Is worldfistw safe?

Business

License

Is WorldFirst Safe or Scam?

Introduction

WorldFirst is an international money transfer service that has established itself in the foreign exchange market since its inception in 2004. Originally founded in London, it has expanded its operations globally, with offices in Australia, Singapore, and Hong Kong. As a broker that primarily serves businesses and e-commerce merchants, it aims to provide competitive exchange rates and efficient money transfer solutions. However, the rise of online trading has also seen an increase in fraudulent schemes, leading traders to exercise caution when selecting a broker. Therefore, assessing the legitimacy and safety of WorldFirst is crucial for potential users. This article employs a comprehensive investigation method, analyzing regulatory compliance, company background, trading conditions, client experiences, and safety measures to determine if WorldFirst is indeed safe or a scam.

Regulatory and Legitimacy

The regulatory framework surrounding a broker is vital to its credibility. WorldFirst operates under the regulation of the Australian Securities and Investments Commission (ASIC) and the UKs Financial Conduct Authority (FCA). These regulatory bodies set high standards for financial institutions, including capital requirements, operational transparency, and consumer protection measures.

| Regulatory Body | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| ASIC | 331945 | Australia | Verified |

| FCA | 900508 | United Kingdom | Verified |

The presence of these licenses indicates that WorldFirst adheres to strict regulatory standards, which is a positive sign for potential clients. However, it is essential to note that while ASIC and FCA regulations are robust, the broker has faced some scrutiny regarding its operational practices. Historical compliance records show no significant breaches, but the presence of complaints about fund withdrawals suggests that clients should remain vigilant. Therefore, while WorldFirst appears to be a legitimate entity, the regulatory landscape requires continuous monitoring by users to ensure their investments are protected.

Company Background Investigation

WorldFirst was founded by Jonathan Quin and Nick Robinson in 2004, with a vision to provide a trustworthy alternative to traditional banks for international money transfers. Over the years, it has grown significantly, especially after its acquisition by Ant Group in 2019, a move that brought additional resources and technological advancements to the platform.

The management team at WorldFirst comprises seasoned professionals with extensive experience in finance and technology, enhancing the company's credibility. However, the rapid expansion and subsequent changes in ownership have raised questions regarding the company's transparency and information disclosure practices. While the company provides information about its services and regulatory compliance, some users have reported a lack of clarity regarding fees and operational changes, which can be a red flag for potential clients.

Overall, WorldFirst's history and ownership structure indicate a robust foundation, but the transparency of its operations and communication with clients needs to be improved to foster trust.

Trading Conditions Analysis

When evaluating whether WorldFirst is safe, it is essential to consider its trading conditions, including fees and overall cost structure. WorldFirst operates with a fee structure that includes competitive exchange rates, typically around 0.6% above interbank rates. However, the minimum transfer amount of $2,000 may be considered high compared to other money transfer services.

| Fee Type | WorldFirst | Industry Average |

|---|---|---|

| Major Currency Pair Spread | 0.6% | 1.5% |

| Commission Model | Variable | Fixed/Variable |

| Overnight Interest Range | Low | Medium |

The fee structure is relatively transparent, but some users have reported unexpected charges, particularly concerning withdrawal fees, which raises concerns about the broker's overall reliability. Such discrepancies in expected costs can lead to dissatisfaction and distrust among clients. Therefore, while WorldFirst offers competitive rates, prospective users should be aware of potential hidden fees that may arise during transactions.

Client Fund Safety

Client fund safety is paramount in determining whether WorldFirst is a safe option for traders. WorldFirst employs several measures to ensure the security of client funds, including segregated accounts that separate client funds from the company's operating capital. This practice is crucial in protecting clients' money in the event of financial difficulties faced by the broker.

Additionally, WorldFirst adheres to strict anti-money laundering (AML) regulations, which require thorough verification of clients' identities and the source of funds. This process enhances the safety of transactions but may also lead to delays in fund transfers.

Despite these safety measures, there have been instances where clients reported issues with fund withdrawals, leading to concerns about the broker's reliability. Such incidents can create a perception of insecurity, making it essential for potential clients to weigh these risks carefully. Overall, while WorldFirst implements several security practices, historical complaints regarding fund access should not be overlooked.

Customer Experience and Complaints

Customer feedback is a critical aspect of assessing whether WorldFirst is a scam or a legitimate service. Reviews from various platforms indicate a mixed bag of experiences. Many clients praise the company's customer service, highlighting the responsiveness and professionalism of the support team. However, a significant number of complaints have surfaced, particularly regarding withdrawal issues and unclear fee structures.

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Issues | High | Slow/Unresolved |

| Fee Discrepancies | Medium | Clarification Provided |

| Customer Service Delays | Medium | Acknowledged |

For instance, some users have reported being unable to withdraw funds without incurring additional fees, leading to frustration and distrust. These complaints are serious and indicate a potential risk for new clients. While WorldFirst has a generally positive reputation, the recurring nature of these complaints suggests that prospective users should proceed with caution and ensure they fully understand the terms and conditions before engaging with the platform.

Platform and Trade Execution

The trading platforms performance is another critical factor in assessing whether WorldFirst is safe. The company offers a user-friendly interface that facilitates smooth transactions and provides access to real-time exchange rates. However, some users have reported instances of slippage and delays in order execution, which can significantly impact trading outcomes.

Moreover, there is no evidence to suggest any manipulation of the platform; however, the reported issues could be indicative of underlying technical challenges that need to be addressed. Overall, while the platform offers a solid trading experience, users should remain aware of potential execution issues that could affect their trading strategies.

Risk Assessment

Using WorldFirst comes with certain risks that potential clients should consider. The following risk assessment summarizes the key areas of concern:

| Risk Category | Risk Level (Low/Medium/High) | Brief Explanation |

|---|---|---|

| Regulatory Compliance | Medium | Regulatory scrutiny exists. |

| Fund Withdrawal Issues | High | Reports of delays and fees. |

| Platform Reliability | Medium | Instances of execution delays. |

To mitigate these risks, clients should conduct thorough research, understand the fee structures, and maintain clear communication with customer service. It is advisable to start with smaller transactions to gauge the platform's reliability before committing larger sums.

Conclusion and Recommendations

In conclusion, while WorldFirst has established itself as a reputable player in the international money transfer market, there are notable concerns that potential clients should consider. The regulatory oversight provided by ASIC and FCA adds a layer of legitimacy, yet the recurring complaints about fund withdrawals and unclear fees raise red flags regarding its overall safety.

For traders seeking reliable services, it is advisable to conduct thorough due diligence and consider alternative options such as TransferWise or OFX, which have demonstrated strong customer satisfaction and transparent fee structures. Ultimately, while WorldFirst is not outright a scam, the potential risks associated with its operations warrant careful consideration before proceeding.

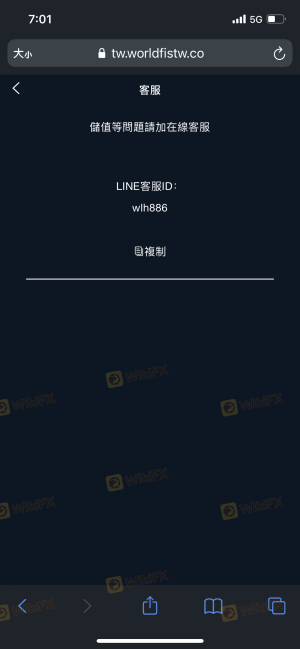

Is worldfistw a scam, or is it legit?

The latest exposure and evaluation content of worldfistw brokers.

worldfistw Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

worldfistw latest industry rating score is 1.49, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.49 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.