VI Markets 2025 Review: Everything You Need to Know

Executive Summary

This comprehensive vi markets review examines a global online broker that has created major controversy in the trading community. VI Markets says it is an award-winning, global online broker that provides 24/5 trading facilities to both retail and institutional investors. The company claims it has built a strong reputation, especially in the Middle East region, and it offers trading across multiple asset classes including cryptocurrencies, commodities, and foreign exchange.

However, our analysis shows major concerns that potential clients should think about carefully. Multiple sources have raised red flags about VI Markets, with some users expressing serious doubts about the company's regulatory status and overall legitimacy. The lack of clear regulatory information and many negative user reports have created uncertainty around this broker. While VI Markets offers a range of trading products and maintains 24/5 trading facilities, these positives are greatly overshadowed by trust and reliability concerns that have emerged from user feedback and industry observations.

Important Notice

This review is based on publicly available information and user feedback from various sources. Readers should note that VI Markets has not provided specific regulatory information in available materials, which may indicate different regulatory environments across various regions. The lack of clear regulatory disclosure means that users in different areas may face varying levels of protection and oversight.

Our evaluation method relies on publicly accessible data, user testimonials, and industry reports. Given the limited transparency from VI Markets regarding their regulatory status and operational details, potential clients should conduct additional research before engaging with this broker. This assessment reflects information available at the time of writing and may not capture all aspects of the broker's current operations.

Rating Framework

Broker Overview

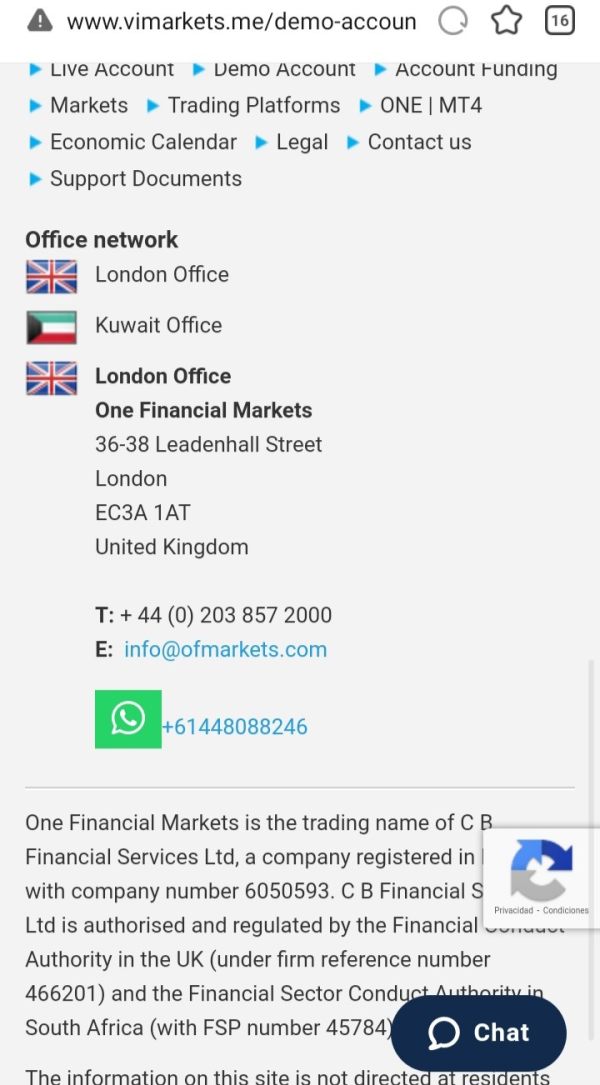

VI Markets presents itself as a global, award-winning online broker that has established operations to serve both retail and institutional investors worldwide. According to available information, the company claims to have achieved recognition within the financial services industry and maintains a particular focus on the Middle East region where it says it has built a strong reputation. The broker's business model centers on providing comprehensive trading services across multiple time zones with their 24/5 trading facility structure.

The company positions itself to serve a diverse clientele ranging from individual retail traders to larger institutional investment entities. This broad targeting approach suggests VI Markets aims to be a comprehensive trading solution provider, though the actual implementation and effectiveness of this strategy remain subjects of debate within the trading community.

