Is VanguardGlobal safe?

Business

License

Is Vanguardglobal A Scam?

Introduction

Vanguardglobal is an emerging player in the forex market, positioning itself as a broker catering to both novice and experienced traders. As the forex trading landscape continues to evolve, it becomes increasingly important for traders to carefully evaluate the legitimacy and reliability of their chosen brokers. Given the complexities and risks associated with forex trading, understanding whether a broker is safe or potentially a scam can significantly impact a trader's financial well-being. This article aims to provide an objective analysis of Vanguardglobal by examining its regulatory standing, company background, trading conditions, client experiences, and overall safety measures. The evaluation is based on a comprehensive review of multiple sources, including regulatory filings, user testimonials, and expert analyses.

Regulation and Legitimacy

Understanding the regulatory framework governing a broker is crucial for assessing its legitimacy. Vanguardglobal's regulatory status is a significant factor in determining whether it is a safe choice for traders. According to various reports, Vanguardglobal currently lacks valid regulatory oversight, which raises red flags for potential investors.

| Regulatory Body | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| N/A | N/A | N/A | Not Regulated |

The absence of regulation means that Vanguardglobal does not have to adhere to the stringent requirements set by financial authorities, which typically include safeguarding client funds, maintaining transparency, and ensuring fair trading practices. This lack of oversight could expose traders to higher risks, including the possibility of fraud or mismanagement of funds. Moreover, the historical compliance record of the broker remains unclear, further complicating the assessment of its trustworthiness. In a market where regulation is paramount, the absence of such oversight raises serious concerns about the safety of trading with Vanguardglobal.

Company Background Investigation

A thorough investigation into Vanguardglobal's history reveals limited information regarding its establishment and operational practices. The company appears to have been founded relatively recently, which may contribute to its lack of established credibility in the forex market. The ownership structure is also unclear, with little information available about the individuals behind the brokerage. This lack of transparency can hinder potential clients' ability to evaluate the broker's reliability and trustworthiness.

While the management team's professional experience is crucial in establishing a broker's credibility, information on Vanguardglobal's leadership is sparse. A well-rounded management team with a proven track record in the financial industry is essential for instilling confidence among traders. Furthermore, the level of transparency and information disclosure from Vanguardglobal is concerning, as potential clients may find it challenging to access vital details that could inform their decisions. This opacity can be a significant deterrent for traders seeking a trustworthy broker, as transparency is a key indicator of a legitimate and reliable financial institution.

Trading Conditions Analysis

When evaluating a forex broker, understanding the trading conditions they offer is critical. Vanguardglobal's fee structure and trading policies are essential components of this analysis. Reports indicate that the broker may have a complex fee structure, which could include hidden charges that are not immediately apparent to traders.

| Fee Type | Vanguardglobal | Industry Average |

|---|---|---|

| Major Currency Pair Spread | High | Low |

| Commission Model | Varies | Standard |

| Overnight Interest Range | Unclear | Clear |

The potential for high spreads and unclear commission structures suggests that traders could face unexpected costs when trading with Vanguardglobal. This lack of clarity in the fee model can be detrimental, especially for traders who rely on precise calculations to manage their risk and profitability. Furthermore, the absence of transparency regarding overnight interest rates may further complicate trading strategies and financial planning. Traders should approach Vanguardglobal with caution, as unfavorable trading conditions could significantly impact their overall trading experience.

Client Funds Safety

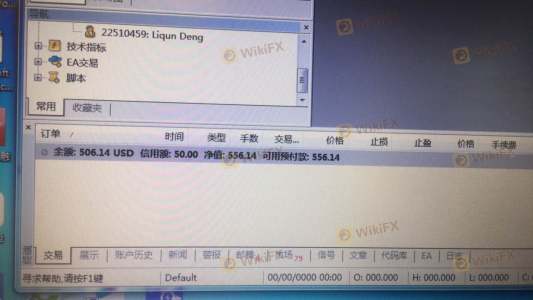

The safety of client funds is a paramount concern for any trader. Vanguardglobal's measures for ensuring the security of client funds are critical to understanding whether it is a safe trading environment. Given the broker's lack of regulatory oversight, there is no guarantee that client funds are segregated or protected against potential insolvency.

