UKG 2025 Review: Everything You Need to Know

Executive Summary

This comprehensive ukg review examines the Ultimate Kronos Group platform. UKG is a human resources management solution that has positioned itself as a comprehensive workforce management provider. Based on available employee feedback and company information, UKG presents a mixed performance profile that warrants careful consideration for potential enterprise users.

UKG's primary strengths lie in its AI and machine learning integration across the UKG Pro and UKG Ready platforms. These platforms offer enhanced analytics and user experience capabilities for large-scale HR operations. The platform focuses on streamlining time and attendance tracking, payroll processing, and benefits management for enterprise-level organizations.

However, the company's overall performance shows room for improvement. Employee satisfaction ratings average 3.1 out of 5 stars based on 672 reviews, though another source indicates 3.2 out of 5 from 262 reviews. Notably, 95% of UKG employee evaluations are rated as positive, suggesting that while satisfaction levels are moderate, the majority of experiences lean toward favorable outcomes. The platform primarily targets large enterprise HR managers seeking comprehensive workforce management solutions with advanced technological integration.

Important Notice

This evaluation is based on comprehensive analysis of user feedback, company information, and publicly available data regarding UKG's platform performance and service delivery. The assessment methodology incorporates multiple data sources to provide a balanced perspective on the platform's capabilities and limitations.

Readers should note that workforce management platforms may vary in performance based on organization size, implementation complexity, and specific use case requirements. This review aims to provide objective insights based on available information and user experiences.

Rating Framework

Company Overview

Ultimate Kronos Group operates as a comprehensive human resources management platform. The company is dedicated to simplifying HR operations and enhancing employee experience across enterprise-level organizations. UKG has established itself in the workforce management sector by focusing on integrated solutions that address time and attendance tracking, seamless payroll processing, and efficient benefits management. The company's business model centers on providing large organizations with the technological infrastructure necessary to manage complex workforce requirements while maintaining operational efficiency.

The platform distinguishes itself through its dual-platform approach. UKG offers both UKG Pro and UKG Ready solutions to accommodate different organizational needs and scales. These platforms incorporate advanced AI and machine learning capabilities designed to enhance analytical insights and improve overall user interaction with the system. Based on available feedback, UKG maintains an employee satisfaction rating of 3.1 out of 5 stars from 672 reviews, with an alternative source showing 3.2 out of 5 from 262 reviews. Despite moderate overall ratings, the fact that 95% of employee evaluations are classified as positive suggests that while there may be areas for improvement, the majority of users find value in the platform's offerings. This ukg review indicates that the company serves primarily large enterprise clients requiring sophisticated HR management capabilities.

Regulatory Coverage: Specific information not detailed in available materials regarding regulatory compliance and oversight jurisdictions.

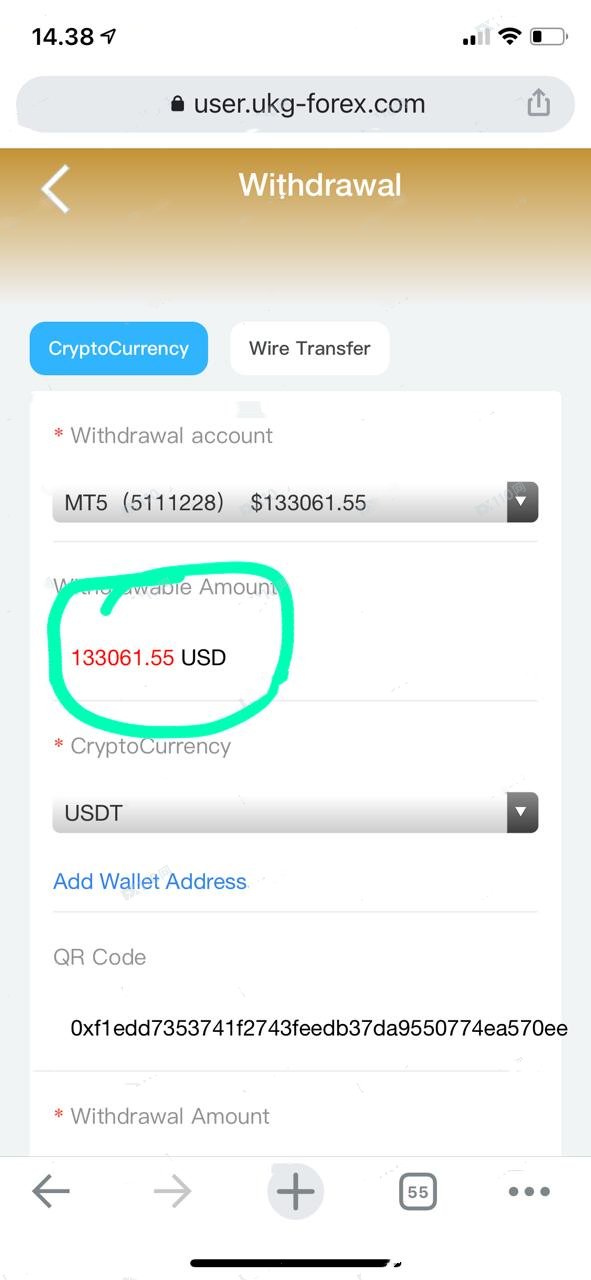

Deposit and Withdrawal Methods: Available materials do not provide detailed information about financial transaction processes and supported payment methods.

