Is BaoSheng safe?

Pros

Cons

Is Baosheng Safe or a Scam?

Introduction

Baosheng, a forex broker, has garnered attention in the trading community for its offerings in the foreign exchange market. As traders seek to maximize their investments, the importance of assessing the legitimacy and safety of their brokers cannot be overstated. The forex market, while lucrative, is also fraught with risks, including potential scams and unregulated entities. Thus, it is crucial for traders to conduct thorough research before committing their funds to any broker.

This article aims to provide a comprehensive evaluation of Baosheng, addressing its regulatory status, company background, trading conditions, customer safety measures, and user experiences. The investigation is based on a review of multiple online sources, including user feedback, regulatory databases, and financial reports. The analysis will help answer the pressing question: Is Baosheng safe?

Regulation and Legitimacy

The regulatory environment in which a forex broker operates is a key indicator of its legitimacy. Baosheng is registered in Hong Kong, but it has been flagged by various regulatory bodies for lacking proper oversight. The absence of strong regulatory backing raises significant concerns about the safety of funds and the overall trustworthiness of the broker.

| Regulatory Body | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| N/A | N/A | Hong Kong | Not Verified |

The lack of regulation from reputable authorities such as the FCA (UK), ASIC (Australia), or CFTC (USA) is alarming. Brokers that operate without stringent oversight are often associated with higher risks, including potential fraud and mismanagement of client funds. Furthermore, Baosheng has been reported to have a history of complaints regarding its withdrawal processes and customer service, which further diminishes its credibility. Given these factors, the question remains: Is Baosheng safe?

Company Background Investigation

Baosheng's history and ownership structure provide additional insights into its operational integrity. The broker operates under the name Baosheng Financial Group and has been active for several years. However, its lack of transparency regarding ownership and management raises red flags. Information about the executives and their qualifications is sparse, which is not typical for reputable brokers that pride themselves on transparency and accountability.

The management teams professional experience is crucial in assessing the broker's reliability. A well-qualified team with a proven track record in finance and trading can significantly enhance a broker's credibility. Unfortunately, Baosheng does not provide adequate information about its management, leaving potential clients in the dark about who is handling their investments.

Moreover, the company's transparency regarding its financial health and operational practices is questionable. A broker that fails to disclose essential information about its operations may not prioritize client interests, leading to potential risks for traders. Therefore, when evaluating Baosheng, one must consider if the broker's lack of transparency contributes to the question: Is Baosheng safe?

Trading Conditions Analysis

Understanding the trading conditions offered by a broker is vital for traders looking to optimize their trading strategies. Baosheng claims to provide competitive spreads and various trading instruments. However, the absence of clear information regarding fees and commissions raises concerns about the broker's overall cost structure.

| Fee Type | Baosheng | Industry Average |

|---|---|---|

| Major Currency Pair Spread | N/A | 1.0-2.0 pips |

| Commission Model | N/A | $5-$10 per lot |

| Overnight Interest Range | N/A | 0.5%-2.0% |

The lack of specific details about spreads and commissions can be indicative of hidden fees or unfavorable trading conditions. Traders must be cautious of brokers that do not transparently disclose their fee structures, as this can lead to unexpected costs that erode profits. Moreover, if Baosheng employs unusual fees or policies that are not standard in the industry, it could be a warning sign, making one wonder: Is Baosheng safe?

Client Funds Safety

The safety of client funds is paramount when choosing a broker. Baosheng's measures for protecting client deposits are critical in assessing its reliability. The broker claims to implement fund segregation practices, which are essential for safeguarding client assets. However, the effectiveness of these measures is difficult to verify due to the broker's lack of regulatory oversight.

Additionally, the absence of investor protection schemes, such as those offered by regulated brokers, poses a risk to traders investments. Without these safeguards, clients may find themselves vulnerable in the event of financial difficulties faced by the broker. Historical complaints about withdrawal issues further highlight potential risks associated with entrusting funds to Baosheng. As traders consider their options, they must ask themselves: Is Baosheng safe?