In a well-regulated environment, brokers are typically required to maintain client funds in segregated accounts, ensuring that personal investments are protected in the event of financial difficulties. However, without valid regulatory oversight, Vanguardglobal may not adhere to these industry standards, posing a risk to traders' capital. Additionally, the absence of negative balance protection could further exacerbate the risk, as traders could find themselves liable for losses exceeding their initial investments.

Historical issues related to fund safety, if any, are not well-documented for Vanguardglobal, which adds another layer of uncertainty. Traders must be vigilant and prioritize their financial security by thoroughly assessing the safety measures in place at Vanguardglobal before committing their funds.

Customer Experience and Complaints

Customer feedback plays a crucial role in evaluating a broker's reliability. An analysis of user experiences with Vanguardglobal reveals a mixed bag of reviews, with some traders expressing concerns over the quality of service and responsiveness. Common complaints include difficulties in withdrawing funds, lack of customer support, and issues with platform stability.

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Issues | High | Slow |

| Customer Support | Medium | Mixed |

| Platform Stability | High | Unresolved |

These complaints highlight significant concerns regarding Vanguardglobal's operational practices and customer service quality. The severity of withdrawal issues is particularly alarming, as timely access to funds is crucial for traders. Additionally, a slow or inadequate response from customer support can lead to frustration and distrust among clients. A couple of case studies illustrate these issues: one trader reported a prolonged delay in processing a withdrawal request, while another encountered persistent technical difficulties during trading hours, leading to missed opportunities. Such experiences underscore the importance of evaluating customer feedback when considering whether Vanguardglobal is a safe option for trading.

Platform and Trade Execution

Evaluating the performance of a trading platform is essential for understanding the overall trading experience. Vanguardglobal's platform has received criticism for its stability and user experience. Traders have reported issues with order execution quality, including slippage and high rejection rates, which can significantly impact trading outcomes.

A reliable trading platform should provide seamless execution of trades, minimal slippage, and a user-friendly interface. If traders are frequently experiencing issues with execution, it raises questions about the broker's operational integrity. The absence of robust trading tools and features further limits the platform's appeal, especially for active traders who rely on advanced functionalities for their strategies.

Risk Assessment

Using Vanguardglobal comes with inherent risks, primarily due to its lack of regulation and transparency. Traders should be aware of the following risk factors:

| Risk Category | Risk Level (Low/Medium/High) | Brief Description |

|---|---|---|

| Regulatory Risk | High | No valid regulatory oversight |

| Financial Risk | High | Potential loss of funds |

| Operational Risk | Medium | Issues with platform stability |

These risks highlight the importance of conducting thorough due diligence before engaging with Vanguardglobal. Traders should consider alternative brokers with established regulatory frameworks and proven track records to mitigate potential risks.

Conclusion and Recommendations

In conclusion, the investigation into Vanguardglobal raises significant concerns regarding its legitimacy and safety for traders. The lack of regulatory oversight, unclear trading conditions, and mixed customer feedback suggest that it may not be a reliable choice for those looking to trade forex. While there is no definitive evidence to label Vanguardglobal as a scam, the potential risks associated with trading with an unregulated broker warrant caution.

For traders seeking a secure and trustworthy trading environment, it is advisable to consider alternative brokers that are well-regulated and have a proven track record of customer satisfaction. Brokers such as OANDA, IG Group, and Forex.com offer robust regulatory frameworks and transparent trading conditions, making them safer options for forex trading. Ultimately, traders should prioritize their financial security and thoroughly research any broker before making a commitment.

Is VanguardGlobal a scam, or is it legit?

The latest exposure and evaluation content of VanguardGlobal brokers.

VanguardGlobal Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

VanguardGlobal latest industry rating score is 1.59, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.59 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.