Is ZenTrade safe?

Pros

Cons

Is ZenTrade A Scam?

Introduction

ZenTrade is an online forex and CFD broker that has garnered attention in the trading community. Positioned as a platform that promises high leverage and a variety of trading instruments, ZenTrade claims to offer an appealing trading environment for both novice and experienced traders. However, the importance of thoroughly evaluating forex brokers cannot be overstated. Traders need to ensure that their investments are secure and that they are dealing with a reputable entity. This article aims to provide an objective assessment of ZenTrade, focusing on its regulatory status, company background, trading conditions, customer experiences, and overall safety profile. Our investigation is based on a review of multiple sources, including regulatory databases, user reviews, and industry analyses, to present a comprehensive view of whether ZenTrade is safe or a potential scam.

Regulation and Legitimacy

One of the primary indicators of a broker's reliability is its regulatory status. A well-regulated broker is subject to strict oversight, which helps protect traders' funds and ensures fair trading practices. Unfortunately, ZenTrade is not regulated by any recognized financial authority. This lack of oversight raises significant concerns about its legitimacy and the safety of clients' funds.

| Regulatory Body | License Number | Regulatory Area | Verification Status |

|---|---|---|---|

| None | N/A | N/A | Not Verified |

The absence of regulation means that ZenTrade operates without the safeguards that reputable brokers offer. Regulatory bodies, such as the Financial Conduct Authority (FCA) in the UK or the Australian Securities and Investments Commission (ASIC), enforce strict rules to protect traders. Without such oversight, traders using ZenTrade are at a higher risk of encountering issues such as withdrawal delays or even fraud. Furthermore, the lack of a regulatory history indicates that ZenTrade has not been held accountable for any potential misconduct, which is a red flag for potential investors.

Company Background Investigation

ZenTrade appears to be based in the Marshall Islands, a location often associated with unregulated brokers. The company's history is relatively obscure, with limited information available regarding its ownership and management team. This lack of transparency is concerning, as it complicates the assessment of the broker's credibility.

The absence of clear information about the company's founders or management team further diminishes trust. A reputable broker typically provides details about its leadership, including their professional backgrounds and experience in the financial industry. However, ZenTrade's website lacks such disclosures, making it difficult for potential clients to gauge the broker's reliability.

Moreover, the overall transparency of ZenTrade is questionable. With minimal information available about its operations, traders are left with uncertainty regarding how their funds will be managed and what recourse they have in case of disputes. This opacity is a significant consideration in determining whether ZenTrade is safe or a scam.

Trading Conditions Analysis

Understanding a broker's trading conditions is crucial for evaluating its overall value. ZenTrade offers a range of trading instruments, including forex pairs, CFDs, and cryptocurrencies. However, the broker's fee structure appears to be less favorable compared to industry standards, which raises questions about the overall cost of trading.

| Fee Type | ZenTrade | Industry Average |

|---|---|---|

| Spread on Major Currency Pairs | Variable (2.8 pips) | 1.0 - 1.5 pips |

| Commission Model | None specified | Varies by broker |

| Overnight Interest Range | Not disclosed | 0.5% - 2% |

The spreads offered by ZenTrade are significantly higher than the industry average, which could lead to increased trading costs for clients. Additionally, the lack of transparency regarding commissions and overnight interest rates is concerning. Traders might find themselves facing unexpected fees, which can erode profits and impact overall performance. The combination of high spreads and unclear fee structures suggests that ZenTrade may not be the most cost-effective option for traders, raising further doubts about whether ZenTrade is safe.

Client Fund Security

The security of client funds is paramount when assessing any broker. ZenTrade has not provided adequate information regarding its measures for safeguarding client funds. The absence of segregated accounts, which are essential for ensuring that client funds are kept separate from the broker's operational funds, is a significant concern. Without this protection, clients may be at risk of losing their funds in the event of the broker's insolvency.

Furthermore, the lack of investor protection mechanisms is alarming. Reputable brokers often have compensation schemes in place to protect clients in case of broker failure. However, ZenTrade does not appear to offer any such protections, leaving clients vulnerable. Historical complaints about withdrawal issues further exacerbate concerns about fund security, suggesting that clients may face challenges accessing their money.

