Foryou 2025 Review: Everything You Need to Know

Summary

This Foryou review looks at a trading platform that offers financial services. Information about this broker is hard to find in most sources. Foryou says it provides services in the financial technology space, and it has mobile apps and customer service. Details about forex trading, rules, and trading conditions are not easy to find in available materials.

The platform seems to help users who want digital financial solutions. The exact types of trading tools and services need more research. Users should be careful and do their homework, since detailed information about trading conditions, rules, and how the company works is not available in current sources. This review gives an honest assessment based on available information and points out areas where more research is needed.

Important Notice

Regional Entity Differences: This review uses limited information about Foryou's operations. Different regional companies may exist with different rules and services. Users should check the rules and licenses in their area before using any services.

Review Methodology: This assessment uses available public information and user feedback sources. Since there is limited data about Foryou's trading services, some parts of this review may not show the complete picture. Potential users should do their own research and check all information.

Rating Framework

Broker Overview

Foryou seems to work in the financial services sector. Specific details about when it started and company background are not easy to find in current sources. The platform focuses on digital solutions, and it has mobile apps and customer service operations. The exact nature of their main business, especially forex and CFD trading services, is unclear from available information.

The company's structure and licenses are not clearly shown in accessible sources. This lack of clear regulatory information and complete service documentation creates problems for potential users who want to understand what Foryou offers. The platform seems to have some customer interaction abilities, as shown by review platforms and customer service references, but detailed information about trading infrastructure and financial service abilities needs more investigation.

Regulatory Status: Specific regulatory information is not detailed in available sources. Potential users should check licensing and compliance status on their own.

Deposit and Withdrawal Methods: Payment processing methods and procedures are not fully documented in current available materials.

Minimum Deposit Requirements: Specific account funding requirements are not clearly stated in accessible sources.

Bonuses and Promotions: Information about promotional offerings or incentive programs is not available in current documentation.

Tradeable Assets: The range of available trading instruments and asset classes is not clearly specified in available materials.

Cost Structure: Detailed information about spreads, commissions, and fee structures is not fully available.

Leverage Ratios: Specific leverage offerings and risk management parameters are not documented in current sources.

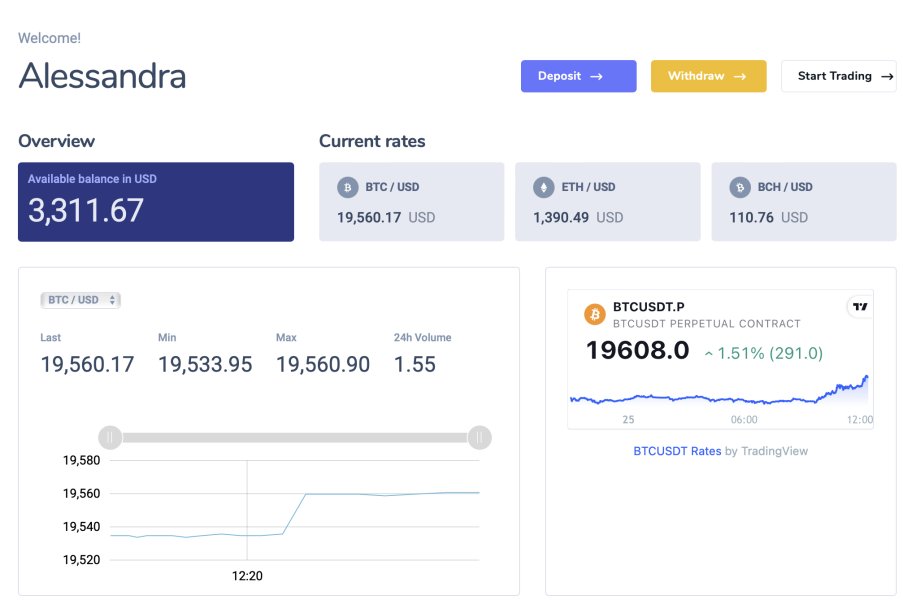

Platform Options: While mobile application presence is indicated, comprehensive platform specifications are not detailed.

Regional Restrictions: Geographic limitations and availability are not clearly specified in available documentation.

Customer Support Languages: Specific language support capabilities are not detailed in current sources.

