Activo Trade 2025 Review: Everything You Need to Know

Summary: Activo Trade has garnered mixed reviews from users and experts alike, highlighting both its competitive trading conditions and significant concerns regarding regulatory oversight. The broker offers a range of trading platforms and assets, but its lack of robust regulation raises red flags for potential investors.

Note: It is important to consider the varying regulatory statuses of Activo Trade's different entities, as this can significantly impact user experiences and protections. This review is based on a comprehensive analysis of multiple sources to ensure fairness and accuracy.

Rating Overview

How We Rated the Broker: Our ratings are based on a thorough analysis of user feedback, expert opinions, and factual data regarding the brokers services and performance.

Broker Overview

Founded in 2010, Activo Trade is a forex and CFD broker based in Spain, providing trading services to clients worldwide, excluding the U.S. and countries under OFAC sanctions. The broker offers access to popular trading platforms, including its proprietary Activo Trade platform, as well as MT4 and MT5. Clients can trade a diverse range of assets, including forex, stocks, indices, commodities, and cryptocurrencies. However, the absence of solid regulatory backing is a significant concern.

Detailed Section

Regulated Regions: Activo Trade operates primarily in Spain and claims to adhere to the MiFID regulations. However, it lacks a valid regulatory license from a recognized authority, leading to skepticism about its operations. According to WikiFX, the broker has a low regulatory score, indicating potential risks for traders.

Deposit/Withdrawal Currencies: Activo Trade supports deposits and withdrawals in major currencies such as EUR and USD. However, it does not appear to support cryptocurrency transactions for funding accounts, which may limit options for some traders.

Minimum Deposit: The minimum deposit requirements vary significantly based on the account type. For instance, the minimum deposit for a basic account is approximately €2,500, while higher-tier accounts require deposits of €3,500 to €10,000. This high threshold may deter novice traders looking to start with smaller amounts.

Bonuses/Promotions: There are currently no promotional bonuses or deposit incentives offered by Activo Trade, which is a common feature among many brokers to attract new customers.

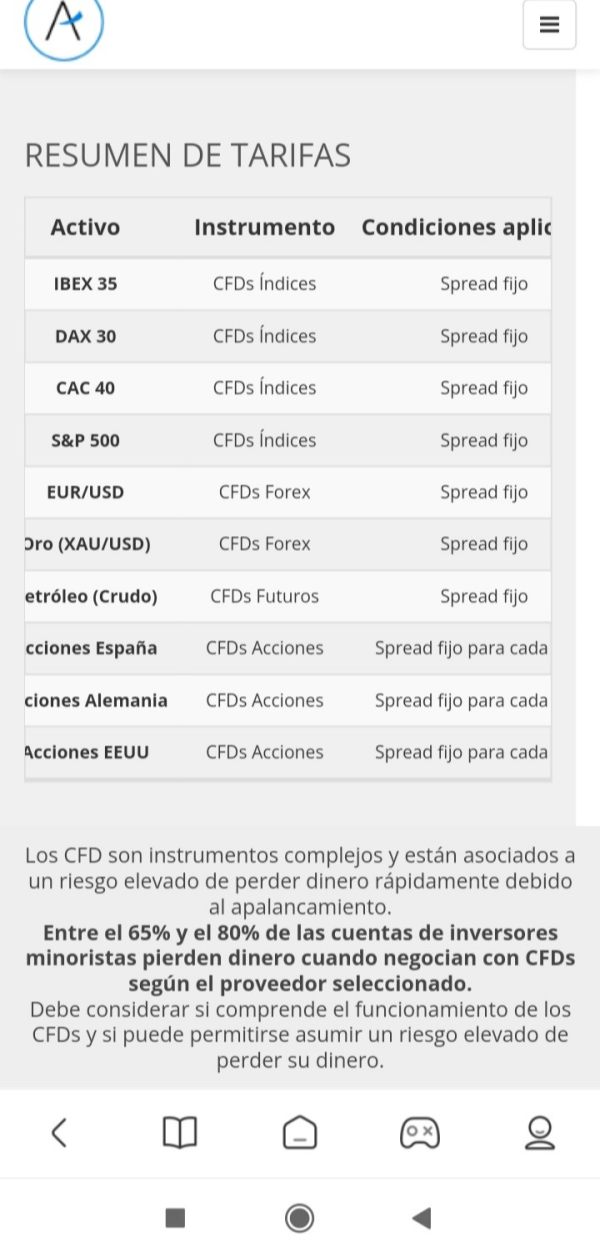

Available Asset Classes: Activo Trade boasts a wide selection of trading instruments, including over 30,000 assets ranging from forex pairs to commodities and stocks. However, the focus remains heavily on forex and CFDs, which may not cater to traders looking for a broader investment portfolio.

