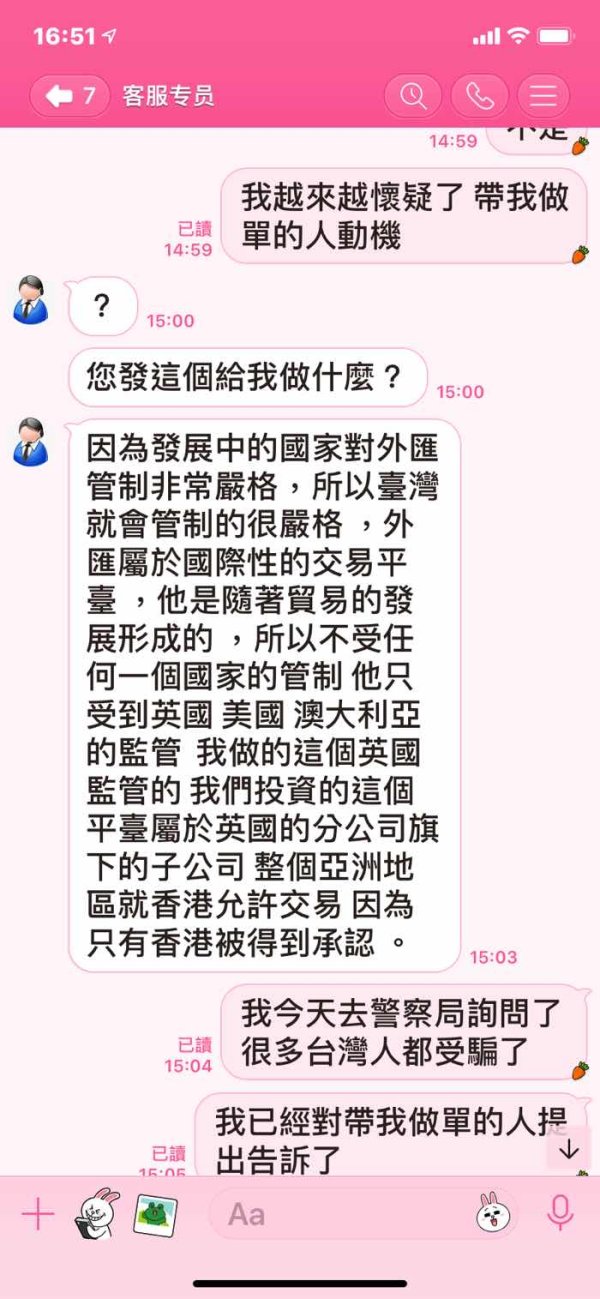

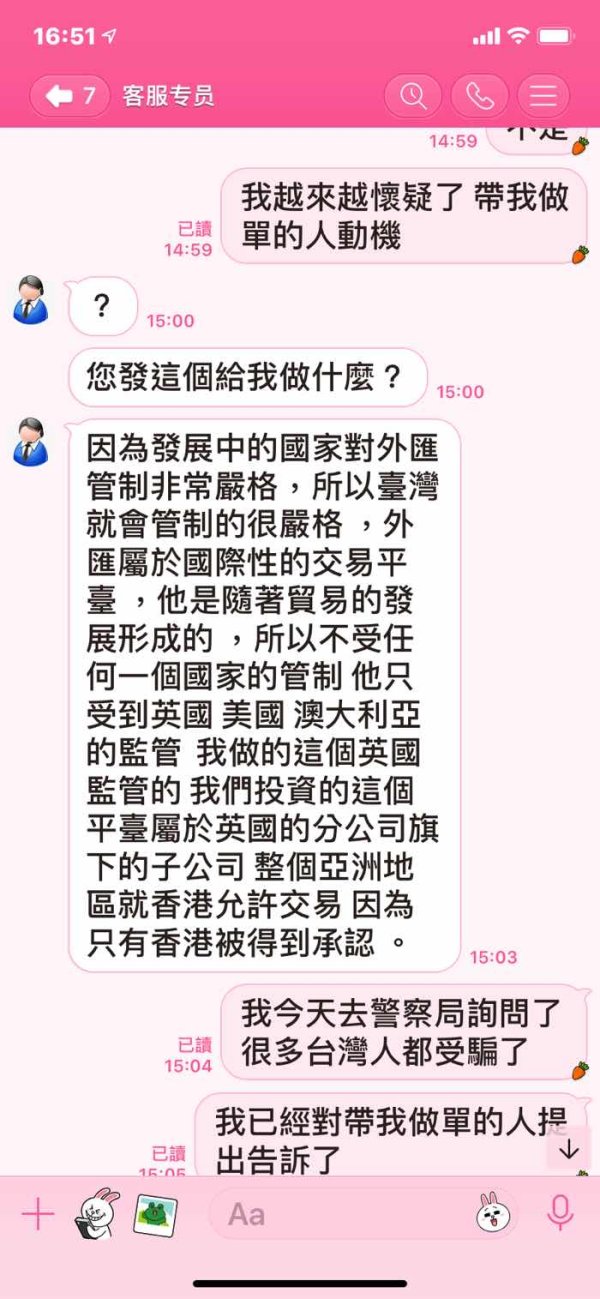

We knew on the chatting network and took calls. The scammer talked about investment to convince you with his personal information including name and occupation such as bank staff. He pretended to be a professional person. I met a woman from Xiamen called Zhang Yunjie. She said she was a lesbian and wanted to found a girlfriend. She held a company which was of customers from Taiwan and Singapore. She invited every user to deposit Boshang and helped them make profits with her trading signal. She promised profits but provided fake MT4 website. I argued with her about the fraud website she sent me. She said people from countries except England could only download it from that website. I did not point out her lie. I opened an account and did transaction for a few days. She told me to verify my identity and I did as she required. Then she persuaded me to deposit every day. I found the platform was a scam without regulation number several days later. There was no server address of it on official MT4/5.

