AC Markets 2025 Review: Everything You Need to Know

Executive Summary

This AC Markets review shows big concerns about this forex broker. Traders should think carefully before they invest their money with this company. AC Markets (Europe) Ltd started in 2002 and says it works from Geneva, Switzerland, with more offices in Zurich. Many industry reports and user reviews show red flags about whether this broker is real and how it operates.

The broker says it follows CySEC rules under license number 350/17. It supports popular trading platforms like MetaTrader 4 (MT4) and MetaTrader 5 (MT5). Even though these credentials look professional, many monitoring services have marked AC Markets as possibly fake, and users report poor service and questionable business practices.

AC Markets requires a very high minimum deposit of €10,000. This makes it hard for average retail traders to use their services. This high threshold, plus concerning user reviews and fraud reports, makes AC Markets a high-risk choice that only works for sophisticated investors who can handle big risks. WikiFX monitor reports show the broker gets few positive reviews but many exposure complaints from users.

Important Notice

AC Markets works in different countries, and rules may be very different between regions. This review uses public data, user feedback, and third-party monitoring services from 2025. Since there are conflicting reports about the broker's regulatory status and fraud allegations, potential clients should be extremely careful and check all broker claims independently.

Traders should know that regulatory oversight and consumer protections can be very different depending on where they live and which AC Markets entity they work with. This review brings together available information but should not replace personal research and professional financial advice.

Rating Framework

Broker Overview

AC Markets started in the forex market in 2002. The company calls itself an established player in European trading. AC Markets (Europe) Ltd has its main headquarters in Geneva, Switzerland, and keeps additional offices in Zurich. This Swiss presence might suggest the company follows the country's strong financial rules, but later investigations have raised questions about whether these operations are real.

The broker's business focuses on giving access to global financial markets through electronic trading platforms. AC Markets mainly targets forex trading services. The company markets itself to wealthy individuals and institutional clients, which explains its high minimum deposit requirements that are much higher than industry standards for retail brokers.

