Is Tercmarkets safe?

Business

License

Is Tercmarkets A Scam?

Introduction

Tercmarkets, also known as Terrain Capital Markets Limited, positions itself as an online broker in the forex market, offering trading services in various financial instruments including forex and CFDs. As the financial landscape continues to evolve, traders are increasingly faced with the challenge of distinguishing between legitimate brokers and potential scams. This is particularly crucial in the forex market, where the lack of regulation can expose traders to significant risks, including loss of capital and fraudulent practices.

In this article, we will conduct a thorough investigation into Tercmarkets to determine its safety and reliability. Our evaluation will be based on a combination of regulatory status, company background, trading conditions, customer experience, and risk assessments. By utilizing various online resources and user feedback, we aim to provide a comprehensive overview of whether Tercmarkets is safe or a potential scam.

Regulation and Legitimacy

The regulatory status of a broker is a critical factor in assessing its legitimacy. Regulated brokers are required to adhere to strict guidelines that protect investors, whereas unregulated brokers operate with minimal oversight, increasing the risk of fraud.

Regulatory Overview

| Regulatory Body | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| None | N/A | N/A | Unregulated |

Tercmarkets does not appear to be regulated by any recognized financial authority, such as the Financial Conduct Authority (FCA) in the UK or the Australian Securities and Investments Commission (ASIC). The absence of regulation raises significant concerns regarding the safety of funds and the operational integrity of the broker. This lack of oversight is a red flag, as it suggests that traders may not have any recourse in the event of issues arising from their trading activities.

Furthermore, the broker's claims of being based in the United Kingdom are unverified, and there are no records matching Terrain Capital Markets Limited in the FCA database. This absence of regulatory oversight and transparency indicates that Tercmarkets may not be a safe choice for traders.

Company Background Investigation

Understanding the background and ownership structure of a broker is essential for evaluating its trustworthiness. Tercmarkets presents itself as a global trading platform, but the lack of publicly available information about its history and ownership raises concerns.

The company's website does not provide detailed information regarding its founders or management team, which is a common practice among reputable brokers. Transparency about the individuals behind the company is crucial for building trust with potential clients. The absence of such information suggests a lack of accountability and could be indicative of a scam.

Moreover, the company's operational history is unclear, with reports from various sources indicating that Tercmarkets has received numerous complaints from users regarding withdrawal issues and poor customer service. Such feedback often highlights a pattern of problematic behavior typical of unregulated entities.

Trading Conditions Analysis

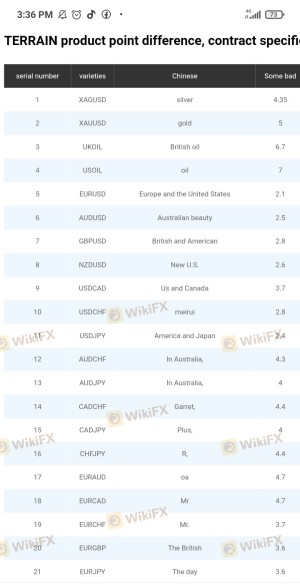

Tercmarkets claims to offer competitive trading conditions, but it is essential to scrutinize their fee structure and trading costs to determine whether they align with industry standards.

Fee Structure Comparison

| Fee Type | Tercmarkets | Industry Average |

|---|---|---|

| Spread on Major Pairs | N/A | 1.0 - 2.0 pips |

| Commission Model | N/A | Varies |

| Overnight Interest Range | N/A | 2% - 5% |

Unfortunately, specific details regarding the fees and spreads charged by Tercmarkets are not readily available, which is concerning. Reputable brokers typically provide clear information about their fee structures, including spreads and commissions. The lack of transparency in this area could indicate hidden fees or unfavorable trading conditions that traders may not be aware of until it is too late.

Moreover, the absence of a defined commission model raises questions about the broker's overall cost structure. Traders should be cautious of brokers that do not clearly outline their fees, as this can lead to unexpected charges that diminish overall profitability.

Customer Funds Security

The safety of customer funds is paramount when choosing a forex broker. Tercmarkets' lack of regulation raises significant concerns regarding its fund security measures.

Tercmarkets does not provide information regarding the segregation of client funds, which is a standard practice among regulated brokers. Segregating client funds ensures that traders' money is kept separate from the broker's operational funds, providing an additional layer of protection in case of insolvency.

Furthermore, there is no indication that Tercmarkets offers any form of investor protection or negative balance protection policies. Negative balance protection is essential for safeguarding traders from losing more than their initial investment, especially in the volatile forex market. The absence of such measures suggests that traders may be at a higher risk of losing their funds.

Customer Experience and Complaints

Analyzing customer feedback can provide valuable insights into a broker's reliability and service quality. Tercmarkets has received a mix of reviews, with numerous complaints highlighting significant issues.

Complaint Overview

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Issues | High | Poor |

| Customer Support Issues | Medium | Slow |

| Misleading Information | High | Unresponsive |

Common complaints include difficulties with fund withdrawals, lack of responsive customer support, and claims of misleading information regarding trading conditions. Many users have reported that their withdrawal requests were delayed or denied, which is a significant concern for any trader.

Additionally, the overall quality of customer support has been criticized, with users stating that their inquiries often went unanswered or received delayed responses. This lack of effective communication can lead to frustration and mistrust among clients.

Platform and Trade Execution

The trading platform's performance is a critical aspect of the trading experience. Tercmarkets claims to use MetaTrader 5, a widely recognized platform known for its reliability and features. However, user feedback indicates that there may be issues with execution quality.

Traders have reported instances of slippage and order rejections, which can adversely affect trading outcomes. Such issues are particularly concerning in fast-moving markets, where timely execution is crucial for capitalizing on opportunities.

Additionally, the absence of clear information regarding platform stability and performance raises questions about the broker's operational integrity. Traders should be wary of brokers that do not provide transparent information about their platform capabilities.

Risk Assessment

Using Tercmarkets presents several risks that potential traders should consider carefully.

Risk Assessment Summary

| Risk Category | Risk Level (Low/Medium/High) | Brief Description |

|---|---|---|

| Regulatory Risk | High | Unregulated broker increases risk of fraud. |

| Fund Security Risk | High | Lack of fund segregation and protection measures. |

| Execution Risk | Medium | Reports of slippage and order issues. |

Given the high regulatory and fund security risks associated with Tercmarkets, traders should approach this broker with caution. It is advisable to conduct thorough research and consider alternative options that offer better regulatory oversight and customer protection.

Conclusion and Recommendations

In conclusion, the evidence gathered in this investigation raises significant concerns regarding the legitimacy and safety of Tercmarkets. The lack of regulation, transparency, and poor customer feedback suggest that Tercmarkets may not be a safe option for traders.

Traders should be particularly cautious about depositing funds with unregulated brokers like Tercmarkets, as the risks of losing capital are heightened. For those seeking reliable trading options, it is advisable to consider brokers that are regulated by reputable authorities and offer strong investor protection measures.

If you are looking for safer alternatives, consider brokers such as IG, OANDA, or Forex.com, which are well-regulated and have established positive reputations in the forex trading community. Always prioritize safety and due diligence when selecting a trading partner.

Is Tercmarkets a scam, or is it legit?

The latest exposure and evaluation content of Tercmarkets brokers.

Tercmarkets Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

Tercmarkets latest industry rating score is 1.47, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.47 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.