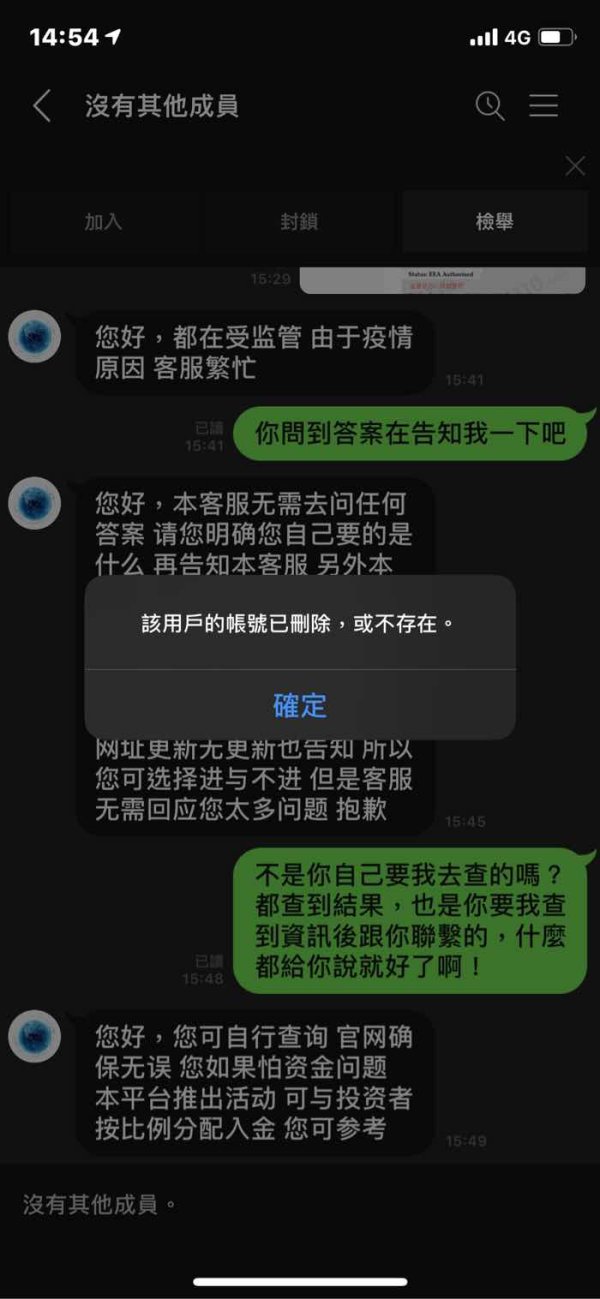

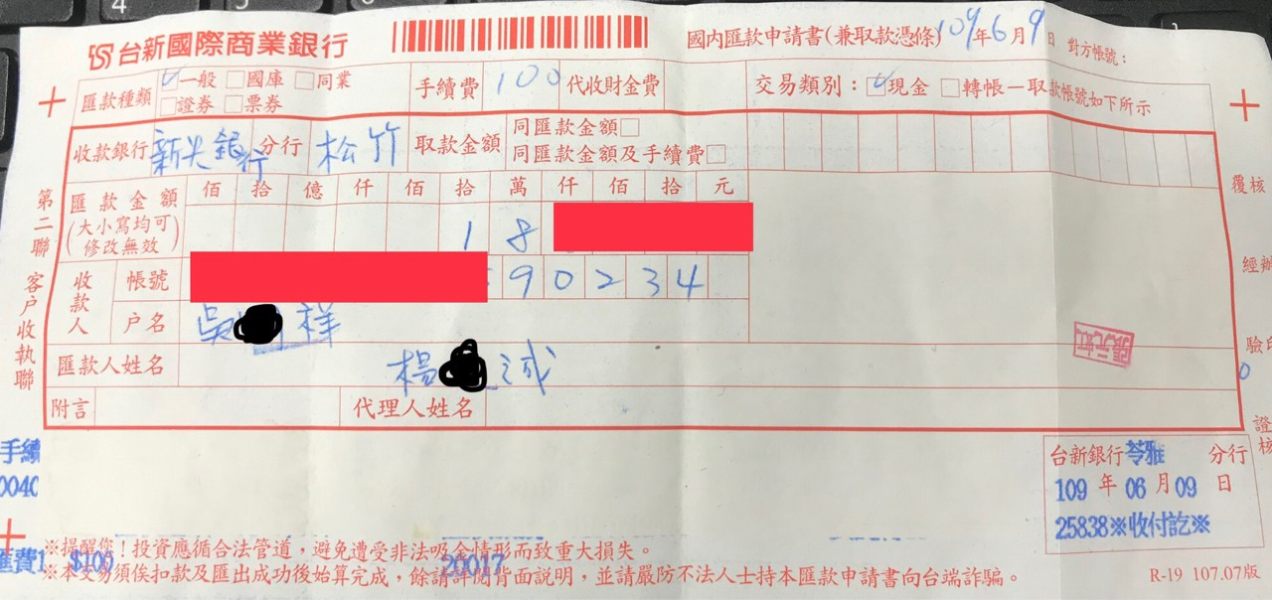

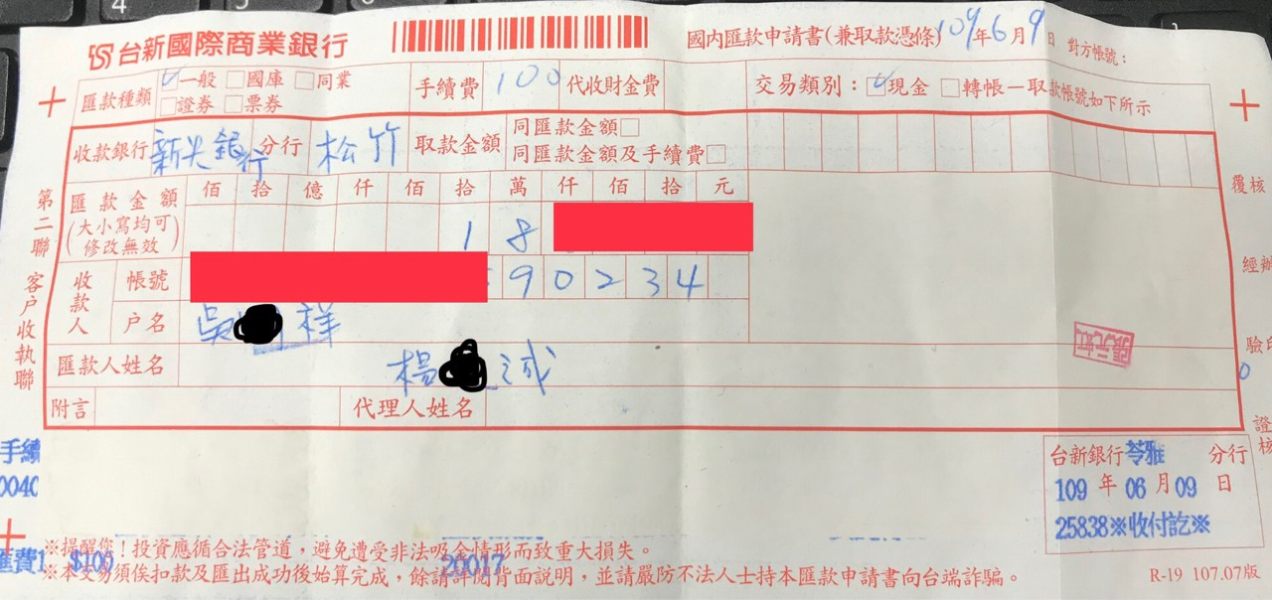

It is hard to believe this intransparent website! Everything was informed by the so-called account manager! The following is the evidence I collected! It is simply a scam! The referrer, self-proclaimed as a bank staff or self-employer, will chat with you often and take you to operate virtual account. He often inveigles me to open the account and deposit fund. To be honest, I deposited fund into the fake account, only to figure out he could know everything about my account! As long as you refuse his proposal, he will disappear immediately! One can recollect whether the routine is same as this. Account manager ID: besseme888

