Is Orient safe?

Pros

Cons

Is Orient Safe or a Scam?

Introduction

Orient Financial Brokers, a brokerage firm based in Dubai, has been operating since 1994, positioning itself as a player in the foreign exchange (forex) market. With a wide range of financial products, including forex trading, CFDs, and commodities, Orient aims to attract both novice and experienced traders. However, in an industry rife with scams and unregulated entities, it is crucial for traders to exercise caution when selecting a broker. This article aims to investigate whether Orient is a safe choice for traders or if it exhibits characteristics of a scam. The evaluation will be based on regulatory compliance, company background, trading conditions, customer fund security, user experiences, platform performance, and risk assessments.

Regulation and Legitimacy

One of the primary factors in determining the safety of a brokerage is its regulatory status. Regulatory bodies enforce rules and standards that protect traders and ensure fair practices. Unfortunately, Orient Financial Brokers is primarily regulated by the Securities and Commodities Authority (SCA) of the UAE, which, while providing some level of oversight, is not considered a top-tier regulator compared to institutions like the FCA or ASIC.

Here's a summary of the regulatory information for Orient:

| Regulatory Body | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| SCA | Not disclosed | UAE | Unverified |

The lack of a top-tier regulatory license raises concerns about the broker's commitment to maintaining high standards of transparency and security. Additionally, the absence of a verification status further complicates the trustworthiness of the broker. While the SCA does provide a framework for operations, it does not guarantee the same level of investor protection offered by more stringent regulators. Traders should be aware that, without a robust regulatory framework, they may have limited recourse in the event of disputes or issues with fund withdrawals.

Company Background Investigation

Orient Financial Brokers has a long history, having been established in 1994. Their ownership structure is not entirely transparent, as specific details regarding the management team and their professional backgrounds are not readily available. This lack of transparency can be a red flag for potential investors.

The company's commitment to customer service and innovation is emphasized in their marketing materials, but the absence of publicly available information about the founders and key executives raises questions about accountability. A well-structured management team with a proven track record is essential for building trust with clients. The lack of detailed disclosures may lead to skepticism regarding the broker's operations and intentions.

Trading Conditions Analysis

The trading conditions offered by Orient Financial Brokers are vital in assessing the overall cost of trading. While the broker claims to offer competitive spreads and various trading instruments, it is essential to analyze the fee structure closely.

The following table outlines the core trading costs associated with Orient:

| Fee Type | Orient Financial Brokers | Industry Average |

|---|---|---|

| Spread for Major Currency Pairs | 1.5 pips | 1.0 pips |

| Commission Model | Variable | Fixed |

| Overnight Interest Range | 0.5% - 2.0% | 0.3% - 1.5% |

The spreads offered by Orient are higher than the industry average, which may eat into traders' profits. Additionally, the variable commission model can lead to unexpected costs, particularly for high-frequency traders. The overnight interest rates also appear to be on the higher end, which can significantly impact long-term positions. Traders should consider these factors when evaluating whether to trade with Orient Financial Brokers.

Customer Fund Security

The safety of customer funds is paramount when evaluating a broker. Orient Financial Brokers claims to implement various security measures, including segregated accounts to protect client funds. However, the effectiveness of these measures is contingent on the regulatory framework under which the broker operates.

While the SCA does require brokers to maintain certain standards, the lack of a top-tier regulatory oversight raises concerns about the adequacy of these protections. Moreover, there have been no significant historical incidents reported that would indicate a breach of fund security at Orient, but the absence of investor protection schemes, such as those offered by the FCA, leaves traders vulnerable in the event of insolvency or mismanagement.

Customer Experience and Complaints

User feedback is another critical aspect of evaluating whether Orient is safe or a scam. While some traders report satisfactory experiences, there are numerous complaints regarding withdrawal delays and customer support responsiveness.

The following table summarizes common complaint types and their severity:

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Issues | High | Slow response time |

| Customer Support | Medium | Mixed feedback |

| Platform Stability | Medium | Occasional downtime |

For example, several users have reported significant delays in processing withdrawal requests, with some waiting weeks for their funds to be released. This raises concerns about the broker's operational efficiency and reliability. Furthermore, the mixed feedback on customer support indicates that while some traders have had positive interactions, others have faced challenges in resolving their issues.

Platform and Execution

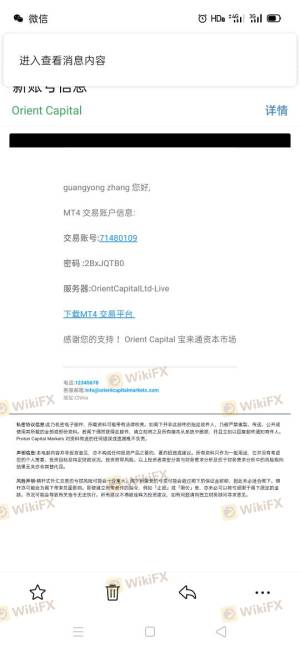

The trading platform's performance is crucial for a seamless trading experience. Orient Financial Brokers utilizes both the Saturn Trader and MetaTrader 5 platforms. However, user reviews indicate that there are occasional stability issues, with reports of slippage during high volatility periods.

Moreover, the execution quality is paramount; traders expect their orders to be filled at the desired price. Any signs of platform manipulation or high rejection rates can significantly impact trader trust.

Risk Assessment

Trading with Orient Financial Brokers involves several risks that potential investors should consider.

The following risk assessment summarizes key areas of concern:

| Risk Category | Risk Level | Brief Description |

|---|---|---|

| Regulatory Risk | High | Lack of top-tier regulation |

| Fund Security | Medium | Segregated accounts, but limited protections |

| Withdrawal Issues | High | Reports of significant delays |

To mitigate these risks, traders should conduct thorough research, consider using a demo account, and only invest funds they can afford to lose.

Conclusion and Recommendations

Based on the evidence gathered, it is clear that while Orient Financial Brokers has established a presence in the forex market, there are significant concerns regarding its regulatory status, trading conditions, and customer experiences. The lack of top-tier regulation and transparency raises red flags that potential investors should not ignore.

For traders seeking a reliable and safe trading environment, it may be prudent to consider alternative brokers with a stronger regulatory framework and better customer feedback. Overall, while Orient may not be a scam per se, the cautionary signs suggest that traders proceed with care and due diligence.

In summary, is Orient safe? The answer is complex. While it may provide some legitimate services, the potential risks and lack of robust regulatory oversight suggest that traders should approach with caution.

Is Orient a scam, or is it legit?

The latest exposure and evaluation content of Orient brokers.

Orient Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

Orient latest industry rating score is 1.56, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.56 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.