Regarding the legitimacy of ROSTONES forex brokers, it provides FSPR and WikiBit, .

Is ROSTONES safe?

Pros

Cons

Is ROSTONES markets regulated?

The regulatory license is the strongest proof.

FSPR Inst Forex Execution (STP)

Financial Service Providers Register

Financial Service Providers Register

Current Status:

RevokedLicense Type:

Inst Forex Execution (STP)

Licensed Entity:

ROSTONES GROUP LIMITED

Effective Date:

2016-11-28Email Address of Licensed Institution:

--Sharing Status:

No SharingWebsite of Licensed Institution:

--Expiration Time:

2018-10-18Address of Licensed Institution:

6 Clayton Street, New Market, Auckland, 9012, New ZealandPhone Number of Licensed Institution:

--Licensed Institution Certified Documents:

Is Rostones A Scam?

Introduction

Rostones is a relatively new player in the forex market, having been established in 2017 and based in New Zealand. As a broker, it aims to provide traders with access to a variety of financial instruments, including major currency pairs, commodities, and indices. However, the forex trading landscape is fraught with risks, and traders must exercise caution when selecting a broker. The importance of evaluating a broker's legitimacy cannot be overstated, as the wrong choice can lead to significant financial losses. This article aims to provide an objective analysis of Rostones, examining its regulatory status, company background, trading conditions, customer experience, and overall risk profile. The assessment draws from multiple sources, including user reviews, regulatory databases, and expert analyses, to paint a comprehensive picture of whether Rostones is safe or a potential scam.

Regulatory and Legitimacy

The regulatory status of a forex broker is one of the most critical factors to consider when evaluating its legitimacy. Rostones claims to be registered with the Financial Service Providers Register (FSPR) in New Zealand. However, it is crucial to note that its license has been revoked, raising questions about its operational legality.

| Regulatory Agency | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| FSPR | 527786 | New Zealand | Revoked |

The revocation of Rostones' license by the FSPR is a significant red flag. Regulatory bodies are designed to protect traders by ensuring that brokers adhere to strict standards of conduct. The absence of a valid license suggests that Rostones may not be operating under the oversight necessary to guarantee trader protection. Furthermore, the lack of any positive regulatory disclosures during the evaluation period indicates a concerning absence of transparency.

Company Background Investigation

Rostones was established in 2017, positioning itself as a modern brokerage solution. However, the company's brief history raises concerns about its stability and long-term viability. The ownership structure is not clearly outlined, which is often a sign of opacity in operations. A transparent broker typically provides detailed information about its management team, ownership, and operational history.

The management teams qualifications and experience are also crucial indicators of a broker's reliability. Unfortunately, Rostones has not disclosed sufficient information regarding its management, leaving potential clients in the dark about the expertise behind the operations. A lack of transparency in this regard is often a warning sign for traders seeking a trustworthy broker.

Trading Conditions Analysis

When assessing a broker, understanding its trading conditions is vital. Rostones operates with a fee structure that includes spreads and commissions, yet the specifics remain somewhat ambiguous. A thorough examination of its fees reveals some concerning aspects.

| Fee Type | Rostones | Industry Average |

|---|---|---|

| Major Currency Pair Spread | High | Low |

| Commission Structure | Not disclosed | Standard |

| Overnight Interest Range | Not disclosed | Standard |

The high spreads on major currency pairs may indicate that traders will face higher costs than with more reputable brokers. Furthermore, the lack of clarity regarding commissions and overnight interest raises questions about potential hidden fees. Such practices can be detrimental to traders' profitability and are often associated with less trustworthy brokers.

Customer Funds Security

The safety of customer funds is another crucial aspect that potential traders must consider when evaluating a broker. Rostones claims to implement certain security measures; however, the specifics of these measures are not well-documented.

The broker does not provide clear information on whether it offers segregated accounts for client funds, which is a standard practice among reputable brokers. Segregated accounts help protect client funds in the event of the broker's insolvency. Additionally, there is no mention of investor protection schemes that can offer compensation in case of broker failure.

Historically, any issues related to fund security can severely impact a broker's reputation. Unfortunately, Rostones has not publicly addressed any past incidents or controversies related to fund security, further clouding its reliability.

Customer Experience and Complaints

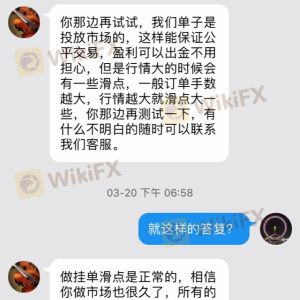

Customer feedback is often a reflection of a broker's performance and reliability. Reviews for Rostones are mixed, with several users expressing dissatisfaction with their experiences. Common complaints include issues with withdrawal processes, poor customer service, and high slippage during trading.

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Delays | High | Slow |

| Customer Service Issues | Medium | Unresponsive |

| Slippage Problems | High | No resolution |

The severity of complaints, particularly regarding withdrawal delays and slippage, raises concerns about the broker's operational integrity. The lack of a prompt and effective response from the company to these complaints is particularly alarming.

One notable case involved a user who reported being pressured into opening an account, only to face significant losses and difficulties in withdrawing funds. Such experiences paint a troubling picture of Rostones and suggest that traders may face challenges if issues arise.

Platform and Trade Execution

Evaluating a broker's trading platform is essential for understanding the overall trading experience. Rostones utilizes the MetaTrader 4 (MT4) platform, which is popular among traders for its user-friendly interface and robust features. However, the platform's performance has been criticized for stability issues and high slippage during volatile market conditions.

The quality of order execution is paramount in forex trading. Reports of significant slippage and rejected orders during high-traffic periods raise concerns about the broker's ability to provide a reliable trading environment. Such issues can lead to poor trading outcomes, especially for those employing strategies that require precise execution.

Risk Assessment

Using Rostones carries several risks that potential traders should carefully consider. The absence of a valid regulatory license, coupled with high spreads and numerous customer complaints, presents a concerning risk landscape.

| Risk Category | Risk Level | Brief Description |

|---|---|---|

| Regulatory Risk | High | Revoked license raises concerns. |

| Financial Risk | Medium | High spreads and unclear fees. |

| Operational Risk | High | Customer complaints about service. |

To mitigate these risks, it is advisable for traders to conduct thorough due diligence before committing funds to Rostones. Seeking alternative brokers with solid regulatory oversight and positive customer feedback could provide a safer trading environment.

Conclusion and Recommendations

In conclusion, the evidence suggests that Rostones may not be a reliable option for forex trading. The revoked regulatory license, high spreads, and numerous customer complaints indicate potential red flags. While the broker offers a familiar trading platform, the overall lack of transparency and accountability raises concerns about its legitimacy.

For traders seeking a safe trading experience, it is advisable to consider alternative brokers that are regulated by top-tier authorities and have a proven track record of customer satisfaction. Options such as Interactive Brokers or eToro may provide more reliable services with better protections for traders.

In summary, traders should exercise caution and conduct thorough research before engaging with Rostones, as the potential for issues and risks remains significant.

Is ROSTONES a scam, or is it legit?

The latest exposure and evaluation content of ROSTONES brokers.

ROSTONES Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

ROSTONES latest industry rating score is 1.62, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.62 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.