Is Saramarkets safe?

Business

License

Is Saramarkets A Scam?

Introduction

Saramarkets is a forex broker that positions itself in the online trading market, offering a range of services including forex, CFDs, and cryptocurrency trading. As with any financial service provider, it is essential for traders to conduct thorough due diligence before committing their funds. The forex market can be rife with risks, and selecting the right broker is crucial to safeguarding investments and ensuring a fair trading environment. This article will investigate the legitimacy of Saramarkets, addressing key concerns such as regulatory compliance, company background, trading conditions, customer experience, and overall risk assessment. Our investigation is based on a comprehensive review of online resources, user testimonials, and industry standards.

Regulation and Legality

Understanding the regulatory landscape is vital when evaluating whether Saramarkets is safe. Regulation serves as a safeguard for traders, ensuring that brokers adhere to specific standards of conduct and financial practices. Saramarkets claims to be based in Seychelles, a jurisdiction known for its lax regulatory framework. The absence of robust regulatory oversight raises significant concerns about the safety of client funds and the broker's overall integrity.

Here is a summary of the regulatory information:

| Regulatory Body | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| None | N/A | Seychelles | Unverified |

Saramarkets does not appear to be regulated by any reputable financial authority, which is a major red flag. Regulatory bodies are crucial as they provide a mechanism for dispute resolution and ensure that client funds are protected. Furthermore, the lack of regulation means that traders have little recourse in the event of fraud or misconduct. Historically, brokers operating without regulation have been known to engage in unethical practices, such as manipulating spreads or delaying withdrawals. Therefore, it is vital for potential clients to approach Saramarkets with caution, as the absence of regulatory oversight significantly diminishes its credibility.

Company Background Investigation

Saramarkets was established relatively recently, with reports indicating its inception in 2021. The company claims to operate under the name Saramarkets Ltd and is purportedly based in Seychelles. However, details regarding its ownership structure and management team remain obscure. This lack of transparency is concerning, as reputable brokers typically provide comprehensive information about their leadership and operational history.

The management teams background and expertise can significantly impact a broker's reliability. Unfortunately, Saramarkets has not disclosed any information about its key personnel, which raises questions about the professionalism and experience of those running the operation. The absence of such details can be indicative of a lack of accountability and may suggest that the company is not committed to maintaining high standards of service.

Moreover, the information available regarding Saramarkets business practices is limited, further complicating the assessment of its legitimacy. In an industry where trust is paramount, the lack of transparency regarding the company's operations and management can be a significant deterrent for potential traders. Therefore, it is essential for individuals considering Saramarkets to weigh these factors carefully.

Trading Conditions Analysis

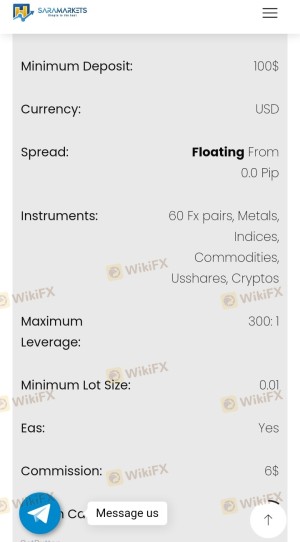

When evaluating whether Saramarkets is safe, it is crucial to examine its trading conditions, including fees, spreads, and commissions. A broker's cost structure can significantly affect a trader's profitability. Saramarkets offers a variety of account types, each with different minimum deposit requirements and trading conditions.

The following table summarizes the core trading costs associated with Saramarkets:

| Cost Type | Saramarkets | Industry Average |

|---|---|---|

| Major Currency Pair Spread | 1.6 pips | 1.0 - 1.5 pips |

| Commission Model | $0 | $5 - $10 per lot |

| Overnight Interest Range | Varies | Varies |

While Saramarkets advertises competitive spreads, the fees associated with its accounts, particularly the commission structure, may not be as favorable compared to industry standards. Additionally, traders should be cautious of any hidden fees that may not be explicitly stated. Unusual or excessive fees can significantly erode trading profits and are often a warning sign of unscrupulous practices.

Moreover, the high leverage offered by Saramarkets, up to 1:2000, can be appealing to traders looking to maximize their potential returns. However, it also poses substantial risks, especially for inexperienced traders. High leverage can amplify losses as well as gains, making it critical for traders to fully understand the implications before engaging with the broker.

