Is YORK FINANCE safe?

Business

License

Is York Finance Safe or a Scam?

Introduction

York Finance is a financial services provider that positions itself in the forex market, offering a range of trading and investment solutions. As the popularity of forex trading continues to grow, so does the number of brokers entering the market. However, not all brokers are created equal, and traders need to exercise caution when selecting a broker. This is particularly true for York Finance, as concerns about its legitimacy have surfaced in various online forums and reviews. In this article, we will investigate whether York Finance is safe or a scam by examining its regulatory status, company background, trading conditions, client fund security, customer experiences, platform performance, and overall risk profile.

Regulation and Legitimacy

The regulatory status of a broker is one of the most critical factors in determining its safety. Trading with a regulated broker generally provides a layer of protection for traders, ensuring that the broker adheres to certain standards of conduct. In the case of York Finance, it has been noted that the broker is not regulated by any top-tier financial authority. This lack of regulation raises significant red flags regarding its legitimacy and the safety of client funds.

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| None | N/A | N/A | Not Regulated |

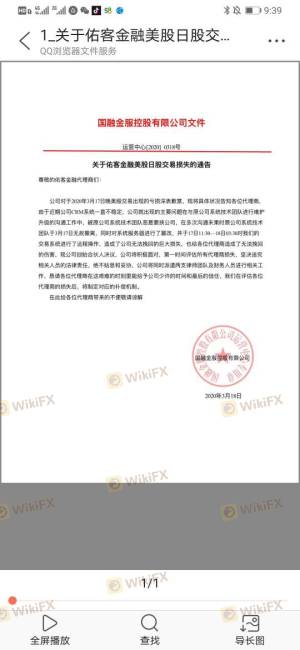

The absence of regulation from reputable authorities such as the FCA (Financial Conduct Authority) or ASIC (Australian Securities and Investments Commission) means that York Finance does not have to comply with strict operational guidelines. This lack of oversight can lead to potential issues, including the mishandling of client funds and unfair trading practices. Furthermore, York Finance has been blacklisted by certain financial regulators, which further solidifies the notion that it may not be a safe option for traders. Therefore, the question remains: Is York Finance safe? The evidence suggests otherwise.

Company Background Investigation

York Finance has a relatively obscure company background, with limited information available about its history and ownership structure. The lack of transparency regarding its origins and management team raises additional concerns about its reliability. Typically, reputable brokers will provide detailed information about their founding, ownership, and management team to instill confidence in potential clients. However, York Finance falls short in this regard, making it difficult for traders to assess its credibility.

Moreover, the management team behind York Finance appears to lack significant experience in the financial services industry. Experienced leadership is crucial for a brokerage, as it directly impacts the quality of service and trustworthiness. The absence of a well-established team may indicate that the broker is not equipped to handle client needs effectively. In conclusion, the lack of transparency regarding York Finance's background and management further complicates the question of whether it is safe.

Trading Conditions Analysis

When evaluating a forex broker, the trading conditions it offers are of paramount importance. York Finance advertises competitive spreads and various account types, but a closer look reveals a potentially problematic fee structure. Traders have reported hidden fees and unexpected charges, which can significantly affect overall trading profitability.

| Fee Type | York Finance | Industry Average |

|---|---|---|

| Major Currency Pair Spread | Variable | 1-2 pips |

| Commission Model | Unknown | 0-0.5% |

| Overnight Interest Range | High | Low to Moderate |

The spread for major currency pairs is often variable, which can lead to higher costs during volatile market conditions. Additionally, the commission model is unclear, which can create confusion for traders when calculating their overall expenses. This lack of clarity raises concerns about the broker's commitment to transparency and fair trading practices. Thus, potential clients must consider whether they are willing to engage with a broker that may impose unexpected costs.

Client Fund Security

The safety of client funds is a crucial aspect of any forex broker's operations. York Finance has not demonstrated robust measures to protect client funds, which is a significant concern for potential traders. The absence of segregated accounts, where client funds are kept separate from the broker's operational funds, increases the risk of loss in the event of financial difficulties faced by the broker. Additionally, York Finance does not offer investor protection schemes, which are typically provided by regulated brokers to safeguard client deposits.

Furthermore, there have been reports of withdrawal issues, where clients have faced delays or outright refusals when attempting to access their funds. This history of complaints raises serious questions about the broker's integrity and the safety of client investments. Therefore, it is essential to ask: Is York Finance safe? The evidence suggests that potential clients should exercise extreme caution when considering this broker.

Customer Experience and Complaints

Customer feedback is an invaluable resource for assessing the reliability of a broker. In the case of York Finance, numerous complaints have surfaced regarding its customer service and overall trading experience. Many users have reported difficulties in communication, slow response times, and a lack of support when issues arise.

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Issues | High | Poor |

| Customer Service | Medium | Average |

| Misleading Information | High | Poor |

Common complaints include withdrawal issues, where traders have experienced significant delays or have been unable to access their funds altogether. The company's response to these complaints has often been inadequate, further exacerbating customer dissatisfaction. These patterns of negative feedback raise serious concerns about whether York Finance is a trustworthy broker.

Platform and Trade Execution

The trading platform offered by a broker plays a crucial role in the overall trading experience. Traders expect a stable and user-friendly platform that allows for efficient trade execution. In the case of York Finance, reviews indicate that the platform may not meet these expectations. Users have reported instances of slippage, order rejections, and overall performance issues.

The execution quality is particularly critical in the fast-paced forex market, where even minor delays can lead to significant losses. If traders frequently experience problems with order execution, it raises concerns about the broker's reliability and the potential for market manipulation. Therefore, traders should carefully consider whether they want to engage with a broker that may compromise their trading experience.

Risk Assessment

Using York Finance as a trading platform comes with inherent risks. The lack of regulation, transparency issues, and negative customer feedback contribute to a high-risk profile for this broker.

| Risk Category | Risk Level (Low/Medium/High) | Brief Description |

|---|---|---|

| Regulatory Compliance | High | No regulation |

| Fund Security | High | Poor client fund protection |

| Customer Support | Medium | Inadequate response to complaints |

Given these factors, potential traders must weigh the risks associated with using York Finance against their trading goals. It is advisable to consider alternative brokers that offer more robust regulatory oversight and better customer support.

Conclusion and Recommendations

In conclusion, the investigation into York Finance raises significant concerns about its safety and legitimacy. The lack of regulation, transparency issues, and a history of customer complaints suggest that it may not be a safe choice for traders. Therefore, the answer to the question, Is York Finance safe? appears to be a resounding "no."

For traders seeking a reliable forex broker, it is recommended to explore alternatives that are regulated by reputable authorities and have a proven track record of customer satisfaction. Brokers such as IG, OANDA, or Forex.com may offer safer trading environments with better client protections. In summary, while York Finance may present appealing trading opportunities, the associated risks far outweigh the potential benefits.

Is YORK FINANCE a scam, or is it legit?

The latest exposure and evaluation content of YORK FINANCE brokers.

YORK FINANCE Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

YORK FINANCE latest industry rating score is 1.56, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.56 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.