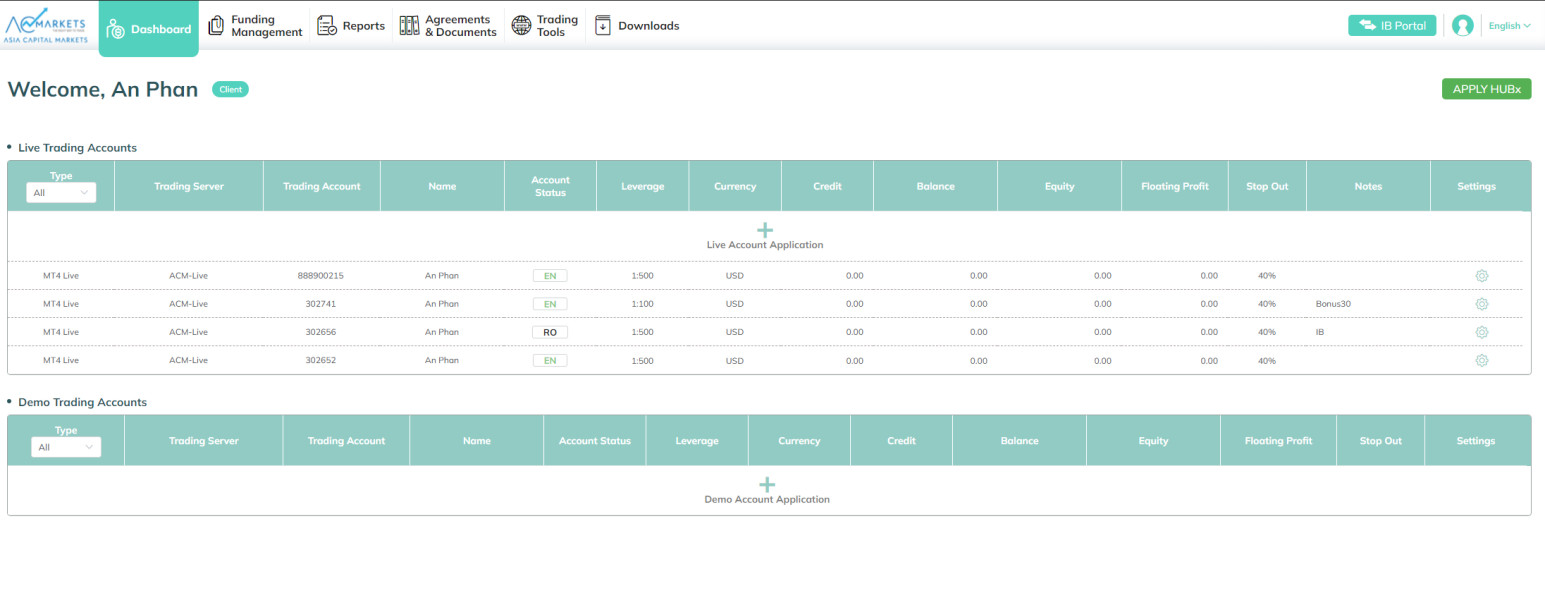

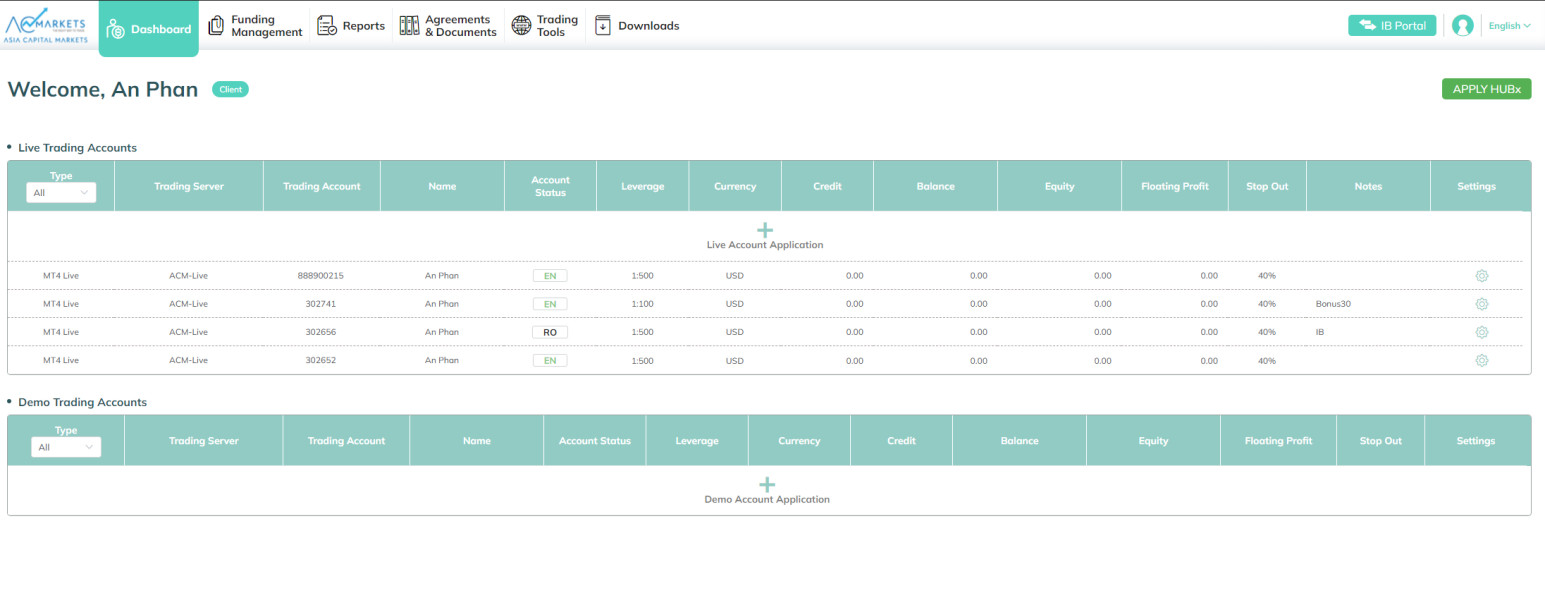

AC Markets says it supports both MetaTrader 4 and MetaTrader 5 trading platforms. These are industry-standard solutions that people recognize for their reliability and comprehensive trading tools. The broker claims the Cyprus Securities and Exchange Commission (CySEC) oversees them under license number 350/17, but this AC Markets review has found big differences in these regulatory claims that potential clients should examine carefully.

