Is TRADEQUICKOPTION safe?

Business

License

Is Tradequickoption Safe or Scam?

Introduction

Tradequickoption is an online trading platform that claims to offer forex, binary options, and cryptocurrency trading. Established in December 2019, it positions itself as a modern investment opportunity within the highly competitive forex market. However, the influx of online trading platforms has made it essential for traders to conduct thorough due diligence before committing their funds. The potential for scams in the forex industry is significant, with many platforms lacking proper regulation and transparency. This article aims to objectively analyze whether Tradequickoption is a safe platform or a scam, utilizing various investigative methods and evaluation frameworks.

Regulation and Legitimacy

When assessing the safety of any trading platform, understanding its regulatory status is paramount. Regulation serves as a safeguard for traders, ensuring that the broker adheres to specific legal standards and practices. Tradequickoption claims to be incorporated in Canada, but it lacks clear evidence of being regulated by a reputable authority. Below is a summary of the core regulatory information for Tradequickoption:

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| None | N/A | N/A | Not Verified |

The absence of a regulatory license raises significant concerns regarding the legitimacy of Tradequickoption. Regulatory bodies such as the Financial Conduct Authority (FCA) in the UK or the Commodity Futures Trading Commission (CFTC) in the US impose strict guidelines to protect investors. Without such oversight, traders may find themselves vulnerable to fraudulent practices. The lack of transparency about the management team and ownership further compounds these concerns. Therefore, the conclusion is clear: Tradequickoption is not regulated, which is a substantial red flag for potential users.

Company Background Investigation

Tradequickoption's history is relatively brief, having been launched in late 2019. The platform claims to offer a range of investment options; however, information regarding its ownership structure and management team is scarce. This lack of transparency is alarming, as reputable brokers typically disclose details about their team and operational history. The absence of a verifiable company background can lead to questions about the platform's credibility and operational integrity.

The website features vague descriptions of its services, and the “About Us” section does not provide any meaningful insights into who is running the company. This anonymity is a common tactic employed by fraudulent platforms to evade accountability. Moreover, the fact that the customer support contact is limited to email communication, with no phone support available to regular clients, raises suspicions about the platforms intention. In conclusion, the lack of transparency and verifiable information about Tradequickoption's management further supports the notion that it may not be a safe trading option.

Trading Conditions Analysis

Understanding the trading conditions offered by Tradequickoption is crucial for evaluating its safety. The platform promotes various investment plans, including promises of high returns within short timeframes; for instance, users are encouraged to invest a minimum of $200 to receive a 25% return within 24 hours. Such offers are typically indicative of scams, as they often lead to unrealistic expectations and financial losses. Below is a comparison of core trading costs associated with Tradequickoption:

| Fee Type | Tradequickoption | Industry Average |

|---|---|---|

| Spread for Major Pairs | N/A | 1-3 pips |

| Commission Model | N/A | Varies |

| Overnight Interest Range | N/A | 0.5-2% |

The absence of clear fee structures and the promise of guaranteed returns are significant warning signs. Legitimate brokers do not guarantee profits, as trading inherently involves risk. Thus, the overall trading conditions presented by Tradequickoption suggest that it may not be a trustworthy platform for investors.

Client Fund Safety

The safety of client funds is another critical aspect to consider when evaluating Tradequickoption. The platform does not provide detailed information on its fund protection measures, such as whether client funds are held in segregated accounts or if there are any investor compensation schemes in place. The lack of such information raises questions about the safety of funds deposited with Tradequickoption.

Without transparent policies regarding fund segregation and negative balance protection, traders are left vulnerable to potential losses. Historical controversies surrounding fund safety within unregulated brokers further emphasize the need for caution. Therefore, it is evident that the absence of robust fund safety measures within Tradequickoption poses a significant risk to clients.

Customer Experience and Complaints

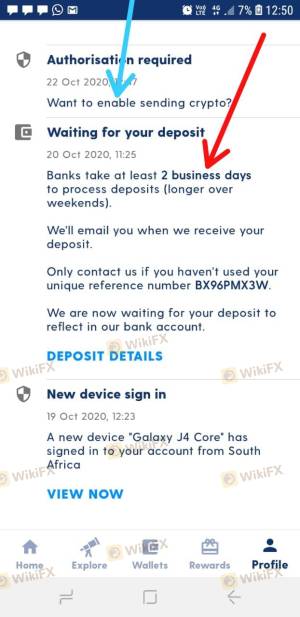

Customer feedback is vital in assessing the reliability of any trading platform. Tradequickoption has garnered a mix of reviews, with many users expressing dissatisfaction regarding their experiences. Common complaints include difficulties in withdrawing funds, lack of responsive customer support, and issues related to the transparency of investment returns. Below is a summary of the primary complaint types and their severity assessment:

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Issues | High | Poor |

| Customer Support Issues | Medium | Poor |

| Transparency Concerns | High | Poor |

For instance, several users have reported being unable to withdraw their funds after making initial deposits, which is a common red flag associated with fraudulent platforms. The overall sentiment among users indicates that Tradequickoption may not prioritize customer satisfaction, further solidifying the notion that it could be a scam.

Platform and Trade Execution

The performance and reliability of the trading platform itself are crucial for a positive trading experience. Tradequickoption claims to offer a user-friendly interface, but there are no independent reviews or testimonials to validate these claims. Additionally, concerns regarding the quality of order execution, including slippage and rejection rates, are prevalent in discussions about the platform.

Without concrete evidence of the platform's performance, traders may find themselves at risk of poor execution and unexpected losses. The lack of transparency regarding platform functionality and execution quality raises further doubts about the platform's legitimacy. Thus, it is essential to approach Tradequickoption with caution, as the absence of verifiable information about platform performance could indicate underlying issues.

Risk Assessment

Engaging with Tradequickoption comes with various inherent risks. The combination of unregulated status, lack of transparency, and negative customer feedback contributes to an overall high-risk profile for potential investors. Below is a summary of the key risk areas associated with Tradequickoption:

| Risk Category | Risk Level (Low/Medium/High) | Brief Description |

|---|---|---|

| Regulatory Compliance | High | No regulatory oversight |

| Fund Safety | High | Lack of clear safety measures |

| Customer Support | Medium | Inconsistent and unresponsive |

| Platform Reliability | High | Unverified performance claims |

To mitigate these risks, potential traders should consider conducting thorough research, only investing funds they can afford to lose, and exploring alternative, more reputable trading platforms.

Conclusion and Recommendations

In conclusion, the investigation into Tradequickoption reveals several red flags, indicating that it may not be a safe trading platform. The lack of regulatory oversight, transparency about the management team, and consistent negative feedback from users collectively suggest that Tradequickoption exhibits characteristics typical of a scam. Traders are advised to exercise extreme caution and consider alternative, well-regulated brokers that prioritize client safety and transparency.

For those seeking reliable trading options, platforms regulated by authorities such as the FCA or ASIC should be prioritized. These brokers typically offer better protection for client funds and adhere to strict compliance standards, ensuring a safer trading environment.

Is TRADEQUICKOPTION a scam, or is it legit?

The latest exposure and evaluation content of TRADEQUICKOPTION brokers.

TRADEQUICKOPTION Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

TRADEQUICKOPTION latest industry rating score is 1.52, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.52 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.