Assetmanagement 2025 Review: Everything You Need to Know

Executive Summary

This comprehensive Assetmanagement review examines a financial services provider that specializes in systematic asset management solutions for both institutional and individual clients. Asset managers focus on growing their clients' portfolios to maximize returns through diversified investment strategies. The company manages a wide variety of asset classes including real estate, stocks, bonds, businesses, patents, and other investment vehicles according to available information.

The platform operates on a third-party management model. It positions itself as an intermediary between clients and various investment opportunities. This approach allows investors to access professional asset management services without requiring extensive market knowledge or time commitment. The service targets investment companies and individuals seeking comprehensive portfolio management solutions.

This Assetmanagement review presents a neutral assessment based on our analysis of available information. Specific details regarding trading conditions, regulatory status, and user experiences remain limited in publicly available sources. The primary strength appears to be the diversity of asset categories offered. The main concern is the lack of transparent information about specific service conditions and regulatory oversight.

Important Notice

This review is conducted based on publicly available information and general industry practices. Readers should exercise caution and conduct their own due diligence before engaging with any financial services provider due to limited specific data about this particular entity. Different regional entities may operate under varying regulatory frameworks and service conditions.

Our evaluation methodology incorporates multiple sources of information, including official documentation, user feedback where available, and industry standard comparisons. The absence of detailed operational information limits the scope of this assessment however.

Rating Framework

Broker Overview

Assetmanagement operates as a financial services entity focused on providing systematic asset management solutions to a diverse client base. The company's business model centers on helping clients manage their financial assets through professional oversight and strategic portfolio allocation. Asset management involves the systematic method of maintaining and growing assets through various investment vehicles and risk management strategies according to industry definitions.

The service structure appears to follow a third-party management approach. The company acts as an intermediary between investors and various asset classes in this model. This model allows clients to access diversified investment opportunities without requiring direct market participation or extensive financial expertise. The systematic approach to asset maintenance suggests a focus on long-term wealth preservation and growth strategies.

Available information indicates that the platform manages multiple asset categories. This creates opportunities for portfolio diversification. Assets under management can include real estate investments, stock portfolios, bond holdings, business acquisitions, patent investments, and other alternative investment vehicles. This diversity potentially allows for risk distribution across different market sectors and investment types.

This Assetmanagement review must note that specific details about the company's establishment date, regulatory jurisdiction, and operational history are not readily available in current public documentation however. The lack of transparent corporate information raises questions about the entity's background and operational transparency that potential clients should consider.

Regulatory Jurisdiction: Specific regulatory oversight information is not detailed in available materials. This represents a significant concern for potential clients seeking regulated financial services.