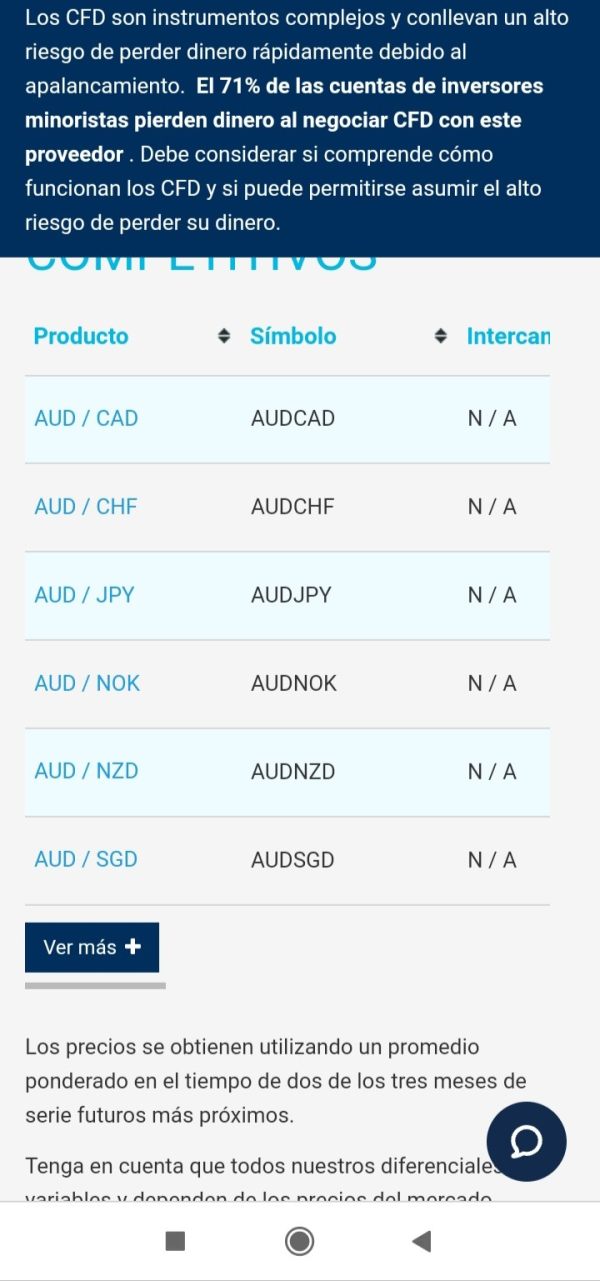

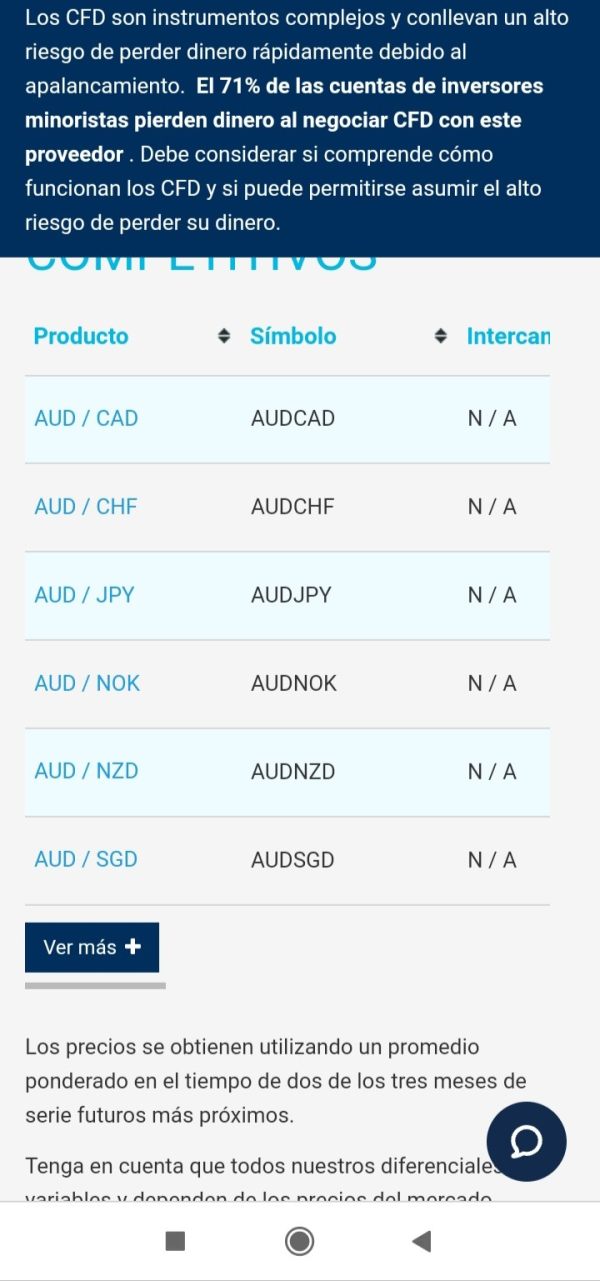

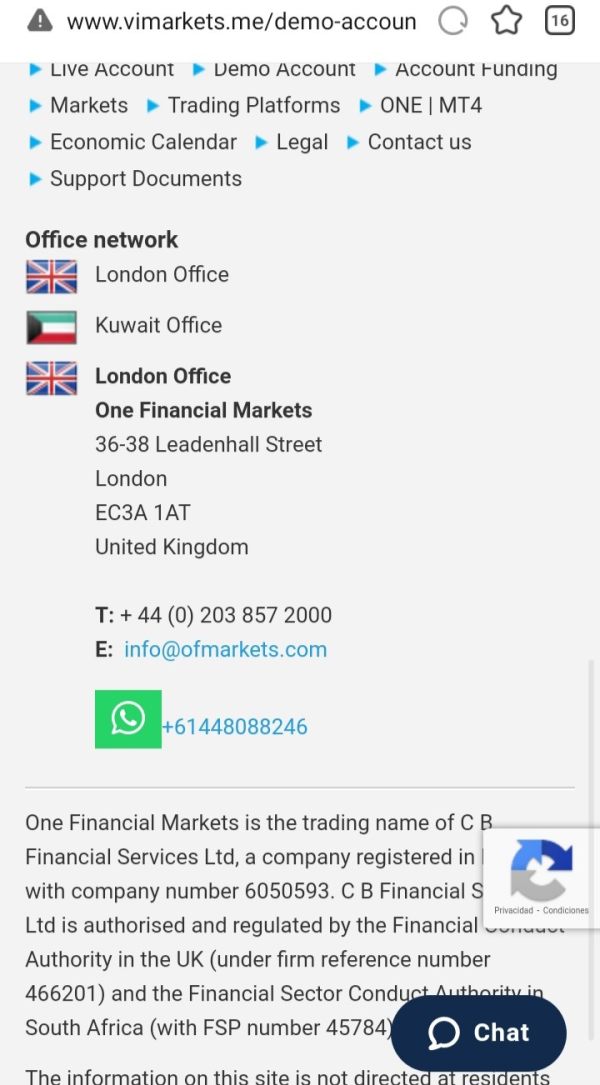

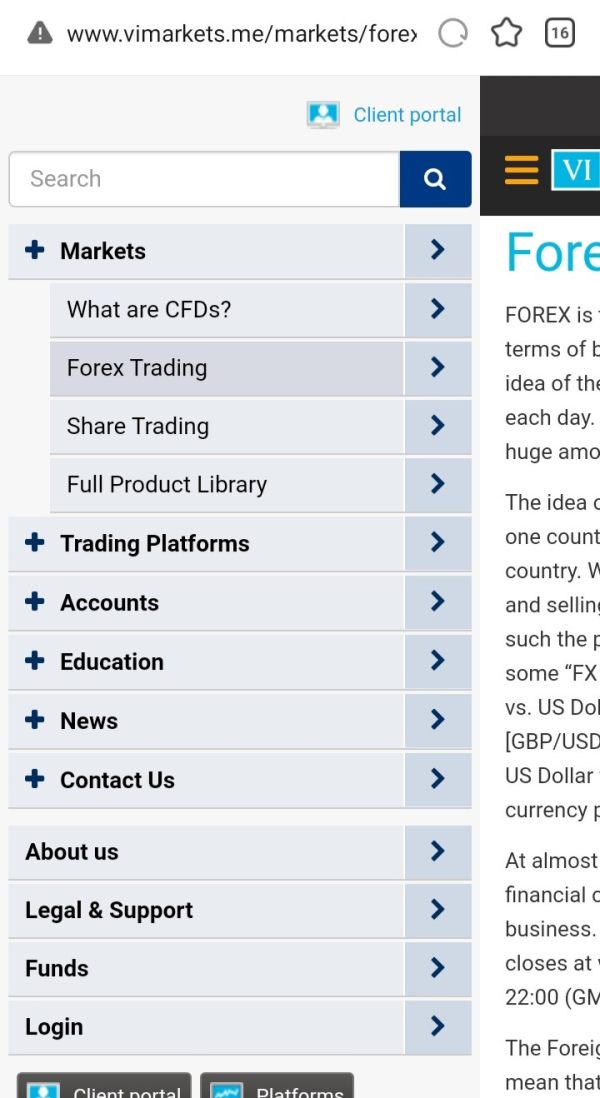

Regarding trading offerings, VI Markets provides access to multiple asset classes including foreign exchange markets, commodities trading, and cryptocurrency instruments. However, specific details about trading platforms, whether they use industry-standard solutions like MetaTrader 4 or MetaTrader 5, are not clearly specified in available materials. The absence of detailed platform information represents a significant gap in transparency that potential clients should consider when evaluating this vi markets review and comparing it with other broker options in the market.

Regulatory Status: Available information does not specify particular regulatory jurisdictions or oversight bodies governing VI Markets' operations, which raises significant concerns about client protection and operational transparency.

Deposit and Withdrawal Methods: Specific information regarding available deposit and withdrawal options is not detailed in accessible materials, making it difficult for potential clients to assess convenience and accessibility.

Minimum Deposit Requirements: The broker has not disclosed specific minimum deposit amounts in available documentation, which typically represents basic information that regulated brokers readily provide to prospective clients.

Bonus and Promotional Offers: No specific information about promotional campaigns, welcome bonuses, or ongoing incentive programs is available in current materials.

Tradeable Assets: VI Markets offers trading opportunities across cryptocurrencies, commodities, and foreign exchange markets, providing some diversification for traders interested in multiple asset classes.

Cost Structure: Critical information regarding spreads, commission structures, overnight financing charges, and other trading costs is not specified in available materials, making cost comparison impossible.

