Is YONG HUA SECURITIES safe?

Business

License

Is Yong Hua Securities Safe or Scam?

Introduction

Yong Hua Securities is a forex broker based in Hong Kong, positioned within the competitive landscape of the foreign exchange market. As a platform for trading various financial instruments, it attracts a diverse clientele, including both novice and experienced traders. However, the forex market is notoriously rife with potential scams and fraudulent activities, making it imperative for traders to conduct thorough evaluations of brokers before committing their funds. In this article, we will investigate whether Yong Hua Securities is a safe option for traders or if it raises red flags that suggest it may be a scam. Our evaluation will utilize a combination of online research, user reviews, regulatory information, and industry standards to provide a comprehensive analysis.

Regulation and Legitimacy

Regulation is a critical factor in assessing the safety of any forex broker. A well-regulated broker is more likely to adhere to strict operational guidelines and provide a secure trading environment for its clients. In the case of Yong Hua Securities, the broker operates without significant oversight from reputable regulatory bodies. This lack of regulation poses considerable risks for potential investors. Below is a summary of the regulatory status of Yong Hua Securities:

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| None | N/A | Hong Kong | Not Verified |

The absence of any regulatory oversight is alarming, as it indicates that Yong Hua Securities may not be held accountable to any financial authority. This lack of regulation can lead to various issues, including the potential for fraud and mismanagement of client funds. Moreover, the broker's suspicious regulatory license has raised concerns among industry experts, highlighting the need for traders to exercise extreme caution when considering this platform.

Company Background Investigation

Yong Hua Securities was established in Hong Kong, but specific details regarding its history and ownership structure remain opaque. The company's lack of transparency is concerning and raises questions about its credibility. A thorough investigation into the management team reveals limited information about their backgrounds and qualifications, which further complicates the assessment of the broker's trustworthiness.

The management team is crucial in establishing a broker's reputation, and without clear information about their experience in the financial industry, it becomes difficult to gauge the company's reliability. Furthermore, the absence of regular disclosures and updates on the company's operations diminishes its credibility and may indicate potential risks for investors.

The overall opacity surrounding Yong Hua Securities adds to the skepticism regarding its legitimacy, making it imperative for potential clients to proceed with caution and consider alternative, more transparent options.

Trading Conditions Analysis

Understanding the trading conditions offered by a broker is essential for evaluating its overall value. In the case of Yong Hua Securities, the trading fees and conditions appear to be somewhat ambiguous. The broker's fee structure has been described as complex, with various charges that may not be immediately apparent to clients. Below is a comparative analysis of core trading costs:

| Fee Type | Yong Hua Securities | Industry Average |

|---|---|---|

| Spread for Major Pairs | Variable | 1.0 - 2.0 pips |

| Commission Model | Hidden Fees | 0 - 10 USD |

| Overnight Interest Range | High | Low to Moderate |

The potential for hidden fees is a significant concern, as it can lead to unexpected costs for traders. Additionally, the variable spreads offered by Yong Hua Securities may not be competitive compared to industry standards, which could deter potential clients. Traders should be wary of any unusual fee structures, as they may indicate attempts to exploit clients financially.

Client Fund Security

The safety of client funds is paramount when selecting a forex broker. In the case of Yong Hua Securities, there are serious concerns regarding the measures in place to protect client investments. The broker does not provide clear information about fund segregation, which is crucial for ensuring that client funds are kept separate from the company's operational funds.

Furthermore, there is no indication that Yong Hua Securities participates in any investor protection schemes, which could safeguard clients in the event of insolvency. The absence of negative balance protection policies adds another layer of risk for traders, as it exposes them to the potential for significant financial losses. Historical complaints regarding fund withdrawals have also surfaced, with some users reporting difficulties in accessing their money.

Such issues are indicative of a broker that may not prioritize the safety of its clients' funds, raising substantial concerns about the overall security of trading with Yong Hua Securities.

Customer Experience and Complaints

Analyzing customer feedback is vital for assessing the reliability of a broker. In the case of Yong Hua Securities, user experiences have been mixed, with numerous complaints surfacing regarding withdrawal difficulties and customer service responsiveness. Below is a summary of the primary complaint types:

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Issues | High | Poor |

| Customer Service Delays | Medium | Average |

| Misleading Information | High | Unresolved |

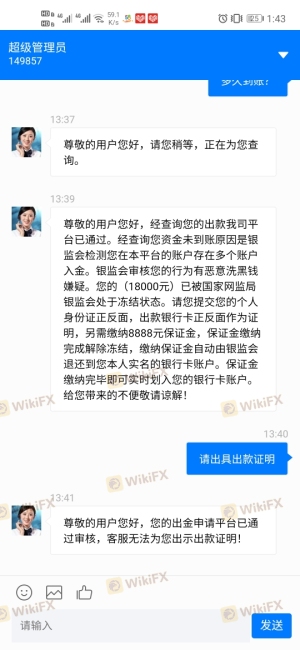

Common complaints include reports of accounts being frozen without notice and difficulties in withdrawing funds, suggesting a lack of transparency and responsiveness on the part of the broker. In particular, the inability to access funds raises significant red flags and indicates that traders may be at risk of losing their investments.

One notable case involved a user who reported being unable to withdraw a substantial amount after experiencing account freezes. When they sought assistance, they were met with unresponsive customer service, further compounding their frustration. Such experiences highlight the potential risks associated with trading through Yong Hua Securities and emphasize the need for caution.

Platform and Trade Execution

The trading platform offered by Yong Hua Securities is another critical aspect of its service. While the broker claims to provide a user-friendly interface, reviews suggest that the platform may suffer from stability issues and poor execution quality. Traders have reported instances of slippage and rejected orders, which can significantly impact trading performance.

It is essential for a broker to provide a reliable trading environment, as any delays or technical issues can lead to missed opportunities and financial losses. Additionally, any signs of platform manipulation should be taken seriously, as they can indicate unethical practices that compromise the integrity of the trading experience.

Risk Assessment

Using Yong Hua Securities presents several risks that traders should be aware of. The following risk assessment summarizes key areas of concern:

| Risk Category | Risk Level (Low/Medium/High) | Brief Description |

|---|---|---|

| Regulatory Risk | High | No significant regulatory oversight. |

| Financial Risk | High | Potential for hidden fees and fund access issues. |

| Operational Risk | Medium | Reports of platform instability and execution issues. |

To mitigate these risks, traders should consider diversifying their investments and not committing significant capital to a broker with questionable practices. Additionally, it may be wise to explore alternative brokers with robust regulatory frameworks and transparent fee structures.

Conclusion and Recommendations

In conclusion, the evidence suggests that Yong Hua Securities may pose significant risks for traders. The lack of regulatory oversight, combined with numerous complaints regarding fund access and customer service, raises substantial concerns about the broker's legitimacy. Furthermore, the opaque fee structure and potential for hidden charges add to the overall risk profile of trading with this broker.

For traders seeking a reliable and secure trading environment, it is advisable to consider alternative options that have established regulatory frameworks and positive customer feedback. Brokers regulated by reputable authorities, such as the FCA or ASIC, tend to provide a safer trading experience and are more likely to prioritize the protection of client funds.

In summary, potential clients should exercise extreme caution when considering Yong Hua Securities and thoroughly investigate alternative brokers that offer greater transparency and security in their operations.

Is YONG HUA SECURITIES a scam, or is it legit?

The latest exposure and evaluation content of YONG HUA SECURITIES brokers.

YONG HUA SECURITIES Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

YONG HUA SECURITIES latest industry rating score is 1.52, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.52 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.