Regarding the legitimacy of Torque Marks forex brokers, it provides ASIC and WikiBit, .

Is Torque Marks safe?

Pros

Cons

Is Torque Marks markets regulated?

The regulatory license is the strongest proof.

ASIC Market Making License (MM)

Australia Securities & Investment Commission

Australia Securities & Investment Commission

Current Status:

UnverifiedLicense Type:

Market Making License (MM)

Licensed Entity:

PLUS500AU PTY. LTD.

Effective Date:

2012-10-09Email Address of Licensed Institution:

complaints@plus500.com.auSharing Status:

No SharingWebsite of Licensed Institution:

--Expiration Time:

--Address of Licensed Institution:

PLUS500AU PTY LTD L 39 264-278 GEORGE ST SYDNEY NSW 2000Phone Number of Licensed Institution:

0292621554Licensed Institution Certified Documents:

Is Torque Marks Safe or a Scam?

Introduction

In the ever-evolving world of forex trading, Torque Marks has emerged as a platform that promises lucrative trading opportunities. As with any financial service, traders need to exercise caution and conduct thorough evaluations before engaging with a broker. The forex market, while offering significant profit potential, is also rife with risks, including the possibility of scams. This article aims to provide a comprehensive analysis of Torque Marks, assessing its legitimacy, regulatory status, company background, trading conditions, client safety, customer experiences, platform performance, and overall risk. Our investigation is based on a combination of user reviews, regulatory data, and financial industry reports.

Regulation and Legitimacy

Regulation is a cornerstone of trust in the financial sector. A broker's regulatory status often reflects its commitment to transparency and client safety. Torque Marks claims to operate under the regulatory framework of several jurisdictions. However, it is crucial to scrutinize these claims to determine their validity.

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| ASIC | N/A | Australia | Suspicious Clone |

| FCA | N/A | United Kingdom | Not Verified |

The Australian Securities and Investments Commission (ASIC) is known for its stringent regulatory standards, yet Torque Marks has been flagged as a suspicious clone. This raises significant concerns about its legitimacy. Additionally, the absence of a valid license from the Financial Conduct Authority (FCA) in the UK further complicates its standing. Without proper regulation, the safety of client funds and the integrity of trading practices come into question, making it essential for traders to consider whether Torque Marks is safe before investing.

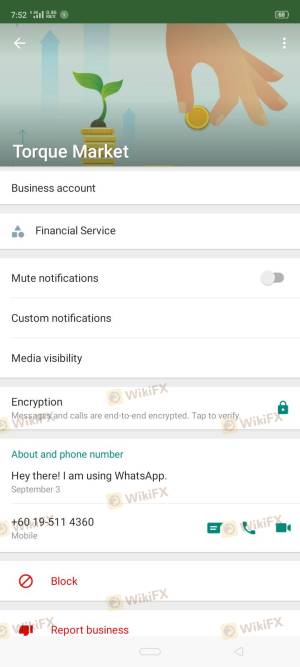

Company Background Investigation

Understanding the background of any trading platform is critical for assessing its reliability. Torque Marks operates under the name Torque Mark ST Ltd, but detailed information about its ownership and operational history is scarce. The company claims to have a global presence, but the lack of transparency regarding its management team and operational structure raises red flags.

The CEO, Bernard Ong, is reportedly involved in several business ventures, yet there is insufficient public information to evaluate his credentials and experience in the financial sector. This lack of transparency can be alarming for potential investors, as it becomes challenging to ascertain the company's credibility and accountability. Furthermore, the absence of clear information regarding the company's financial health and operational practices leads to questions about whether Torque Marks is safe for traders looking for a reliable forex broker.