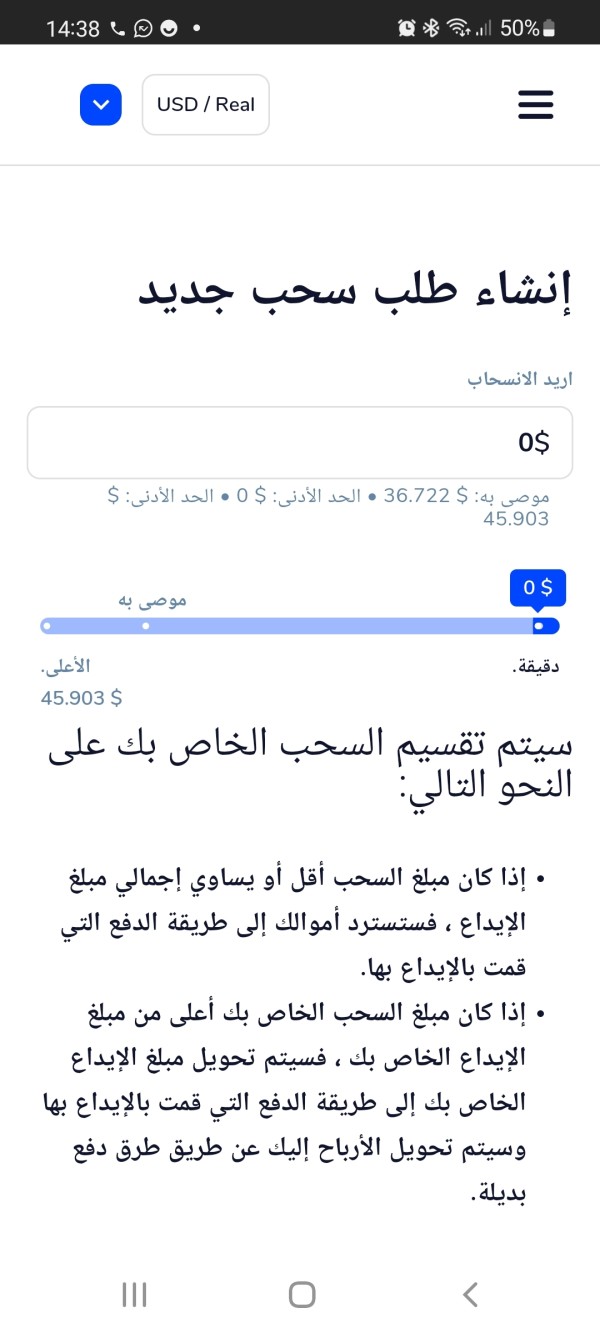

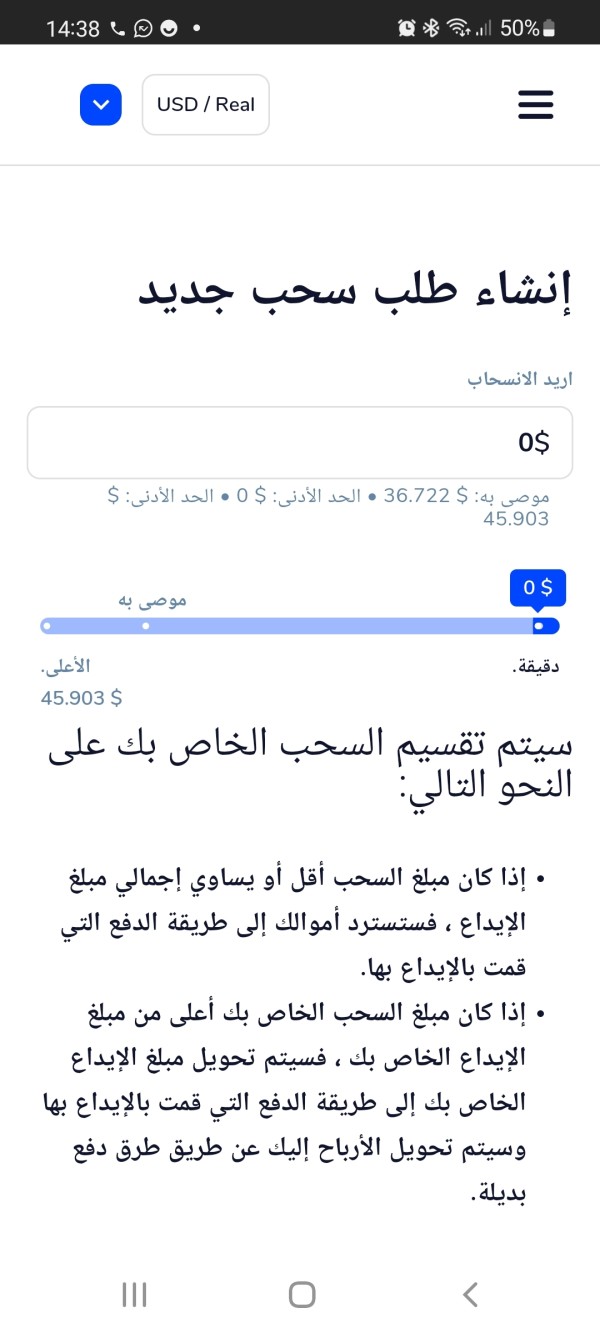

Deposit and Withdrawal Methods: Payment processing options and fund transfer mechanisms are not specified in current documentation. This limits client understanding of operational procedures.

Minimum Deposit Requirements: Entry-level investment thresholds are not disclosed. This makes it difficult for potential clients to assess accessibility.

Promotional Offers: Current bonus structures or promotional incentives are not outlined in available information.

Tradeable Assets: The platform reportedly manages diverse asset classes including real estate properties, stock portfolios, bond investments, business entities, patent holdings, and various other investment vehicles. This provides potential for portfolio diversification.

Cost Structure: Fee schedules, management charges, and transaction costs are not transparently disclosed in available materials. This is concerning for cost-conscious investors.

Leverage Ratios: Information about leverage availability and risk multipliers is not provided in current documentation.

Platform Options: Specific trading platforms or management interfaces are not detailed in available sources.

Geographic Restrictions: Service availability by region or country-specific limitations are not clearly outlined.

Customer Support Languages: Multi-language support capabilities are not specified in current materials.

This Assetmanagement review emphasizes that the lack of detailed operational information represents a significant limitation for potential clients seeking comprehensive service evaluation.

Detailed Rating Analysis

Account Conditions Analysis

The evaluation of account conditions for Assetmanagement presents significant challenges. The absence of specific information about account types, requirements, and features creates this difficulty. Traditional asset management services typically offer various account structures including individual portfolios, institutional accounts, and specialized investment vehicles. Specific details about this provider's offerings are not available in current documentation however.

Potential clients cannot adequately assess whether the service aligns with their investment capacity and objectives without access to information about minimum deposit requirements, account opening procedures, or special account features. The lack of transparency regarding account conditions raises concerns about operational clarity and client communication standards.

