Is Fast Profit safe?

Pros

Cons

Is Fast Profit A Scam?

Introduction

Fast Profit is a forex broker that has entered the market with promises of high returns and an easy trading experience. Positioned as a platform for both novice and experienced traders, it claims to provide a user-friendly interface and a range of trading options. However, the forex market is notorious for its complexities and risks, making it crucial for traders to carefully evaluate brokers before committing their funds. In this article, we will explore the legitimacy of Fast Profit by examining its regulatory status, company background, trading conditions, customer experiences, and overall risk profile. Our investigation is based on a thorough review of multiple sources, including user testimonials, regulatory databases, and industry reports.

Regulation and Legitimacy

Understanding the regulatory status of a broker is paramount for assessing its legitimacy. Regulation serves as a form of protection for traders, ensuring that brokers adhere to certain standards of conduct. Fast Profit claims to be based in the United States; however, it has garnered attention for operating without proper regulatory oversight.

Here is a summary of the regulatory details:

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| N/A | N/A | N/A | Unregulated |

The absence of regulation from recognized authorities such as the Financial Conduct Authority (FCA) or the Commodity Futures Trading Commission (CFTC) raises significant concerns about the broker's credibility. Reports indicate that Fast Profit has been flagged as a potential scam due to its lack of regulatory compliance and misleading claims regarding its licensing status. Without a governing body overseeing its operations, traders using Fast Profit may be exposed to heightened risks, including the potential loss of their funds.

Company Background Investigation

Fast Profit's history and ownership structure are critical factors in assessing its reliability. The broker claims to have been operational for a few years, but detailed information about its founders or management team is sparse. This lack of transparency is concerning, as reputable brokers typically provide clear information about their leadership and operational history.

The company's website offers minimal insight into its development or the qualifications of its team. Such opacity often indicates a lack of accountability, making it difficult for traders to trust the broker. Furthermore, the absence of a physical office or a verifiable corporate structure can lead to skepticism regarding its legitimacy. In the world of finance, transparency is key, and Fast Profit falls short in this regard.

Trading Conditions Analysis

When evaluating a broker, understanding the trading conditions, including fees and spreads, is essential. Fast Profit advertises competitive trading conditions but lacks clarity in its fee structure. This ambiguity can lead to unexpected costs for traders.

Here is a comparison of core trading costs:

| Fee Type | Fast Profit | Industry Average |

|---|---|---|

| Major Currency Pair Spread | N/A | 1.0 - 2.0 pips |

| Commission Model | N/A | Varies |

| Overnight Interest Range | N/A | Varies |

The absence of specific details regarding spreads and commissions raises red flags. Traders may find themselves facing hidden fees or unfavorable trading conditions, which can significantly impact their profitability. Moreover, the lack of a demo account limits traders' ability to test the platform without risking real money, further complicating the decision to engage with Fast Profit.

Customer Fund Safety

The safety of customer funds is a primary concern when choosing a broker. Fast Profit's website does not provide sufficient information regarding its fund protection measures. Reputable brokers typically segregate client funds from their operational funds and provide investor protection schemes.

In the case of Fast Profit, the absence of such assurances raises questions about the safety of traders' investments. Reports of withdrawal issues and difficulties in accessing funds have emerged, indicating potential risks associated with this broker. Traders should be wary of any broker that does not clearly outline its policies regarding fund security and investor protection.

Customer Experience and Complaints

Customer feedback is invaluable for understanding the experiences of traders with a broker. Fast Profit has received mixed reviews, with many users reporting significant issues related to withdrawals and customer service responsiveness.

Here is a summary of common complaint types and their severity:

| Complaint Type | Severity | Company Response |

|---|---|---|

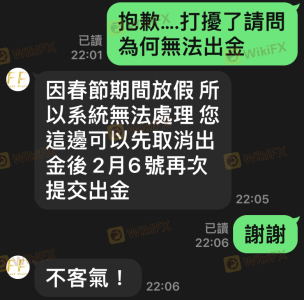

| Withdrawal Delays | High | Poor |

| Unresponsive Customer Support | Medium | Poor |

| Misleading Information | High | Poor |

Many users have expressed frustration over delayed withdrawals, with some claiming that their requests were ignored or met with excessive delays. This pattern of complaints suggests a lack of effective customer support and raises concerns about the broker's overall reliability.

Platform and Trade Execution

The performance and reliability of a trading platform are crucial for a successful trading experience. Fast Profit claims to offer a robust trading platform; however, user reviews indicate mixed experiences regarding its stability and execution quality.

Traders have reported instances of slippage and order rejections, which can severely impact trading outcomes. The lack of transparency surrounding the platform's operational mechanics raises concerns about potential market manipulation or unfair trading practices.

Risk Assessment

Engaging with Fast Profit presents several risks that traders should be aware of. Below is a risk assessment summary:

| Risk Category | Risk Level (Low/Medium/High) | Brief Description |

|---|---|---|

| Regulatory Risk | High | Unregulated status increases risk exposure. |

| Fund Safety Risk | High | Lack of clear fund protection measures. |

| Withdrawal Risk | High | Reports of withdrawal delays and issues. |

| Customer Service Risk | Medium | Poor response to customer inquiries. |

To mitigate these risks, traders are advised to conduct thorough research and consider using regulated brokers with established reputations.

Conclusion and Recommendations

In conclusion, the evidence suggests that Fast Profit raises significant concerns regarding its legitimacy and safety. The lack of regulation, transparency, and consistent customer complaints indicate that traders should exercise extreme caution. While some may find the broker appealing due to its marketing claims, the potential risks far outweigh the benefits.

For traders seeking a reliable forex broker, it is advisable to consider established and regulated alternatives. Brokers with a proven track record, transparent fee structures, and robust customer support are essential for ensuring a safe trading environment. Ultimately, traders must prioritize their financial security and choose brokers that align with their investment goals and risk tolerance.

In summary, is Fast Profit safe? The evidence points towards a high level of risk, and it is prudent for traders to look elsewhere for their trading needs.

Is Fast Profit a scam, or is it legit?

The latest exposure and evaluation content of Fast Profit brokers.

Fast Profit Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

Fast Profit latest industry rating score is 1.43, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.43 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.