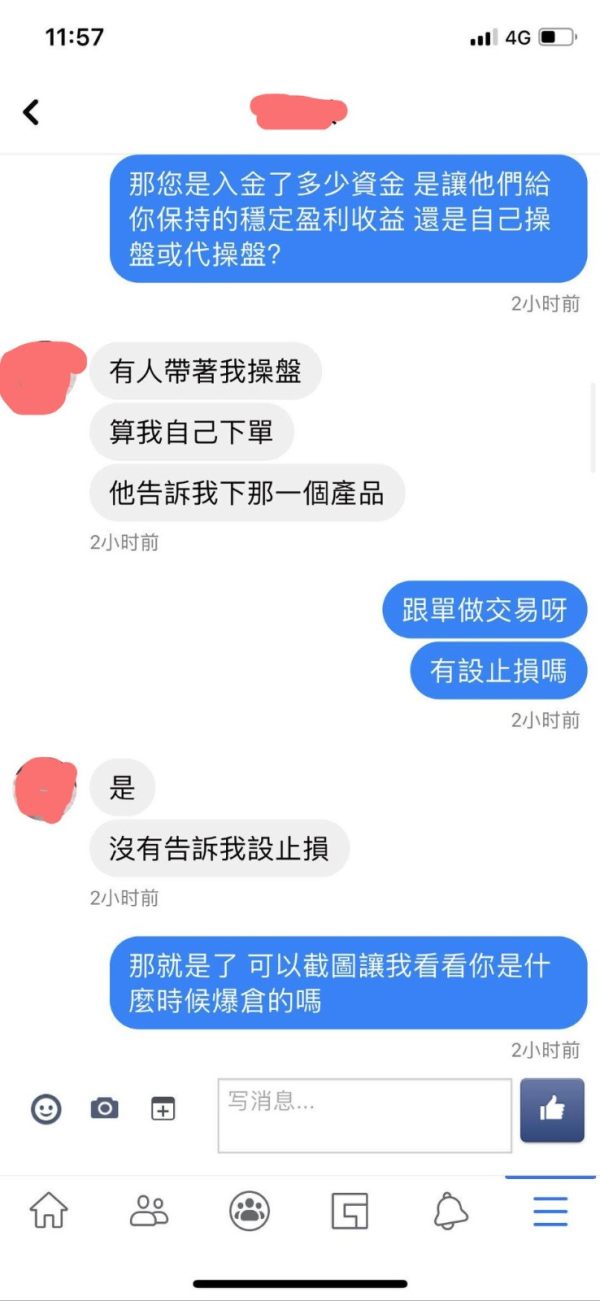

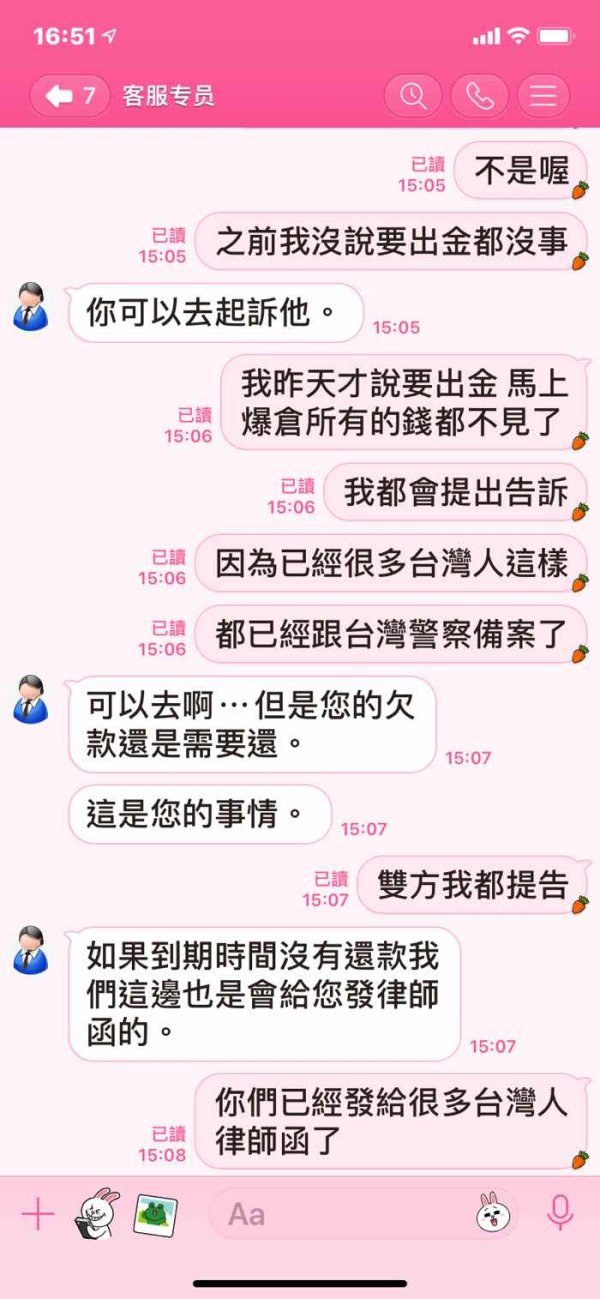

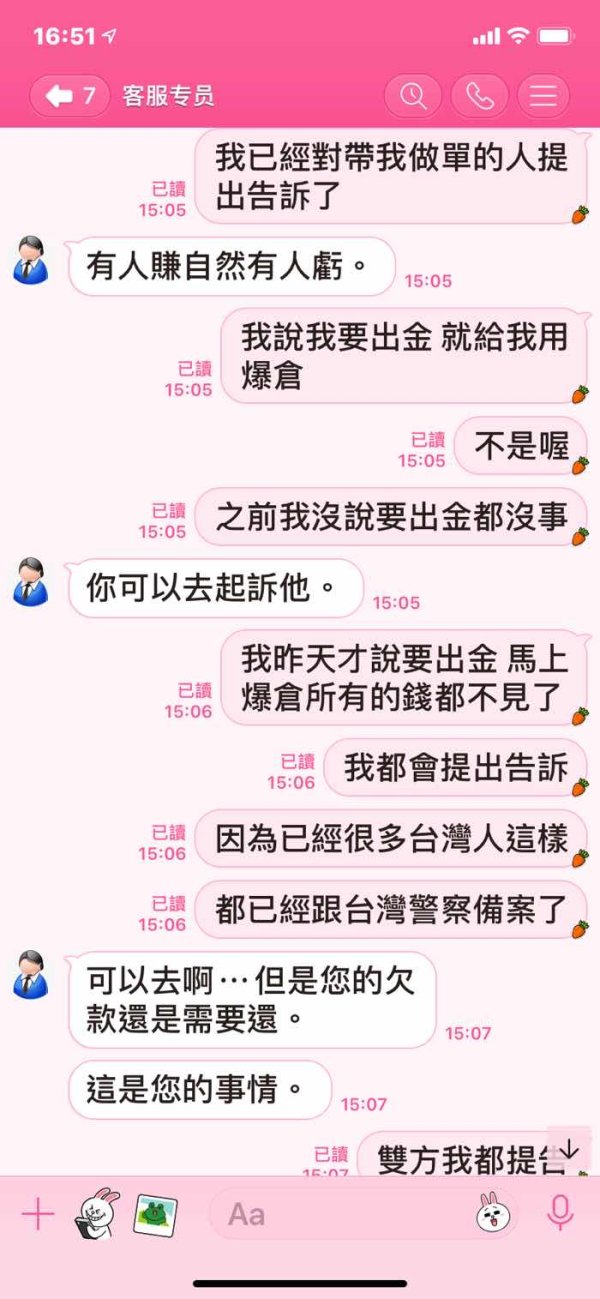

The gang of frauds will pretend to be your friend and client manager to inveigle you to deposit fund. At first, there will be come profits. Having induced you to add up to 50 thousand, they would one day asked you to use all fund to build position, claiming that there was a cocking market. Forced liquidation is doomed in wake of it. At this time, they would comfort you and ask you to make up for the loss. They also blamed the losses on the insufficient fund. Later, they even blacklisted you to add the fund. It is simply a scam platform.

