Viseno, operating as Viseno Capital Limited, is purportedly registered in the United Kingdom and is primarily identified as a forex broker. However, detailed information regarding the company—such as its founding year, ownership structure, and legitimacy—remains scant, creating a shroud of uncertainty around its operational practices. With the regulatory status marked as "no license" across numerous review platforms, traders are urged to exercise caution before proceeding.

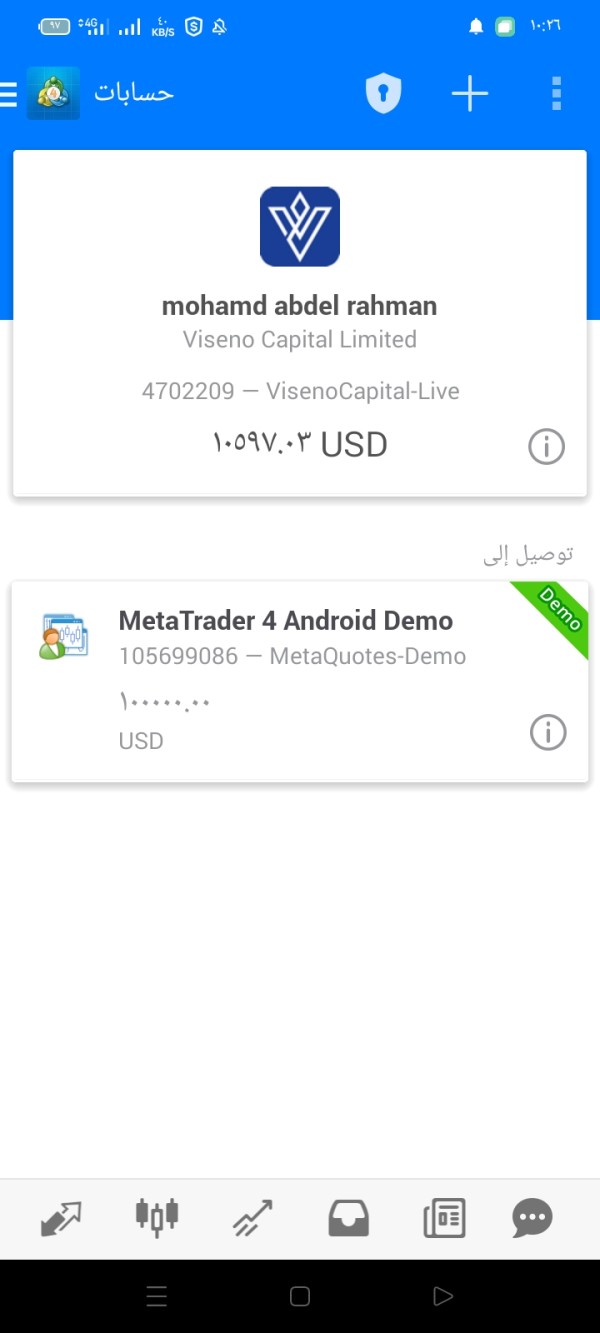

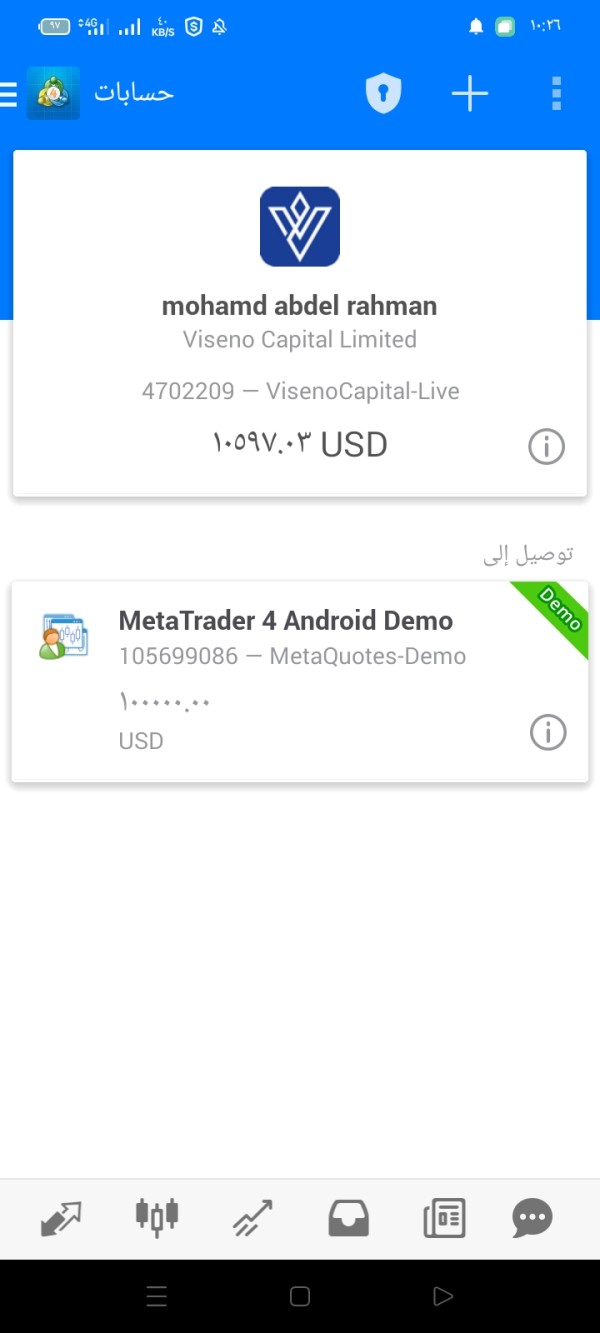

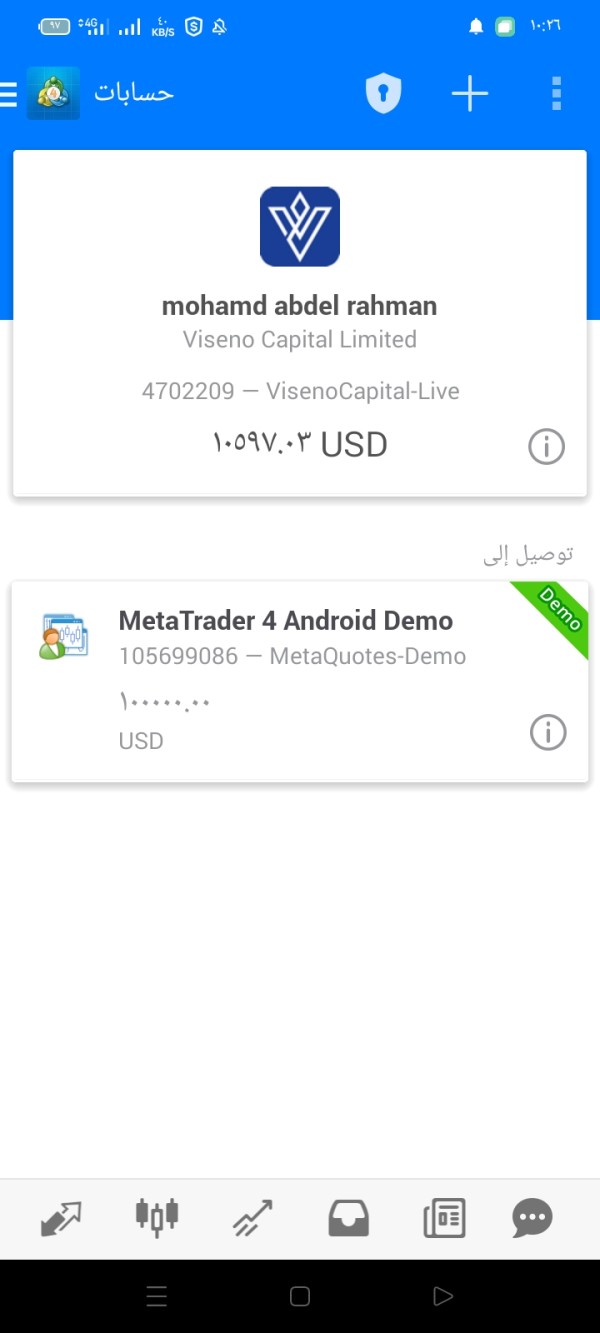

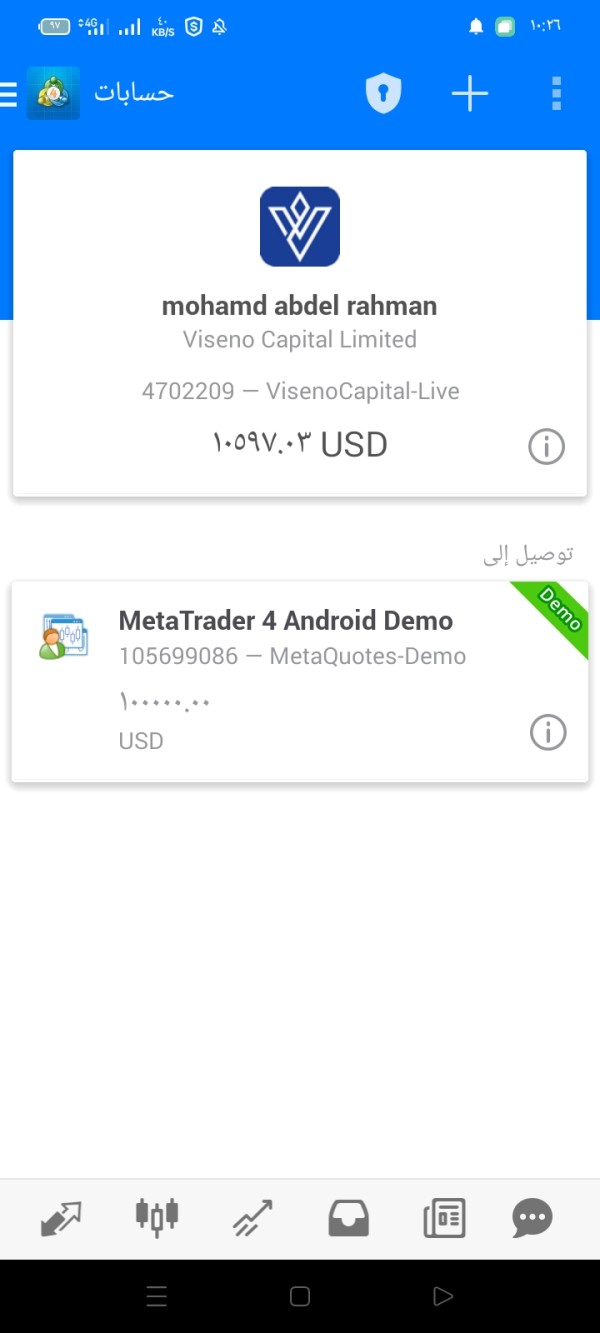