Minimum Deposit Requirements: Specific minimum investment or setup cost information not specified in available materials.

Promotional Offers: Details regarding promotional programs, incentives, or special offers not outlined in available materials.

Available Assets: Comprehensive information about service modules and available features not fully detailed in accessible materials.

Cost Structure: Detailed pricing information, fee schedules, and cost breakdowns not specified in available materials.

Platform Options: UKG offers two primary platforms - UKG Pro and UKG Ready. Both platforms incorporate AI and machine learning technologies for enhanced workforce management capabilities.

Geographic Restrictions: Specific information about regional availability and service limitations not detailed in available materials.

Customer Support Languages: Details regarding multilingual support options not specified in available materials.

This ukg review reveals that while UKG provides robust platform options with advanced technological integration, many specific operational details require direct consultation with the company for comprehensive understanding.

Detailed Rating Analysis

Account Conditions Analysis

The account setup and management conditions for UKG platforms present several considerations for potential enterprise users. However, specific information not detailed in available materials limits the comprehensive assessment of account types, their distinctive features, and associated requirements. The variety of account options and their particular characteristics remain unclear based on accessible documentation.

Minimum deposit requirements and their reasonableness relative to platform capabilities cannot be adequately evaluated. This limitation exists due to insufficient specific information in available materials. Similarly, the account opening process, including verification procedures, documentation requirements, and timeline expectations, lacks detailed coverage in accessible sources.

Special account functionalities, such as customized enterprise solutions or specialized industry-specific configurations, are not comprehensively outlined in available materials. The absence of detailed information regarding account management features, user permission structures, and administrative controls makes it challenging to provide a thorough evaluation of this dimension.

User feedback regarding account setup experiences and ongoing account management satisfaction is not extensively documented in available sources. This limitation restricts the ability to provide user-perspective insights. This ukg review must acknowledge that comprehensive account condition assessment requires direct consultation with UKG representatives for detailed information.

UKG's tools and resources represent one of the platform's strongest dimensions. This strength comes primarily through the UKG Pro and UKG Ready platforms that integrate advanced AI and machine learning technologies. These platforms provide enhanced analytics capabilities, offering users sophisticated data insights for workforce management decision-making. The technological integration demonstrates UKG's commitment to providing cutting-edge tools that can handle complex enterprise-level requirements.

The AI and machine learning integration extends beyond basic functionality. It offers predictive analytics and automated insights that can help organizations optimize their workforce management strategies. These advanced features position UKG as a technology-forward solution in the HR management space, providing users with tools that can adapt and learn from organizational patterns and requirements.

However, specific details regarding educational resources, training materials, and user development programs are not extensively covered in available materials. The breadth of analytical tools, reporting capabilities, and customization options, while clearly advanced based on the AI integration, lacks detailed documentation in accessible sources.

The automation capabilities and workflow optimization features, while implied through the AI integration, would benefit from more detailed explanation regarding specific functionalities and implementation possibilities. User feedback regarding tool effectiveness and resource accessibility is not extensively documented in available materials, though the positive employee evaluation percentage suggests general satisfaction with available resources.

Customer Service and Support Analysis

Customer service and support evaluation for UKG faces significant limitations due to insufficient detailed information in available materials. The availability of customer service channels, including phone support, email assistance, live chat options, and help desk functionalities, is not comprehensively documented in accessible sources. This lack of specific information makes it challenging to assess the breadth and accessibility of support options.

Response time expectations and service level agreements are not detailed in available materials. This prevents evaluation of support efficiency and reliability. The quality of customer service interactions, including problem resolution effectiveness and support staff expertise, cannot be adequately assessed based on current information availability.

Multilingual support capabilities and international customer service coverage remain unclear from available documentation. Similarly, customer service availability hours, including business hours coverage and after-hours support options, are not specified in accessible materials.

User feedback regarding customer service experiences, including satisfaction levels with support quality and problem resolution effectiveness, is not extensively documented in available sources. The absence of specific customer service performance metrics or user testimonials regarding support experiences limits the comprehensive evaluation of this critical dimension.