Leverage Ratios: Specific leverage offerings and maximum leverage ratios are not disclosed in accessible documentation.

Platform Options: Details about available trading platforms, mobile applications, and technological infrastructure are not comprehensively outlined in current materials.

Geographic Restrictions: Information about countries or regions where VI Markets services may not be available is not specified.

Customer Support Languages: Available customer service languages and communication options are not detailed in accessible materials, representing another transparency gap in this vi markets review.

Detailed Rating Analysis

Account Conditions Analysis

The evaluation of VI Markets' account conditions faces significant limitations due to the absence of detailed information in available materials. Typically, reputable brokers provide comprehensive details about different account types, their respective features, minimum funding requirements, and special account options such as Islamic accounts for clients requiring Sharia-compliant trading solutions.

Without access to specific account tier information, potential clients cannot adequately assess whether VI Markets offers suitable options for their trading capital and experience level. The lack of transparent minimum deposit requirements makes it impossible to determine accessibility for new traders or those with limited initial capital. Additionally, the absence of detailed account opening procedures and verification requirements raises questions about the broker's operational transparency and compliance standards.

Professional traders and institutional clients typically require access to premium account features, enhanced customer support, and specialized trading conditions. However, VI Markets has not provided sufficient information to evaluate whether such enhanced services are available or how they might differ from standard retail offerings. This information gap significantly hampers the ability to provide a comprehensive assessment in this vi markets review regarding account suitability for different trader categories.

VI Markets' tools and resources offering receives a moderate rating based on the limited information available. While the broker provides access to multiple trading products across different asset classes, the quality and comprehensiveness of their trading tools remain unclear from available materials. The 24/5 trading facility represents a positive feature, allowing traders to access markets during extended hours compared to traditional market sessions.

However, critical gaps exist in understanding the research and analysis resources that VI Markets provides to its clients. Professional traders typically rely on comprehensive market analysis, economic calendars, trading signals, and educational materials to make informed decisions. The absence of detailed information about these resources suggests either limited offerings or poor communication of available services.

Educational resources play a crucial role in trader development, particularly for newcomers to financial markets. Without clear information about webinars, tutorials, market insights, or trading guides, it becomes difficult to assess VI Markets' commitment to client education and development. Similarly, the availability of automated trading support, expert advisors, or algorithmic trading capabilities remains unspecified, limiting the assessment of the broker's technological sophistication.

Customer Service and Support Analysis

Customer service evaluation for VI Markets reveals concerning patterns based on available user feedback. While specific customer service channels, response times, and support availability hours are not detailed in accessible materials, user reports suggest significant challenges with service quality and responsiveness.

