Alvexo 2025 Review: Everything You Need to Know

Executive Summary

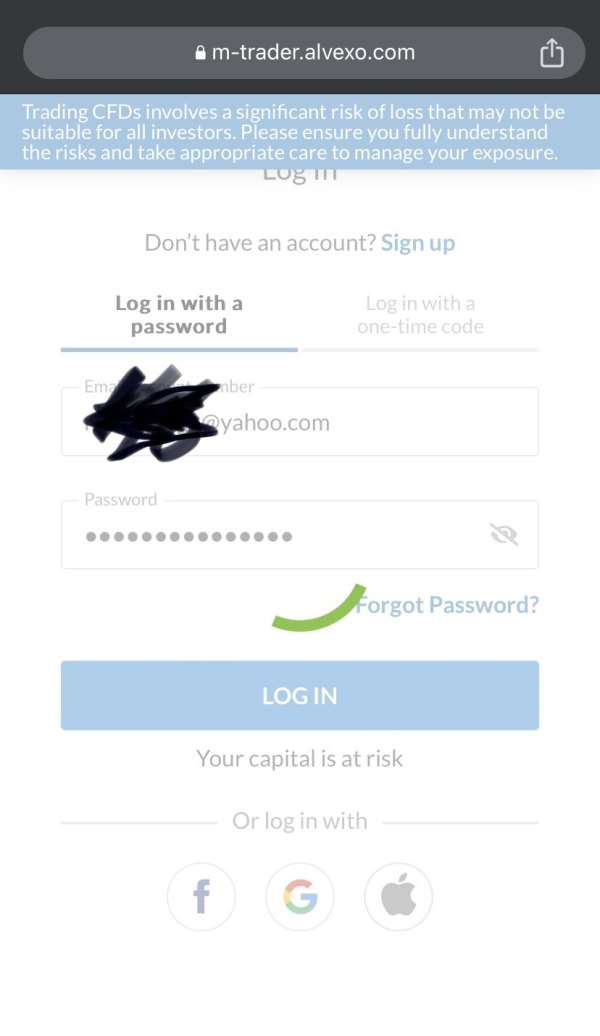

This Alvexo review shows a well-regulated forex broker that has built itself as a complete trading platform since 2014. VPR Safe Financial Group Limited runs Alvexo and combines the skills of market experts with modern technology to provide trading and investment services across many asset types. The broker stands out with its CySEC regulation under license number 236/14. This ensures it follows strict European standards.

Two key features make Alvexo different in the competitive forex world. First, market experts and high-tech professionals built and run the platform, bringing both trading skills and technology innovation to their services. Second, Alvexo focuses on trader education through complete webinars and live trading events. This makes it appealing to traders who want to improve their skills while trading.

The platform serves both new and experienced traders through its browser-based Alvexo Web Trader. This trader offers fast execution, advanced charting abilities, and smart trading tools. With support for forex, cryptocurrency, and CFD trading, Alvexo positions itself as a flexible broker. It suits traders looking to diversify their investment portfolios across different asset types.

Important Notice

Traders should know that Alvexo operates under different regulatory frameworks depending on the region. Users must select the right trading platform based on their location and local regulations. The main entity discussed in this review operates under CySEC regulation in Cyprus, but services and conditions may vary for clients in different areas.

This Alvexo review is based on currently available information and does not include real-time user feedback or live market data. Future traders should do additional research and consider their individual trading needs before making any decisions. Trading CFDs involves significant risk of loss and may not be suitable for all investors.

Rating Overview

Broker Overview

Alvexo appeared in the forex trading landscape in 2014. Market veterans and high-tech professionals founded it through a strategic combination. This unique founding team composition reflects the broker's dual focus on trading expertise and technology innovation. VPR Safe Financial Group Limited operates Alvexo and has positioned itself as a complete trading and investment service provider. The company offers traders what they describe as "the best opportunity for success" in the financial markets.

The broker's business model centers on providing multi-asset trading abilities combined with strong educational resources. Alvexo's approach emphasizes not just helping trades happen, but also empowering traders through knowledge and smart tools. This philosophy is clear in their commitment to offering webinars and live trading events that serve traders across all experience levels. These range from complete beginners to seasoned professionals.

Alvexo operates mainly through its own Alvexo Web Trader platform. This is a browser-based solution designed for accessibility and functionality. The platform supports trading across multiple asset classes including forex pairs, cryptocurrencies, and contracts for difference. The broker maintains its regulatory standing through the Cyprus Securities & Exchange Commission. It operates under license number 236/14, which subjects it to the commission's thorough oversight and strict compliance regulations. This regulatory framework provides traders with important protections and ensures the broker follows European financial services standards.