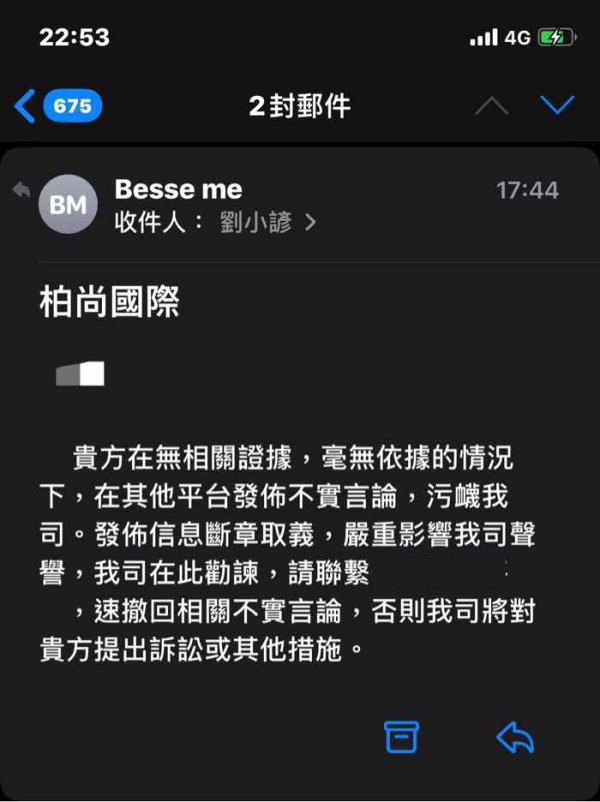

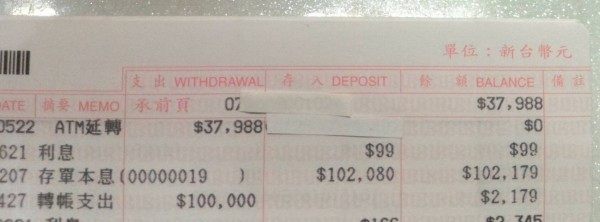

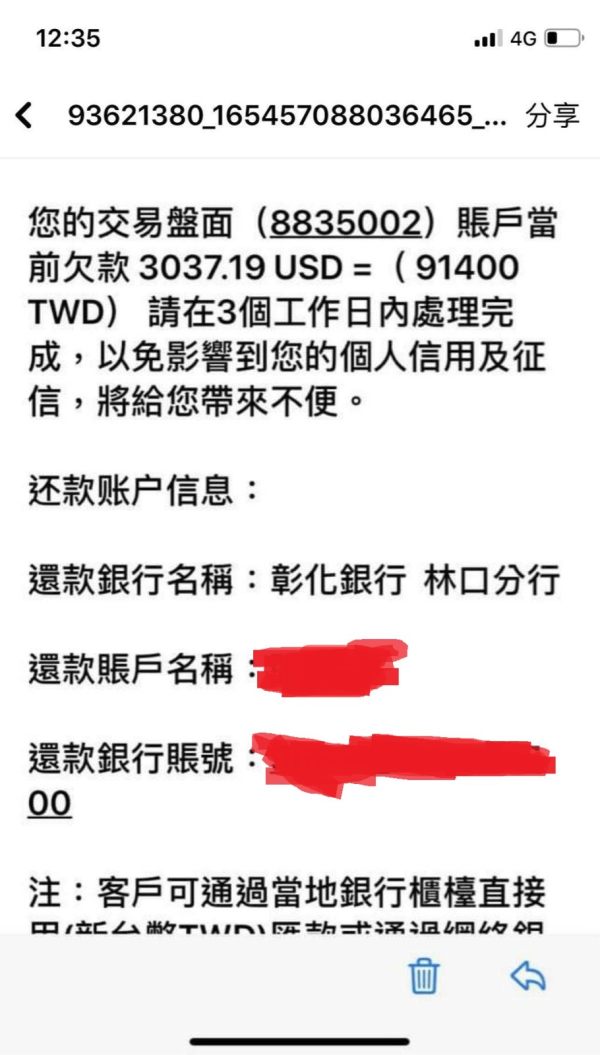

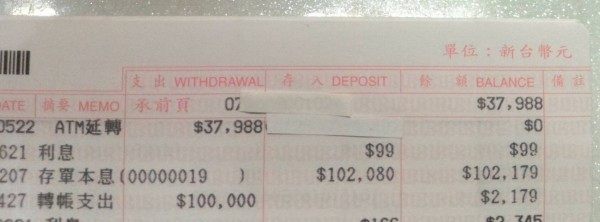

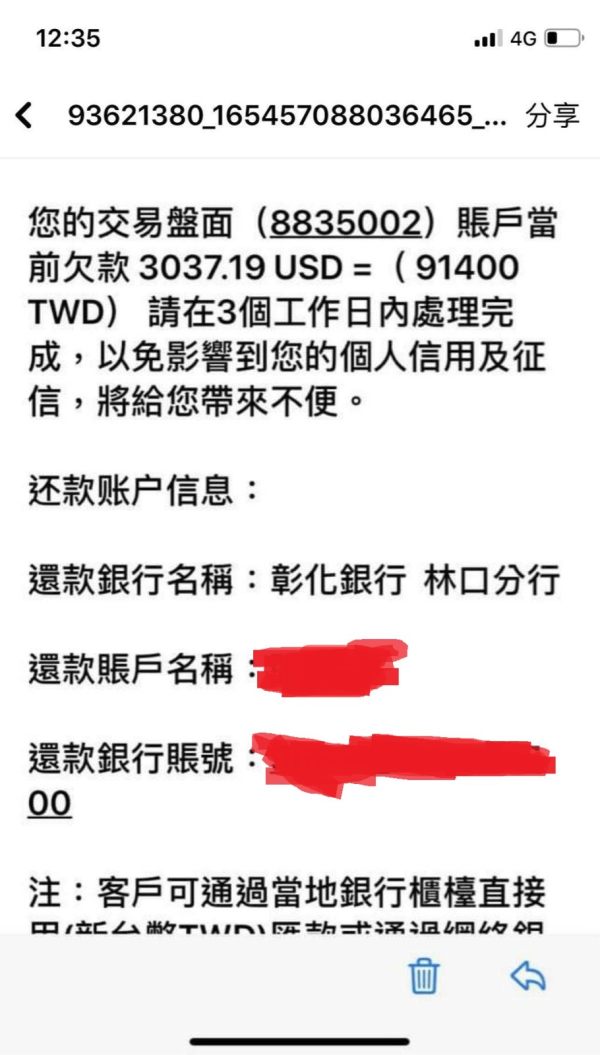

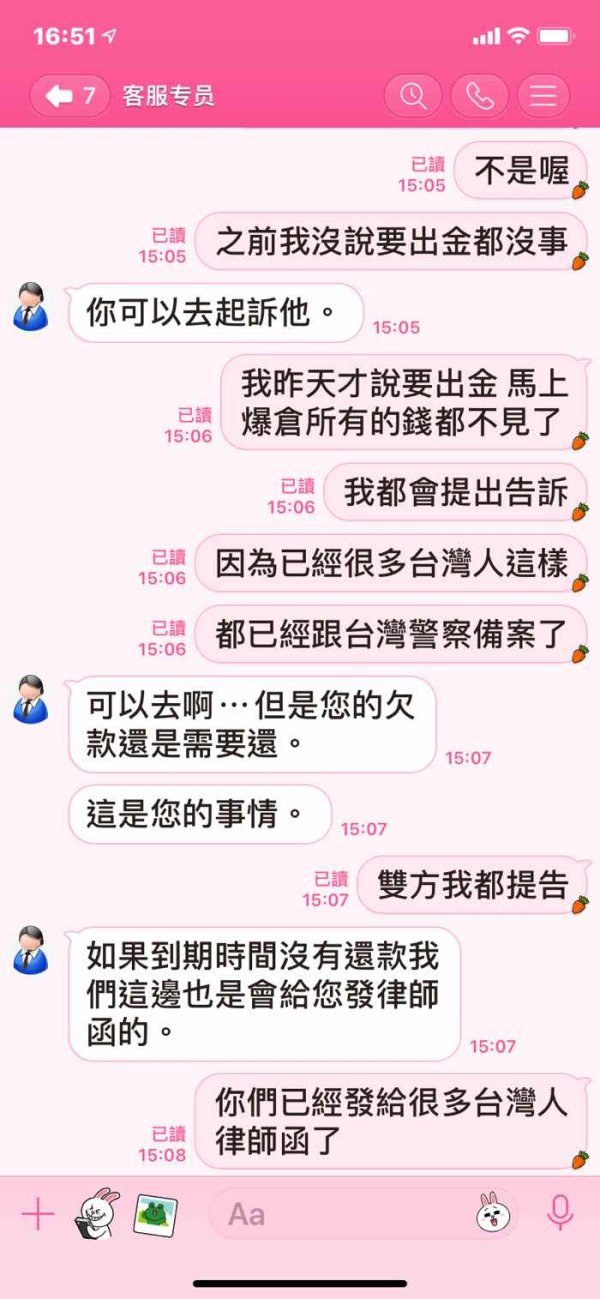

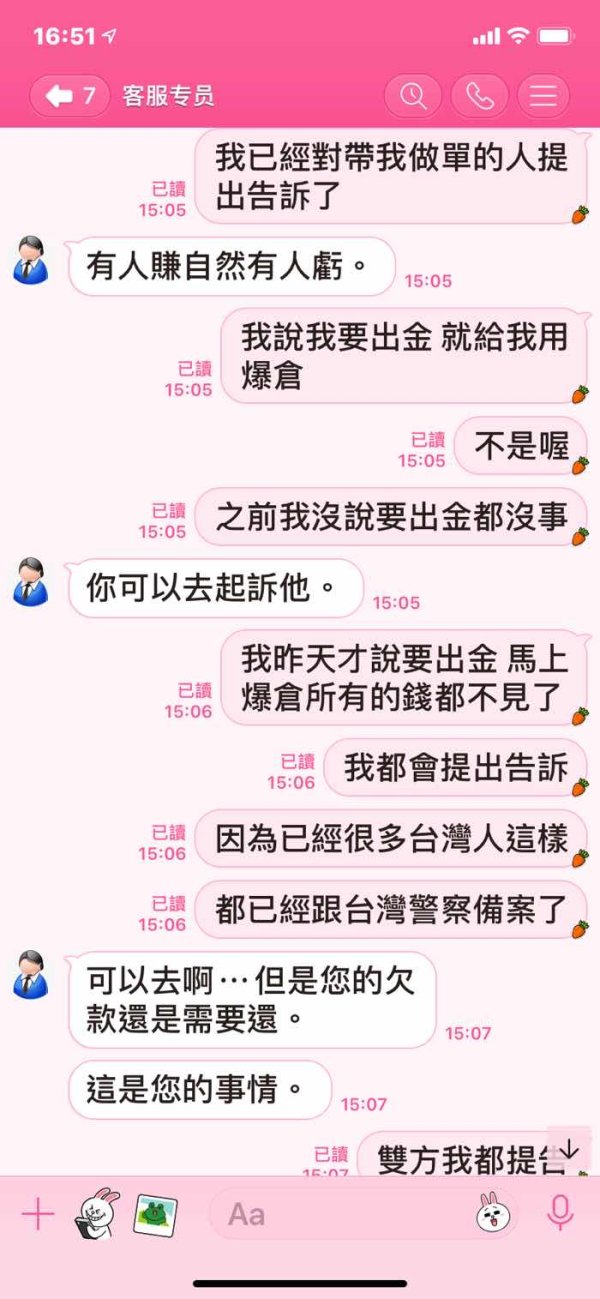

At first, they made you profit a lot. As long as you made withdrawal, they would make your account liquidated. They even blackmailed me to pay a fee. Otherwise, they would ban my account and send lawyer’s letter. Today, they told me that they had sent relevant letter, assigning blame on me. The website is disabled. Stay away from BESSEME .

