Is Ozbey safe?

Business

License

Is Ozbey Safe or Scam?

Introduction

Ozbey is a forex brokerage based in Turkey, offering a range of trading services to clients globally. As the forex market continues to expand, traders are increasingly drawn to platforms like Ozbey for their potential to generate profits. However, with the rise of online trading, the risk of encountering untrustworthy brokers has also increased. Therefore, it is crucial for traders to carefully evaluate the legitimacy and safety of any forex broker before committing their funds. This article aims to investigate whether Ozbey is a safe trading platform or a potential scam. To do this, we will analyze its regulatory status, company background, trading conditions, customer safety measures, user experiences, and overall risk profile.

Regulation and Legitimacy

One of the most critical factors in determining whether a broker is safe is its regulatory status. A regulated broker is subject to oversight by a financial authority, which helps ensure that it operates fairly and transparently. Unfortunately, Ozbey is not properly regulated, which raises significant concerns about its legitimacy.

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| None | N/A | Turkey | Unregulated |

The lack of regulation means that Ozbey does not have to adhere to the stringent requirements set by regulatory bodies, potentially exposing traders to higher risks. Without oversight, there are no guarantees regarding the safety of client funds or the fairness of trading practices. Historically, unregulated brokers have been associated with various compliance issues, including the mismanagement of client funds and manipulation of trading conditions. Therefore, the absence of a regulatory framework around Ozbey raises a red flag for potential investors.

Company Background Investigation

Ozbey was established in 1992 and has been operating primarily in Turkey. While the company claims to offer a variety of financial instruments, including forex, CFDs, commodities, and indices, its lack of regulatory oversight significantly diminishes its credibility. The ownership structure of Ozbey is not transparently disclosed, which makes it difficult for potential clients to assess the accountability of its management.

The management team appears to have experience in the financial markets, but specific details about their backgrounds and qualifications are scarce. This lack of transparency can be concerning for traders who value clear information about the companies they choose to work with. A company that does not openly share its ownership and management details may not have the best interests of its clients at heart, further questioning whether Ozbey is safe for trading.

Trading Conditions Analysis

When evaluating a broker's safety, it is essential to consider its trading conditions, including fees and spreads. Ozbey's overall fee structure is not well-documented, which can lead to unexpected costs for traders.

| Fee Type | Ozbey | Industry Average |

|---|---|---|

| Major Currency Pair Spread | Unknown | 1.0 - 2.0 pips |

| Commission Model | Not Specified | Varies |

| Overnight Interest Range | Unknown | 0.5% - 1.5% |

The lack of clear information about trading costs raises concerns about potential hidden fees that could affect profitability. Traders should be wary of brokers that do not provide transparent fee structures, as this can often lead to unexpected financial burdens. Furthermore, if Ozbey's spreads are significantly higher than the industry average, it may not be a competitive option for traders seeking low-cost trading opportunities.

Client Fund Safety

The safety of client funds is paramount when assessing whether a broker is safe. Ozbey does not appear to have robust measures in place to ensure the security of client funds. There is no mention of segregated accounts, which are essential for protecting client deposits from being used for operational expenses. Furthermore, the absence of investor protection schemes means that traders may not be compensated in the event of a broker failure.

The lack of insurance for clients further exacerbates these concerns. In regulated environments, brokers are often required to provide some level of insurance to protect client funds. However, since Ozbey operates without regulation, it is not obligated to follow such protocols. This raises significant concerns about the safety of funds deposited with Ozbey.

Customer Experience and Complaints

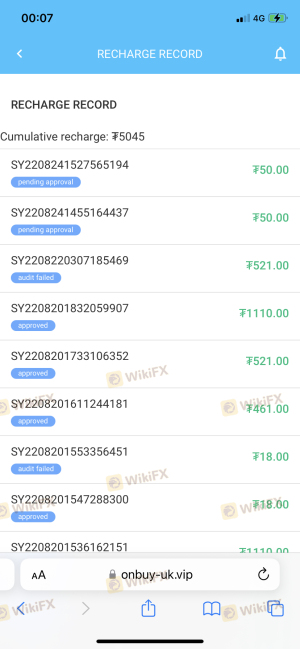

Customer feedback plays a crucial role in evaluating a broker's reliability. Unfortunately, there are limited reviews available for Ozbey, and those that exist often highlight issues related to withdrawal difficulties and poor customer service.

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Issues | High | Slow response |

| Poor Customer Support | Medium | Inconsistent |

Common complaints include long waiting times for withdrawals, which can be a significant red flag for any broker. A broker that delays or complicates the withdrawal process may be attempting to retain client funds longer than necessary. Additionally, the inconsistency in customer service responses indicates a lack of professionalism and accountability, further questioning whether Ozbey is safe for traders.

Platform and Trade Execution

An effective trading platform is essential for a positive trading experience. Ozbey does not utilize popular platforms like MetaTrader 4 or MetaTrader 5, which are industry standards for their reliability and advanced features. The absence of such platforms may hinder traders' ability to execute trades efficiently.

The quality of trade execution is another critical aspect to consider. Reports of slippage and order rejections can create a frustrating trading experience. Without transparent information regarding execution quality, traders may find themselves at a disadvantage, raising further concerns about whether Ozbey is safe for trading.

Risk Assessment

Using Ozbey carries inherent risks, primarily due to its lack of regulation and transparency.

| Risk Category | Risk Level | Brief Explanation |

|---|---|---|

| Regulatory Risk | High | Unregulated broker |

| Financial Risk | High | No investor protection |

| Operational Risk | Medium | Poor customer service |

The absence of regulatory oversight significantly increases the risk of fraud and mismanagement. Additionally, the unclear fee structure and withdrawal issues further compound the financial risks associated with trading on this platform. Traders should carefully consider these factors before deciding to engage with Ozbey.

Conclusion and Recommendations

In conclusion, while Ozbey presents itself as a forex broker with various trading options, the evidence suggests that it is not a safe platform for traders. The lack of regulation, transparency issues, and concerning customer feedback raise significant red flags.

If you are considering trading with Ozbey, it is advisable to exercise caution and thoroughly assess your risk tolerance. For traders seeking safer alternatives, consider well-regulated brokers with transparent practices and positive customer reviews. Overall, it is prudent to prioritize safety and regulatory compliance when selecting a forex broker, as this can significantly impact your trading experience and financial security.

Is Ozbey a scam, or is it legit?

The latest exposure and evaluation content of Ozbey brokers.

Ozbey Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

Ozbey latest industry rating score is 1.56, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.56 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.