Regulatory Status: AC Markets claims CySEC regulation under license 350/17, but many industry monitoring services have flagged the broker as potentially operating without proper permission. WikiFX reports show the broker may work as an unauthorized forex entity, which raises serious concerns about client fund protection and regulatory compliance.

Minimum Deposit Requirements: The broker requires a very high minimum deposit of €10,000. This is much higher than industry averages and stops most retail traders from using their services.

Trading Platforms: AC Markets gives access to MetaTrader 4 and MetaTrader 5 platforms. These offer standard charting tools, technical indicators, and automated trading through Expert Advisors (EAs).

Available Assets: Specific information about tradeable instruments, including forex pairs, commodities, indices, and other financial products, stays limited in public documentation.

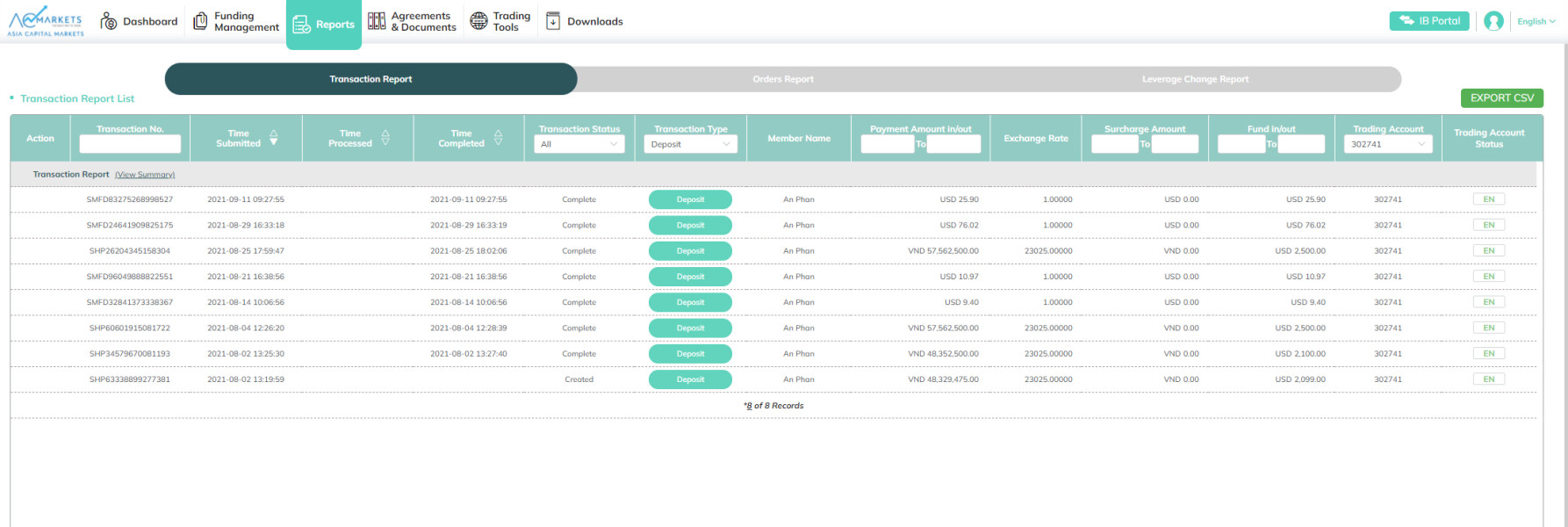

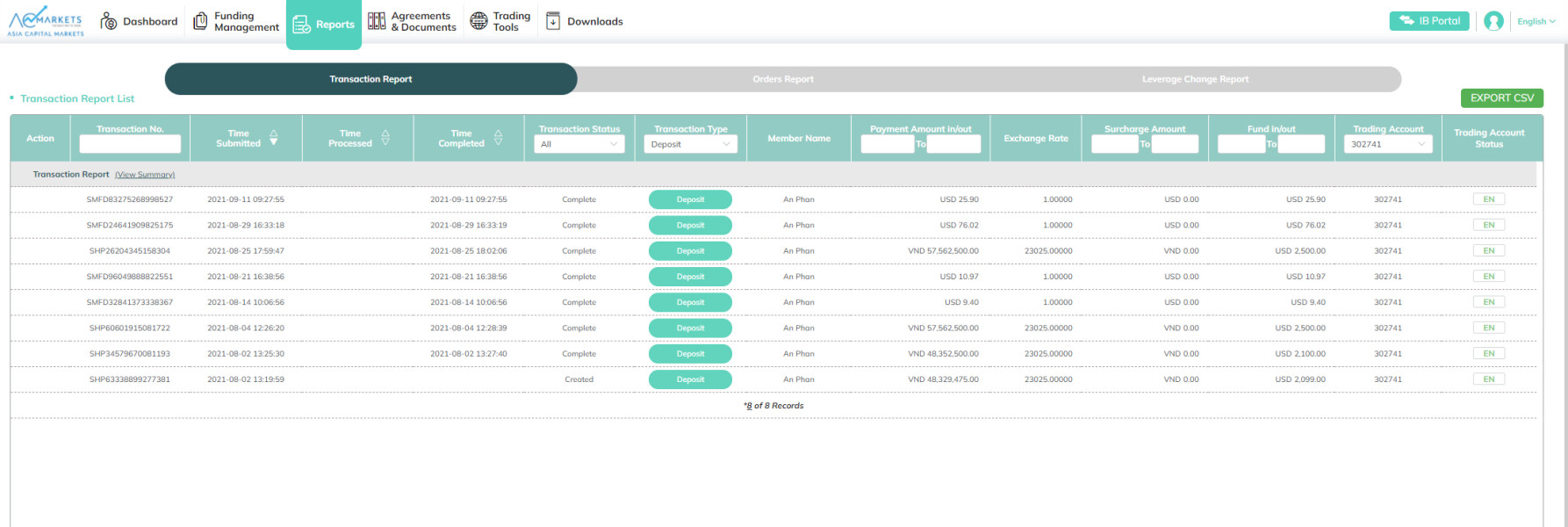

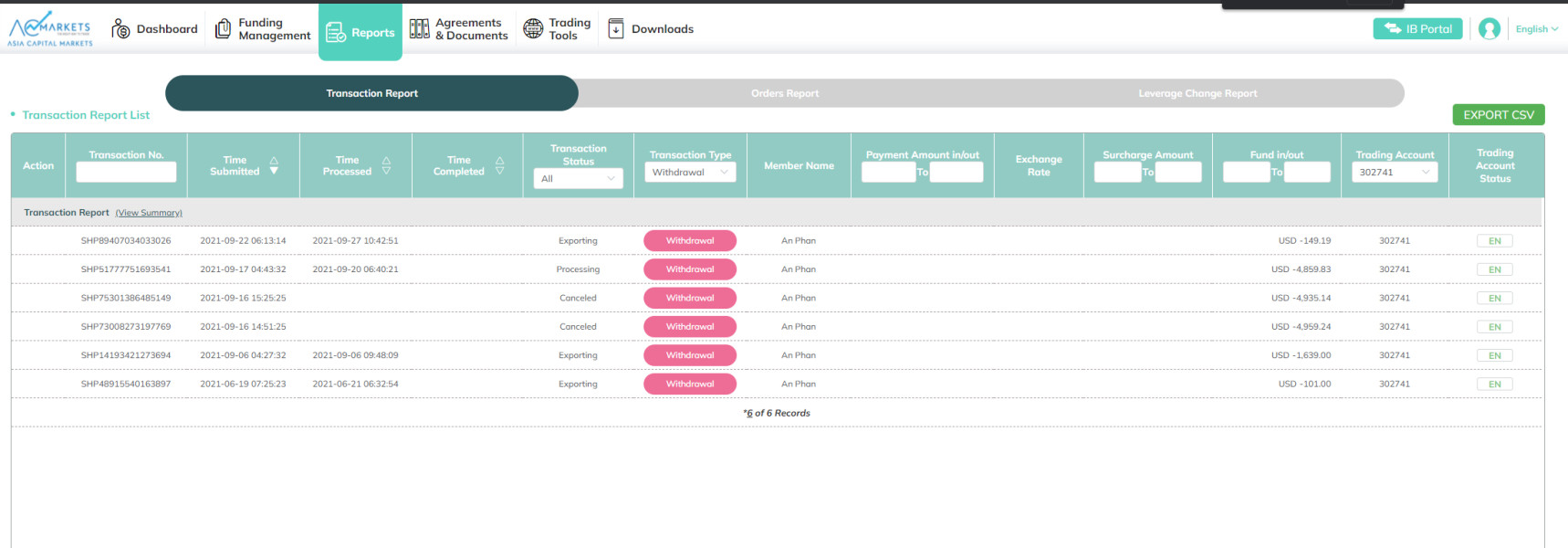

Funding Methods: Details about deposit and withdrawal options, processing times, and fees are not fully disclosed in available materials. This represents a transparency concern for potential clients.

Cost Structure: Information about spreads, commissions, overnight financing charges, and other trading costs lacks clarity in public documentation. This makes it hard for traders to assess the true cost of trading with AC Markets.

