Is tianchengguoji safe?

Business

License

Is Tianchengguoji Safe or Scam?

Introduction

Tianchengguoji, a forex broker that has gained attention in the trading community, positions itself as a viable option for traders seeking to engage in foreign exchange markets. With the influx of online trading platforms, it has become crucial for traders to meticulously evaluate the legitimacy and reliability of forex brokers before committing their funds. The forex market is rife with potential risks, including scams and unregulated entities that can jeopardize traders' investments. Therefore, it is imperative to conduct thorough research and due diligence before choosing a broker. This article employs a multi-faceted approach to investigate whether Tianchengguoji is safe or a potential scam. We will analyze its regulatory status, company background, trading conditions, customer fund security, user experiences, platform performance, and overall risk assessment.

Regulatory and Legitimacy

The regulatory environment is a critical aspect when determining the safety of any forex broker. A well-regulated broker is generally considered safer, as it adheres to strict standards set by financial authorities. For Tianchengguoji, we need to examine its regulatory status in detail. The following table summarizes the core regulatory information:

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| N/A | N/A | N/A | Not Verified |

Currently, Tianchengguoji does not appear to be regulated by any recognized financial authority. This lack of oversight raises significant concerns regarding its legitimacy. Regulation is essential as it provides a safety net for traders, ensuring that brokers adhere to ethical practices, maintain transparency, and protect client funds. Without regulatory oversight, traders may face challenges in recovering funds in case of disputes or fraudulent activities. Furthermore, the absence of a regulatory license may indicate that Tianchengguoji operates in a high-risk environment, potentially exposing traders to scams. Therefore, it is crucial to consider the regulatory quality and historical compliance of a broker when evaluating its safety.

Company Background Investigation

A thorough understanding of a company's history, ownership structure, and management team is vital in assessing its credibility. Unfortunately, detailed information about Tianchengguoji's history and development is scarce. The company's ownership structure remains unclear, which raises questions about its transparency. A reputable broker typically discloses information about its founders and management team, showcasing their experience and qualifications in the financial industry. In contrast, Tianchengguoji's lack of information may suggest a lack of accountability.

The management team's background and professional experience play a significant role in determining a broker's reliability. A well-experienced team can be an indicator of sound business practices and ethical trading. However, without clear insights into the management of Tianchengguoji, it is difficult to ascertain the company's commitment to transparency and ethical trading practices. This opacity may lead to a lack of trust among potential clients, as traders often prefer brokers with clear and accessible information about their operations.

Trading Conditions Analysis

Understanding the trading conditions offered by a broker is essential for traders to make informed decisions. Tianchengguoji's overall fee structure and trading conditions warrant careful consideration. The following table provides a comparison of core trading costs:

| Fee Type | Tianchengguoji | Industry Average |

|---|---|---|

| Spread on Major Pairs | N/A | Varies |

| Commission Structure | N/A | Varies |

| Overnight Interest Range | N/A | Varies |

Unfortunately, specific information regarding Tianchengguoji's trading fees is not readily available, which is concerning. A reputable broker should provide clear information about spreads, commissions, and any other fees associated with trading. An unclear fee structure can lead to unexpected costs for traders, further complicating their trading strategies. Additionally, if the broker employs unusual or hidden fees, it could indicate a lack of transparency and ethical practices. Traders should be wary of brokers that do not provide straightforward information about their trading conditions, as this may be a red flag for potential scams.

Customer Fund Security

The security of client funds is paramount when assessing a forex broker's safety. Traders need to ensure that their investments are protected through appropriate measures. Tianchengguoji's approach to fund security requires scrutiny. Key aspects to consider include fund segregation, investor protection mechanisms, and negative balance protection policies.

A reputable broker typically segregates client funds from its operational funds, ensuring that traders' money is safeguarded against potential insolvency issues. Additionally, investor protection schemes, such as compensation funds, provide an extra layer of security for clients. Unfortunately, without clear information on Tianchengguoji's fund security measures, it is challenging to determine whether it adheres to best practices. Any historical issues or disputes related to fund security could further raise concerns about the broker's reliability. Traders should prioritize brokers that have a proven track record of safeguarding client funds and maintaining transparent security measures.