Trading Conditions Analysis

When evaluating a trading platform, the cost structure and trading conditions are paramount. Torque Marks offers a range of trading instruments, but it is essential to dissect its fee structure and any potential hidden costs.

| Fee Type | Torque Marks | Industry Average |

|---|---|---|

| Major Currency Pair Spread | N/A | 1.0 - 1.5 pips |

| Commission Model | N/A | Varies |

| Overnight Interest Range | N/A | 2% - 5% |

While specific figures for Torque Marks are not readily available, the lack of transparency regarding spreads and commission structures can be concerning. Traders should be wary of any broker that does not clearly outline its fees, as this can lead to unexpected costs that erode profits. The absence of a well-defined fee structure raises doubts about whether Torque Marks is safe and whether traders can trust the platform to provide fair trading conditions.

Client Funds Safety

The safety of client funds is a critical consideration when choosing a forex broker. Torque Marks claims to implement various safety measures, but the effectiveness of these measures remains uncertain.

Key aspects to evaluate include:

- Segregation of Funds: Are client funds held in separate accounts from the company's operational funds?

- Investor Protection: Is there any insurance or protection in place for client deposits?

- Negative Balance Protection: Does the broker offer protection against negative account balances?

Without clear policies on these issues, traders may find themselves at risk. Historical issues regarding fund safety or any past controversies can also jeopardize a broker's reputation. Given the current lack of information, potential clients should question if Torque Marks is safe and consider whether they are comfortable entrusting their funds to this broker.

Customer Experience and Complaints

Customer feedback is often a reflection of a broker's reliability and service quality. A review of user experiences with Torque Marks reveals a mix of opinions, with some praising the platform while others report significant issues.

| Complaint Type | Severity | Company Response |

|---|---|---|

| Withdrawal Issues | High | Slow Response |

| Poor Customer Support | Medium | Inconsistent |

| Misleading Information | High | Limited Transparency |

Common complaints include difficulties in withdrawing funds and a lack of responsive customer support. These issues can be detrimental to a trader's experience and may indicate deeper problems within the company's operational practices. If clients are unable to access their funds or receive timely support, it raises serious concerns about whether Torque Marks is safe.

Platform and Trade Execution

The performance of a trading platform is crucial for effective trading. Torque Marks claims to offer a robust trading environment, yet the quality of order execution, slippage rates, and any signs of manipulation must be assessed.

Traders have reported varying experiences with order execution, with some noting instances of slippage and order rejections. These issues can significantly impact trading outcomes, especially in a fast-paced market. If there are indications of platform manipulation or unreliable execution, it further questions the integrity of the broker and whether Torque Marks is safe for traders.

Risk Assessment

Using Torque Marks presents several risks that potential investors should consider.

| Risk Category | Risk Level (Low/Medium/High) | Brief Explanation |

|---|---|---|

| Regulatory Risk | High | Lack of proper regulation |

| Fund Safety Risk | High | Unclear safety measures |

| Customer Service Risk | Medium | Inconsistent support and responses |

Given these risk factors, traders must weigh the potential rewards against the inherent dangers of using this broker. It is advisable for individuals to conduct thorough due diligence and consider alternative platforms that offer stronger regulatory oversight and better client protections.

Conclusion and Recommendations

In conclusion, the evidence suggests that Torque Marks may not be a trustworthy broker. The combination of regulatory concerns, lack of transparency, and negative customer feedback raises significant doubts about its legitimacy. Traders should approach this platform with caution and consider whether they feel comfortable risking their funds in an environment that lacks clear safeguards.

For those seeking reliable alternatives, it is advisable to explore brokers that are well-regulated, have a proven track record of customer satisfaction, and provide transparent information regarding fees and fund safety. Always remember to conduct thorough research and prioritize your financial security when choosing a trading platform. Ultimately, the question remains: is Torque Marks safe? Given the current evidence, potential investors might be better off looking elsewhere.

Is Torque Marks a scam, or is it legit?

The latest exposure and evaluation content of Torque Marks brokers.

Torque Marks Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

Torque Marks latest industry rating score is 1.54, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.54 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.