Is Viseno safe?

Pros

Cons

Is Viseno Safe or a Scam?

Introduction

Viseno is a forex broker that has emerged in the competitive landscape of online trading, claiming to offer various trading products, including forex, CFDs, and cryptocurrencies. Established in an era where online trading platforms are proliferating, Viseno aims to attract traders with promises of high leverage and low minimum deposits. However, as the trading environment becomes increasingly saturated with both reputable and dubious brokers, it is crucial for traders to carefully evaluate the legitimacy and safety of their chosen platforms. This article investigates whether Viseno is a safe broker or a potential scam, employing a structured approach that encompasses regulatory compliance, company background, trading conditions, customer experiences, and risk assessments.

Regulation and Legitimacy

The regulatory status of a broker is one of the most critical factors that determine its safety and reliability. Regulation serves as a safeguard for traders, ensuring that brokers adhere to established standards and protect clients' funds. Unfortunately, Viseno does not hold a license from any reputable financial authority, which raises significant red flags regarding its legitimacy.

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| None | N/A | N/A | Unregulated |

The absence of regulation means that Viseno is not subject to oversight by any governing body, which could leave traders vulnerable to potential fraud or mismanagement of funds. Regulatory bodies typically require brokers to maintain a certain level of capital, segregate client funds, and adhere to strict operational guidelines. Without such oversight, traders may find it challenging to recover their funds in case of disputes or financial irregularities. Furthermore, warnings have been issued by various financial authorities, including Spain's CNMV, indicating that Viseno has engaged in unauthorized activities. This lack of regulatory compliance severely undermines the safety of trading with Viseno.

Company Background Investigation

A thorough investigation into the background of Viseno reveals a concerning lack of transparency. The company claims to be headquartered in the UK, yet there is no verifiable information regarding its physical address, ownership structure, or management team. This opacity raises questions about the authenticity of the broker and its operations.

Viseno's website provides minimal information about its history or the individuals behind the company. The absence of detailed disclosures about the management team and their professional backgrounds further complicates the assessment of the broker's reliability. A reputable broker typically provides comprehensive information about its founders and key personnel, including their qualifications and experience in the financial industry. In contrast, Viseno's lack of transparency may indicate that potential investors are dealing with an entity that is not fully committed to ethical business practices.

Trading Conditions Analysis

When evaluating a broker, it is essential to analyze the trading conditions it offers, including fees, spreads, and leverage. Viseno advertises a low minimum deposit requirement, which may appear attractive to new traders. However, the overall cost structure and potential hidden fees must be carefully examined.

| Fee Type | Viseno | Industry Average |

|---|---|---|

| Major Currency Pair Spread | 2.1 pips | 1.5 pips |

| Commission Model | N/A | Varies |

| Overnight Interest Range | N/A | Varies |

The spreads offered by Viseno, particularly on major currency pairs, are significantly higher than the industry average. This could indicate that traders may incur higher costs when executing trades, ultimately affecting their profitability. Moreover, the lack of clarity regarding commission structures and overnight interest rates adds to the complexity of understanding the true costs associated with trading on the platform. Traders should be cautious of any broker that does not provide comprehensive details about its fee structures, as this could lead to unexpected expenses.

Client Fund Safety

Client fund safety is paramount when considering a broker's reliability. In the case of Viseno, the absence of regulatory oversight raises serious concerns about how client funds are managed. Reputable brokers typically implement measures such as segregated accounts to ensure that client funds are kept separate from the broker's operational funds. This practice protects clients in the event of the broker's insolvency or financial difficulties.