Regulatory Standing: Alvexo operates under the supervision of the Cyprus Securities and Exchange Commission with license number 236/14 and company registration number HE 322134. This regulatory framework ensures the broker complies with European financial services directives and provides client protection measures standard across CySEC-regulated entities.

Deposit and Withdrawal Methods: Specific information regarding deposit and withdrawal options is not detailed in available materials. Future traders must contact the broker directly for complete payment method information.

Minimum Deposit Requirements: The minimum deposit amount required to open an account with Alvexo is not specified in current available documentation.

Promotional Offers: Details regarding bonus programs or promotional offers are not provided in the available information sources.

Tradeable Assets: Alvexo supports trading across multiple asset classes, with confirmed availability of forex currency pairs, cryptocurrency trading, and contracts for difference. This multi-asset approach allows traders to diversify their portfolios within a single platform.

Cost Structure: Specific information regarding spreads, commissions, and other trading costs is not detailed in the available materials. Traders should ask Alvexo directly for current pricing information and fee structures.

Leverage Options: Leverage ratios and margin requirements are not specified in the current information sources.

Platform Selection: The primary trading platform is the Alvexo Web Trader, a browser-based solution featuring advanced charting abilities, smart trading tools, and one-click order processing functionality. It is designed to serve both new and experienced traders.

Geographic Restrictions: Specific regional limitations are not detailed in available materials.

Customer Support Languages: Information regarding supported languages for customer service is not available in current sources.

This Alvexo review highlights the need for future traders to obtain additional details directly from the broker regarding specific terms and conditions.

Account Conditions Analysis

The available information regarding Alvexo's account conditions presents a significant gap that potential traders should address through direct contact with the broker. While the platform clearly serves both new and experienced traders, the specific account types, their features, and related requirements are not detailed in current public materials.

Without access to complete account information, this Alvexo review cannot provide definitive analysis of minimum deposit requirements, account tier structures, or special account features such as Islamic accounts for traders requiring Sharia-compliant trading conditions. The absence of this basic information in available materials suggests that Alvexo may provide customized account solutions or that detailed terms are disclosed during the account opening process.

The broker's regulatory standing under CySEC license 236/14 does provide assurance that whatever account conditions are offered must comply with European financial services standards. This includes client money protection and fair trading practices. However, future traders should prioritize obtaining detailed account information, including any fees, minimum balance requirements, and account-specific features before committing to the platform.

The lack of publicly available account condition details represents a transparency concern that potential clients should address through direct communication with Alvexo's representatives. This approach would allow traders to understand the full scope of account options and make informed decisions based on their individual trading needs and capital requirements.

Alvexo demonstrates strong abilities in providing trading tools and educational resources. The company earns recognition for its complete approach to trader support. The platform's Alvexo Web Trader serves as the foundation for its tool offering, featuring advanced charting abilities and smart trading tools designed to meet the needs of traders across experience levels.

The browser-based platform design ensures accessibility without requiring software downloads, while still delivering professional-grade functionality including one-click order processing and fast execution abilities. The advanced charting tools provide traders with technical analysis abilities essential for informed trading decisions across forex, cryptocurrency, and CFD markets.

Alvexo's educational commitment stands out through its structured webinar program and live trading events. These sessions are conducted by Alvexo analysts and cover trading topics spanning all experience levels, from basic concepts for beginners to advanced strategies for experienced traders. This educational approach demonstrates the broker's investment in trader development beyond simple transaction help.

The combination of smart trading tools with complete educational resources creates a supportive environment for trader growth and success. However, specific details regarding research and analysis resources, automated trading support, or additional analytical tools are not provided in available materials. This limits the complete assessment of the platform's full abilities.

While the confirmed tools and educational offerings represent solid value, traders seeking specific analytical resources or automated trading abilities should ask Alvexo directly to understand the complete scope of available tools and resources.

Customer Service and Support Analysis

The evaluation of Alvexo's customer service abilities faces limitations due to insufficient detail in available materials regarding support channels, response times, and service quality metrics. This gap in information represents a significant consideration for potential traders, as customer support quality often proves crucial during trading activities and account management.

Without specific information about available customer service channels such as live chat, phone support, email assistance, or help desk ticketing systems, this review cannot provide definitive assessment of Alvexo's support accessibility. Similarly, the absence of data regarding support availability hours, multilingual abilities, or average response times prevents complete evaluation of service efficiency.

The broker's regulatory standing under CySEC does imply certain standards for client communication and complaint handling procedures. European financial services regulations typically require regulated entities to maintain appropriate customer service standards. However, the specific implementation and quality of these services remain unclear from available sources.

Future traders should prioritize evaluating Alvexo's customer support abilities through direct interaction before committing significant funds. Testing response times, assessing the knowledge level of support staff, and understanding available communication channels would provide valuable insights into the quality of ongoing support they can expect.

