Is WillKing safe?

Business

License

Is WillKing Safe or Scam?

Introduction

WillKing is a forex broker that positions itself within the competitive landscape of online trading platforms. As the forex market continues to grow, traders are increasingly drawn to various brokers promising lucrative opportunities. However, the proliferation of brokers also means that potential scams are on the rise, making it essential for traders to carefully evaluate their options. In this article, we will investigate whether WillKing is a safe trading platform or a potential scam. Our evaluation will be based on a comprehensive review of regulatory compliance, company background, trading conditions, customer feedback, and overall risk assessment.

Regulation and Legitimacy

The regulatory status of a broker is a critical factor in determining its legitimacy. WillKing claims to operate under the regulatory framework of Hong Kong, but there are concerns regarding its compliance with international standards. The following table summarizes the core regulatory information for WillKing:

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| N/A | N/A | Hong Kong | Not Verified |

The absence of a recognized regulatory authority raises red flags about WillKing's operations. Regulatory bodies such as the FCA (UK), ASIC (Australia), and NFA (USA) are known for their stringent oversight, which helps protect traders from fraudulent activities. In contrast, WillKing's lack of regulation suggests a potential for unmonitored practices, which could jeopardize traders' funds. Furthermore, reports from sources like WikiFX label WillKing as operating under a suspicious license, further questioning its credibility. This lack of oversight and regulatory verification is a significant concern for anyone asking, "Is WillKing safe?"

Company Background Investigation

WillKing's company history and ownership structure provide further insights into its reliability. The broker claims to have been established in Hong Kong, but detailed information about its founding, management team, and operational history is scarce. A transparent company profile typically includes information about key executives, their backgrounds, and their experience in the financial industry. However, WillKing does not provide sufficient details, which raises questions about its transparency.

Moreover, the management team's expertise is crucial for ensuring the broker's integrity and operational standards. A lack of information about the management team could indicate potential issues with accountability and governance. Without a clear understanding of who is running the company, traders may find it challenging to trust WillKing fully. This lack of transparency is another aspect to consider when evaluating, "Is WillKing safe?"

Trading Conditions Analysis

Examining the trading conditions offered by WillKing is essential to assess its attractiveness to traders. The broker's fee structure and trading costs can significantly impact a trader's profitability. WillKing claims to offer competitive spreads and low commissions, but it is essential to scrutinize these claims closely. The following table outlines the core trading costs associated with WillKing:

| Fee Type | WillKing | Industry Average |

|---|---|---|

| Spread for Major Currency Pairs | 2.0 pips | 1.5 pips |

| Commission Model | $5 per lot | $3 per lot |

| Overnight Interest Range | 2.5% | 1.0% |

The spreads offered by WillKing are higher than the industry average, which may deter cost-conscious traders. Additionally, the commission structure appears less favorable compared to other brokers, which could impact overall trading profitability. Moreover, any hidden fees or unusual cost policies should be scrutinized, as they can lead to unexpected financial burdens. Thus, traders should carefully consider whether these conditions align with their trading strategies before committing to WillKing. This analysis raises further doubts about the question, "Is WillKing safe?"

Client Fund Security

A broker's approach to safeguarding client funds is a crucial aspect of its overall safety profile. WillKing claims to implement various security measures, but the lack of specific details leaves much to be desired. Effective fund security typically includes measures such as segregated accounts, investor protection schemes, and negative balance protection. However, WillKing's transparency regarding these measures is limited.

The absence of clear information about fund segregation raises concerns about the safety of clients' investments. If a broker does not segregate client funds from its operational funds, traders may risk losing their investments in the event of the broker's insolvency. Additionally, any history of fund security issues or disputes should be examined closely. The lack of clarity surrounding WillKing's fund security policies raises significant concerns for potential traders, further complicating the question, "Is WillKing safe?"

Customer Experience and Complaints

Understanding customer feedback and experiences is crucial for evaluating a broker's reliability. WillKing has received mixed reviews from users, with some praising its trading platform while others express dissatisfaction with customer support and withdrawal processes. The following table summarizes the primary complaint types associated with WillKing:

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Issues | High | Slow Response |

| Poor Customer Support | Medium | Inconsistent |

| Platform Stability | Low | Limited Feedback |

Common complaints include difficulties in withdrawing funds and slow customer support responses. These issues can significantly affect a trader's experience and trust in the broker. Additionally, the company's response to complaints is crucial for assessing its commitment to customer satisfaction. A lack of proactive engagement in resolving issues can indicate deeper operational problems and may lead traders to question, "Is WillKing safe?"

Platform and Execution

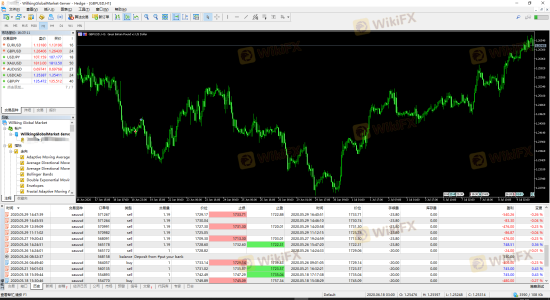

The performance of a trading platform directly impacts a trader's experience. WillKing claims to offer a user-friendly platform with robust features, but user experiences vary. Key performance indicators such as order execution quality, slippage rates, and rejection rates should be carefully evaluated. Traders have reported instances of slippage during volatile market conditions, which can negatively affect trading outcomes. If a broker frequently experiences execution issues, it raises concerns about its reliability and overall trading environment.

Risk Assessment

Using WillKing entails various risks that traders should be aware of. The following risk scorecard summarizes the key risk areas associated with this broker:

| Risk Category | Risk Level (Low/Medium/High) | Brief Explanation |

|---|---|---|

| Regulatory Compliance | High | Lack of regulation raises concerns |

| Fund Security | High | Unclear fund protection measures |

| Customer Support | Medium | Reports of slow response and issues |

| Trading Conditions | Medium | Higher spreads and commissions |

To mitigate these risks, traders should conduct thorough due diligence before opening an account with WillKing. It is advisable to start with a small deposit, test the trading environment, and assess the platform's performance before committing significant funds.

Conclusion and Recommendations

After a comprehensive evaluation, it is evident that WillKing presents several red flags that warrant caution. The lack of regulatory oversight, transparency in fund security measures, and mixed customer feedback raise significant concerns. Therefore, traders should approach WillKing with a healthy degree of skepticism when asking, "Is WillKing safe?"

For those seeking a reliable trading experience, it may be wise to consider alternative brokers that offer robust regulatory oversight, transparent trading conditions, and positive customer feedback. Brokers regulated by top-tier authorities such as the FCA or ASIC may provide a safer trading environment. In conclusion, while WillKing may offer certain trading opportunities, the associated risks and concerns suggest that traders should proceed with caution.

Is WillKing a scam, or is it legit?

The latest exposure and evaluation content of WillKing brokers.

WillKing Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

WillKing latest industry rating score is 1.55, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.55 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.