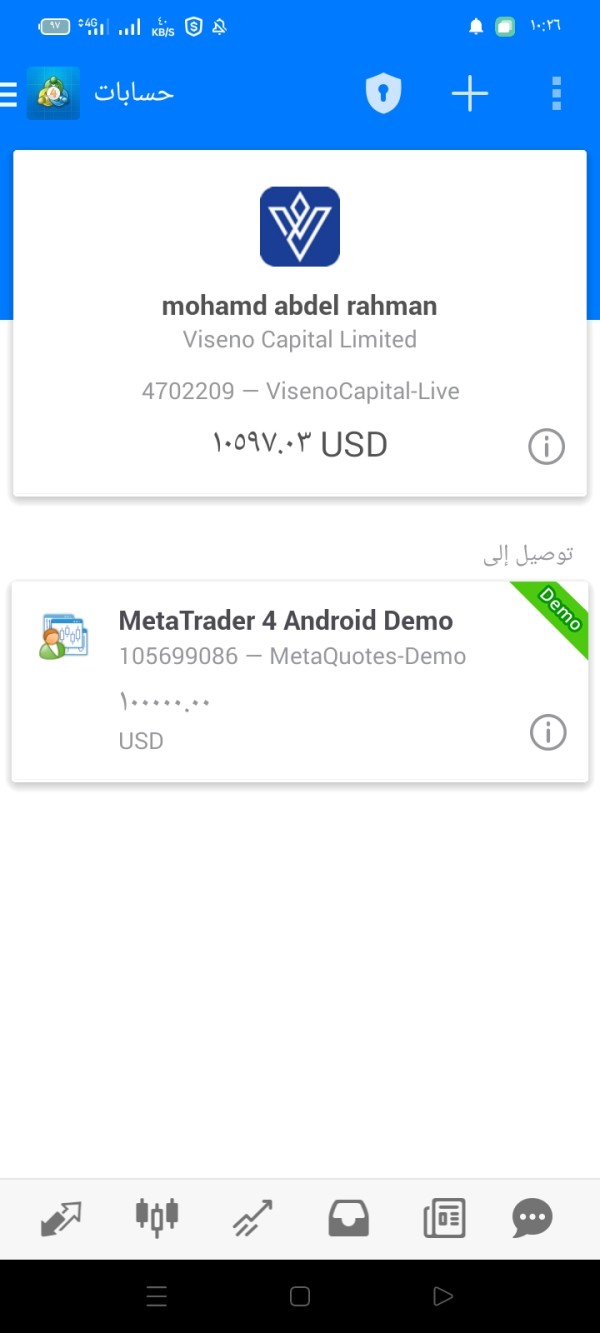

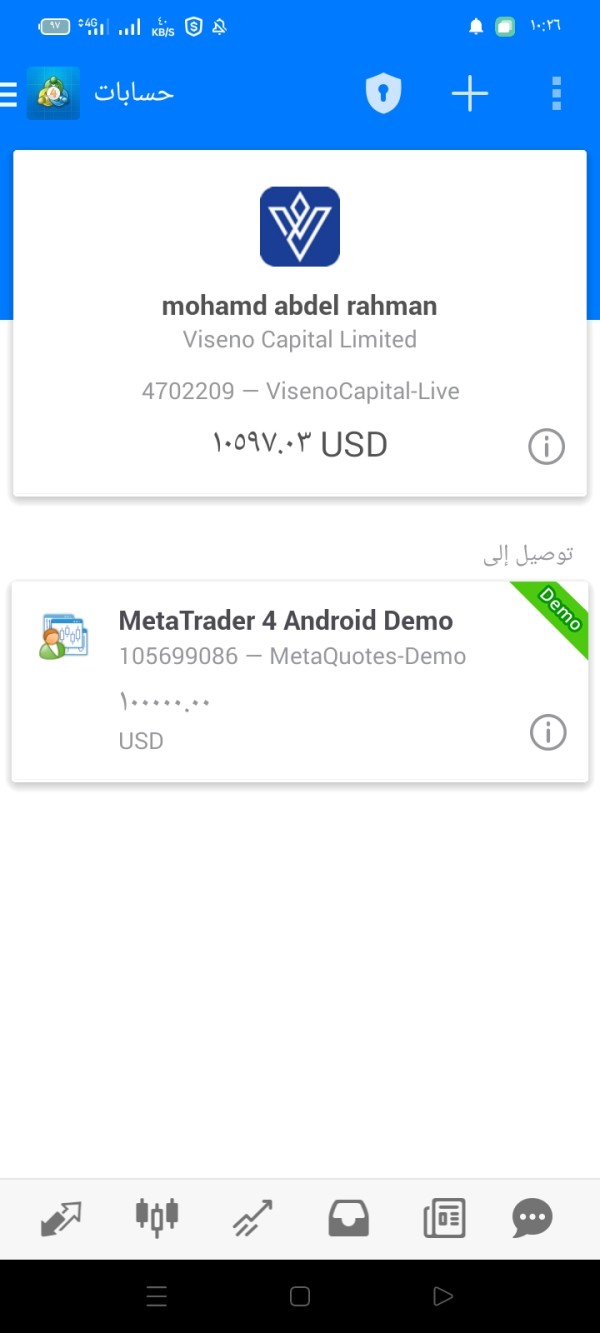

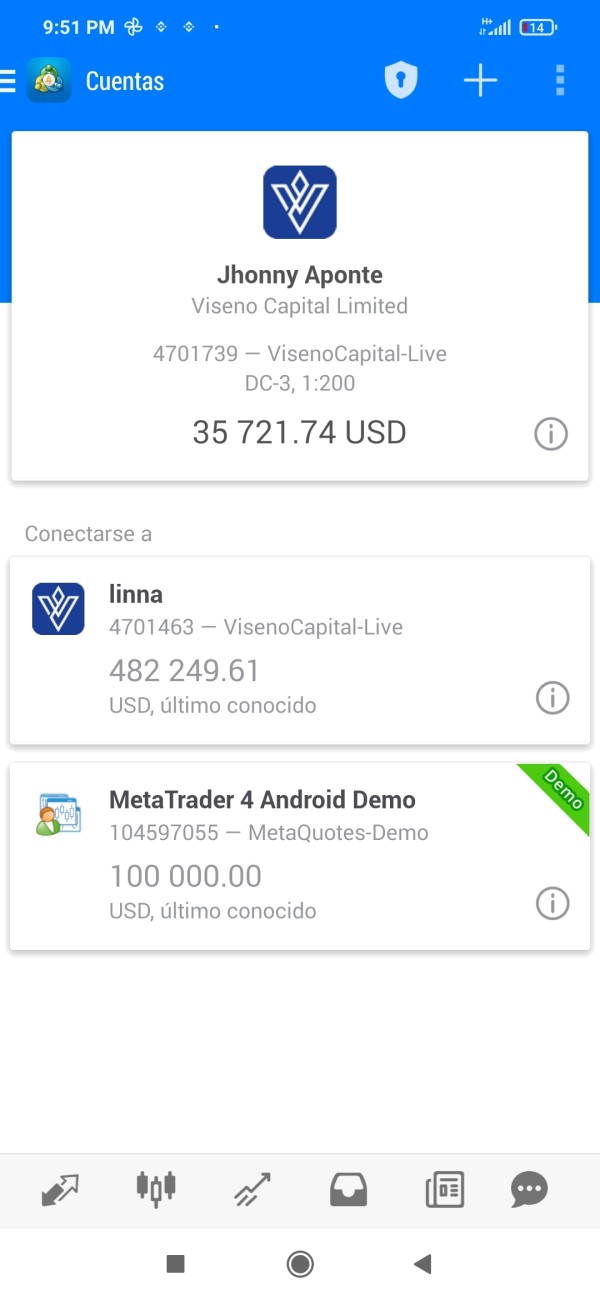

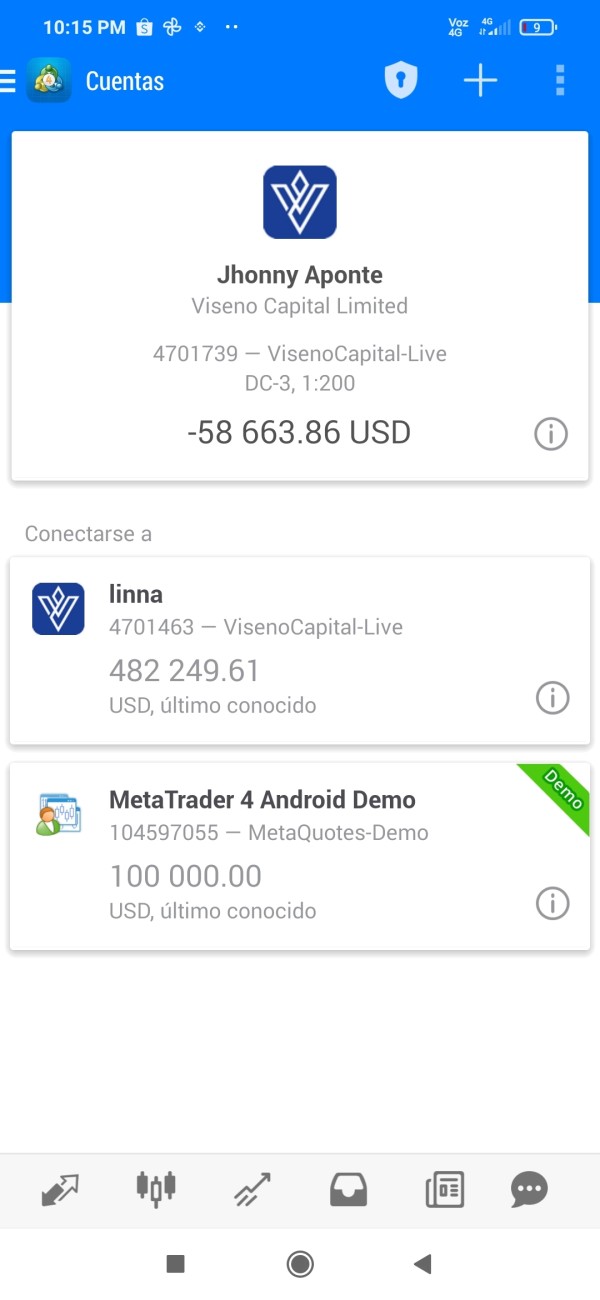

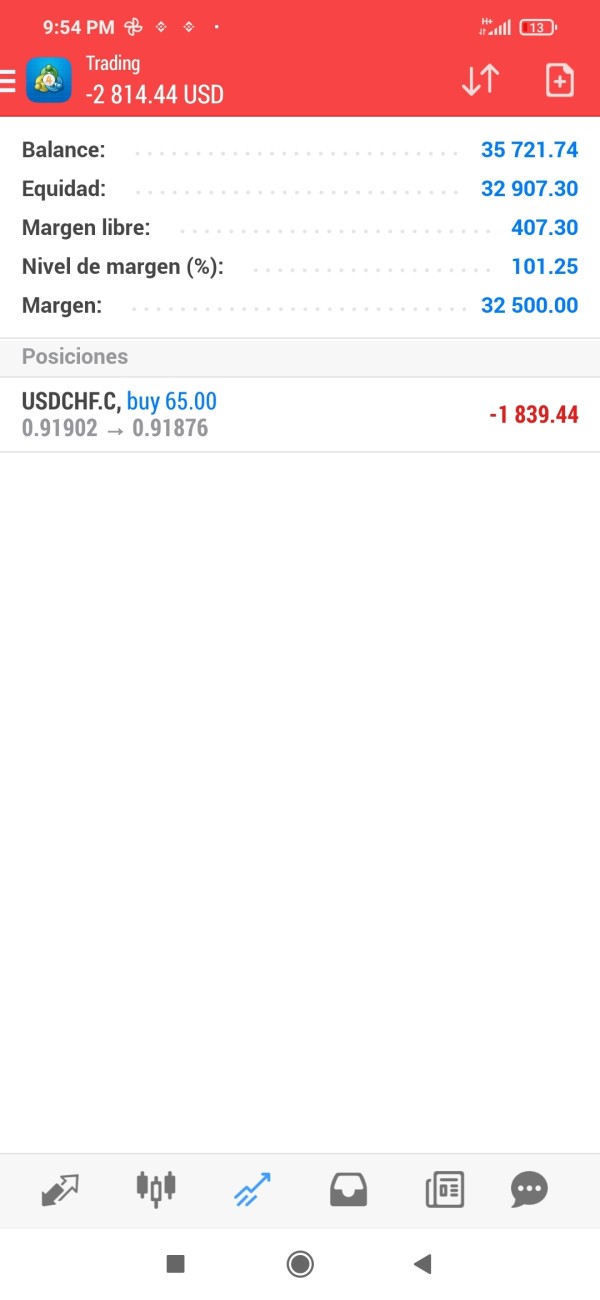

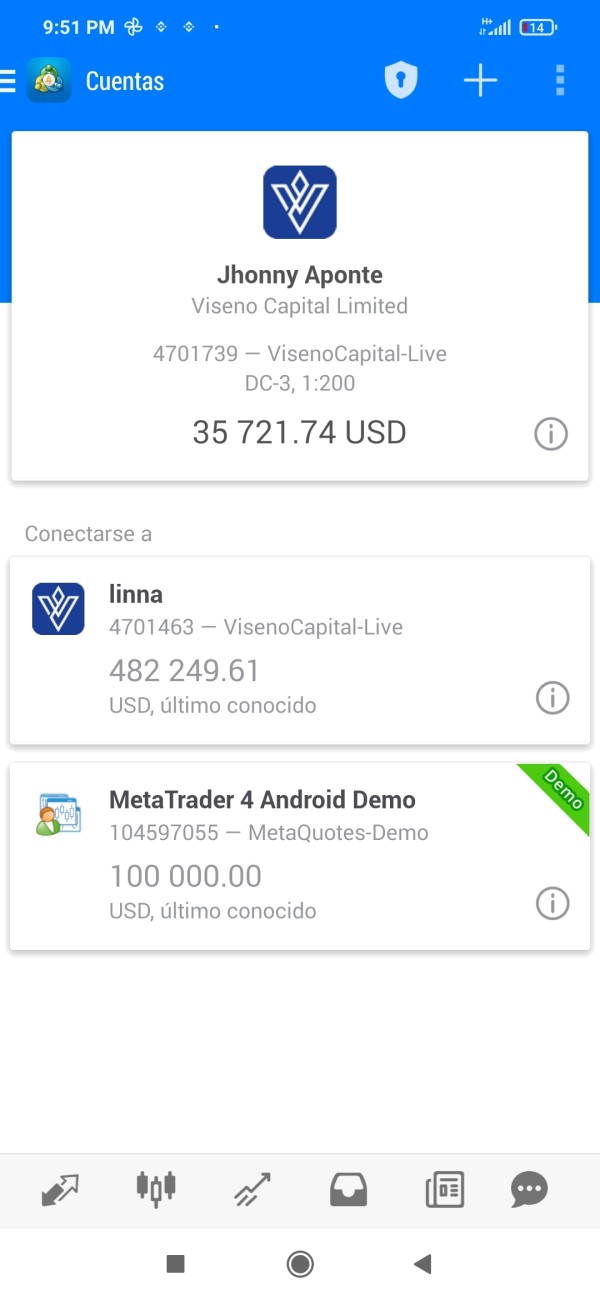

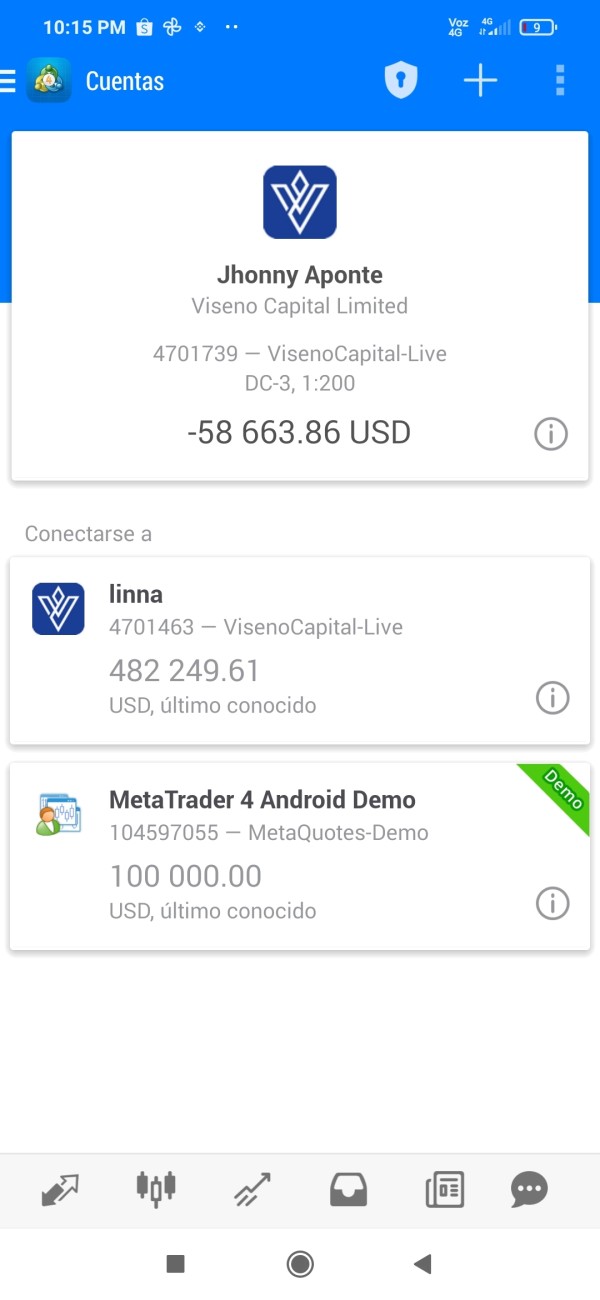

Viseno specializes in forex trading and contracts for differences (CFDs), claiming to provide its clients with a platform that features a broad array of asset classes. Notably, it offers high leverage (up to 1:500), which is much higher than many other brokers, enticing traders with the promise of substantial returns. The main platform used for trading is the widely recognized MetaTrader 4 (MT4), which is celebrated for its reliability in the trading community. However, specifics on regulatory bodies overseeing its operations remain shrouded in ambiguity, with conflicting claims about local versus international regulations.