Customer Fund Safety

The safety of customer funds is a paramount concern when assessing whether Saramarkets is safe. A reliable broker should implement robust measures to protect client deposits, including segregated accounts and investor protection schemes. Unfortunately, Saramarkets has not demonstrated a commitment to ensuring the safety of client funds.

The broker does not provide information on whether it offers segregated accounts, which are essential for protecting client funds in the event of company insolvency. Additionally, there is no indication of any investor compensation scheme, which would typically provide a safety net for clients in case of broker failure.

Moreover, Saramarkets does not appear to have faced any significant security incidents or fund-related disputes, but the absence of transparency regarding its financial practices raises concerns. Traders should be cautious and consider the potential risks associated with entrusting their funds to a broker lacking in safety measures and regulatory oversight.

Customer Experience and Complaints

Customer feedback is a valuable source of information when evaluating whether Saramarkets is safe. A review of online testimonials reveals a mixed bag of experiences. While some users praise the platform's ease of use and quick transaction processing, others have reported issues related to withdrawals and customer support.

The following table summarizes common complaint types and their severity:

| Complaint Type | Severity | Company Response |

|---|---|---|

| Withdrawal Delays | High | Poor |

| Poor Customer Support | Medium | Inconsistent |

| Account Verification Issues | Medium | Slow |

One notable complaint involves delays in processing withdrawal requests, with some users reporting that their funds were held for extended periods. This is a significant concern, as timely access to funds is critical for traders. Additionally, the quality of customer support has been criticized, with many users stating that their inquiries were not addressed promptly or satisfactorily.

Two specific case studies exemplify these issues. In one instance, a user reported that their withdrawal request was delayed for over two months, leading to frustration and distrust in the broker. Another trader expressed dissatisfaction with the customer support team's responsiveness, indicating that their questions went unanswered for days. Such complaints highlight the potential risks associated with trading with Saramarkets and underscore the need for caution.

Platform and Trade Execution

The performance of a trading platform is crucial for a trader's overall experience. Saramarkets offers the widely used MetaTrader 4 (MT4) platform, which is known for its robust features and user-friendly interface. However, the platform's stability and execution quality are vital factors in determining whether Saramarkets is safe.

Users have reported mixed experiences with trade execution, with some noting instances of slippage and rejected orders during high volatility periods. Such issues can significantly impact trading outcomes and raise concerns about the broker's reliability.

Furthermore, any signs of platform manipulation, such as frequent re-quotes or sudden changes in spreads, can indicate a lack of transparency and fairness in trading practices. Traders should remain vigilant and monitor their trading experiences closely to identify any irregularities that may arise.

Risk Assessment

Using Saramarkets comes with inherent risks that potential traders should carefully consider. The following risk scorecard summarizes key risk areas:

| Risk Category | Risk Level (Low/Medium/High) | Brief Description |

|---|---|---|

| Regulatory Risk | High | Unregulated broker with no oversight. |

| Fund Security Risk | High | Lack of segregation and investor protection. |

| Execution Risk | Medium | Reports of slippage and rejected orders. |

| Customer Support Risk | Medium | Inconsistent response times and support quality. |

To mitigate these risks, traders are advised to conduct thorough research and consider using regulated brokers that offer better protections. It is also prudent to start with a demo account to assess the platform's performance and customer service before committing significant funds.

Conclusion and Recommendations

In conclusion, while Saramarkets presents itself as a viable option for forex trading, the evidence suggests that it may not be a safe choice for traders. The lack of regulatory oversight, transparency regarding company operations, and reports of withdrawal issues raise significant concerns.

Traders should exercise caution when considering Saramarkets, especially given the potential risks associated with unregulated brokers. For those seeking safer alternatives, it is advisable to explore well-established brokers with robust regulatory frameworks and proven track records in customer service and fund security.

In summary, if you are contemplating trading with Saramarkets, it is crucial to weigh the risks carefully and consider whether the benefits outweigh the potential downsides. As always, ensure you are comfortable with the level of risk you are taking on and explore regulated options that offer greater peace of mind.

Is Saramarkets a scam, or is it legit?

The latest exposure and evaluation content of Saramarkets brokers.

Saramarkets Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

Saramarkets latest industry rating score is 1.50, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.50 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.