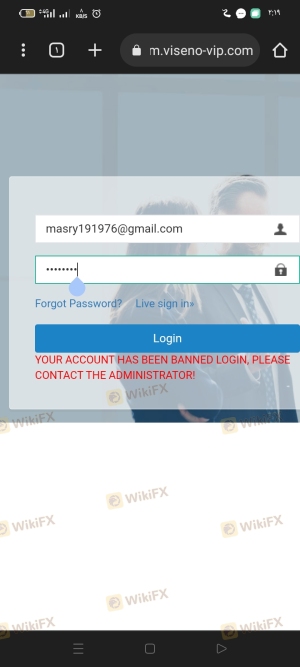

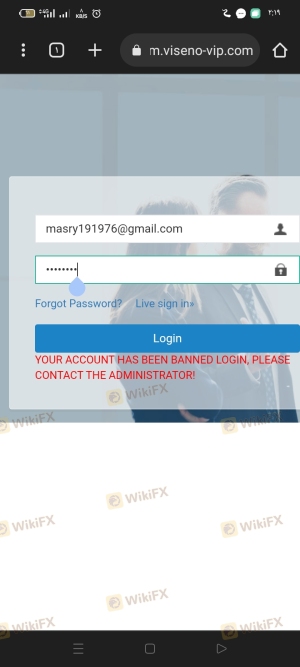

Unfortunately, there is no information available regarding Viseno's policies on fund segregation or investor protection mechanisms. Furthermore, the lack of a valid regulatory framework means that traders have limited recourse if they encounter issues with fund withdrawals or account access. Historical complaints and negative reviews from users suggest that some traders have experienced difficulties in accessing their funds, which further compounds concerns about the safety of client deposits.

Customer Experience and Complaints

Customer feedback is a valuable indicator of a broker's reliability and service quality. A review of user experiences with Viseno reveals a pattern of dissatisfaction, with many traders reporting issues related to withdrawal delays and poor customer service.

| Complaint Type | Severity | Company Response |

|---|---|---|

| Withdrawal Delays | High | Poor |

| Account Access Issues | High | Poor |

Common complaints include difficulties in withdrawing funds, with users alleging that their requests are often ignored or met with unreasonable conditions. Such issues are particularly alarming, as they suggest that Viseno may not prioritize customer satisfaction or transparency in its operations. In some cases, traders have reported being pressured to deposit additional funds without being able to access their existing balances. These patterns of complaints raise significant concerns about the broker's practices and its commitment to ethical trading.

Platform and Trade Execution

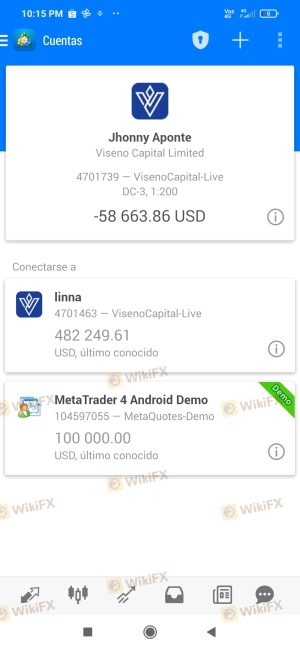

The trading platform provided by a broker plays a crucial role in the overall trading experience. Viseno claims to offer the widely-used MetaTrader 4 platform, which is known for its user-friendly interface and robust trading features. However, the performance and reliability of the platform must be evaluated.

Traders have reported issues with order execution, including slippage and rejections of orders. Such problems can significantly impact trading outcomes and raise suspicions of potential platform manipulation. A reputable broker should provide a stable trading environment with minimal disruptions to ensure that traders can execute their strategies effectively. The lack of transparency regarding execution quality and potential manipulation further highlights the risks associated with trading with Viseno.

Risk Assessment

Given the findings from the analysis above, it is crucial to assess the overall risk associated with trading with Viseno. The absence of regulatory oversight, combined with reports of customer complaints and issues related to fund safety, creates a high-risk environment for traders.

| Risk Category | Risk Level (Low/Medium/High) | Brief Explanation |

|---|---|---|

| Regulatory Compliance | High | Unregulated broker with no oversight. |

| Fund Safety | High | Lack of segregation and protection measures. |

| Customer Service | Medium | Poor response to complaints and withdrawal issues. |

| Platform Reliability | High | Reports of execution issues and potential manipulation. |

To mitigate these risks, traders should exercise extreme caution when considering Viseno as a trading option. It is advisable to seek out brokers with established regulatory frameworks, transparent operations, and positive customer feedback.

Conclusion and Recommendations

In light of the evidence presented, it is clear that Viseno poses significant risks to potential traders. The absence of regulation, combined with numerous complaints regarding fund access and customer service, strongly suggests that Viseno may not be a trustworthy broker. Traders should be wary of engaging with Viseno, especially those who are new to the trading environment.

For those seeking reliable alternatives, it is recommended to consider brokers that are regulated by reputable authorities, have transparent operational practices, and demonstrate a commitment to customer satisfaction. By prioritizing safety and reliability, traders can enhance their chances of achieving successful trading outcomes without falling victim to potential scams.

Is Viseno a scam, or is it legit?

The latest exposure and evaluation content of Viseno brokers.

Viseno Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

Viseno latest industry rating score is 1.49, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.49 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.