This Foryou review highlights the significant information gaps that potential users should know about when considering this service provider.

Account Conditions Analysis

The account structure and conditions offered by Foryou remain mostly undocumented in available sources. This creates significant concerns for potential users. Unlike established forex brokers that typically provide clear information about account types, minimum deposits, and trading conditions, Foryou's account offerings are not clearly detailed.

Standard industry practices include offering multiple account tiers with different minimum deposits, spread structures, and feature sets. However, specific information about Foryou's account categories, whether they offer demo accounts, or what minimum funding requirements exist is not available in current documentation. This lack of transparency makes it difficult for traders to assess whether the broker's account conditions match their trading needs and capital requirements.

The absence of clear account condition information also raises questions about the platform's operational maturity and regulatory compliance. Established brokers typically provide comprehensive account documentation as part of their regulatory obligations and customer transparency commitments. Potential users should request detailed account information directly from Foryou and verify all conditions before putting in funds.

Without clear account structure information, this Foryou review cannot provide definitive guidance on whether their account offerings work for different trader profiles.

The trading tools and educational resources available through Foryou are not fully documented in available sources. This significantly impacts the platform's appeal to serious traders. Modern forex and CFD trading typically requires access to sophisticated analytical tools, market research, and educational materials to support informed decision-making.

Standard industry offerings include real-time charting packages, technical analysis indicators, economic calendars, market news feeds, and educational content ranging from beginner guides to advanced trading strategies. However, specific information about Foryou's tool suite, research capabilities, or educational resource library is not available in current documentation.

The mobile application presence suggests some level of technological development. Without detailed specifications about trading tools, analytical capabilities, or research support, it's impossible to assess the platform's competitiveness in this crucial area. Professional traders typically require comprehensive toolsets that may not be available or clearly documented with Foryou.

The lack of detailed information about available tools and resources represents a significant limitation for potential users who depend on comprehensive analytical support for their trading activities.

Customer Service and Support Analysis

Customer service capabilities appear to exist based on review platform presence. Detailed information about support quality, availability, and responsiveness is limited in available sources. The presence of customer reviews suggests some level of service interaction, though the scope and quality of support services require further investigation.

Industry-standard customer support typically includes multiple contact channels such as live chat, email, and telephone support, often with extended hours or 24/7 availability to accommodate global trading schedules. Multi-language support is also common among international brokers. However, specific information about Foryou's support channels, operating hours, or language capabilities is not detailed in current documentation.

The limited available customer feedback provides mixed signals about service quality. The sample size appears insufficient for comprehensive assessment. Without clear information about support infrastructure, response times, or service level commitments, potential users cannot reliably assess whether Foryou's customer service will meet their needs.

Effective customer support is crucial in financial services, particularly for trading platforms where technical issues or account problems require prompt resolution. The lack of detailed support information represents a significant concern for potential users.

Trading Experience Analysis

The trading experience offered by Foryou cannot be comprehensively assessed due to limited available information about platform capabilities, execution quality, and trading infrastructure. Modern forex and CFD trading requires reliable platform performance, competitive execution speeds, and robust technical infrastructure to support effective trading activities.

Key trading experience factors typically include platform stability, order execution speed, price accuracy, slippage management, and mobile trading capabilities. While some mobile application presence is indicated, detailed specifications about trading platform performance, execution quality, or technical reliability are not available in current sources.

Professional traders require platforms that can handle high-frequency trading, provide accurate real-time pricing, and execute orders reliably during volatile market conditions. Without detailed information about Foryou's trading infrastructure, execution capabilities, or platform specifications, potential users cannot assess whether the platform meets professional trading requirements.

The absence of comprehensive trading experience documentation makes it difficult for this Foryou review to provide meaningful guidance about platform suitability for different trading styles or experience levels.