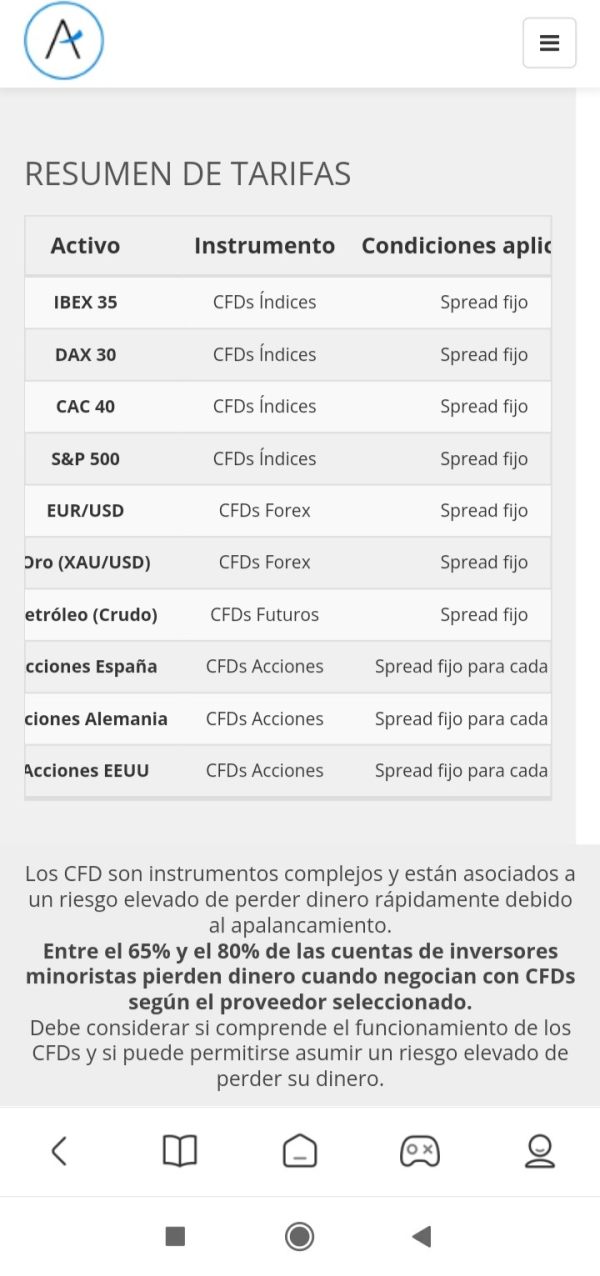

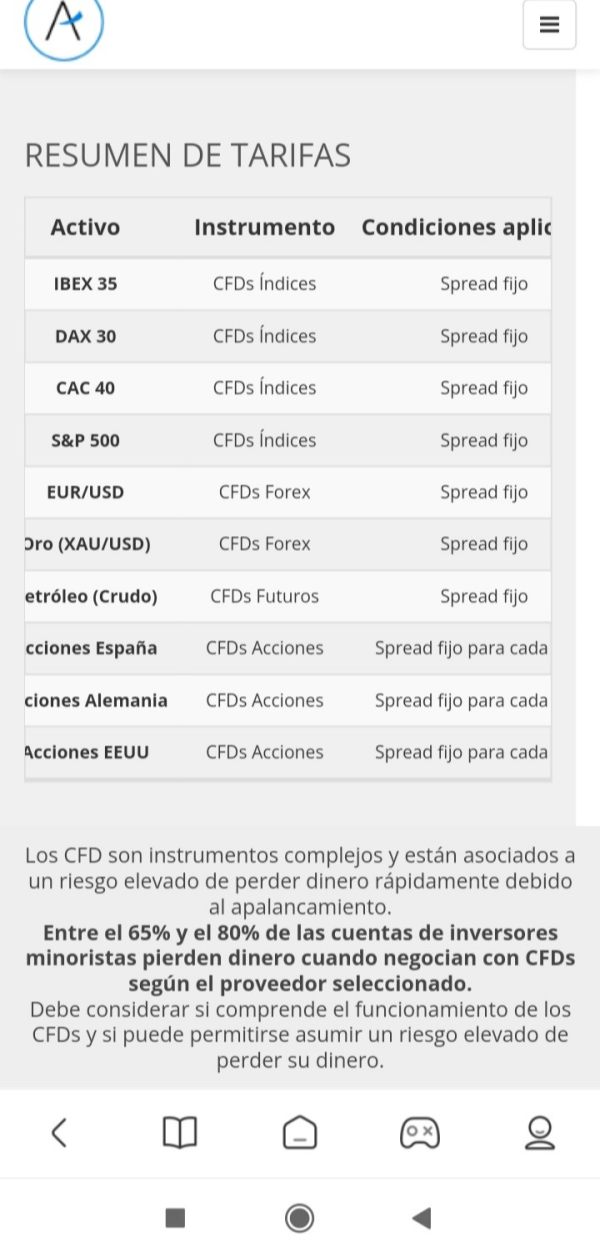

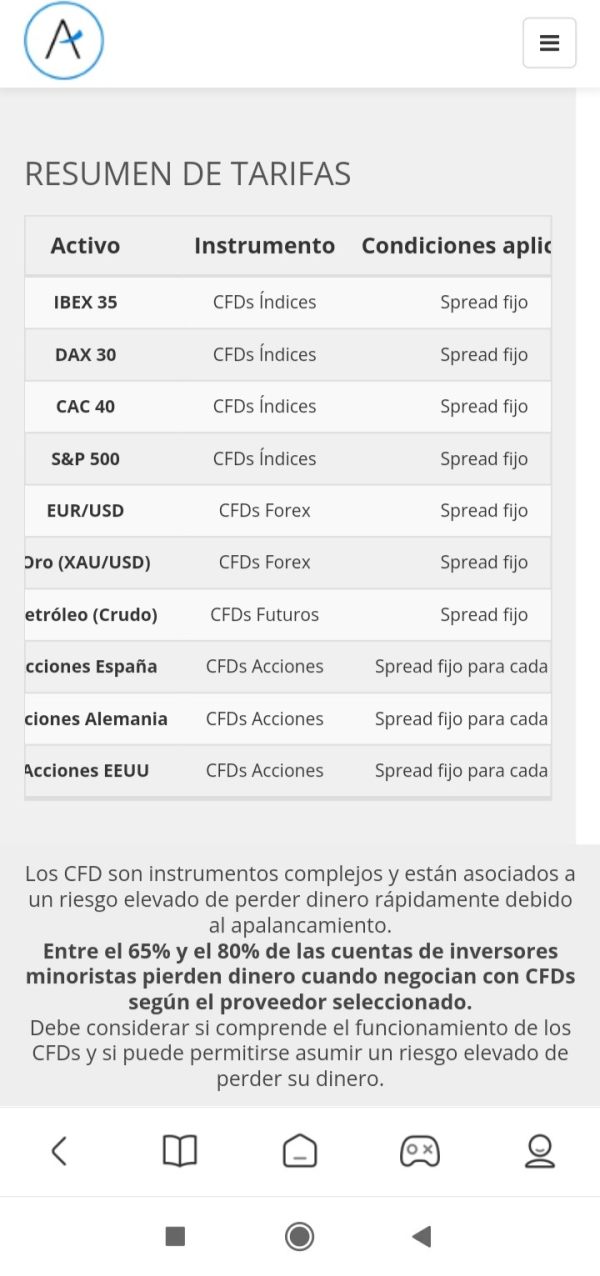

Costs (Spreads, Fees, Commissions): The broker claims to offer fixed spreads, but specific details are often vague. For instance, the spread for major currency pairs like EUR/USD starts at around 0.6 pips, while commissions for U.S. stocks can range from $0.015 per share, with a minimum charge of $8. According to Traders Union, trading costs can be considered moderate but vary based on account type and market conditions.

Leverage: Activo Trade offers leverage up to 1:30 for retail clients in Europe, which is standard. However, some reports suggest that higher leverage ratios may be available through its offshore entities, raising further questions about regulatory compliance and risk management.

Permitted Trading Platforms: Clients can trade using the Activo Trade platform, MT4, and MT5. Each platform offers various tools for analysis and execution, but the proprietary platform's features may not be as comprehensive as those found in MT4 and MT5.

Restricted Areas: Activo Trade does not provide services to clients in the U.S., Canada, Japan, and several other countries due to regulatory restrictions. This limitation can significantly affect potential clients seeking access to the broker's services.

Available Customer Service Languages: Customer support is available in multiple languages, including English and Spanish. However, the absence of 24/7 support may be a drawback for traders who require assistance outside of standard business hours.

Rating Overview (Revised)

Detailed Breakdown

Account Conditions (6.5): The high minimum deposit requirements may limit access for novice traders. However, the variety of account types caters to different trading styles.

Tools and Resources (7.0): The availability of multiple trading platforms, including MT4 and MT5, enhances the trading experience. However, the proprietary platform may lack some advanced features.

Customer Support (6.0): While customer service is available in multiple languages, the lack of 24/7 support may hinder assistance during critical trading hours.

Trading Setup (6.5): The trading setup is user-friendly, but the lack of clarity around costs and commissions can lead to confusion among traders.

Trustworthiness (4.0): The absence of robust regulatory oversight raises concerns about the safety of funds and the overall credibility of the broker.

User Experience (5.0): User experiences are mixed, with some praising the platform's usability while others express concerns over the broker's regulatory standing.

In conclusion, while Activo Trade offers a range of trading options and platforms, potential traders should exercise caution due to the broker's lack of robust regulation and high minimum deposit requirements. As always, thorough research and consideration of individual trading needs are essential before engaging with any broker.