Is FXVIP safe?

Business

License

Is FXVIP Safe or Scam?

Introduction

FXVIP is a foreign exchange broker that has positioned itself within the retail trading market since its establishment in 2005. The broker claims to provide a user-friendly trading platform, access to various financial instruments, and a range of account types. However, the foreign exchange market is rife with potential risks, and traders must exercise caution when selecting a broker. Due to the prevalence of scams in the industry, it is essential to conduct thorough due diligence. This article aims to assess the safety and legitimacy of FXVIP by examining its regulatory status, company background, trading conditions, client fund safety, and customer experiences. The analysis is based on a review of multiple sources, including user feedback, regulatory information, and industry assessments.

Regulation and Legitimacy

Regulatory oversight is a critical component of any broker's legitimacy. FXVIP operates under the ownership of Goldman Global Group, with its primary entity registered in Saint Vincent and the Grenadines. While it claims to be regulated by the International Financial Services Commission (IFSC) of Belize, there are significant concerns regarding the quality and credibility of this regulation.

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| IFSC | N/A | Belize | Not Verified |

The absence of a robust regulatory framework raises red flags for potential traders. Regulatory bodies such as the UKs Financial Conduct Authority (FCA) or the U.S. Commodity Futures Trading Commission (CFTC) provide more reliable oversight and protections for traders. The fact that FXVIP has been placed on various broker blacklists due to numerous complaints regarding withdrawal issues further complicates its credibility. Traders should approach FXVIP with caution, given its questionable regulatory status and history of non-compliance.

Company Background Investigation

FXVIP was founded by a team of foreign exchange experts with extensive experience in the financial markets. The broker's ownership structure involves multiple entities, including VIP Goldman Global Ltd. and Goldman Ltd., which are registered in offshore jurisdictions. While the company claims to have a solid foundation and operational history, the lack of transparency regarding its management team and corporate structure raises concerns.

The management team‘s professional backgrounds are not readily available, which limits the ability to assess their expertise and credibility. Transparency in company operations is vital for building trust with clients, and FXVIP’s failure to provide sufficient information about its executives may deter potential traders. This lack of disclosure is a common characteristic of brokers that may not prioritize client interests. Therefore, traders must consider these factors when evaluating whether FXVIP is safe for their trading activities.

Trading Conditions Analysis

FXVIP offers a variety of trading conditions, including leverage options and account types. However, potential traders should scrutinize the overall fee structure and any hidden costs that may not be immediately apparent. The broker's website claims competitive spreads and low commission rates, but many users report dissatisfaction with the actual trading conditions experienced.

| Fee Type | FXVIP | Industry Average |

|---|---|---|

| Major Currency Pair Spread | 1.5 pips | 1.0 pips |

| Commission Model | Variable | Fixed/Variable |

| Overnight Interest Range | High | Moderate |

Reports indicate that FXVIP may impose higher-than-average spreads and commissions, which could diminish profitability for traders. Additionally, the lack of clarity regarding overnight interest rates and other fees can lead to unexpected costs. Traders should be aware of these potential financial pitfalls and consider whether the trading conditions at FXVIP align with their trading strategies and risk tolerance.

Client Fund Safety

The safety of client funds is a primary concern for any trader. FXVIP claims to implement various measures to protect client funds, including segregated accounts and risk management protocols. However, the broker's regulatory status raises questions about the effectiveness of these measures.

Historical complaints about withdrawal issues and the reported blacklisting of FXVIP by regulatory authorities indicate potential vulnerabilities in their fund management practices. Without a solid regulatory framework to enforce fund protection, traders may find themselves at risk of losing their deposits. It is crucial for potential clients to assess these factors and determine whether FXVIP is safe before committing any capital.

Customer Experience and Complaints

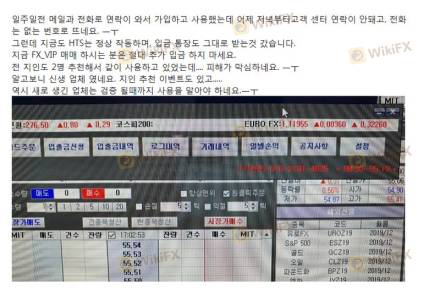

Customer feedback is a valuable indicator of a broker's reliability. Reviews of FXVIP reveal a mixed bag of experiences, with many users reporting issues related to withdrawals, poor customer service, and unfulfilled promises regarding trading conditions.

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Issues | High | Poor |

| Customer Support | Medium | Average |

| Trading Conditions | High | Poor |

Common complaints include difficulties in processing withdrawals, which have been a significant source of frustration for many traders. Users have reported that FXVIP often fails to respond adequately to their inquiries, leading to further dissatisfaction. These patterns suggest that FXVIP may not prioritize customer support and responsiveness, raising concerns about its overall reliability. Traders should weigh these experiences heavily when considering whether FXVIP is safe for their trading needs.

Platform and Trade Execution

The performance of a trading platform is crucial for the trading experience. FXVIP offers access to popular trading software like MetaTrader 4 and 5, but user reviews indicate varying levels of satisfaction regarding platform stability and execution quality.

Traders have reported instances of slippage and order rejections, which can significantly impact trading outcomes. Additionally, any signs of platform manipulation or unfair trading practices should be a cause for concern. A broker's ability to execute trades efficiently and transparently is a key factor in determining whether FXVIP is safe for traders.

Risk Assessment

Using FXVIP comes with inherent risks that potential traders should consider. The lack of robust regulation, combined with negative user experiences and withdrawal issues, suggests a higher risk profile for this broker.

| Risk Category | Risk Level (Low/Medium/High) | Brief Explanation |

|---|---|---|

| Regulatory Compliance | High | Limited oversight |

| Fund Security | High | Withdrawal issues |

| Customer Service | Medium | Inadequate support |

To mitigate these risks, traders should thoroughly research and consider alternative brokers with stronger regulatory backing and better customer reviews. Implementing strict risk management strategies and only investing what they can afford to lose will also help protect traders from potential losses.

Conclusion and Recommendations

In summary, the evidence suggests that FXVIP presents several red flags that warrant caution. The broker's questionable regulatory status, negative customer experiences, and withdrawal issues raise significant concerns about its legitimacy and safety. Traders should be particularly wary of committing funds to FXVIP without a thorough understanding of the associated risks.

For those seeking a more secure trading environment, it may be prudent to consider alternative brokers that are well-regulated and have established positive reputations within the trading community. Ultimately, the decision to trade with FXVIP should be made with careful consideration of the potential risks involved.

Is FXVIP a scam, or is it legit?

The latest exposure and evaluation content of FXVIP brokers.

FXVIP Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

FXVIP latest industry rating score is 1.56, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.56 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.