Trust and Regulation Analysis

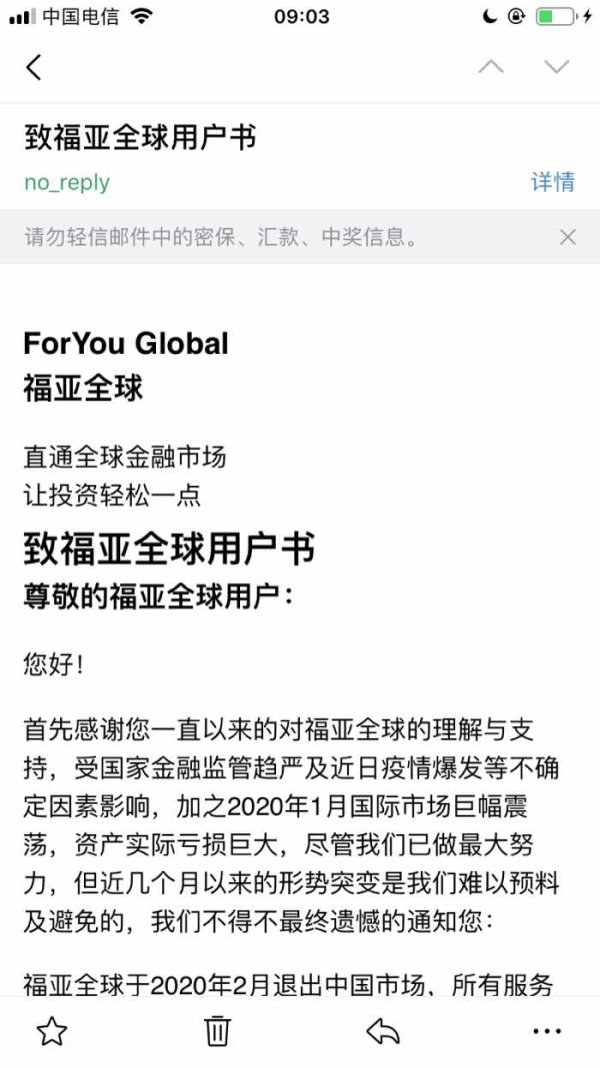

The regulatory status and trustworthiness of Foryou present significant concerns due to the lack of clear licensing information and regulatory compliance documentation in available sources. Regulatory oversight is crucial in forex and CFD trading, providing essential consumer protections and operational standards.

Established forex brokers typically hold licenses from recognized financial regulators such as the FCA, ASIC, CySEC, or other respected authorities. These licenses require compliance with strict capital requirements, segregated client fund arrangements, and operational transparency standards. However, specific regulatory information for Foryou is not documented in available sources.

The absence of clear regulatory status raises important questions about client fund protection, dispute resolution mechanisms, and operational oversight. Without regulatory supervision, traders may lack important protections and recourse options that are standard with properly licensed brokers.

Industry best practices include transparent disclosure of regulatory status, licensing numbers, and compliance arrangements. The lack of such information in Foryou's available documentation represents a significant trust and safety concern for potential users who require regulatory protection for their trading activities.

User Experience Analysis

User experience assessment for Foryou is limited by the scarcity of comprehensive user feedback and detailed platform information in available sources. The limited customer review presence suggests some user interaction, though the sample size and scope appear insufficient for thorough user experience evaluation.

Modern trading platforms typically prioritize user interface design, ease of navigation, account management functionality, and seamless transaction processing. However, specific information about Foryou's user interface design, platform usability, or customer journey optimization is not detailed in available documentation.

The registration and verification processes, which are crucial components of user experience in financial services, are not clearly documented. Similarly, information about deposit and withdrawal procedures, account management features, and overall platform navigation is not comprehensively available.

Without substantial user feedback or detailed platform specifications, it's challenging to assess whether Foryou provides a competitive user experience compared to established forex and CFD platforms. The limited available information suggests potential users should thoroughly test any services before committing significant resources.

Conclusion

This Foryou review reveals significant information gaps that potential users must carefully consider. While the platform appears to have some presence in the financial services space, the lack of comprehensive documentation about trading conditions, regulatory status, and operational capabilities presents substantial concerns.

The absence of clear regulatory information, detailed trading conditions, and transparent operational documentation suggests that Foryou may not meet the standards typically expected of established forex and CFD brokers. Potential users seeking reliable trading services should prioritize platforms with clear regulatory oversight, transparent operational practices, and comprehensive service documentation.

For traders requiring professional-grade services, established brokers with clear regulatory status and comprehensive service offerings may provide more suitable alternatives. Any consideration of Foryou's services should involve thorough due diligence and direct verification of all operational and regulatory claims.