Case studies or examples of successful problem resolution and customer service excellence are not provided in available materials. This makes it difficult to demonstrate support capabilities through concrete examples.

Trading Experience Analysis

The evaluation of user experience with UKG platforms faces limitations due to the nature of available information. This appears to be primarily an HR management platform rather than a traditional trading platform. However, the platform stability and operational speed can be inferred from the general user satisfaction metrics, where 95% of employee evaluations are rated as positive, suggesting reliable system performance.

Platform functionality completeness appears robust based on the AI and machine learning integration across UKG Pro and UKG Ready platforms. These technological capabilities suggest comprehensive feature sets designed to handle complex workforce management requirements. The integration of advanced analytics and automated insights indicates sophisticated platform capabilities that can support enterprise-level operations.

Mobile accessibility and user interface design are not specifically detailed in available materials. However, the positive employee evaluation percentage suggests that users generally find the platform accessible and functional. The user interaction experience, while not explicitly documented, can be inferred to be generally positive based on the high percentage of favorable evaluations.

System reliability and operational environment stability are suggested by the continued operation and positive user feedback. However, specific performance metrics and uptime statistics are not provided in available materials. This ukg review must note that detailed platform performance data would require direct consultation with UKG for comprehensive technical specifications.

Trust and Reliability Analysis

Trust and reliability assessment for UKG encounters significant limitations due to insufficient detailed information in available materials regarding regulatory compliance and oversight mechanisms. The specific regulatory qualifications, licensing status, and compliance certifications that would typically support trust evaluation are not comprehensively documented in accessible sources.

Financial security measures, data protection protocols, and user information safeguarding procedures are not detailed in available materials. This makes it challenging to assess the platform's security infrastructure. Company transparency regarding operations, financial status, and business practices cannot be adequately evaluated based on current information availability.

Industry reputation and standing within the workforce management sector, while implied by the company's continued operation and user base, lack specific documentation regarding industry recognition, awards, or peer evaluations. The handling of negative events, crisis management capabilities, and reputation management practices are not detailed in accessible materials.

Third-party evaluations, independent assessments, and external validation of UKG's trustworthiness are not extensively documented in available sources. User trust feedback and confidence levels in the platform's reliability cannot be comprehensively assessed due to limited specific information regarding user security experiences and trust-related satisfaction.

The absence of detailed regulatory information and security documentation represents a significant gap in trust assessment capabilities for this evaluation.

User Experience Analysis

User experience analysis reveals mixed but generally positive indicators for UKG platforms. The overall user satisfaction shows moderate levels with employee ratings of 3.1 out of 5 stars based on 672 reviews, while an alternative source indicates 3.2 out of 5 from 262 reviews. Despite these moderate overall ratings, the fact that 95% of employee evaluations are classified as positive suggests that while there may be areas for improvement, the majority of users experience favorable outcomes with the platform.

Interface design and usability specifics are not detailed in available materials. However, the positive evaluation percentage implies that users generally find the platform accessible and functional. The user interface effectiveness and navigation ease can be inferred to be adequate based on the overall positive feedback trends, though specific design elements and usability features require more detailed documentation.

Registration and verification processes are not comprehensively outlined in available materials. This limits the assessment of user onboarding experiences. Similarly, ongoing user interaction processes and administrative functionality ease cannot be thoroughly evaluated due to insufficient specific information.

Common user concerns and feedback patterns indicate that IT teams provide the most feedback. This suggests that technical aspects of the platform generate significant user engagement and potentially some complexity that requires IT involvement. However, specific details regarding user complaints, common issues, or frequently requested improvements are not extensively documented in available sources.

The user demographic appears to primarily consist of large enterprise HR managers and related personnel. This indicates that the platform successfully serves its intended audience despite moderate satisfaction ratings.

Conclusion

Based on this comprehensive ukg review, UKG presents a mixed performance profile that reflects both strengths and areas requiring improvement. The platform demonstrates solid technological capabilities through its AI and machine learning integration across UKG Pro and UKG Ready platforms, positioning it as a technology-forward solution in the workforce management space.

UKG appears most suitable for large enterprise HR managers and organizations requiring sophisticated workforce management capabilities with advanced analytical features. The platform's strength lies in its technological integration and comprehensive approach to HR management, though moderate user satisfaction ratings suggest room for enhancement in overall user experience.

The primary advantages include advanced AI-powered analytics and comprehensive workforce management capabilities. The main limitations involve insufficient transparency regarding regulatory compliance, detailed operational conditions, and specific service parameters. Potential users should conduct direct consultation with UKG representatives to obtain comprehensive information about platform specifics, pricing, and implementation requirements.