Regarding the legitimacy of Regal forex brokers, it provides VFSC and WikiBit, .

Is Regal safe?

Pros

Cons

Is Regal markets regulated?

The regulatory license is the strongest proof.

VFSC Forex Trading License (EP)

Vanuatu Financial Services Commission

Vanuatu Financial Services Commission

Current Status:

RevokedLicense Type:

Forex Trading License (EP)

Licensed Entity:

Regal Core Markets

Effective Date:

--Email Address of Licensed Institution:

--Sharing Status:

No SharingWebsite of Licensed Institution:

--Expiration Time:

--Address of Licensed Institution:

--Phone Number of Licensed Institution:

--Licensed Institution Certified Documents:

Is Regal Safe or a Scam?

Introduction

Regal is an online forex broker that has garnered attention in the trading community for its offerings and claims of competitive trading conditions. Established in Vanuatu, Regal aims to provide traders with access to various financial markets, including forex, commodities, and indices. However, the importance of due diligence in evaluating forex brokers cannot be overstated. Traders need to be vigilant and conduct thorough assessments of brokers to protect their investments. This article investigates the safety and legitimacy of Regal by examining its regulatory status, company background, trading conditions, client fund security, customer experiences, and overall risk profile. Our methodology involves analyzing multiple reputable sources, including regulatory databases and user reviews, to provide a balanced view of whether Regal is a trustworthy broker or a potential scam.

Regulation and Legitimacy

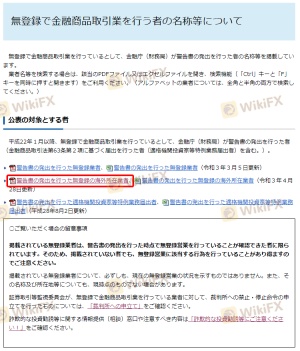

Regulatory oversight is crucial for any financial institution, especially in the forex market, where the risk of fraud is prevalent. A broker's regulatory status often reflects its adherence to industry standards and the level of investor protection it offers. Regal is registered with the Vanuatu Financial Services Commission (VFSC); however, it has faced scrutiny regarding its regulatory compliance.

Here is a summary of Regal's regulatory information:

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| Vanuatu Financial Services Commission (VFSC) | 15022 | Vanuatu | Revoked |

The VFSC's revocation of Regal's license raises significant concerns about the broker's legitimacy. Without a valid regulatory framework, traders may find themselves exposed to increased risks, such as unfair trading practices and lack of recourse in case of disputes. Furthermore, the absence of oversight from top-tier regulators like the FCA (UK) or ASIC (Australia) diminishes the broker's credibility. It is essential to recognize that while Regal may operate legally within Vanuatu, its lack of stringent regulatory oversight makes it imperative for traders to ask, "Is Regal safe?"

Company Background Investigation

Understanding a broker's history and ownership structure is vital for assessing its reliability. Regal was established in 2017 and has positioned itself as a forex trading platform targeting both novice and experienced traders. However, there is limited information available regarding its ownership and management team, which raises questions about transparency.

A thorough investigation indicates that Regal's management team lacks the credentials typically expected in a reputable brokerage. This absence of experienced leadership can lead to operational inefficiencies and questionable business practices. Additionally, the company's transparency regarding its operations and financial health is inadequate, with minimal disclosures available on its website. In an industry where trust is paramount, such opaqueness can deter potential clients. Therefore, the question of whether "Is Regal safe?" becomes increasingly relevant, as the lack of transparency can be a red flag for prospective traders.

Trading Conditions Analysis

Regal claims to offer competitive trading conditions, including low spreads and various trading instruments. However, a closer examination reveals potential discrepancies in its fee structure and overall trading environment.

Here is a comparison of core trading costs:

| Fee Type | Regal | Industry Average |

|---|---|---|

| Spread on Major Currency Pairs | 2.5 pips | 1.0 - 1.5 pips |

| Commission Model | None | Varies (0 - $10) |

| Overnight Interest Range | High | Moderate |

The spread on major currency pairs at Regal is notably higher than the industry average, which can significantly impact trading profitability, especially for high-frequency traders. Furthermore, while Regal advertises a commission-free structure, the elevated spreads may effectively serve as hidden costs, raising concerns about the broker's pricing transparency. As such, traders must consider whether the trading conditions offered by Regal align with their trading strategies and risk tolerance, prompting the question, "Is Regal safe?"

