Is REGIS-TR safe?

Pros

Cons

Is Regis Tr Safe or Scam?

Introduction

Regis Tr is a forex brokerage based in Luxembourg, emerging in the financial landscape since its establishment in 2010. It offers a range of trading services, including forex, contracts for difference (CFDs), commodities, and indices to clients worldwide. However, in the ever-evolving forex market, traders must exercise caution and conduct thorough evaluations of brokers before committing their funds. This is particularly crucial given the prevalence of scams and unregulated entities in the industry.

In this article, we will investigate the safety and legitimacy of Regis Tr by examining its regulatory status, company background, trading conditions, customer fund security, user experiences, and overall risk. Our analysis is based on information gathered from various reputable sources, including broker reviews, regulatory databases, and customer feedback. We aim to provide a comprehensive and objective assessment to help traders determine whether Regis Tr is safe or potentially a scam.

Regulatory and Legitimacy

The regulatory status of a brokerage is a critical factor in assessing its legitimacy. A well-regulated broker typically adheres to strict standards that protect investors and ensure fair trading practices. Unfortunately, Regis Tr is reported to be unregulated, which raises significant concerns about its operational integrity and the safety of client funds.

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| None | N/A | Luxembourg | Unverified |

The absence of regulation means that Regis Tr does not have oversight from a recognized financial authority, such as the Financial Conduct Authority (FCA) in the UK or the Securities and Exchange Commission (SEC) in the United States. This lack of oversight can lead to questionable practices, as there are no regulatory bodies to enforce compliance or protect investors in case of disputes. Furthermore, the historical compliance record of Regis Tr is not available, making it difficult to ascertain its commitment to ethical trading practices.

Company Background Investigation

Regis Tr was founded in 2010, with its headquarters located in Luxembourg. The brokerage aims to provide various trading services to a global clientele. However, the lack of transparency regarding its ownership structure and management team raises concerns about its operational integrity.

The management team's background and expertise are crucial in determining the reliability of a brokerage. Unfortunately, there is limited information available about the individuals behind Regis Tr, leaving potential clients in the dark regarding their qualifications and experience in the financial industry.

Moreover, the companys transparency in terms of information disclosure is questionable, as there is minimal public information regarding its financial health, operational practices, or any potential affiliations with established financial institutions. In an industry where trust is paramount, such opacity can be a red flag for prospective traders.

Trading Conditions Analysis

When evaluating a brokerage, understanding its trading conditions is essential. Regis Tr offers various financial instruments, but the overall fee structure and trading conditions remain ambiguous.

| Fee Type | Regis Tr | Industry Average |

|---|---|---|

| Major Currency Pair Spread | Varies | 1.0 - 2.0 pips |

| Commission Model | N/A | $5 - $10 per lot |

| Overnight Interest Range | Varies | 0.5% - 3.0% |

The lack of clear information on spreads, commissions, and overnight interest could indicate potential hidden fees, which are often a tactic used by unscrupulous brokers to exploit traders. Traders should be wary of any unusual or excessive fees that could significantly impact their trading profitability.

Furthermore, the absence of a transparent commission model raises concerns about potential conflicts of interest, where the broker may prioritize its profits over the clients' trading success. This ambiguity in trading conditions further complicates the question of whether Regis Tr is safe for investors.

Client Fund Security

The safety of client funds is a paramount concern for any trader. A reputable brokerage typically implements robust security measures to protect client deposits and ensure their funds are segregated from the company's operational funds.

However, there are significant concerns regarding the fund security measures at Regis Tr. Reports indicate that there is no clear information on whether client funds are held in segregated accounts or if there are any investor protection mechanisms in place.

Additionally, the absence of a regulatory framework means that there is no safety net for investors in the event of financial difficulties or insolvency. Historical incidents of fund mismanagement or disputes involving Regis Tr have not been documented, but the lack of transparency and regulatory oversight raises alarms about the potential risks associated with trading with this brokerage.

Customer Experience and Complaints

Customer feedback is an essential component of assessing a broker's reliability. Reviews of Regis Tr reveal a mixed bag of experiences, with some users reporting satisfactory interactions while others express serious concerns regarding the broker's practices.

| Complaint Type | Severity Level | Company Response |

|---|---|---|

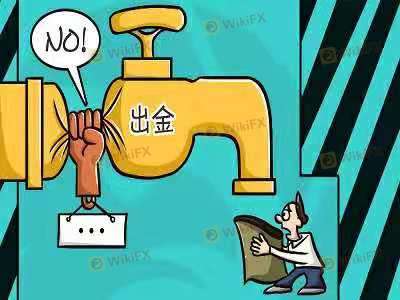

| Withdrawal Issues | High | Unresponsive |

| Poor Customer Support | Medium | Slow Response |

| Misleading Information | High | No Acknowledgment |

Common complaints include difficulties in withdrawing funds and inadequate customer support, which are significant issues that can severely impact a trader's experience. In some cases, users have reported that their requests for withdrawals went unanswered, leading to frustration and distrust.

One typical case involved a trader who attempted to withdraw funds after several months of trading, only to find their requests ignored. Such experiences highlight the potential risks involved with Regis Tr, raising the question of whether it operates ethically and transparently.

Platform and Trade Execution

The trading platform's performance is another critical aspect of a brokerage's reliability. A stable, user-friendly platform with efficient order execution is essential for traders to capitalize on market opportunities.

Regis Tr's platform reportedly offers basic functionalities, but user reviews indicate issues with stability and execution quality. Traders have experienced slippage and delays in order execution, which can lead to significant financial consequences, especially in a fast-moving market environment.

Moreover, there are no indications of platform manipulation, but the lack of transparency regarding its operational practices raises concerns about the overall integrity of the trading environment provided by Regis Tr.

Risk Assessment

Using Regis Tr comes with inherent risks, primarily due to its unregulated status and lack of transparency.

| Risk Category | Risk Level (Low/Medium/High) | Brief Description |

|---|---|---|

| Regulatory Risk | High | Unregulated broker poses risks to client funds. |

| Operational Risk | Medium | Potential issues with platform stability and execution. |

| Financial Risk | High | Lack of transparency regarding fees and fund security. |

Traders are advised to approach Regis Tr with caution, considering the potential risks involved. To mitigate these risks, it is recommended that traders conduct thorough research, utilize small amounts for initial trading, and explore alternative regulated brokers with a proven track record.

Conclusion and Recommendation

In conclusion, the evidence suggests that Regis Tr may not be a safe option for traders. The absence of regulation, coupled with a lack of transparency regarding its operational practices and customer fund security, raises significant red flags.

While some traders may find success with this broker, the risks associated with trading with an unregulated entity far outweigh the potential benefits. For those seeking a reliable and secure trading environment, it is advisable to consider regulated alternatives that offer robust investor protection and transparent trading conditions.

In light of the findings, traders are encouraged to prioritize their safety and seek brokers that are overseen by reputable regulatory authorities to ensure a secure trading experience.

Is REGIS-TR a scam, or is it legit?

The latest exposure and evaluation content of REGIS-TR brokers.

REGIS-TR Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

REGIS-TR latest industry rating score is 1.55, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.55 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.