Regarding the legitimacy of XINHUA SECURITIES forex brokers, it provides SFC and WikiBit, (also has a graphic survey regarding security).

Is XINHUA SECURITIES safe?

Business

License

Is XINHUA SECURITIES markets regulated?

The regulatory license is the strongest proof.

SFC Derivatives Trading License (AGN)

Securities and Futures Commission of Hong Kong

Securities and Futures Commission of Hong Kong

Current Status:

UnverifiedLicense Type:

Derivatives Trading License (AGN)

Licensed Entity:

Xin Hua Securities (Hong Kong) Limited

Effective Date: Change Record

2016-10-18Email Address of Licensed Institution:

--Sharing Status:

No SharingWebsite of Licensed Institution:

--Expiration Time:

--Address of Licensed Institution:

--Phone Number of Licensed Institution:

--Licensed Institution Certified Documents:

Is Xinhua Securities Safe or a Scam?

Introduction

Xinhua Securities, based in Hong Kong, has positioned itself as a player in the forex and CFD trading markets since its establishment in 2016. As with any financial service provider, particularly in the volatile realm of forex trading, it is crucial for traders to conduct thorough due diligence before committing their capital. The rise of online trading has unfortunately been accompanied by an increase in scams and unreliable brokers, making it imperative for traders to critically assess the credibility of their chosen platforms. This article aims to provide an objective evaluation of Xinhua Securities, exploring its regulatory status, company background, trading conditions, customer experiences, and overall safety.

To achieve this, we utilized various sources, including user reviews, regulatory databases, and financial news articles. Our assessment framework focuses on key areas such as regulatory compliance, company history, trading conditions, and customer feedback to determine whether Xinhua Securities is a safe option for traders or a potential scam.

Regulation and Legitimacy

The regulatory environment in which a broker operates is a fundamental indicator of its legitimacy and safety. Xinhua Securities claims to be regulated by the Securities and Futures Commission (SFC) of Hong Kong, which is a reputable regulatory authority. However, the specifics of its licensing and compliance history are critical to understanding its operational integrity.

| Regulatory Body | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| Securities and Futures Commission (SFC) | BHM 536 | Hong Kong | Verified |

The SFC is known for its stringent regulatory standards, requiring brokers to adhere to strict guidelines regarding capital adequacy, client fund protection, and operational transparency. Despite Xinhua Securities being regulated by the SFC, there have been several complaints regarding its operations, including issues related to fund withdrawals and customer service responsiveness. This raises questions about the effectiveness of its regulatory oversight and adherence to compliance.

Moreover, while the SFC is a credible authority, it is essential to note that not all brokers under its jurisdiction are equally reliable. Some may have a history of regulatory infractions or poor customer service, which can significantly impact traders' experiences. Therefore, while Xinhua Securities is technically regulated, the quality of its regulatory compliance and the historical context surrounding its operations warrant further examination.

Company Background Investigation

Xinhua Securities has a relatively short history, having been established in 2016. Its ownership structure and management team are also important factors in assessing its reliability. The company operates as "Xinhua Securities (Hong Kong) Limited" and is primarily focused on providing trading services in forex and CFDs.

The management teams background can significantly influence a company's operational integrity. Unfortunately, detailed information about the key executives at Xinhua Securities is sparse, which can be a red flag for potential investors. Transparency regarding management experience and qualifications is crucial, as it reflects the company's commitment to professionalism and ethical standards.

In terms of information disclosure, Xinhua Securities appears to provide basic details about its services on its website. However, the lack of comprehensive information about its regulatory status, management team, and operational practices can lead to skepticism. A broker that is hesitant to disclose important information may not be fully committed to transparency, raising concerns about its overall reliability.

Trading Conditions Analysis

When evaluating a forex broker, understanding the trading conditions they offer is essential. Xinhua Securities provides a range of trading products, including forex pairs and CFDs on various assets. However, traders must consider the associated costs and fees, which can impact overall profitability.

The fee structure at Xinhua Securities includes spreads, commissions, and overnight financing rates. A thorough analysis of these costs is vital to ensure they align with industry standards.

| Fee Type | Xinhua Securities | Industry Average |

|---|---|---|

| Major Currency Pair Spread | Variable | 1-2 pips |

| Commission Model | None | Varies |

| Overnight Interest Range | High | Low to Moderate |

While Xinhua Securities offers variable spreads, reports indicate that some users have experienced higher-than-average costs, particularly regarding overnight financing. This could potentially erode profits for traders who hold positions overnight. Furthermore, the absence of a clear commission structure may lead to confusion and unexpected costs for traders.