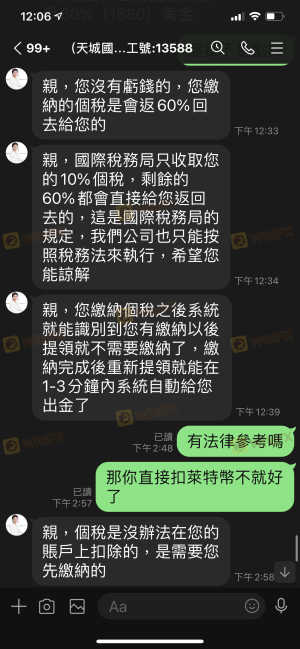

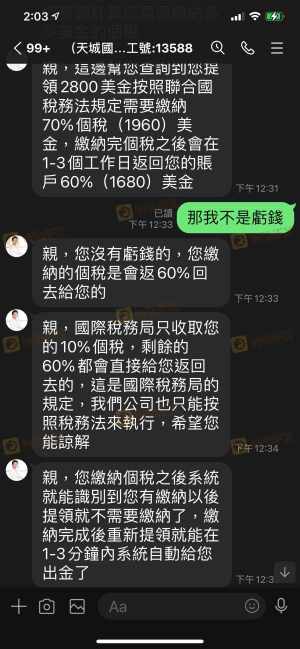

Customer Experience and Complaints

Evaluating customer feedback and user experiences is essential in determining the reliability of a forex broker. Tianchengguoji's reputation in the trading community will provide insights into its customer service and overall performance. Common complaint patterns and the company's responsiveness to issues can indicate its commitment to client satisfaction.

The following table lists the major complaint types and their severity assessment:

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Issues | High | Unresponsive |

| Poor Customer Support | Medium | Slow Response |

| Misleading Information | High | No Resolution |

Reports of withdrawal issues and poor customer support are particularly alarming, as they can significantly impact traders' experiences. If customers struggle to access their funds, it raises serious concerns about the broker's reliability. Furthermore, a lack of responsiveness from the company can exacerbate these issues, leaving traders feeling frustrated and vulnerable.

Real-life case studies of users who have faced challenges with Tianchengguoji can shed light on the broker's operational practices. Such experiences can serve as cautionary tales for potential clients, emphasizing the importance of thorough research before choosing a broker.

Platform and Execution

The performance of the trading platform is a critical factor in the overall trading experience. Traders need a reliable and efficient platform to execute their strategies effectively. Tianchengguoji's platform performance, stability, and user experience should be assessed to determine its reliability.

Key aspects to evaluate include order execution quality, slippage rates, and any indications of platform manipulation. A platform that frequently experiences technical issues or has high slippage rates can hinder traders' ability to execute trades effectively. Additionally, any signs of manipulation, such as unusual price spikes or discrepancies in order execution, can raise red flags regarding the broker's integrity.

Risk Assessment

Using Tianchengguoji as a trading platform involves certain risks that must be carefully considered. The following risk scorecard summarizes key risk areas associated with this broker:

| Risk Category | Risk Level (Low/Medium/High) | Brief Description |

|---|---|---|

| Regulatory Risk | High | Unregulated status raises concerns. |

| Fund Security Risk | High | Lack of transparency in fund security. |

| Customer Service Risk | Medium | Reports of poor customer support. |

Traders should be aware of these risks and take appropriate measures to mitigate them. This may include setting strict limits on their investments, using risk management strategies, and remaining vigilant about any unusual activities on their accounts.

Conclusion and Recommendations

In conclusion, the investigation into Tianchengguoji raises significant concerns regarding its safety and reliability. The absence of regulatory oversight, unclear trading conditions, and reports of customer complaints suggest that traders should exercise caution when considering this broker. There are indications of potential scams, particularly in terms of fund security and customer support.

For traders seeking a reliable forex broker, it is advisable to look for alternatives that are well-regulated, transparent about their fees, and have a proven track record of customer satisfaction. Brokers regulated by reputable authorities, such as the FCA or ASIC, are typically safer options. Always conduct thorough research and due diligence before committing funds to any trading platform. In this volatile market, ensuring the safety of investments should be the top priority for all traders.

Is tianchengguoji a scam, or is it legit?

The latest exposure and evaluation content of tianchengguoji brokers.

tianchengguoji Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

tianchengguoji latest industry rating score is 1.49, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.49 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.