Client Fund Security

The safety of client funds is a paramount concern for any trader. Regal claims to implement various security measures to protect client deposits; however, the details of these measures remain vague. The broker's website lacks comprehensive information about fund segregation, investor protection mechanisms, and negative balance protection policies.

A review of Regal's fund security measures reveals that while it claims to segregate client funds from its operational capital, the lack of regulatory oversight raises doubts about the effectiveness of these measures. In the absence of a robust regulatory framework, clients may find it challenging to recover their funds in the event of insolvency or unethical practices. Historical complaints from users regarding withdrawal issues further exacerbate concerns about the safety of funds with Regal. This leads to the critical question, "Is Regal safe?"—a question that remains unanswered for many potential clients.

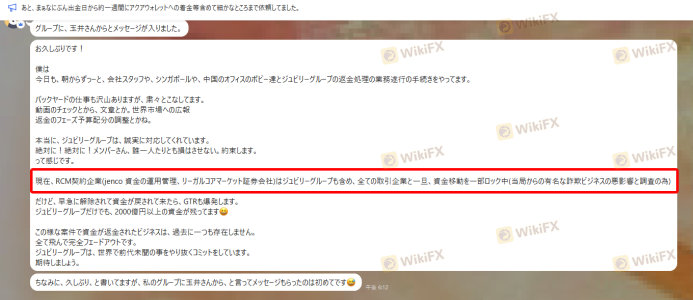

Customer Experience and Complaints

Customer feedback can provide valuable insights into a broker's reliability and service quality. An analysis of user reviews for Regal indicates a troubling pattern of complaints, particularly concerning withdrawal difficulties and poor customer support.

Here is a summary of common complaint types:

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Issues | High | Slow response |

| Poor Customer Service | Medium | Unresolved |

| Misleading Information | High | Ignored |

Many users report being unable to withdraw their funds in a timely manner, leading to frustration and loss of trust in the broker. Additionally, the quality of customer service has been criticized, with many clients experiencing long wait times for responses and inadequate resolutions to their issues. These complaints raise significant concerns about Regal's operational integrity and customer care. As such, potential traders must consider whether "Is Regal safe?" in light of these negative experiences.

Platform and Trade Execution

The performance of a trading platform can significantly influence a trader's experience. Regal offers the widely-used MetaTrader 4 (MT4) platform, which is known for its robust features and user-friendly interface. However, user experiences with Regal's execution quality have been mixed.

A review of execution quality indicates that while the MT4 platform generally performs well, there are reports of slippage and delayed order executions during high volatility periods. Such issues can adversely affect trading outcomes, particularly for scalpers and day traders who rely on precise execution. Furthermore, there are no indications of platform manipulation, but the lack of transparency regarding execution policies raises concerns. In this context, the question "Is Regal safe?" gains importance, as traders must be aware of the potential risks associated with execution quality.

Risk Assessment

Engaging with any broker involves inherent risks, and assessing these risks is crucial for informed decision-making. A comprehensive risk assessment of Regal reveals several key areas of concern.

Here is a summary of the risk profile:

| Risk Category | Risk Level (Low/Medium/High) | Brief Explanation |

|---|---|---|

| Regulatory Risk | High | Unregulated status and revoked license |

| Financial Risk | Medium | Lack of transparency in fund security |

| Operational Risk | Medium | Complaints of withdrawal issues |

Given these risks, prospective traders should exercise caution when considering Regal as their broker. It is advisable to conduct thorough research and consider alternative options that offer stronger regulatory oversight and better customer service. To mitigate risks, traders should only invest funds they can afford to lose and consider diversifying their investments across multiple brokers.

Conclusion and Recommendations

In conclusion, the evidence gathered raises significant concerns about the safety and legitimacy of Regal as a forex broker. The absence of robust regulatory oversight, combined with a troubling history of customer complaints and issues related to fund security, suggests that traders should approach Regal with caution. While it is not outrightly labeled a scam, the risks associated with trading with Regal are substantial, and potential clients must weigh these risks carefully.

For traders who prioritize safety and reliability, it may be prudent to consider alternative brokers that are regulated by reputable authorities and offer transparent trading conditions. Some recommended alternatives include brokers regulated by the FCA or ASIC, which provide a higher level of investor protection and regulatory compliance. Ultimately, the question "Is Regal safe?" should serve as a critical consideration for any trader contemplating an account with this broker.

Is Regal a scam, or is it legit?

The latest exposure and evaluation content of Regal brokers.

Regal Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

Regal latest industry rating score is 1.61, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.61 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.