Regarding the legitimacy of UIIC forex brokers, it provides FCA and WikiBit, (also has a graphic survey regarding security).

Is UIIC safe?

Pros

Cons

Is UIIC markets regulated?

The regulatory license is the strongest proof.

FCA Market Making License (MM)

Financial Conduct Authority

Financial Conduct Authority

Current Status:

RegulatedLicense Type:

Market Making License (MM)

Licensed Entity:

Uzbekinvest International Insurance Company Ltd

Effective Date:

2001-12-01Email Address of Licensed Institution:

hasan.mamadjonov@aig.comSharing Status:

No SharingWebsite of Licensed Institution:

www.uiic.co.ukExpiration Time:

--Address of Licensed Institution:

The AIG Building 58 Fenchurch Street London EC3M 4AB UNITED KINGDOMPhone Number of Licensed Institution:

--Licensed Institution Certified Documents:

Is UIIC Safe or a Scam?

Introduction

In the dynamic world of forex trading, selecting a reliable broker is crucial for success and security. One such broker is UIIC, or Uzbek Invest International Insurance Company Limited, which has been operating since 2001 and is based in the United Kingdom. As the forex market continues to grow, traders must exercise caution and conduct thorough evaluations of brokers to ensure their safety and legitimacy. This article aims to provide an objective analysis of UIIC, examining its regulatory status, company background, trading conditions, customer feedback, and overall risk profile. Our investigation is based on data collected from various credible sources, including broker reviews and regulatory disclosures.

Regulation and Legitimacy

Understanding a broker's regulatory framework is vital for assessing its safety. UIIC is regulated by the Financial Conduct Authority (FCA) in the UK, which is known for its stringent oversight of financial institutions. Regulatory bodies like the FCA play a crucial role in ensuring that brokers adhere to strict guidelines that protect traders' interests.

Heres a summary of UIIC's regulatory information:

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| Financial Conduct Authority (FCA) | 202923 | United Kingdom | Verified |

The FCA's oversight means that UIIC must comply with various operational standards, including capital requirements and the segregation of client funds. This regulatory framework helps to mitigate risks associated with trading, ensuring that clients' funds are held in separate accounts, thus enhancing security. Moreover, during our evaluation, no negative regulatory disclosures were found against UIIC, indicating a clean compliance record. However, it is essential to note that while FCA regulation is robust, traders should still conduct their due diligence, as not all regulatory bodies enforce the same level of scrutiny.

Company Background Investigation

UIIC has a rich history dating back to its establishment in 2001. As a broker operating in the UK, it has developed a reputation in the forex and CFD markets. The ownership structure of UIIC is transparent, with its parent company being Uzbek Invest International Insurance Company Limited. This transparency is crucial in establishing trust with clients.

The management team at UIIC comprises professionals with extensive experience in finance and trading. Their backgrounds contribute to the broker's credibility and operational integrity. UIIC's commitment to transparency is reflected in its regular disclosures and updates about its services and policies. The company has also maintained a consistent presence in the market, which is often a positive indicator of stability and reliability.

Trading Conditions Analysis

When evaluating whether UIIC is safe, understanding its trading conditions is essential. UIIC offers a variety of trading products, including forex, CFDs, commodities, and indices. The broker's fee structure is competitive, but it is vital to scrutinize any unusual fees that may arise.

Heres a comparison of UIIC's core trading costs:

| Fee Type | UIIC | Industry Average |

|---|---|---|

| Major Currency Pair Spread | Variable (not specified) | 1.0 - 3.0 pips |

| Commission Model | Varies (not specified) | 0 - $10 per lot |

| Overnight Interest Range | Not specified | 2% - 5% |

While UIIC does not specify its spreads and commissions in detail, traders should inquire directly with the broker for precise figures. The lack of clear information on these aspects can be a red flag, prompting traders to dig deeper into UIICs fee structure.