The presence of negative user reviews specifically mentioning customer service issues indicates potential problems with support effectiveness and problem resolution capabilities. Professional trading environments require reliable, knowledgeable customer support that can address technical issues, account problems, and trading concerns promptly and effectively.

Without information about available support channels such as live chat, telephone support, email assistance, or help desk tickets, potential clients cannot assess the convenience and accessibility of customer service options. Additionally, the absence of details regarding multilingual support capabilities raises questions about service availability for international clients, particularly given VI Markets' claims of global operations and Middle East focus.

The lack of transparency regarding customer service standards, response time commitments, and escalation procedures further compounds concerns about the overall support experience that clients might expect when choosing VI Markets as their trading partner.

Trading Experience Analysis

The trading experience evaluation for VI Markets faces significant challenges due to limited specific information about platform performance, execution quality, and user interface design. User feedback suggests concerns about the overall trading experience, though detailed specifics about platform stability, order execution speed, and trading environment quality are not comprehensively documented.

Platform reliability and execution quality represent fundamental aspects of any trading experience. Without specific information about trading platform options, whether VI Markets uses industry-standard platforms or proprietary solutions, and how these platforms perform under various market conditions, it becomes difficult to assess the technical trading environment that clients might encounter.

Mobile trading capabilities have become increasingly important for modern traders who require flexibility and accessibility. However, available materials do not provide sufficient detail about mobile applications, their functionality, or how they compare to desktop trading solutions offered by VI Markets.

Order execution quality, including factors such as slippage, requotes, and execution speed during volatile market conditions, remains unspecified in available documentation. These technical aspects significantly impact trading profitability and user satisfaction, making their absence in this vi markets review a notable limitation for potential clients seeking comprehensive platform assessment.

Trust and Reliability Analysis

Trust and reliability represent the most concerning aspects of VI Markets' evaluation, with significant red flags emerging from available information. The absence of specific regulatory disclosure creates immediate concerns about client protection, fund security, and operational oversight that regulated brokers typically provide through transparent regulatory compliance.

Multiple sources have raised serious questions about VI Markets' legitimacy, with some reports suggesting potential fraudulent operations. These allegations, combined with the lack of clear regulatory authorization, create a high-risk environment for potential clients considering this broker for their trading activities.

Regulated brokers typically provide clear information about client fund segregation, deposit protection schemes, and regulatory oversight bodies that monitor their operations. The absence of such transparency from VI Markets suggests either non-compliance with standard regulatory requirements or operations in jurisdictions with limited financial oversight.

The company's claims of being "award-winning" and having established reputation lack specific verification or third-party validation in available materials. Without independent confirmation of achievements, industry recognition, or regulatory standing, these claims cannot be substantiated, further undermining confidence in the broker's credibility and market position.

User Experience Analysis

User experience assessment for VI Markets reveals predominantly negative feedback patterns that raise significant concerns about overall client satisfaction. Available user reviews and feedback indicate widespread dissatisfaction with various aspects of the broker's services, though specific interface design and usability details are not comprehensively documented.

The registration and account verification process, which represents the first interaction point for new clients, lacks detailed documentation in available materials. Efficient, transparent onboarding processes typically characterize professional brokers, and the absence of clear information about these procedures may indicate operational deficiencies or poor communication standards.