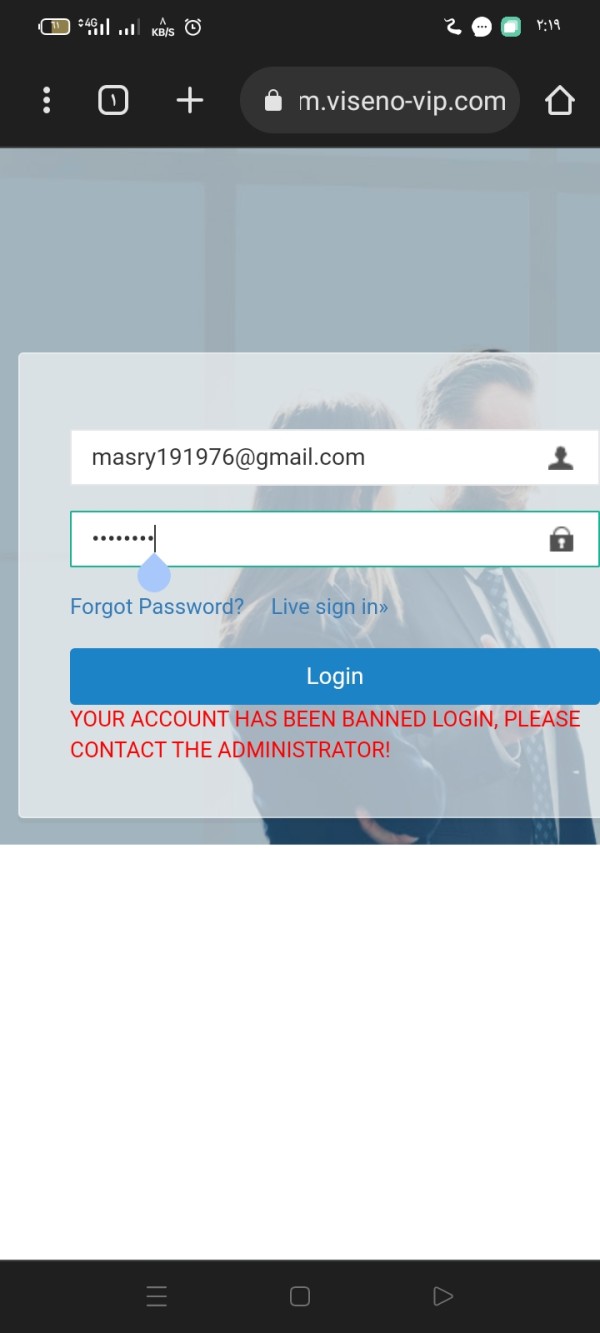

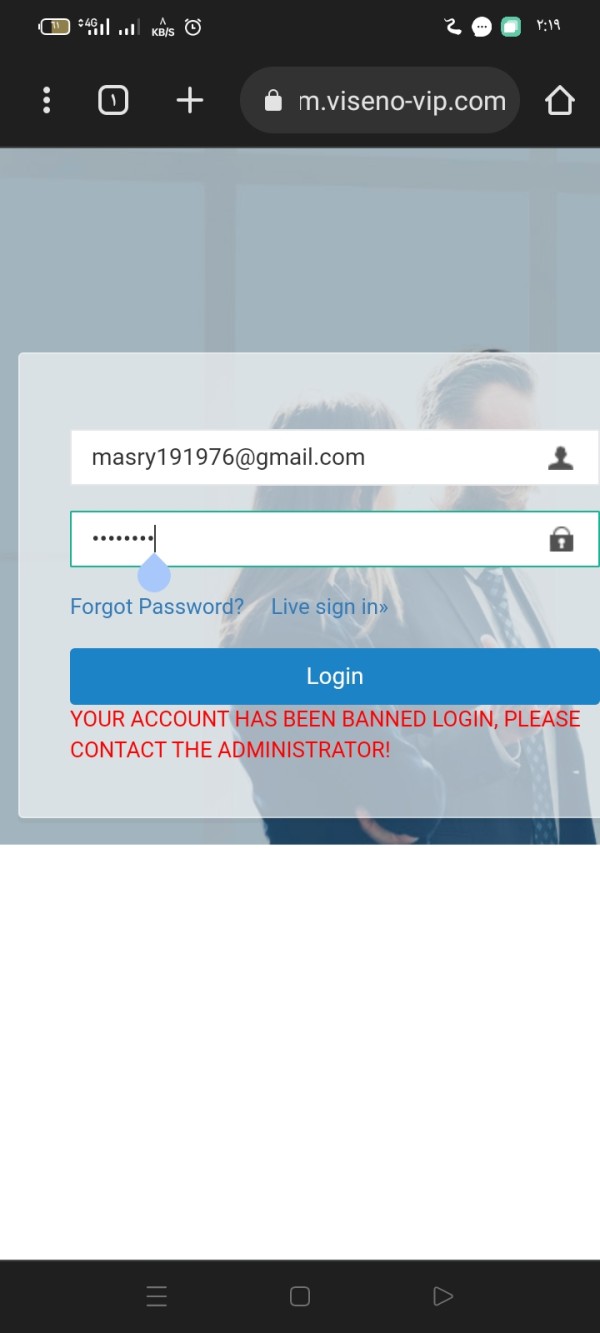

The absence of valid regulatory oversight raises alarms while examining Viseno. Reviews confirm that Viseno does not fall under the jurisdiction of any recognized regulatory body, marking its regulatory index at 0.00 on WikiFX. This lack of regulation significantly heightens the potential risks traders face when dealing with this platform.

