Regarding the legitimacy of XS forex brokers, it provides HKGX and WikiBit, .

Is XS safe?

Business

License

Is XS markets regulated?

The regulatory license is the strongest proof.

HKGX Precious Metals Trading (AGN)

Hong Kong Gold Exchange

Hong Kong Gold Exchange

Current Status:

UnverifiedLicense Type:

Precious Metals Trading (AGN)

Licensed Entity:

香港紅獅集團有限公司

Effective Date:

--Email Address of Licensed Institution:

--Sharing Status:

No SharingWebsite of Licensed Institution:

https://www.rlc9000.comExpiration Time:

--Address of Licensed Institution:

九龍尖沙咀漆咸道南87-105號百利商業中心15字樓1511室Phone Number of Licensed Institution:

23927848Licensed Institution Certified Documents:

Is XS Safe or a Scam?

Introduction

XS, a multi-asset brokerage founded in 2010, has established itself as a significant player in the forex market, offering a wide range of trading services, including forex, commodities, indices, and cryptocurrencies. As the popularity of online trading continues to soar, traders must exercise caution and conduct thorough evaluations of their chosen brokers to ensure a safe trading environment. The forex market is notorious for its volatility and potential for significant financial loss, making it imperative for traders to select reliable and trustworthy brokers. This article aims to provide an objective assessment of XS, focusing on its regulatory status, company background, trading conditions, client fund security, customer experience, and overall risk profile. The assessment is based on a comprehensive review of various online sources, regulatory databases, and user feedback.

Regulation and Legitimacy

The regulatory status of a broker is paramount in determining its legitimacy and safety. XS operates under several regulatory authorities, which is a positive indicator of its compliance with industry standards. The following table summarizes XS's core regulatory information:

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| ASIC | 374409 | Australia | Verified |

| CySEC | 412/22 | Cyprus | Verified |

| FSA | SD 089 | Seychelles | Verified |

| FSCA | 53199 | South Africa | Verified |

| LFSA | MB/21/0081 | Labuan | Verified |

The presence of multiple licenses across different jurisdictions enhances XS's credibility. ASIC and CySEC, in particular, are known for their stringent oversight, ensuring that brokers adhere to strict regulatory requirements designed to protect investors. The historical compliance record of XS appears to be positive, with no significant regulatory infractions reported. This track record suggests that the broker has consistently adhered to the necessary legal frameworks aimed at safeguarding traders. However, potential clients should remain aware of the risks associated with trading under offshore regulations, as these may not provide the same level of investor protection as those in more established jurisdictions.

Company Background Investigation

XS has its roots as a liquidity provider in Australia, transitioning into a full-fledged brokerage that offers a diverse range of financial instruments. Over the years, the company has expanded its operations globally, establishing a presence in various regions, including Cyprus, Seychelles, and South Africa. This international footprint allows XS to cater to a broad audience of traders, enhancing its market reach.

While the ownership structure of XS is not extensively disclosed, the management team comprises experienced professionals with significant backgrounds in finance and trading. This expertise contributes to the broker's operational integrity and commitment to providing a secure trading environment. The company's commitment to transparency is reflected in its regulatory disclosures, which include detailed information about its licenses and oversight. However, the absence of comprehensive educational materials may limit the ability of novice traders to fully understand the trading environment and the risks involved.

Trading Conditions Analysis

The trading conditions offered by XS are competitive, with a fee structure that appeals to various types of traders. The broker employs a combination of spreads and commissions, depending on the account type. Below is a comparison of core trading costs:

| Cost Type | XS | Industry Average |

|---|---|---|

| Major Currency Pair Spread (EUR/USD) | From 0.6 pips | 1.0 pips |

| Commission Structure | Varies by account type | Varies |

| Overnight Interest Range | Standard rates apply | Standard rates apply |

XS offers a standard account with spreads starting from 0.6 pips, which is below the industry average, making it attractive for cost-conscious traders. However, the minimum deposit requirement of $1,000 for this account type may be prohibitive for beginners. While the low spreads are appealing, potential clients should be aware of any unusual fees that may apply, such as a 3% inactivity fee on dormant accounts. It is crucial for traders to fully understand the fee structure and ensure that it aligns with their trading strategies and frequency of activity.

Client Fund Security

Client fund security is a critical aspect of any trading operation, and XS appears to take this matter seriously. The broker implements several measures to ensure the safety of client funds, including segregated accounts, which keep client funds separate from the broker's operational capital. This practice reduces the risk of loss in the event of insolvency. Additionally, XS offers negative balance protection, preventing clients from losing more than their initial investment during periods of high market volatility.