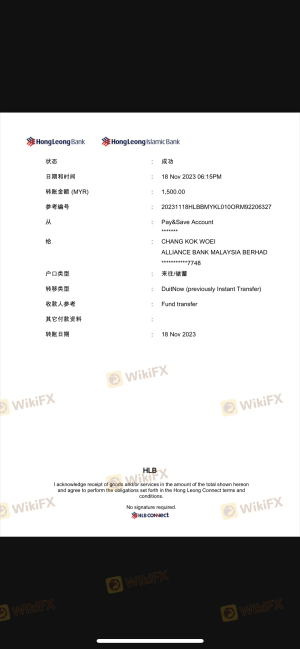

Client Fund Safety

The safety of client funds is a critical factor in determining whether UIIC is safe. UIIC implements measures to protect client funds, including the segregation of accounts and adherence to FCA regulations. This means that clients' funds are kept separate from the company's operational funds, reducing the risk of misappropriation.

UIIC also provides investor protection measures, ensuring that clients are safeguarded against potential losses. However, it is essential to assess whether the broker has ever faced any significant disputes regarding fund security. While there have been no major incidents reported, traders should remain vigilant and monitor any emerging issues related to fund safety.

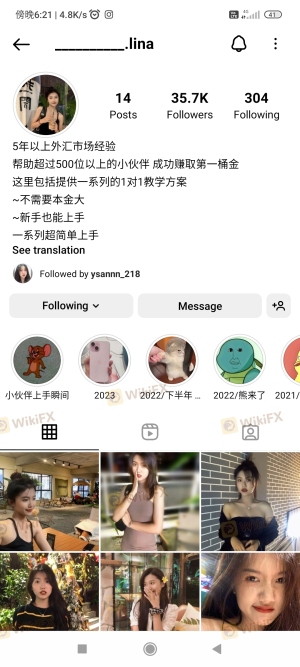

Customer Experience and Complaints

Analyzing customer feedback is crucial in determining whether UIIC is a scam or a legitimate broker. Overall, client reviews of UIIC are mixed. While some users praise the broker for its regulatory compliance and trading conditions, others have reported issues related to fund withdrawals and customer service responsiveness.

Heres a breakdown of common complaint types and their severity:

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Delays | High | Slow response times |

| Poor Customer Service | Medium | Inconsistent support |

| Unclear Fee Structures | Medium | Limited clarification |

For instance, one user reported that after making a deposit, they faced difficulties withdrawing their funds, citing delays and a lack of communication from the support team. Such complaints highlight potential areas of concern regarding UIICs customer service and operational efficiency.

Platform and Trade Execution

The trading platform offered by UIIC plays a significant role in the overall trading experience. UIIC provides access to a proprietary trading platform, which has garnered mixed reviews regarding its performance and stability. Users have reported issues related to order execution quality, including slippage and occasional rejections of orders.

The platforms user interface is generally user-friendly, but traders should be cautious of any signs of manipulation or technical glitches that could impact their trading outcomes. Ensuring that the platform is stable and reliable is essential for traders looking to execute their strategies effectively.

Risk Assessment

When considering whether UIIC is safe, it is essential to evaluate the overall risk profile associated with trading with this broker.

Heres a summary of the key risk areas:

| Risk Category | Risk Level (Low/Medium/High) | Brief Explanation |

|---|---|---|

| Regulatory Compliance | Low | FCA regulation provides security |

| Fund Safety | Medium | Segregated accounts, but monitor for issues |

| Customer Service Issues | High | Complaints regarding withdrawals and support |

| Platform Reliability | Medium | Mixed reviews on execution quality |

To mitigate these risks, traders should engage in thorough due diligence before opening an account with UIIC. It is advisable to start with a small investment and test the platform's functionalities before committing significant capital.

Conclusion and Recommendations

In conclusion, determining whether UIIC is safe or a scam requires careful consideration of various factors. While the broker is regulated by the FCA, which adds a layer of credibility, there have been notable complaints regarding customer service and withdrawal issues.

Traders should approach UIIC with caution, especially if they are sensitive to potential risks associated with fund withdrawals and customer support. For those who prioritize regulatory compliance and are willing to navigate potential customer service challenges, UIIC may still be a viable option. However, it is essential to remain vigilant and conduct ongoing evaluations of the broker's performance.

For traders seeking alternatives, consider brokers with a strong reputation for customer service and transparent fee structures. Researching multiple options can help ensure a safer trading experience in the forex market.

Is UIIC a scam, or is it legit?

The latest exposure and evaluation content of UIIC brokers.

UIIC Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

UIIC latest industry rating score is 6.88, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 6.88 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.