Regarding the legitimacy of safegoldsf forex brokers, it provides SFC and WikiBit, (also has a graphic survey regarding security).

Is safegoldsf safe?

Business

License

Is safegoldsf markets regulated?

The regulatory license is the strongest proof.

SFC Derivatives Trading License (AGN)

Securities and Futures Commission of Hong Kong

Securities and Futures Commission of Hong Kong

Current Status:

UnverifiedLicense Type:

Derivatives Trading License (AGN)

Licensed Entity:

Future Securities Limited

Effective Date:

2017-07-31Email Address of Licensed Institution:

cs@xxex.comSharing Status:

No SharingWebsite of Licensed Institution:

https://xxex.com/Expiration Time:

--Address of Licensed Institution:

香港九龍觀塘創業街9號23樓2301室Phone Number of Licensed Institution:

--Licensed Institution Certified Documents:

Is safegoldsf Safe or Scam?

Introduction

In the ever-evolving landscape of the foreign exchange (forex) market, the emergence of numerous brokers has made it essential for traders to conduct thorough assessments before committing their funds. One such broker, safegoldsf, has garnered attention in recent discussions, prompting inquiries about its legitimacy and safety. This article aims to provide an objective analysis of whether safegoldsf is a safe trading platform or a potential scam. We will explore various facets, including regulatory status, company background, trading conditions, customer experiences, and risk factors. Our investigation is based on extensive research from credible sources, including expert reviews and user feedback.

Regulatory and Legality

The regulatory status of a forex broker is a critical factor in determining its safety. A well-regulated broker is subject to oversight by financial authorities, which helps ensure compliance with industry standards and the protection of client funds. In the case of safegoldsf, the broker claims to be regulated by the Securities and Futures Commission (SFC) of Hong Kong. However, reports indicate that the regulatory status may not be as robust as advertised.

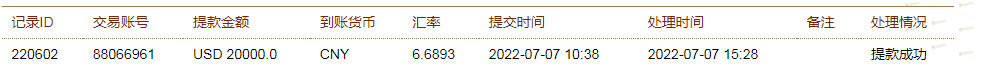

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| SFC | Not provided | Hong Kong | Unverified |

The lack of a valid license number and the unverified status raise significant concerns about the quality of regulation. Furthermore, the SFCs reputation as a regulatory body is well-established, but if a broker operates without proper licensing or under dubious regulations, it poses a risk to traders. Historical compliance issues, if any, can also indicate the broker's reliability. In the case of safegoldsf, there is a lack of transparency regarding its regulatory history, making it difficult for potential investors to assess its legitimacy.

Company Background Investigation

Understanding the companys history and ownership structure is vital for evaluating its credibility. safegoldsf is reported to be associated with Ding Zhan Securities and Futures Co., Ltd., based in Hong Kong. However, details about the company's establishment, ownership, and operational history are scant.

The management team‘s background and expertise also play a crucial role in the broker’s reliability. A team with extensive experience in financial markets is typically a good sign. Unfortunately, safegoldsf does not provide sufficient information about its management team, leading to questions about its operational transparency.

Moreover, the companys information disclosure practices are critical. A trustworthy broker should provide clear details about its services, fees, and any potential risks associated with trading. The lack of comprehensive disclosures from safegoldsf further complicates the evaluation of its trustworthiness.

Trading Conditions Analysis

The trading conditions offered by a broker can significantly impact a traders experience and profitability. safegoldsf claims to provide competitive spreads and various account types, but scrutiny reveals potential issues.

| Fee Type | safegoldsf | Industry Average |

|---|---|---|

| Major Currency Pair Spread | Not disclosed | 1-2 pips |

| Commission Model | Not disclosed | Variable |

| Overnight Interest Range | Not disclosed | 1-3% |

The absence of clear information regarding spreads, commissions, and overnight interest rates raises red flags. Traders need to be aware of any hidden fees or unfavorable trading conditions that could erode their profits. Additionally, if the fees are significantly higher than industry averages, it may indicate a lack of competitiveness, which could be detrimental to traders' success.

Customer Funds Safety

The security of client funds is a paramount concern for any forex trader. safegoldsf needs to implement stringent measures to protect customer deposits. Key aspects include fund segregation, investor protection schemes, and negative balance protection policies.

While safegoldsf claims to take customer fund safety seriously, there is little evidence to support these assertions. The absence of detailed information regarding fund segregation and protection policies makes it difficult for potential clients to assess the safety of their investments. Furthermore, any historical issues related to fund security can greatly influence a trader's decision to engage with the broker.

Customer Experience and Complaints

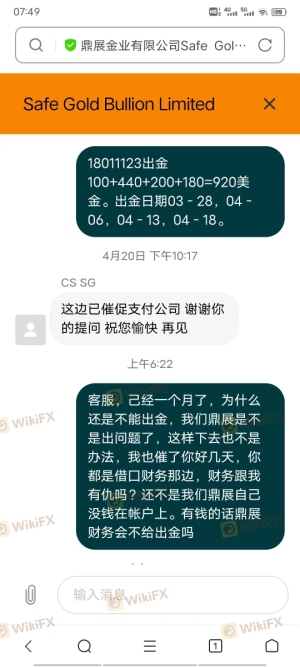

Analyzing customer feedback is essential to understanding a broker's reputation. Reviews and complaints about safegoldsf indicate a pattern of dissatisfaction among users. Many clients have reported difficulties in withdrawing their funds, with some claiming that their requests went unanswered.

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Issues | High | Poor |

| Customer Service Delays | Medium | Poor |

| Transparency Concerns | High | Poor |

The severity of these complaints suggests significant operational issues within safegoldsf. For instance, clients have reported waiting weeks for withdrawals, leading to concerns about the broker's liquidity and reliability. Additionally, the company's response to these complaints appears to be inadequate, which can further erode trust among potential investors.

Platform and Trade Execution

The performance and reliability of a trading platform are crucial to a trader's success. safegoldsf offers a trading platform that is expected to be user-friendly and efficient. However, user reviews suggest that the platform may suffer from stability issues, leading to execution delays and slippage during critical trading moments.

The quality of order execution is another critical factor. Reports of high slippage and rejected orders can indicate potential manipulation or inefficiencies within the trading system. Such issues not only affect trading performance but also raise questions about the broker's integrity.

Risk Assessment

Engaging with safegoldsf presents various risks that potential investors should consider.

| Risk Category | Risk Level (Low/Medium/High) | Brief Description |

|---|---|---|

| Regulatory Risk | High | Unverified regulatory status |

| Fund Safety Risk | High | Lack of clear fund protection measures |

| Withdrawal Risk | High | Reports of withdrawal difficulties |

| Customer Service Risk | Medium | Poor response to client complaints |

To mitigate these risks, traders should conduct thorough due diligence, consider using smaller amounts for initial trades, and remain cautious about committing significant funds to safegoldsf.

Conclusion and Recommendations

In conclusion, the evidence gathered suggests that safegoldsf exhibits several characteristics that warrant caution. The lack of verified regulatory oversight, transparency issues regarding company operations, and numerous complaints from clients raise significant concerns about the broker's safety and reliability.

While some traders may still choose to engage with safegoldsf, it is crucial to approach with caution. For those seeking safer alternatives, consider reputable brokers that are well-regulated, have a transparent fee structure, and demonstrate a solid track record of positive client experiences. Always prioritize safety and conduct thorough research before making any investment decisions in the forex market.

Is safegoldsf a scam, or is it legit?

The latest exposure and evaluation content of safegoldsf brokers.

safegoldsf Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

safegoldsf latest industry rating score is 1.58, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.58 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.