Understanding these trading conditions is crucial for evaluating whether Xinhua Securities is a safe platform for trading or if it presents red flags that could indicate a scam. Traders should always compare these costs with other brokers to ensure they are receiving competitive rates.

Client Fund Safety

The safety of client funds is paramount when choosing a forex broker. Xinhua Securities claims to implement measures to protect client funds, including segregating client accounts from operational funds. This is a standard practice in the industry, designed to ensure that client capital remains secure, even in the event of company insolvency.

Additionally, investor protection measures, such as negative balance protection, are crucial in safeguarding traders from incurring debts beyond their initial investment. However, the specifics of Xinhua Securities' policies regarding these protections are not clearly outlined, which can be concerning for potential clients.

Historically, there have been complaints related to fund withdrawals and access to capital, which raises questions about the effectiveness of their fund protection measures. Any broker with a significant number of complaints regarding fund safety should be approached with caution, as this can indicate systemic issues within the company's operational framework.

Customer Experience and Complaints

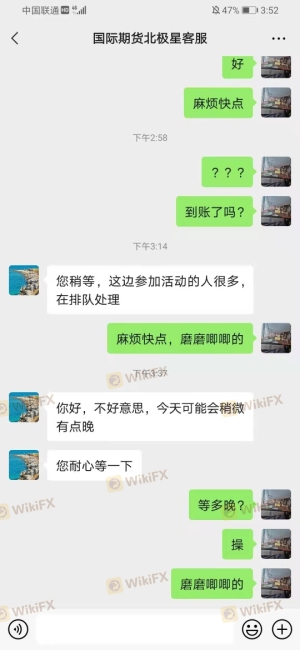

Customer feedback is an invaluable resource for assessing a broker's reliability. Xinhua Securities has received mixed reviews from users, with a notable number of complaints regarding withdrawal issues and customer service responsiveness. Analyzing these complaints can provide insight into the overall client experience.

| Complaint Type | Severity | Company Response |

|---|---|---|

| Withdrawal Issues | High | Poor |

| Customer Service | Medium | Average |

Common complaints include difficulties in withdrawing funds, delayed responses from customer support, and a lack of transparency regarding fees and account management. These issues are significant, as they can directly impact a trader's ability to access their funds and receive assistance when needed.

In one case, a user reported being unable to withdraw funds after multiple attempts, leading to frustration and financial loss. Such experiences can severely undermine trust in the broker and highlight potential red flags that traders should be wary of.

Platform and Trade Execution

An effective trading platform is crucial for a seamless trading experience. Xinhua Securities offers a proprietary trading platform, but user feedback indicates that it may not perform as reliably as expected. Issues such as slow execution times, slippage, and occasional platform outages have been reported, which can negatively affect trading outcomes.

Traders should evaluate the quality of order execution, including the frequency of slippage and the rate of rejected orders. A platform that frequently experiences issues can lead to significant financial losses, particularly in the fast-paced forex market.

Risk Assessment

Using Xinhua Securities carries inherent risks that potential traders should consider. The following risk assessment summarizes the key areas of concern:

| Risk Category | Risk Level (Low/Medium/High) | Brief Description |

|---|---|---|

| Regulatory Compliance | Medium | Mixed reviews on compliance |

| Fund Safety | High | Withdrawal issues reported |

| Customer Service | High | Poor responsiveness noted |

To mitigate these risks, potential clients should conduct thorough research, including reading user reviews and seeking alternative brokers with better reputations. It may also be beneficial to start with a smaller investment to gauge the platform's reliability before committing larger sums.

Conclusion and Recommendations

In conclusion, while Xinhua Securities is regulated by the SFC in Hong Kong, there are several concerning factors that suggest it may not be the safest option for traders. The combination of withdrawal issues, mixed customer feedback, and a lack of transparency raises significant red flags.

Traders should approach Xinhua Securities with caution, especially those who prioritize fund safety and customer service. For those seeking reliable alternatives, brokers with established reputations and robust regulatory oversight should be considered. Overall, it is crucial for traders to remain vigilant and informed to protect their investments in the forex market.

In summary, Is Xinhua Securities Safe? Based on the evidence presented, it is prudent to exercise caution and consider alternative brokers with a proven track record of reliability and customer satisfaction.

Is XINHUA SECURITIES a scam, or is it legit?

The latest exposure and evaluation content of XINHUA SECURITIES brokers.

XINHUA SECURITIES Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

XINHUA SECURITIES latest industry rating score is 1.63, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.63 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.