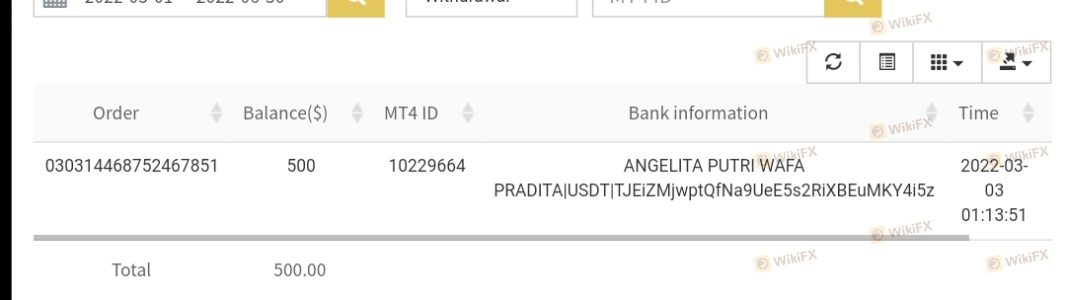

Customer Experience and Complaints

Customer feedback is a valuable indicator of a broker's reliability. Unfortunately, ZenTrade has received numerous negative reviews from clients, indicating widespread dissatisfaction with its services. Common complaints include difficulties with fund withdrawals, unresponsive customer support, and issues with account management.

| Complaint Type | Severity | Company Response |

|---|---|---|

| Withdrawal Issues | High | Poor |

| Unresponsive Customer Support | Medium | Poor |

| Account Management Problems | High | Poor |

Many users have reported being unable to withdraw their funds, with some claiming that their requests were ignored or met with unreasonable delays. These issues not only highlight potential operational inefficiencies but also raise serious concerns about the trustworthiness of ZenTrade. A typical case involved a client who reported waiting over six months for a withdrawal, only to receive vague responses from customer support. Such experiences contribute to the perception that ZenTrade may not be a safe broker for traders.

Platform and Trade Execution

The trading platform is a critical component of a broker's offering. ZenTrade provides access to a proprietary trading platform, which, while user-friendly, lacks some of the features and reliability of industry-standard platforms like MetaTrader 4 or 5. The performance of the platform is essential for executing trades effectively, and any issues with stability or execution can lead to significant losses.

Traders have reported instances of slippage and order rejections, which can severely impact trading outcomes. Additionally, the absence of transparency regarding execution policies raises concerns about potential manipulation or unfair practices. Traders need to be cautious, as any signs of platform manipulation could indicate that ZenTrade is not a trustworthy broker.

Risk Assessment

Engaging with ZenTrade carries inherent risks that potential traders should carefully consider. The lack of regulation, combined with high fees, poor customer service, and negative user experiences, paints a concerning picture of the broker's reliability.

| Risk Category | Risk Level (Low/Medium/High) | Brief Description |

|---|---|---|

| Regulatory Risk | High | No oversight from recognized authorities. |

| Financial Risk | High | High spreads and unclear fees. |

| Operational Risk | Medium | Complaints about customer service and withdrawals. |

| Platform Risk | High | Reports of slippage and order rejections. |

To mitigate these risks, potential traders should approach ZenTrade with caution. It is advisable to conduct thorough research, consider using a demo account, and ensure that they fully understand the terms and conditions before committing funds.

Conclusion and Recommendations

In conclusion, the evidence suggests that ZenTrade exhibits numerous red flags that warrant serious consideration. The lack of regulation, combined with poor customer feedback and questionable trading conditions, raises significant concerns about whether ZenTrade is safe or a scam. Traders should be particularly wary of the potential for withdrawal issues and high trading costs.

For those seeking to engage in forex trading, it may be wise to consider alternative brokers that are well-regulated and have a proven track record of reliability. Recommended alternatives include brokers like IG, OANDA, and Forex.com, which offer robust regulatory frameworks and positive user experiences.

Ultimately, while ZenTrade may present itself as a viable trading option, the risks associated with its use make it a less favorable choice for traders seeking security and reliability in their trading endeavors.

Is ZenTrade a scam, or is it legit?

The latest exposure and evaluation content of ZenTrade brokers.

ZenTrade Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

ZenTrade latest industry rating score is 1.53, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.53 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.