The broker is also part of a compensation fund that provides an additional layer of security for traders in case of financial difficulties. This commitment to safeguarding client assets is a positive indicator of XS's operational integrity. However, traders should remain vigilant and conduct their due diligence, especially when dealing with offshore entities, as the level of protection may vary. Historically, there have been no significant reports of fund security issues or disputes involving XS, which further supports its reputation as a trustworthy broker.

Customer Experience and Complaints

Customer feedback plays a vital role in assessing the overall experience with a broker. Reviews of XS indicate a mixed response from users, with many praising the broker's competitive trading conditions and user-friendly platforms. However, some common complaints have emerged regarding customer support and the overall responsiveness of the company. The following table summarizes the primary types of complaints received about XS:

| Complaint Type | Severity | Company Response |

|---|---|---|

| Withdrawal Delays | Moderate | Generally responsive but may vary |

| Customer Support Issues | High | Limited direct contact options |

| Account Verification Delays | Moderate | Typically resolved within a few days |

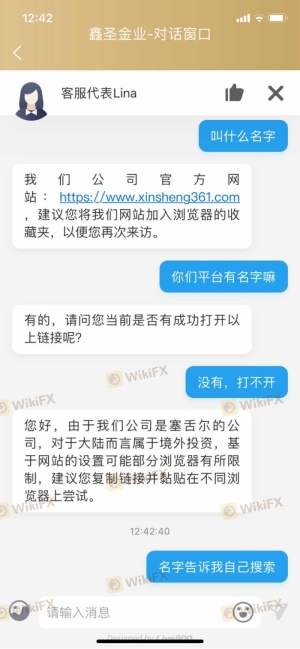

A notable concern among users is the difficulty in reaching customer support representatives directly. The reliance on a virtual assistant for live chat inquiries has led to frustrations, especially for those seeking immediate assistance. While the broker does offer email support and a call-back feature, the lack of a direct support line may hinder timely resolutions for urgent issues.

Platform and Trade Execution

The performance and reliability of the trading platform are crucial for a successful trading experience. XS offers access to the widely used MetaTrader 4 (MT4) and MetaTrader 5 (MT5) platforms, both of which are known for their robust features and user-friendly interfaces. However, the execution quality has been a point of contention among users. Feedback indicates that while most trades are executed promptly, some traders have experienced slippage during volatile market conditions. This can result in orders being filled at less favorable prices than anticipated, which may impact trading profitability.

Additionally, there have been isolated reports of rejected orders, which could be concerning for active traders relying on timely execution. Overall, the platforms are rated highly for their functionality and ease of use, but traders should remain cautious and prepared for potential execution issues, especially during periods of high market volatility.

Risk Assessment

Engaging with any broker entails inherent risks, and XS is no exception. The overall risk profile for trading with XS can be summarized in the following risk assessment table:

| Risk Category | Risk Level (Low/Medium/High) | Brief Description |

|---|---|---|

| Regulatory Risk | Medium | Operates under multiple jurisdictions with varying protections. |

| Fund Security Risk | Low | Strong measures in place, including segregation and insurance. |

| Customer Support Risk | Medium | Limited direct support options may hinder timely assistance. |

| Execution Risk | Medium | Occasional slippage and rejected orders reported. |

To mitigate these risks, traders should conduct thorough research on the broker's operations and ensure they understand the trading environment. It is advisable to start with smaller investments and gradually increase exposure as familiarity with the platform grows. Additionally, maintaining clear communication with the broker and keeping abreast of any regulatory changes can further enhance safety.

Conclusion and Recommendations

In conclusion, XS presents itself as a legitimate and well-regulated broker, offering competitive trading conditions and a diverse range of financial instruments. The presence of multiple regulatory licenses, particularly from reputable authorities like ASIC and CySEC, suggests a commitment to compliance and investor protection. However, potential clients should remain cautious, particularly regarding the broker's customer support and execution quality, which have received mixed reviews.

While there are no clear indications of XS being a scam, traders should approach with due diligence, especially if they are new to the forex market. It is recommended to start with a demo account to familiarize oneself with the trading environment before committing significant capital. For traders seeking alternatives, consider brokers with strong regulatory oversight, comprehensive educational resources, and responsive customer support, such as IG, OANDA, and Forex.com, which are known for their robust trading platforms and client support.

In summary, IS XS SAFE? The evidence suggests that XS is a reliable broker, but traders should remain vigilant and informed to ensure a positive trading experience.

Is XS a scam, or is it legit?

The latest exposure and evaluation content of XS brokers.

XS Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

XS latest industry rating score is 1.53, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.53 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.