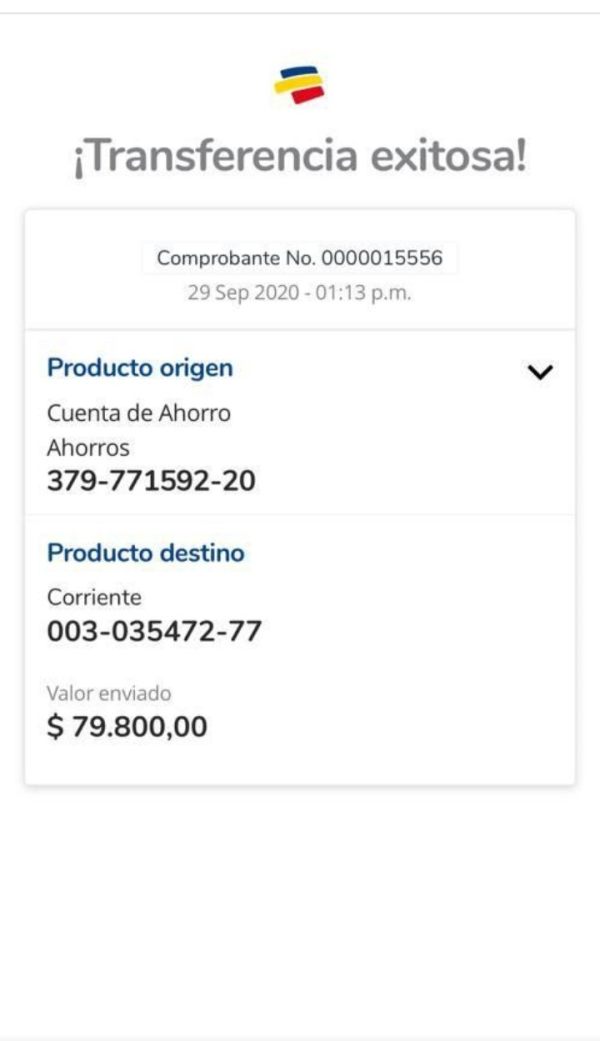

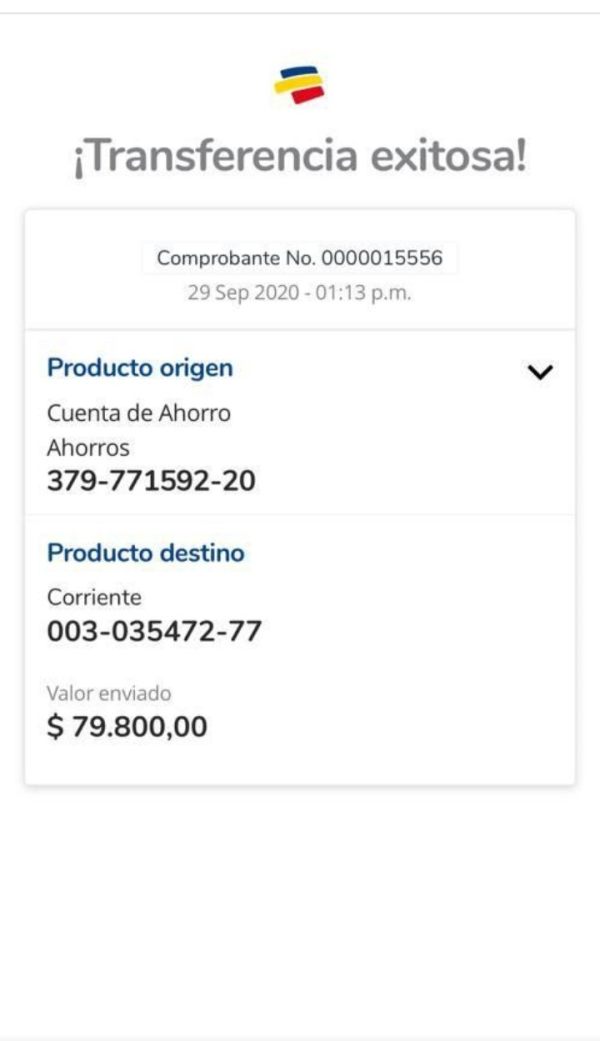

Fund management operations, including deposit processing, withdrawal procedures, and transaction transparency, represent critical user experience components. However, specific information about these processes, associated timeframes, and user satisfaction levels is not adequately documented in accessible materials.

Common user complaints appear to center around concerns about regulatory transparency and overall service reliability. The pattern of negative feedback suggests systemic issues rather than isolated incidents, indicating potential fundamental problems with VI Markets' operational approach and client relationship management that prospective traders should carefully consider before engagement.

Conclusion

This comprehensive vi markets review reveals significant concerns that potential clients should carefully weigh before considering this broker. While VI Markets offers access to multiple trading products and 24/5 trading facilities, these limited advantages are substantially overshadowed by serious trust and transparency issues that have emerged from user feedback and operational analysis.

The broker's lack of clear regulatory disclosure, combined with widespread negative user reviews and allegations of fraudulent operations, makes VI Markets unsuitable for risk-averse investors seeking secure, regulated trading environments. The absence of transparent information about account conditions, costs, and operational procedures further compounds these concerns.

For traders prioritizing security, regulatory protection, and reliable customer service, numerous alternative brokers offer superior transparency and regulatory compliance. VI Markets may only be considered by extremely high-risk tolerance investors who fully understand and accept the significant uncertainties surrounding this broker's operations and legitimacy.