Industry standards typically require clear disclosure of account terms, fee structures, and service limitations. The absence of such information in this Assetmanagement review suggests either limited public disclosure practices or restricted access to operational details. Potential clients should request comprehensive account documentation before engaging with the service.

The inability to evaluate account conditions based on available information results in an incomplete assessment. This limits the usefulness of this review for decision-making purposes.

Assessment of trading tools and analytical resources proves challenging due to limited information availability. Professional asset management services typically provide clients with portfolio tracking systems, market analysis tools, research reports, and performance monitoring capabilities. Specific details about this provider's technological infrastructure are not disclosed however.

The absence of information about analytical resources, research capabilities, and client portal features represents a significant gap in service transparency. Modern asset management platforms usually offer sophisticated tools for portfolio analysis, risk assessment, and performance tracking. Without specific details, clients cannot evaluate the technological sophistication of the service.

Educational resources and client support materials are also not detailed in available documentation. Professional asset management services often provide market insights, investment education, and strategic guidance to help clients understand their portfolios and market conditions.

The lack of detailed information about tools and resources limits client ability to assess the value proposition and operational capabilities of the service platform.

Customer Service and Support Analysis

Customer service evaluation is severely limited by the absence of specific information about support infrastructure, communication channels, and service availability. Professional asset management services typically maintain dedicated client relationship teams, multiple communication channels, and comprehensive support systems. Details about this provider's customer service capabilities are not available however.

Response times, service quality metrics, and problem resolution procedures are not documented in available materials. The lack of information about support team qualifications, availability hours, and communication methods raises concerns about client service standards and operational transparency.

Multi-language support capabilities and geographic service coverage are also not specified. This limits understanding of the provider's ability to serve diverse client populations. Professional asset management services often require ongoing client communication and support. This makes service quality a critical evaluation factor.

This Assetmanagement review cannot provide meaningful assessment of customer support capabilities without access to client feedback or service quality metrics.

Trading Experience Analysis

Platform stability, execution quality, and user interface assessment cannot be adequately performed. Insufficient information about the trading infrastructure and client interface systems creates this limitation. Asset management platforms typically provide clients with portfolio access, transaction capabilities, and performance monitoring tools. Specific details about this provider's technological capabilities are not available however.

Order execution quality, platform reliability, and system performance metrics are not disclosed in current documentation. The absence of technical specifications and performance data limits client ability to assess the operational efficiency and reliability of the service platform.

Mobile accessibility, platform features, and user interface design are also not detailed in available materials. Modern asset management services increasingly rely on digital platforms to serve clients effectively. This makes platform quality a crucial evaluation factor.

The lack of specific information about trading experience and platform capabilities represents a significant limitation in this Assetmanagement review. It prevents comprehensive assessment of operational quality.

Trust Factor Analysis

Trust assessment proves particularly challenging due to the absence of regulatory information, safety measures, and transparency disclosures. Professional asset management services typically operate under strict regulatory oversight, maintain segregated client funds, and provide comprehensive disclosure about their operations and risk management procedures.

The lack of specific regulatory jurisdiction information raises significant concerns about oversight and client protection measures. Regulated asset management providers typically display their regulatory status prominently and provide detailed information about client fund protection and operational oversight.

Company transparency, operational history, and industry reputation cannot be adequately assessed based on available information. The absence of detailed corporate information and regulatory disclosures represents a significant red flag for potential clients seeking trustworthy asset management services.

This trust factor evaluation remains incomplete and concerning without verifiable regulatory status and transparency measures.

User Experience Analysis

Overall user satisfaction and service quality assessment cannot be performed. The absence of client feedback, testimonials, and user experience data creates this limitation. Professional asset management services typically maintain high client satisfaction standards and provide transparent communication about service quality and client outcomes.

Interface design, service accessibility, and client onboarding processes are not detailed in available documentation. The registration and verification procedures, fund management processes, and ongoing client communication standards cannot be evaluated based on current information.

Common client concerns, service limitations, and improvement areas are not identified in available materials. Potential clients cannot assess the practical aspects of engaging with the service provider without access to user feedback and experience data.

The absence of user experience information significantly limits the value of this Assetmanagement review for potential clients seeking practical service assessment.

Conclusion

This Assetmanagement review reveals a concerning lack of transparent information about operational details, regulatory status, and service conditions. The platform appears to offer diverse asset management services across multiple investment categories including real estate, stocks, bonds, and alternative investments. The absence of specific operational information raises significant concerns about transparency and client protection however.

The service may be suitable for investors seeking professional asset management solutions. It particularly targets those interested in diversified portfolio management across multiple asset classes. The lack of detailed information about account conditions, regulatory oversight, and service terms makes it difficult to recommend the platform without additional due diligence however.

Potential clients should request comprehensive documentation about regulatory status, fee structures, service terms, and operational procedures before engaging with the platform. The absence of transparent disclosure in this review highlights the importance of thorough investigation before committing to any asset management service.