Customer Experience and Complaints

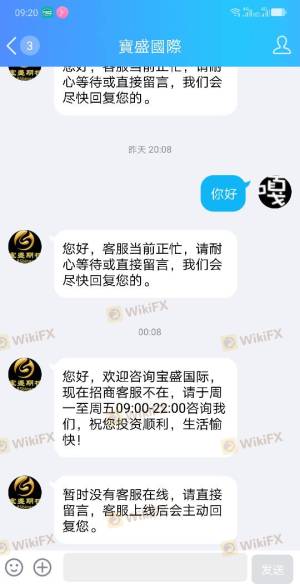

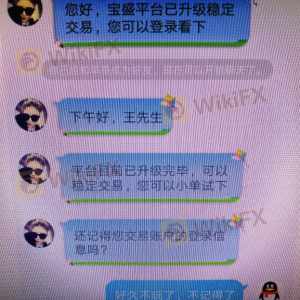

User feedback is a critical component in evaluating a broker's performance. A review of customer experiences with Baosheng reveals a pattern of dissatisfaction, particularly regarding withdrawal processes and customer service responsiveness. Many users have reported being unable to withdraw their funds, which is a significant red flag for any financial institution.

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Issues | High | Poor |

| Customer Service Issues | Medium | Poor |

| Misleading Promotions | High | Poor |

Typical case studies highlight traders who faced prolonged delays in accessing their funds, leading to frustration and financial losses. These complaints suggest systemic issues within the broker's operations, raising concerns about its overall reliability. As traders weigh the risks of using Baosheng, they must consider the implications of these complaints on their trading experience and ask: Is Baosheng safe?

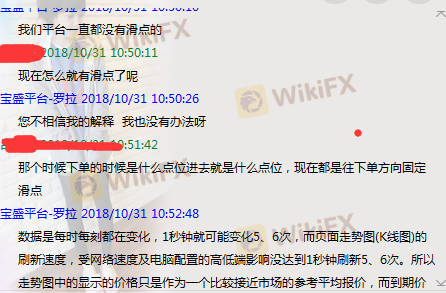

Platform and Execution

The performance and reliability of the trading platform are crucial for successful trading. Baosheng offers a trading platform that is reportedly user-friendly, but concerns about execution quality and slippage have been raised by users. Instances of delayed order executions and unexpected slippage can significantly impact trading outcomes, particularly in volatile markets.

Furthermore, there are allegations of potential market manipulation, which could compromise the integrity of trades executed on the platform. Traders must be vigilant about the performance of the platform they choose to trade on, as it can directly affect their profitability. Given these concerns, the question arises: Is Baosheng safe?

Risk Assessment

In conclusion, the overall risk profile of Baosheng presents several areas of concern that potential users should carefully consider.

| Risk Category | Risk Level | Brief Description |

|---|---|---|

| Regulatory Risk | High | Lack of oversight increases fraud risk. |

| Operational Risk | Medium | Complaints about withdrawals and service. |

| Financial Risk | High | Potential for fund mismanagement. |

To mitigate these risks, traders should consider diversifying their investments across multiple brokers and maintaining a cautious approach when dealing with Baosheng. Engaging with brokers that offer strong regulatory backing and transparent practices is advisable for those seeking to minimize exposure to potential scams.

Conclusion and Recommendations

After a comprehensive review of Baosheng, it is clear that there are significant concerns regarding its legitimacy and safety. The lack of regulatory oversight, poor customer feedback, and transparency issues all contribute to a troubling picture of the broker. Therefore, the question remains: Is Baosheng safe? Based on the evidence presented, traders should exercise caution when considering Baosheng as their forex broker.

For traders seeking reliable alternatives, brokers regulated by top-tier authorities such as the FCA, ASIC, or CFTC are recommended. These brokers typically offer better protection for client funds, transparent fee structures, and a more robust trading environment. In summary, while Baosheng may present itself as a viable option, the risks associated with it suggest that traders should look elsewhere for a safer trading experience.

Is BaoSheng a scam, or is it legit?

The latest exposure and evaluation content of BaoSheng brokers.

BaoSheng Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

BaoSheng latest industry rating score is 1.61, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.61 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.