Is RIFA Markets safe?

Business

License

Is Rifa Markets A Scam?

Introduction

Rifa Markets, a brokerage firm that operates in the forex market, has garnered attention from traders seeking opportunities in currency trading. However, with the proliferation of online trading platforms, it is crucial for traders to exercise caution and thoroughly evaluate the legitimacy and safety of any brokerage they consider. This article aims to provide a comprehensive analysis of Rifa Markets, examining its regulatory status, company background, trading conditions, customer experience, and overall risk profile. The evaluation is based on a review of various online sources, including user feedback and regulatory disclosures.

Regulation and Legitimacy

The regulatory status of a brokerage is a key indicator of its legitimacy and the safety of traders' funds. Rifa Markets operates without proper regulatory oversight, which raises significant concerns. The following table summarizes the core regulatory information:

| Regulatory Authority | License Number | Regulated Area | Verification Status |

|---|---|---|---|

| NFA | Unauthorized | USA | Not Verified |

Rifa Markets is reported to have an unauthorized status with the NFA (National Futures Association), which means it is not subject to the rigorous oversight that regulated brokers must adhere to. This lack of regulation increases the risk of potential fraudulent activities and misconduct. Additionally, the absence of a functional official website further compounds these concerns, suggesting that the broker may not be operating with transparency. Historical compliance issues and negative disclosures from regulatory bodies also indicate a troubling pattern that traders should be aware of.

Company Background Investigation

Rifa Markets, also known as Rifa Technology Company Limited, is a relatively new player in the forex market, having been established in 2020. The company claims to be based in the United Kingdom but operates primarily in Hong Kong. The ownership structure and management team details are scant, which raises questions about the company's transparency. A lack of clear information regarding the management's professional backgrounds can further deter potential investors. Transparency in operations and information disclosure is vital for building trust with clients, and Rifa Markets appears to fall short in this regard.

Trading Conditions Analysis

Understanding the trading conditions offered by Rifa Markets is essential for assessing its viability as a brokerage. The overall fee structure and trading costs can significantly impact a trader's profitability.

| Fee Type | Rifa Markets | Industry Average |

|---|---|---|

| Major Currency Pair Spread | Not Disclosed | 1.0 - 3.0 pips |

| Commission Model | Not Disclosed | Varies |

| Overnight Interest Range | Not Disclosed | Varies |

The lack of transparency regarding spreads, commissions, and overnight interest rates is a red flag. Traders often rely on clear fee structures to gauge the potential costs of trading, and the absence of this information can indicate underlying issues. Furthermore, any unusual or hidden fees can erode profits and lead to negative trading experiences.

Customer Funds Security

The safety of customer funds is paramount when evaluating a brokerage. Rifa Markets has not demonstrated robust security measures to protect client funds. The broker's lack of regulatory oversight raises significant concerns regarding fund segregation, investor protection, and negative balance protection policies. Historical issues related to fund security and customer complaints about withdrawal difficulties further exacerbate these concerns. Without adequate safeguards in place, traders may be at risk of losing their investments.

Customer Experience and Complaints

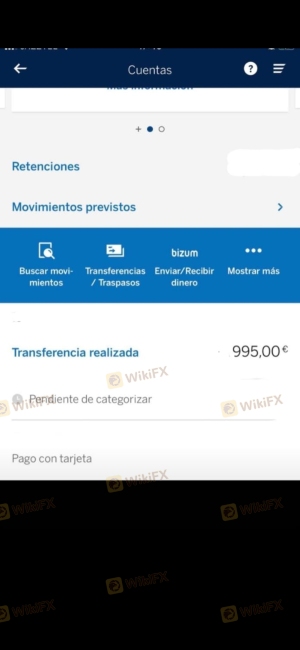

Customer feedback plays a crucial role in assessing the reliability of a brokerage. Numerous negative reviews and complaints have been documented regarding Rifa Markets, highlighting common issues such as withdrawal difficulties, unresponsive customer service, and misleading information.

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Issues | High | Poor |

| Customer Service Quality | Medium | Poor |

| Misinformation | High | Poor |

Typical case studies reveal traders struggling to withdraw their funds, often met with excuses or delays from the broker. Such patterns indicate a lack of accountability and responsiveness, which are critical for maintaining trust in a trading environment.

Platform and Trade Execution

The performance and reliability of the trading platform are vital for a positive trading experience. Rifa Markets offers a proprietary trading platform, but detailed evaluations of its performance, stability, and user experience are lacking. Concerns about order execution quality, slippage, and rejection rates remain unaddressed, leaving potential clients uncertain about the platform's reliability. Any signs of platform manipulation could severely undermine traders' confidence.

Risk Assessment

Engaging with Rifa Markets presents several risks that traders should carefully consider.

| Risk Category | Risk Level (Low/Medium/High) | Brief Description |

|---|---|---|

| Regulatory Compliance | High | No proper regulation |

| Customer Fund Safety | High | Lack of fund protection |

| Customer Service | Medium | Poor response to complaints |

To mitigate these risks, traders are advised to conduct thorough research and consider alternative, regulated brokers with established reputations. Seeking out brokers that prioritize transparency and compliance can provide a safer trading environment.

Conclusion and Recommendations

In light of the evidence gathered, it is evident that Rifa Markets presents several red flags that warrant caution. The lack of regulatory oversight, combined with numerous customer complaints and a lack of transparency, suggests that traders should be wary of engaging with this broker. For those considering trading in the forex market, it may be prudent to explore alternative options that offer better regulatory protection and a proven track record of reliability.

In conclusion, is Rifa Markets safe? The overwhelming evidence points towards a high-risk profile, making it advisable for traders to proceed with extreme caution or seek out more reputable alternatives.

Is RIFA Markets a scam, or is it legit?

The latest exposure and evaluation content of RIFA Markets brokers.

RIFA Markets Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

RIFA Markets latest industry rating score is 1.53, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.53 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.