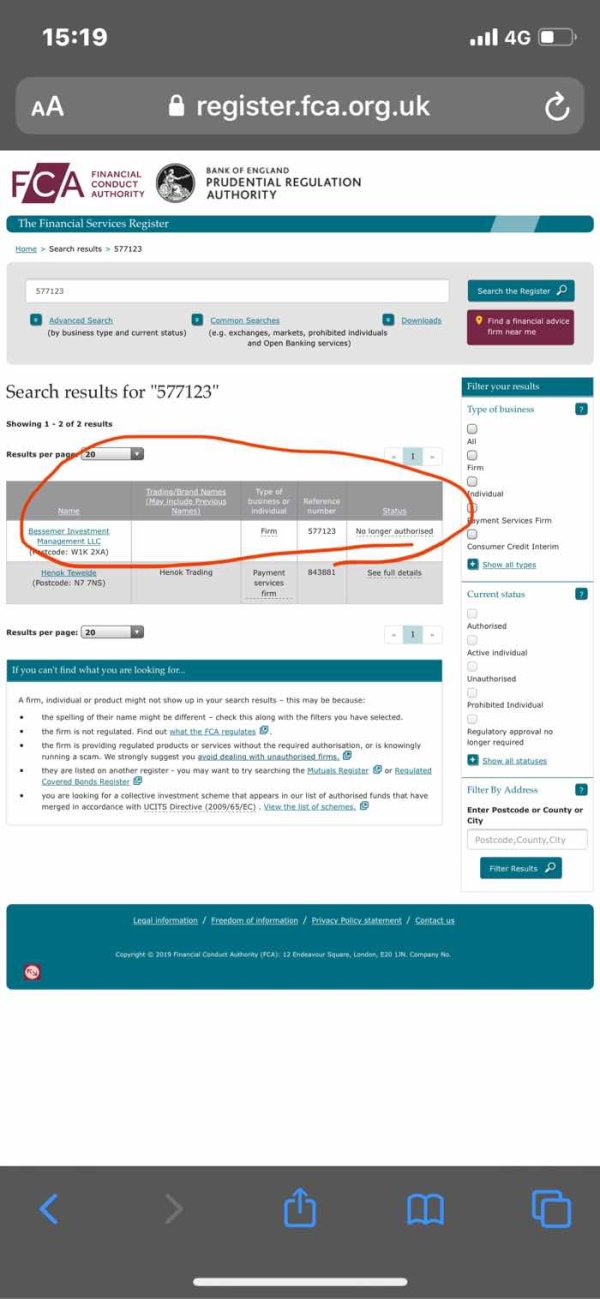

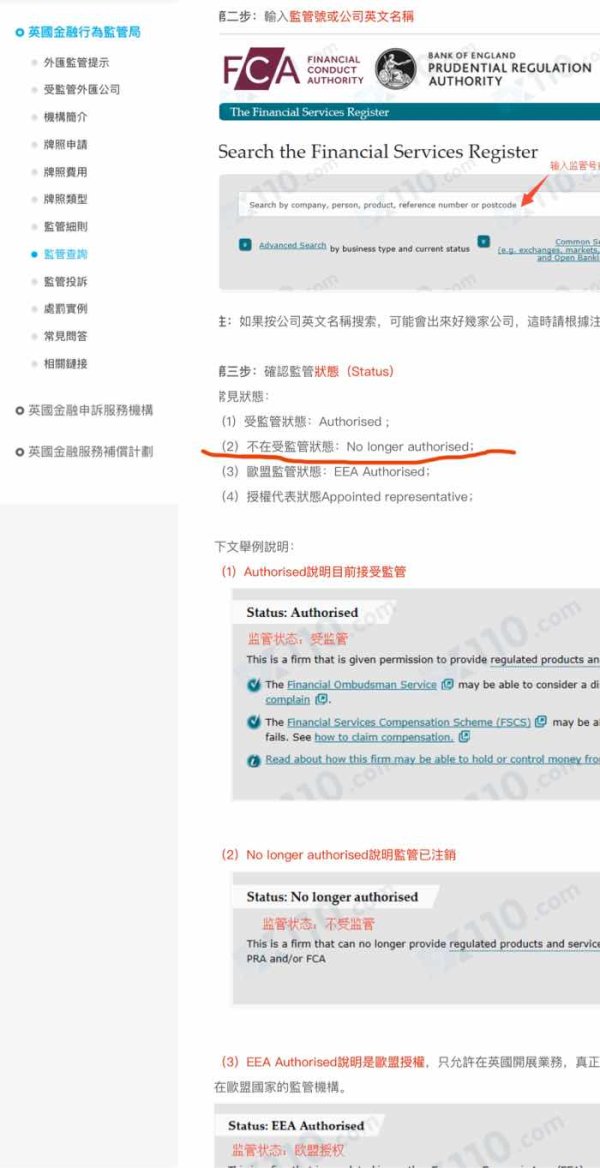

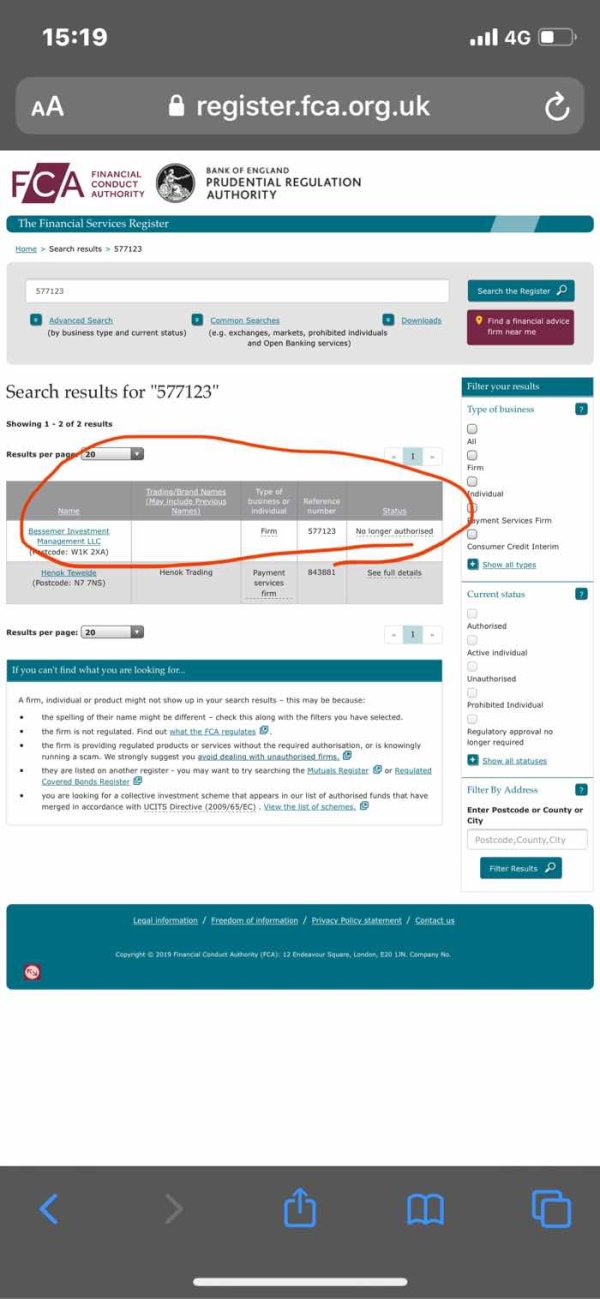

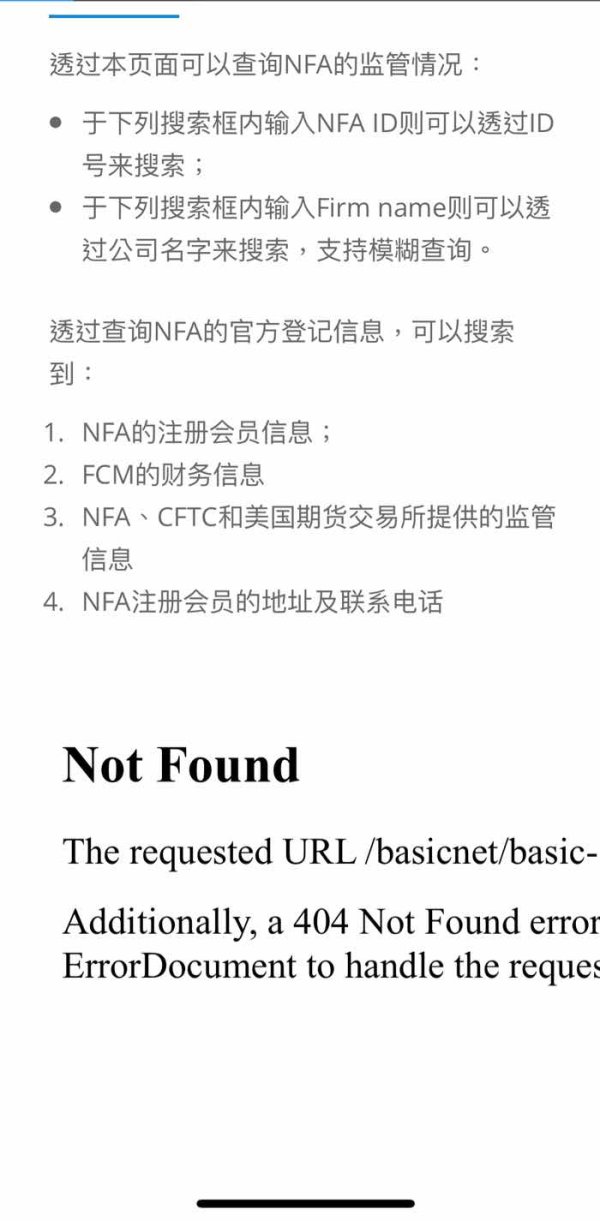

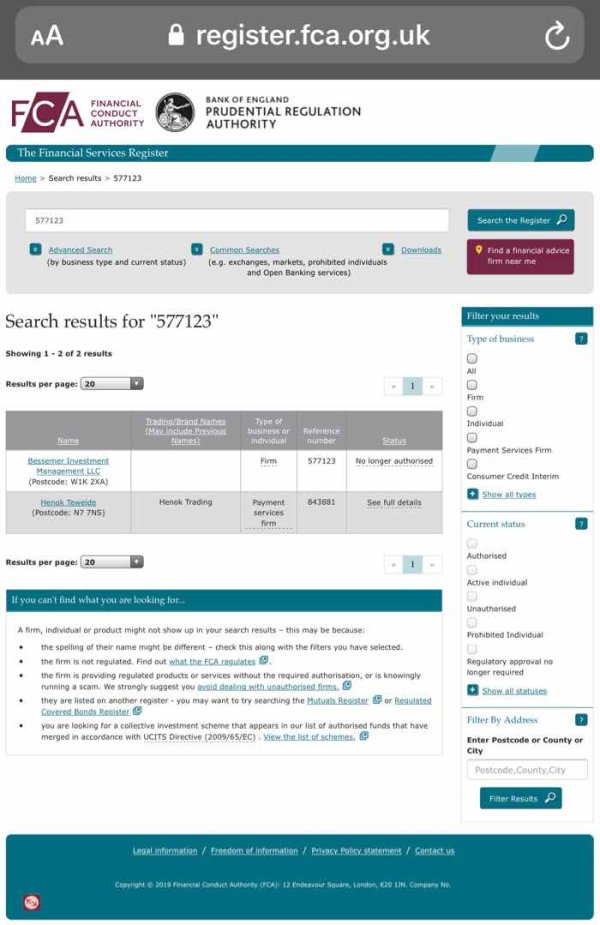

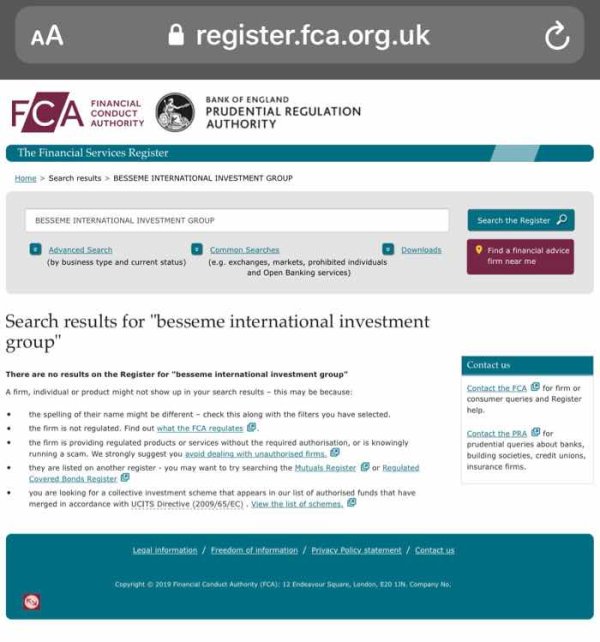

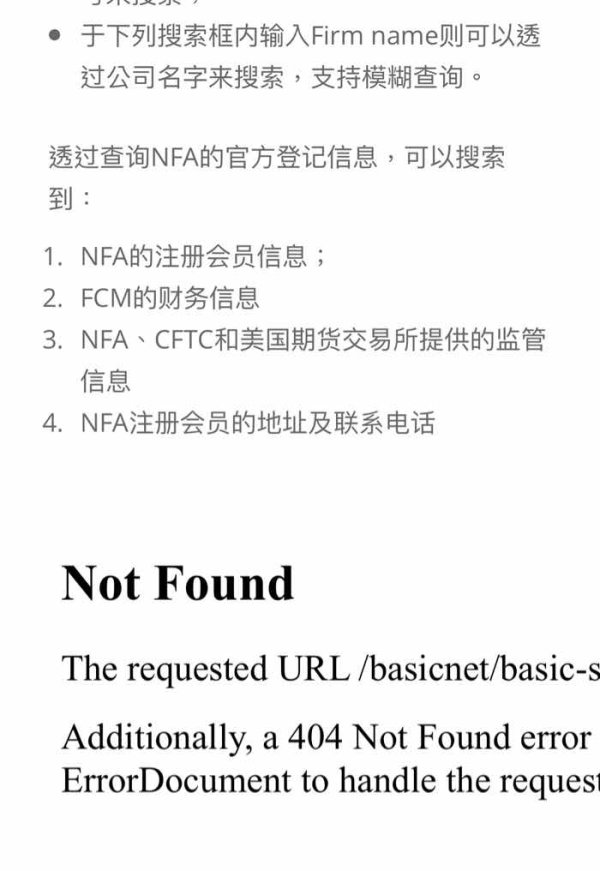

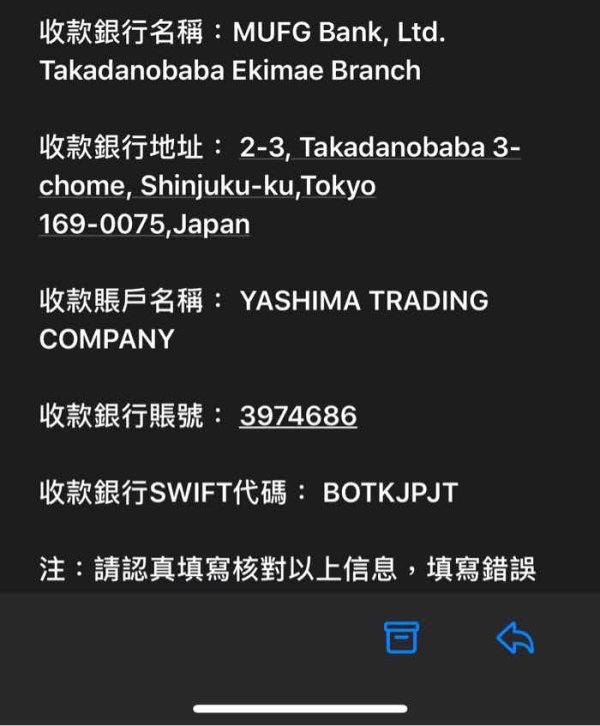

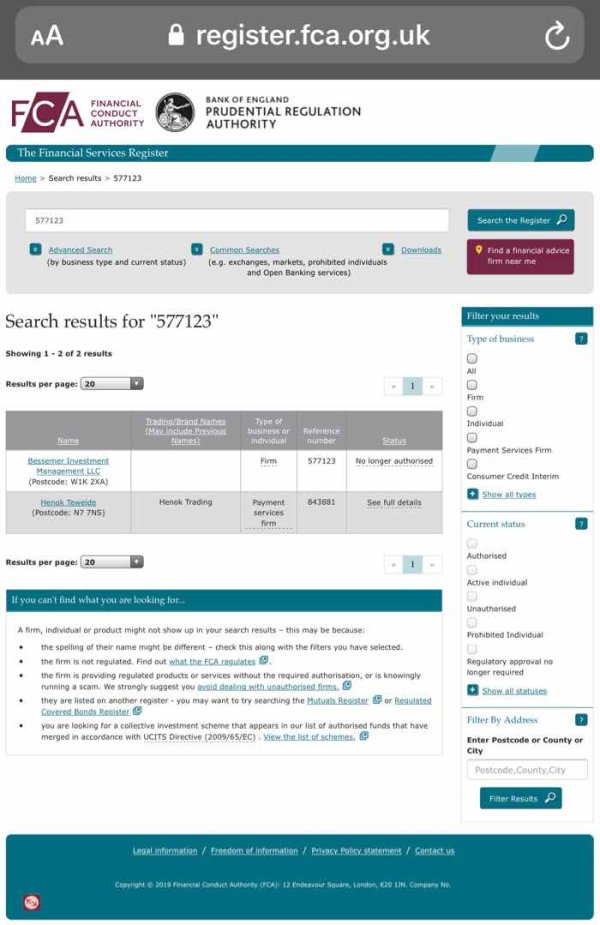

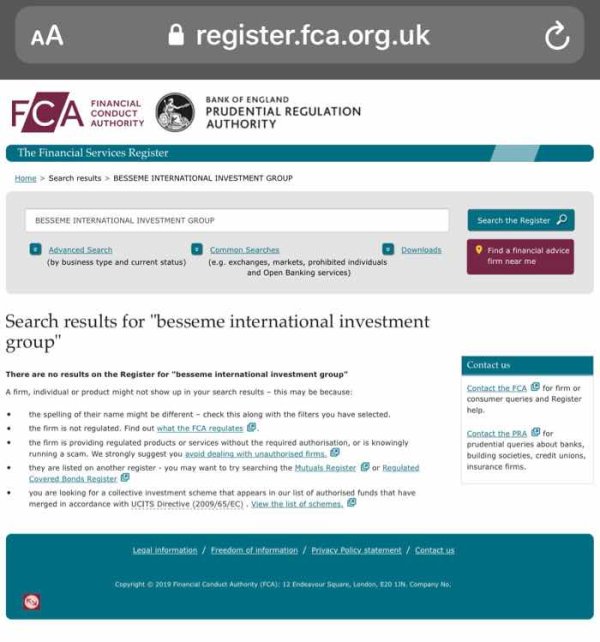

