Is Takeoff Global safe?

Business

License

Is Takeoff Global Safe or Scam?

Introduction

Takeoff Global is a relatively new player in the forex market, established in 2021 and based in the United Kingdom. It positions itself as a broker offering a range of trading instruments, including forex, indices, and CFDs, through the popular MetaTrader 5 platform. As the forex market continues to expand, it becomes increasingly crucial for traders to evaluate the legitimacy and safety of their chosen brokers. With the rise of online trading, the risk of encountering scams has also increased, making it vital for traders to conduct thorough due diligence before investing their hard-earned money. This article employs a comprehensive evaluation framework, drawing insights from various sources, including user reviews, regulatory information, and industry analysis, to determine the safety and reliability of Takeoff Global.

Regulation and Legitimacy

The regulatory status of a broker is a critical factor in assessing its legitimacy. Takeoff Global claims to be regulated by the National Futures Association (NFA); however, this claim is questionable as it lacks proper authorization. The following table summarizes the core regulatory information for Takeoff Global:

| Regulatory Agency | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| National Futures Association (NFA) | 0545510 | United States | Unauthorized |

The absence of a robust regulatory framework raises red flags about the brokers operational legitimacy. Regulatory bodies are established to protect traders by enforcing strict compliance standards, ensuring that brokers operate transparently, and safeguarding client funds. The lack of regulation means that Takeoff Global may not adhere to these necessary standards, making it a potential risk for traders. Furthermore, the broker has received a low score of 1.33 out of 10 on platforms like WikiFX, which indicates significant concerns about its reliability. This lack of oversight and the questionable regulatory status of Takeoff Global underscore the importance of caution when considering trading with this broker.

Company Background Investigation

Takeoff Global was founded with the aim of providing a user-friendly trading experience, but its history is relatively short, raising concerns about its stability and longevity in the market. The ownership structure and management team are critical elements to consider. Unfortunately, detailed information about the management team is sparse, which could indicate a lack of transparency. Without a well-documented history and an experienced management team, it is difficult for potential clients to trust the broker fully.

Moreover, the broker's transparency in terms of information disclosure is lacking. A reputable broker typically provides detailed information about its operations, including its ownership structure, management team backgrounds, and company history. The absence of such information for Takeoff Global raises questions about its commitment to transparency and accountability. Traders should be wary of engaging with brokers that do not offer clear insights into their operational background.

Trading Conditions Analysis

When evaluating a broker, understanding the overall cost structure is essential. Takeoff Global offers competitive trading conditions, including low spreads and high leverage. However, traders must be cautious of any hidden fees or unusual policies that could affect their trading experience. The following table compares core trading costs associated with Takeoff Global against industry averages:

| Fee Type | Takeoff Global | Industry Average |

|---|---|---|

| Major Currency Pair Spread | 0.0 pips | 1.0 pips |

| Commission Model | Commission-free | $5 per lot |

| Overnight Interest Range | Not specified | Varies widely |

While the broker advertises ultra-low spreads starting at 0.0 pips, the lack of clarity on overnight interest and commission structures raises concerns. Traders should be aware of the potential for hidden fees that could significantly impact their profitability. Additionally, the minimum deposit requirement of $1,000 is relatively high compared to other brokers, which may deter novice traders or those with limited capital.

Client Fund Safety

The safety of client funds is paramount when selecting a broker. Takeoff Global's policies regarding fund security, such as segregation of client accounts and negative balance protection, are crucial factors to consider. Unfortunately, the broker has not provided clear information regarding these safety measures. The lack of transparency regarding fund security raises concerns about the potential risks involved.

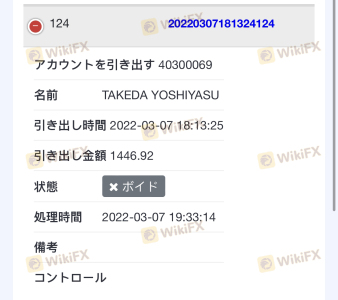

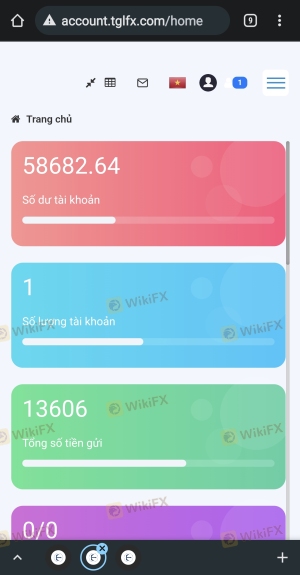

In the past, there have been complaints from users about difficulties in withdrawing funds, which is a significant red flag. Traders must ensure that their funds are protected and that they can access their money without undue hassle. Historical issues related to fund security can indicate a broker's reliability, and the absence of a solid track record for Takeoff Global could pose a risk to potential investors.

Customer Experience and Complaints

User feedback is a valuable source of information when assessing a broker's reputation. Takeoff Global has received multiple complaints, with users reporting issues related to withdrawals and customer service. The following table summarizes the main types of complaints and their severity:

| Complaint Type | Severity | Company Response |

|---|---|---|

| Withdrawal issues | High | Slow response |

| Customer service availability | Medium | Inconsistent support |

| Platform stability | Low | Under investigation |

The common theme among complaints is the broker's inadequate response to client concerns, particularly regarding withdrawal issues. Such patterns can indicate systemic problems within the company and may suggest that Takeoff Global is not adequately equipped to handle customer inquiries or resolve issues effectively. Traders should consider these factors seriously before deciding to trade with this broker.

Platform and Trade Execution

The trading platform is a critical aspect of the trading experience. Takeoff Global utilizes the MetaTrader 5 platform, which is known for its robust features and user-friendly interface. However, the platform's performance, stability, and execution quality are essential for successful trading. Users have reported mixed experiences, with some noting issues related to order execution and slippage.

Moreover, any signs of platform manipulation, such as frequent rejections of orders or unexpected price changes, can be alarming. Traders should be vigilant and monitor their trading experiences closely, as these factors can significantly impact their overall trading success.

Risk Assessment

Using Takeoff Global comes with various risks that traders should be aware of. The following risk assessment summarizes the key areas of concern:

| Risk Category | Risk Level (Low/Medium/High) | Brief Description |

|---|---|---|

| Regulatory Risk | High | Lack of regulation increases risks |

| Fund Safety Risk | High | Insufficient information on fund security |

| Customer Service Risk | Medium | Inconsistent support and responsiveness |

| Trading Platform Risk | Medium | Reports of execution issues and slippage |

Traders should take proactive measures to mitigate these risks, such as starting with a smaller investment, utilizing demo accounts, and regularly monitoring their trading activities. Understanding the risks associated with Takeoff Global can help traders make informed decisions about their investments.

Conclusion and Recommendations

In conclusion, the evidence suggests that Takeoff Global is not a safe trading option. The lack of proper regulation, combined with numerous user complaints and insufficient transparency, raises significant red flags. Traders should exercise extreme caution when considering this broker and be aware of the potential risks involved.

For those seeking reliable alternatives, it is advisable to explore brokers that are well-regulated, have a solid track record of customer service, and provide transparent information about their operations. Brokers such as OANDA, IG, and Forex.com are examples of reputable options that offer a safer trading environment.

Ultimately, conducting thorough research and due diligence is essential in the forex market, and traders should prioritize their safety and security above all else.

Is Takeoff Global a scam, or is it legit?

The latest exposure and evaluation content of Takeoff Global brokers.

Takeoff Global Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

Takeoff Global latest industry rating score is 1.47, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.47 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.