Leverage Offerings: Specific leverage ratios and margin requirements are not clearly outlined in available promotional materials. These would typically follow regulatory limitations based on client classification and jurisdiction.

Geographic Restrictions: The broker's service availability across different regions and any trading restrictions remain unclear from public information.

Detailed Rating Analysis

Account Conditions Analysis (Rating: 3/10)

AC Markets' account structure creates big barriers that severely limit access to the broader trading community. The €10,000 minimum deposit requirement is one of the highest thresholds in the retail forex industry. This effectively positions the broker exclusively toward wealthy individuals and institutional clients. This big financial barrier raises questions about the broker's target market strategy and potentially limits the diversity of its client base.

The lack of detailed information about different account tiers, their features, and progression pathways suggests a limited product offering. This compares poorly to more established brokers who typically provide multiple account options for various trader segments. User feedback compiled by monitoring services criticizes the account opening process for lack of transparency and unclear documentation requirements.

The absence of demo account information in public materials further adds to concerns about the broker's commitment to client education and risk management. Most reputable brokers prominently feature demo trading options to help clients learn platforms and strategies before committing capital. This AC Markets review finds that the restrictive account conditions, combined with limited transparency about account features and benefits, significantly hurt the overall client value proposition.

AC Markets' trading infrastructure centers around the widely-adopted MetaTrader 4 and MetaTrader 5 platforms. These provide a solid foundation for technical analysis and trade execution. These platforms offer comprehensive charting capabilities, multiple timeframes, extensive technical indicator libraries, and support for automated trading through Expert Advisors. However, the broker's offering appears to lack additional proprietary tools or enhanced features that might make it different from competitors.

The absence of detailed information about research resources, market analysis, economic calendars, and educational materials suggests limited commitment to supporting trader development and market awareness. Most established brokers supplement their platform offerings with comprehensive research departments, daily market commentary, webinars, and educational resources designed to enhance client trading capabilities.

User feedback indicates that while the MT4 and MT5 platforms function adequately, the overall trading environment lacks additional resources and support tools that characterize leading industry providers. The limited scope of available tools and resources, combined with unclear information about platform customization options and advanced features, contributes to a mediocre rating in this category despite the solid foundation provided by the MetaTrader platforms.