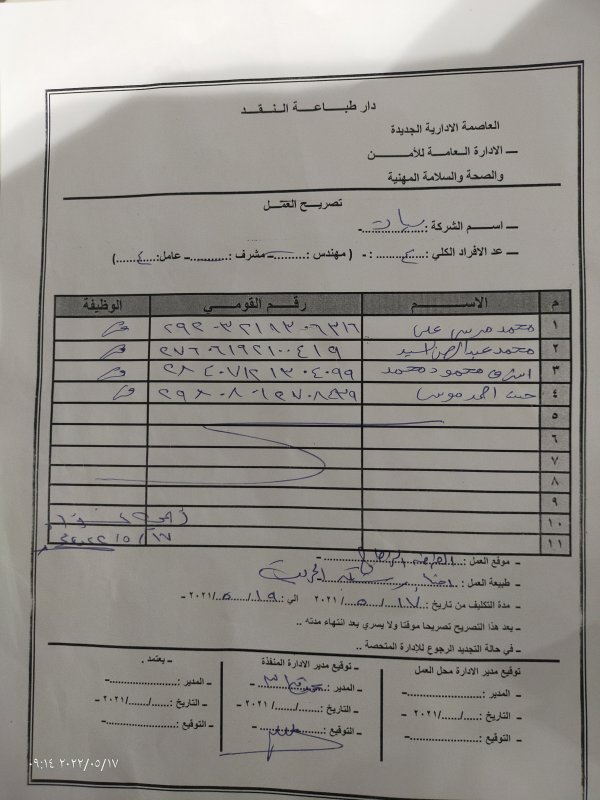

Traders are advised to undertake the following steps to verify the legitimacy of Viseno:

- Visit the NFA BASIC Database: Use it to confirm if Viseno Capital Limited has any valid registration.

- Search the FCA Register: Ensure that no licensing information appears for Viseno.

- Consult with ASIC Alerts: Review any public warnings issued against Viseno by the Australian Securities and Investments Commission.

- Examine CNMV Communications: The CNMV has already communicated warnings regarding Viseno; look into these for additional context.

- Utilize WikiFX and Forex Brokers Info: Run a broker analysis using these tools to assess the regulatory scores and user feedback.