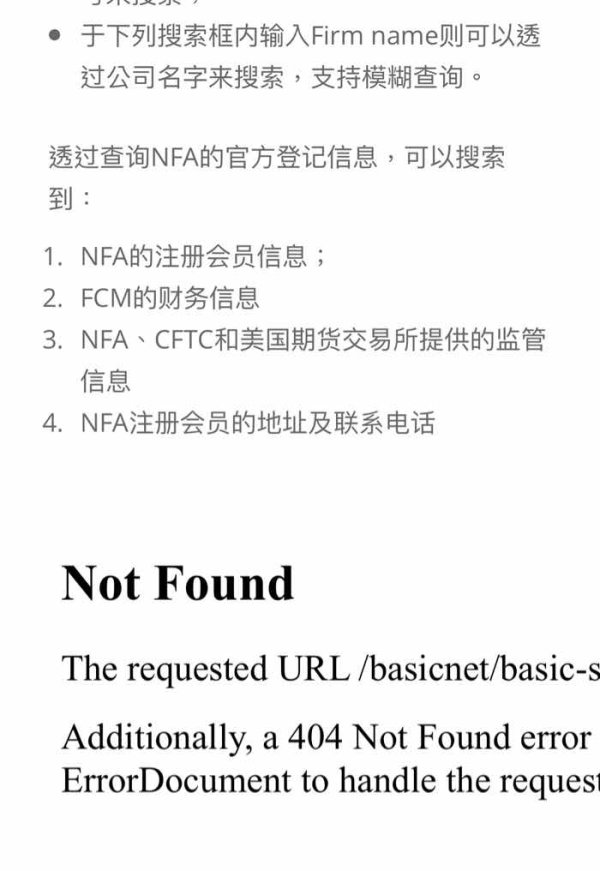

This company is out of transparency since I couldn’t find the server of my Mt4 and Mt5 there! They blackmailed and asked me to delete the exposure, then closed the line account! I don’t know whether they have found the so-called fraud or changed an account to continue to scam! It is out of the regulation of FCA. Its parent company is also a counterfeit! There were many Taiwanese who had been scammed out of hundreds of thousands of dollars! After I reflected the problem on software, they asked to download another strange software which isn’t from the appstore. In addition, the legit broker won’t arrange for a manager to cope with my problem! As long as you trade in this broker, your fund will be doomed! I also verified their so-called regulation, only to find nothing! One must know more numbers about the broker to avoid being cheated!