Customer Service and Support Analysis (Rating: 4/10)

Customer support represents a critical weakness in AC Markets' service delivery. Multiple user testimonials and industry monitoring reports confirm this problem. The broker's support infrastructure appears inadequately equipped to handle client inquiries effectively, with users reporting poor response times, limited availability, and unsatisfactory resolution of trading-related issues.

WikiFX monitoring data indicates that AC Markets has accumulated multiple exposure complaints from users. This suggests systemic issues with customer service quality and problem resolution capabilities. The lack of clearly published support channels, operating hours, and multilingual capabilities further adds to concerns about the broker's commitment to client service excellence.

User feedback consistently highlights frustrations with communication quality, technical support responsiveness, and overall professionalism of customer service interactions. The absence of comprehensive self-service resources, detailed FAQs, and educational support materials places additional burden on the customer service team while limiting clients' ability to resolve common issues independently. These service deficiencies contribute significantly to the negative user experiences reported across multiple review platforms and monitoring services.

Trading Experience Analysis (Rating: 5/10)

The trading experience with AC Markets appears to be hurt by limited transparency about execution quality, pricing competitiveness, and platform performance metrics. While the broker offers access to industry-standard MetaTrader platforms, the lack of detailed information about order execution speeds, slippage rates, and liquidity provision raises questions about the overall trading environment quality.

User testimonials suggest inconsistent trading experiences. Some clients report satisfactory platform stability while others have encountered technical issues and execution delays. The absence of published statistics about average execution speeds, fill rates, and price improvement metrics makes it difficult for potential clients to assess the broker's competitive positioning in terms of trading conditions.

The limited information available about mobile trading capabilities, platform customization options, and advanced order types further constrains the overall trading experience evaluation. Most competitive brokers provide detailed performance metrics, regular platform updates, and comprehensive mobile solutions to enhance client trading capabilities. This AC Markets review finds that while basic trading functionality appears to be available, the lack of transparency and performance data prevents a more favorable assessment of the overall trading experience.

Trust and Safety Analysis (Rating: 2/10)

Trust and safety concerns represent the most significant issues identified in this AC Markets evaluation. Multiple industry monitoring services, including WikiFX, have flagged AC Markets as potentially operating without proper regulatory authorization. This happens despite claims of CySEC regulation under license number 350/17. These conflicting reports about regulatory status create substantial uncertainty about client fund protection and regulatory oversight.