Industry Reputation and Summary

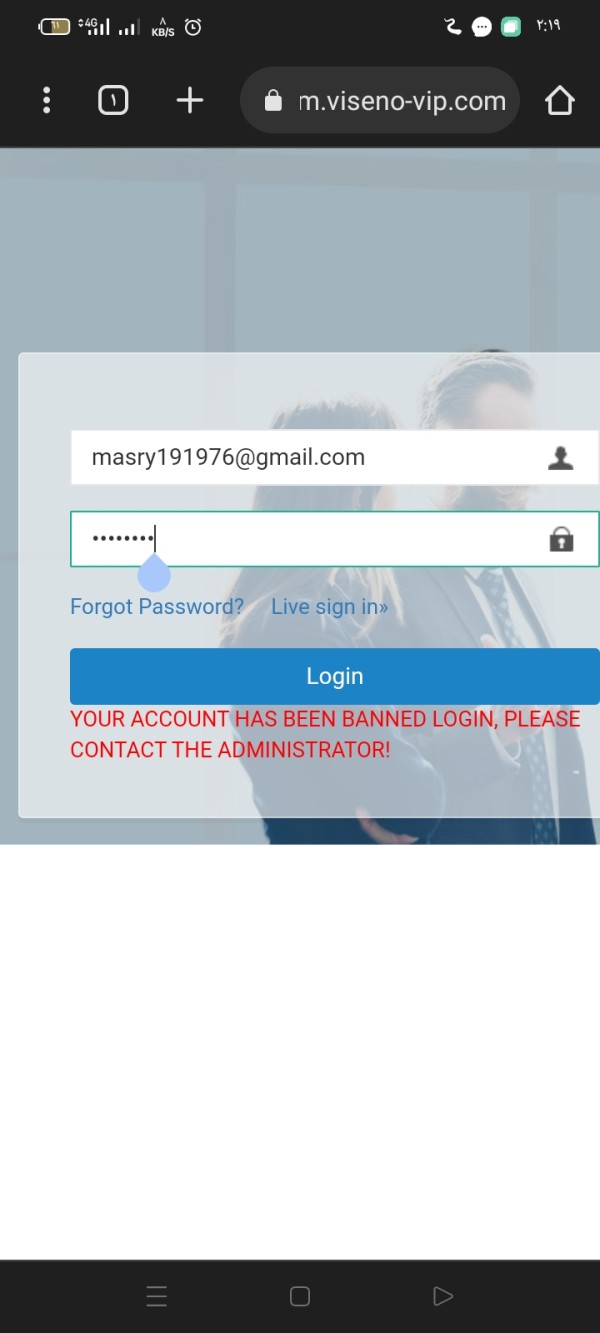

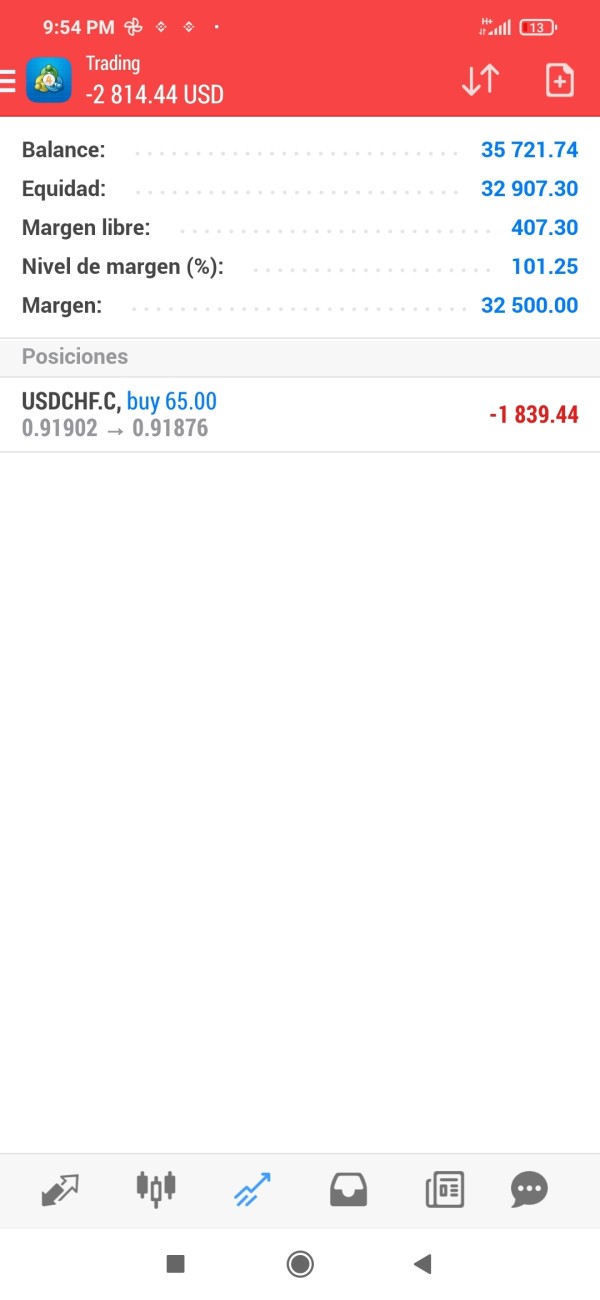

The collective feedback from users paints a grim picture of Viseno's reputation. Users have reported multiple challenges including severe slippage and significant difficulties in processing their withdrawals. As one user noted:

"I tried to withdraw my funds after a month of trading and was met with delays and excuses. It's like they dont want me to take my money out."

Such testimonials highlight the importance of self-verification for safeguarding one's investments.

6.2 Trading Costs Analysis

Advantages in Commissions

Viseno presents an appealing low-cost structure, especially for beginning traders drawn by the allure of a minimal initial deposit. The company's minimum deposit requirement of $1 can serve as an attractive entry point compared to many competitors that initiate accounts with significantly higher capital demands.

The "Traps" of Non-Trading Fees

However, its vital to scrutinize the other costs associated with trading on Viseno. Numerous users have highlighted exorbitant withdrawal fees, creating an environment where gaining access to profits becomes challenging. Reports indicate complaints about fees as high as $30 per withdrawal, which can severely eat into any profits made.

"They charge a hefty fee just to withdraw your money, making it feel like a trap," stated a disgruntled user on WikiFX.

Cost Structure Summary

While low commissions on the opening of accounts are appealing, the hidden costs associated with withdrawals can compound quickly, negating the financial advantages upfront. This illustrates the necessity of evaluating total costs before embarking on a trading journey with Viseno.

Viseno employs the time-tested MetaTrader 4 (MT4), which offers trader-prized features such as automated trading, sophisticated indicators, and various expert advisors. MT4 enables traders to customize their trading environment to enhance the experience.

While the given platform is robust, the educational resources and trading tools provided by Viseno leave much to be desired. Theres scant information about additional tools or materials to assist new traders in their journey, limiting their capacity for learning.

Many users have raised concerns regarding usability and support with the MT4 client as integrated by Viseno. They report challenges in executing trades smoothly. As one user stated,

"The platform can be buggy, and I often struggle with consistency in trade execution."

6.4 User Experience Analysis

User Interface and Accessibility

The user interface on Viseno‘s platform has received mixed reviews from traders. While MT4 is known for its usability, reports reveal that adapting to Viseno’s specific integration can be challenging for beginners, who may be overwhelmed by the absence of clear navigational guidance.

Customer Reviews and Feedback

User feedback reveals a significant divide, with positive remarks often overshadowed by complaints regarding withdrawal processes and overall support. Many users express frustration about the lack of direct communication with the broker's representatives.

Overall User Experience Summary

Overall, the trading experience on Viseno can be characterized as turbulent. With a scarcity of relevant support and unclear user pathways, many potential traders may find themselves disillusioned.

6.5 Customer Support Analysis

Availability and Responsiveness

Based on user experiences, Visenos customer support appears limited. Many traders report frustration stemming from an apparent lack of available channels for establishing communication, which can escalate problems encountered with trading.

Quality of Support

Despite users seeking assistance, feedback suggests a low response rate and disillusionment regarding the resolution of queries. Potential users report that many attempts to reach customer support often go unanswered, further diminishing trust in the broker.

Customer Support Summary

Overall, customer support emerges as a critical weak point for Viseno, spreading discontent among users relying on prompt and effective service during trading operations.

6.6 Account Conditions Analysis

Account Types and Requirements

Viseno has a very basic offering in terms of account types, with no clearly outlined plans or structures for different trader profiles. This can be off-putting for traders seeking personalization or varied benefits based on capital invested.

Deposit and Withdrawal Conditions

While the minimum deposit appears attractive, details on deposit and withdrawal methods are notably absent from Visenos communications. This lack of transparency raises concerns regarding fund mobility.

Account Conditions Summary

In summary, the terms and conditions surrounding accounts at Viseno remain vague at best. Without clear pathways outlined for deposits and withdrawals, traders may find themselves swiftly disillusioned.

Conclusion

In encapsulation, while Viseno offers enticing entry points for novice traders through its low minimum deposit and high leverage, the overarching concerns regarding its unregulated status, shaky customer experiences, and hidden fees necessitate a cautious approach. Traders should prioritize verification and regulatory safety over potential short-term gains, as the risks, evidenced by numerous complaints and warnings from regulatory bodies, could far outweigh any initial benefits. Ultimately, reconsidering engagement with Viseno may be a prudent strategy in favor of investing with a more trusted, regulated broker.