The lack of publicly available information about customer service abilities represents an area where Alvexo could improve transparency. Support quality often influences trader satisfaction and platform loyalty in the competitive forex brokerage market.

Trading Experience Analysis

The assessment of Alvexo's trading experience relies mainly on the confirmed abilities of the Alvexo Web Trader platform. Complete performance metrics and user experience data are not available in current materials. The browser-based platform design suggests accessibility and convenience, eliminating the need for software downloads while promising professional trading functionality.

The platform's emphasis on fast execution and one-click order processing indicates attention to trading efficiency. This is crucial for active traders and those trading in volatile markets. The advanced charting abilities provide essential technical analysis tools, supporting informed trading decisions across the supported asset classes of forex, cryptocurrencies, and CFDs.

However, critical trading experience factors such as platform stability during high volatility periods, actual execution speeds, order slippage rates, and system uptime statistics are not detailed in available information. These performance metrics significantly impact real-world trading success and trader satisfaction.

The absence of specific information regarding mobile trading abilities represents another gap. Mobile access has become increasingly important for modern traders who need platform access across different devices and locations. Similarly, details about trading environment features such as market depth, order types, and risk management tools are not completely covered.

This Alvexo review emphasizes that while the platform appears to offer solid basic trading functionality, future traders should test the platform thoroughly through demo accounts or initial small trades to evaluate actual trading experience quality before committing substantial capital.

Trust Factor Analysis

Alvexo's trust credentials center on its regulatory standing with the Cyprus Securities and Exchange Commission. The company operates under license number 236/14 with company registration number HE 322134. CySEC regulation provides significant credibility as the commission is known for thorough oversight and strict compliance requirements. This subjects Alvexo to European financial services standards and client protection measures.

The broker's establishment in 2014 by market veterans and high-tech professionals adds to its credibility profile. This suggests experienced leadership with both trading expertise and technology abilities. This founding team composition indicates serious intent to build a sustainable, professional trading platform rather than a short-term operation.

However, several trust-related factors lack detailed information in available materials. Specific client fund protection measures, segregated account policies, and financial safeguards beyond basic regulatory requirements are not detailed. Similarly, information about the broker's financial backing, insurance coverage, or additional security measures is not available for evaluation.

The absence of detailed information regarding company transparency, such as published financial statements, management team details, or corporate governance practices, represents a limitation in fully assessing trustworthiness. Additionally, no information is available regarding the broker's handling of negative events, complaint resolution procedures, or regulatory compliance history.

While CySEC regulation provides a solid foundation for trust, future traders should consider conducting additional research regarding fund safety measures and corporate transparency before committing significant capital to the platform.

User Experience Analysis

The evaluation of Alvexo's user experience faces significant limitations due to insufficient detail in available materials regarding actual user feedback, interface design specifics, and operational processes. While the platform is described as serving both new and experienced traders, the specific design elements and usability features that support this broad appeal are not detailed.

The browser-based Alvexo Web Trader platform suggests convenience and accessibility. It potentially offers good user experience through elimination of software installation requirements. The one-click order processing feature indicates attention to trading efficiency and user convenience, which typically contributes to positive user experience.

However, critical user experience elements such as interface design quality, navigation ease, registration and verification process efficiency, and overall platform responsiveness are not described in available sources. These factors significantly impact day-to-day trading satisfaction and platform adoption success.

The confirmed user base spanning new to experienced traders suggests the platform achieves reasonable usability across different skill levels. However, without specific user feedback or detailed interface descriptions, the mechanisms enabling this broad appeal remain unclear. Similarly, information about common user complaints, platform limitations, or areas requiring improvement is not available.

The absence of complete user experience information represents a significant gap that future traders should address through demo account testing and direct platform evaluation before making trading commitments.

Conclusion

This Alvexo review reveals a regulated forex broker with solid foundational credentials and a focus on trader education. However, significant information gaps limit complete evaluation. Alvexo's CySEC regulation under license 236/14 provides important credibility and client protection, while the broker's educational commitment through webinars and live trading events demonstrates value beyond simple transaction help.

The platform appears most suitable for traders who value educational resources and regulatory compliance, particularly those seeking to develop their trading skills through structured learning programs. The multi-asset trading abilities across forex, cryptocurrencies, and CFDs offer portfolio diversification opportunities within a single regulated platform.

However, the lack of detailed information regarding account conditions, customer support specifics, and complete trading costs represents significant limitations. Future traders should prioritize obtaining complete details about fees, account requirements, and support abilities before committing capital. The absence of user feedback and detailed performance metrics also requires thorough demo testing to evaluate actual trading experience quality.