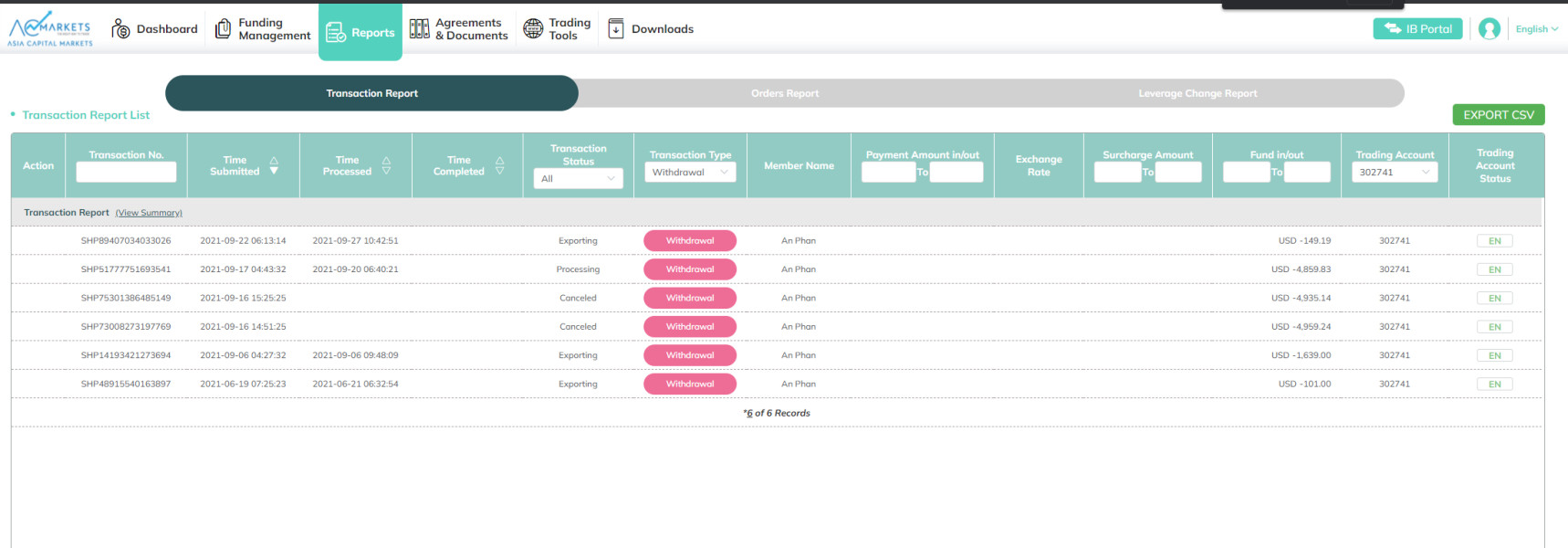

The presence of fraud allegations and scam warnings from various industry watchdogs raises serious questions about the broker's legitimacy and operational integrity. User exposure reports and negative testimonials suggest that some clients have experienced difficulties with fund withdrawals, account access, and general business practices that deviate from industry standards.

The lack of transparent information about client fund segregation, insurance coverage, compensation schemes, and dispute resolution mechanisms further undermines confidence in the broker's safety measures. Established brokers typically provide detailed information about regulatory compliance, fund protection measures, and client safeguards as fundamental aspects of their value proposition. The significant concerns raised by monitoring services and user feedback indicate substantial trust and safety risks that potential clients should carefully consider before engaging with AC Markets.

User Experience Analysis (Rating: 3/10)

Overall user satisfaction with AC Markets appears to be predominantly negative. This is based on available feedback from review platforms and monitoring services. WikiFX data shows the broker has received minimal positive reviews while accumulating multiple exposure complaints and negative testimonials from users. This pattern suggests systemic issues with service delivery and client satisfaction across multiple touchpoints.

User complaints frequently cite poor customer service responsiveness, unclear business practices, and difficulties with account management and fund operations. The high minimum deposit requirement creates additional friction in the user journey, limiting accessibility and creating barriers that may contribute to client frustration and dissatisfaction.

The lack of comprehensive onboarding resources, educational materials, and user-friendly account management tools appears to make the negative user experience worse. Most successful brokers invest heavily in user interface design, client education, and streamlined account processes to enhance overall satisfaction. The predominantly negative user feedback and limited positive testimonials suggest that AC Markets has significant room for improvement in delivering a satisfactory user experience that meets contemporary client expectations and industry standards.

Conclusion

This comprehensive AC Markets review reveals a broker with significant operational and reputational challenges that substantially outweigh any potential benefits. While AC Markets offers access to popular MetaTrader platforms and maintains a presence in Switzerland, the numerous red flags identified throughout this evaluation suggest extreme caution is warranted for potential clients.

The broker's exceptionally high minimum deposit requirement of €10,000, combined with questionable regulatory status and multiple fraud allegations, makes it unsuitable for most retail traders. The predominantly negative user feedback, poor customer service reports, and trust concerns identified by industry monitoring services create a risk profile that is difficult to justify for ordinary investors seeking reliable forex trading services.

For sophisticated investors with substantial risk tolerance who might consider AC Markets despite these concerns, thorough independent research and verification of all regulatory claims would be essential before proceeding. However, the weight of evidence suggests that most traders would be better served by selecting more established, transparently regulated brokers with stronger reputational standings and more comprehensive client protections.